Car Loan Paperwork Processing Time

Introduction to Car Loan Paperwork

When it comes to purchasing a vehicle, one of the most critical aspects of the process is the car loan paperwork. This is the stage where the buyer and the lender agree on the terms of the loan, including the interest rate, repayment period, and monthly payments. The car loan paperwork processing time can vary depending on several factors, including the lender, the borrower’s credit score, and the complexity of the loan application. In this article, we will delve into the world of car loan paperwork, exploring the typical processing time, the factors that affect it, and the steps involved in the process.

Typical Car Loan Paperwork Processing Time

The typical car loan paperwork processing time can range from a few hours to several days or even weeks. On average, it can take around 1-3 business days for the lender to review and approve the loan application. However, this timeframe can be shorter or longer depending on the lender’s efficiency and the borrower’s cooperation. Some lenders may offer expedited processing options, which can reduce the processing time to as little as 30 minutes. In contrast, more complex loan applications or those that require additional documentation may take longer to process.

Factors Affecting Car Loan Paperwork Processing Time

Several factors can affect the car loan paperwork processing time, including: * Credit score: Borrowers with excellent credit scores may experience faster processing times, as their creditworthiness is already established. * Loan application complexity: Loan applications that require additional documentation, such as income verification or employment confirmation, may take longer to process. * Lender efficiency: The lender’s efficiency and workload can impact the processing time. Some lenders may have more staff or more efficient systems, allowing them to process loan applications faster. * Borrower cooperation: The borrower’s cooperation and responsiveness to requests for additional information can also affect the processing time.

