5 Check N Go Papers

Introduction to Check N Go Papers

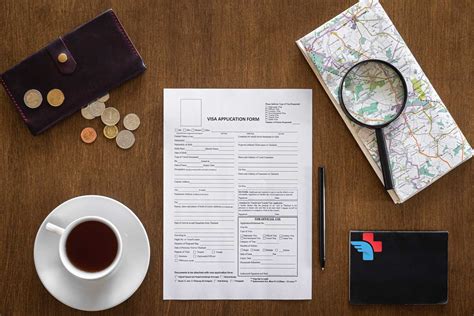

Check N Go papers are a type of loan document that individuals may encounter when dealing with short-term loans or payday advances. These documents are essential for both lenders and borrowers, as they outline the terms and conditions of the loan agreement. In this blog post, we will delve into the world of Check N Go papers, exploring their significance, key components, and the implications for borrowers.

Understanding Check N Go Papers

Check N Go papers are contracts between the lender and the borrower, detailing the loan amount, interest rates, repayment terms, and any additional fees associated with the loan. These documents are designed to protect both parties involved in the transaction, ensuring that the borrower is aware of their obligations and the lender can recover their investment. It is crucial for borrowers to carefully review and understand the contents of Check N Go papers before signing, as this will help prevent any misunderstandings or disputes down the line.

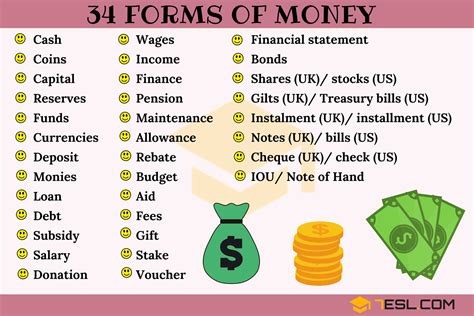

Key Components of Check N Go Papers

When examining Check N Go papers, there are several key components to look out for: * Loan Amount: The total amount borrowed by the individual, including any additional fees or charges. * Interest Rate: The percentage rate at which interest is calculated on the loan, which can significantly impact the overall cost of the loan. * Repayment Terms: The schedule and method of repayment, including the due date, payment amount, and any late payment fees. * Fees and Charges: Any additional costs associated with the loan, such as origination fees, late payment fees, or NSF fees. * Collateral: In some cases, borrowers may be required to provide collateral, such as a post-dated check or a lien on a vehicle.

Importance of Reviewing Check N Go Papers

It is essential for borrowers to thoroughly review Check N Go papers before signing, as this will help ensure that they understand the terms and conditions of the loan. Some key aspects to look out for include: * Interest Rates: Be aware of the interest rate and how it will impact the overall cost of the loan. * Fees and Charges: Understand any additional fees associated with the loan, including late payment fees or NSF fees. * Repayment Terms: Verify the repayment schedule and method, including the due date and payment amount. * Collateral: Be aware of any collateral requirements, such as a post-dated check or a lien on a vehicle.

📝 Note: Borrowers should always review Check N Go papers carefully before signing, as this will help prevent any misunderstandings or disputes down the line.

Implications for Borrowers

Check N Go papers can have significant implications for borrowers, particularly if they are not carefully reviewed and understood. Some potential risks include: * Debt Cycle: Borrowers may become trapped in a debt cycle, where they are forced to take out additional loans to pay off existing debts. * Late Payment Fees: Borrowers may be subject to late payment fees, which can add significant costs to the loan. * Damage to Credit Score: Failure to repay the loan can damage the borrower’s credit score, making it more difficult to obtain credit in the future.

Best Practices for Borrowers

To avoid potential pitfalls associated with Check N Go papers, borrowers should follow best practices, including: * Carefully Reviewing the Loan Agreement: Take the time to thoroughly review the loan agreement, including all terms and conditions. * Understanding the Interest Rate and Fees: Be aware of the interest rate and any additional fees associated with the loan. * Verifying the Repayment Terms: Confirm the repayment schedule and method, including the due date and payment amount. * Seeking Professional Advice: If unsure about any aspect of the loan, consider seeking professional advice from a financial advisor or credit counselor.

In summary, Check N Go papers are essential documents that outline the terms and conditions of short-term loans or payday advances. Borrowers must carefully review and understand these documents to avoid potential pitfalls, including debt cycles, late payment fees, and damage to their credit score. By following best practices and seeking professional advice when needed, borrowers can navigate the complexities of Check N Go papers and make informed decisions about their financial obligations.

What are Check N Go papers?

+

Check N Go papers are loan documents that outline the terms and conditions of short-term loans or payday advances.

Why is it essential to review