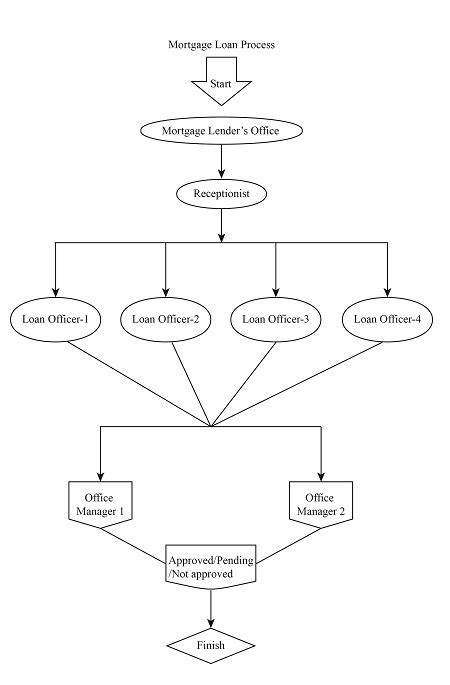

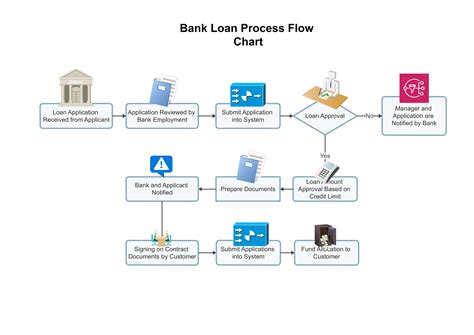

Steps Involved in Car Loan Paperwork Processing

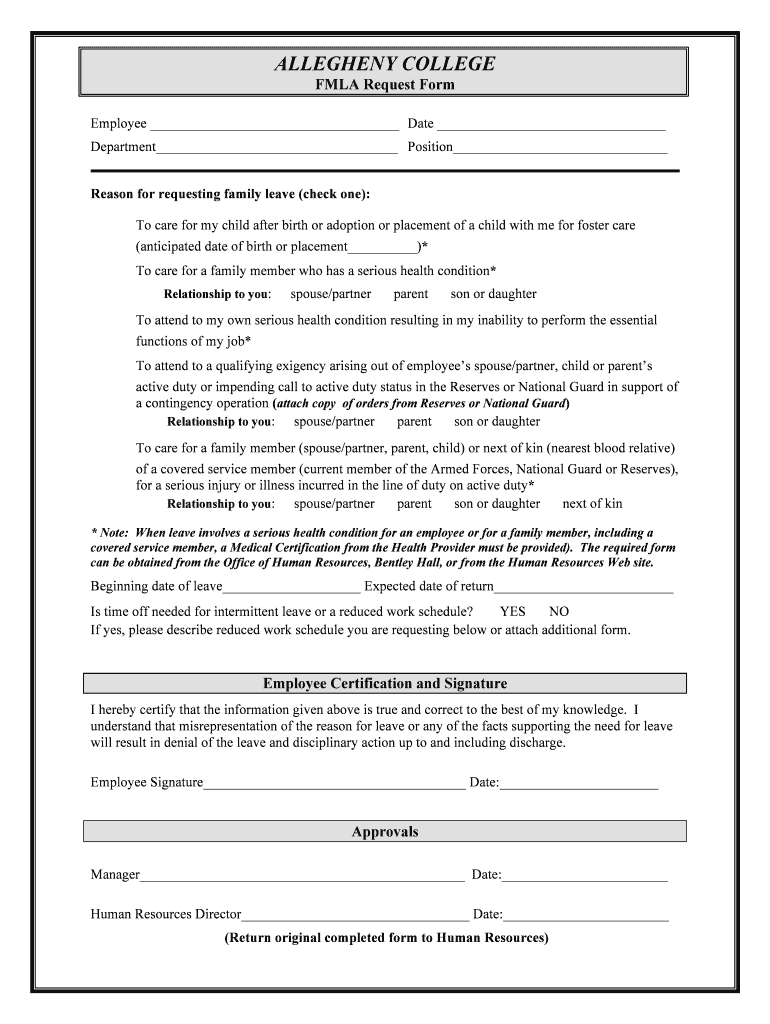

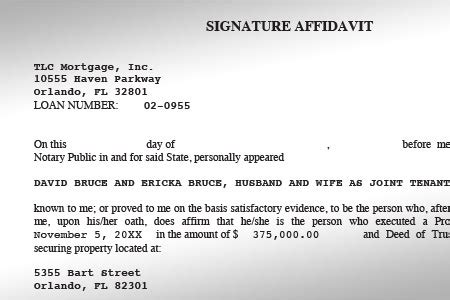

The car loan paperwork processing involves several steps, including: * Pre-approval: The borrower applies for pre-approval, providing basic information such as income, employment, and credit score. * Loan application: The borrower submits a complete loan application, including documentation such as pay stubs, bank statements, and identification. * Verification: The lender verifies the borrower’s information, including credit score, income, and employment. * Approval: The lender approves the loan application, and the borrower receives a loan offer outlining the terms of the loan. * Signing: The borrower signs the loan agreement, and the lender disburses the funds.

📝 Note: It is essential to carefully review the loan agreement before signing, ensuring that all terms and conditions are understood and agreed upon.

Ways to Reduce Car Loan Paperwork Processing Time

To reduce the car loan paperwork processing time, borrowers can take several steps, including: * Gathering documentation in advance: Borrowers can gather required documentation, such as pay stubs and bank statements, before submitting the loan application. * Using online platforms: Many lenders offer online platforms for loan applications, which can streamline the process and reduce processing time. * Cooperating with the lender: Borrowers can respond promptly to requests for additional information, helping to keep the process moving.

| Lender | Processing Time |

|---|---|

| Lender A | 1-2 business days |

| Lender B | 2-3 business days |

| Lender C | 3-5 business days |

In summary, the car loan paperwork processing time can vary depending on several factors, including the lender, credit score, and loan application complexity. By understanding the typical processing time, the factors that affect it, and the steps involved in the process, borrowers can better navigate the car loan process and reduce the processing time. Additionally, by taking steps such as gathering documentation in advance and using online platforms, borrowers can help streamline the process and get behind the wheel of their new vehicle sooner.

As we reflect on the car loan paperwork process, it becomes clear that efficiency and cooperation are key to reducing processing time. By working together with the lender and providing required documentation promptly, borrowers can help ensure a smooth and timely process. With the right mindset and preparation, borrowers can navigate the car loan paperwork process with confidence and get on the road to driving their new vehicle.

What is the typical car loan paperwork processing time?

+

The typical car loan paperwork processing time can range from a few hours to several days or even weeks, with an average of 1-3 business days.

What factors affect the car loan paperwork processing time?

+

Factors that affect the car loan paperwork processing time include credit score, loan application complexity, lender efficiency, and borrower cooperation.

How can I reduce the car loan paperwork processing time?

+

To reduce the car loan paperwork processing time, borrowers can gather documentation in advance, use online platforms, and cooperate with the lender by responding promptly to requests for additional information.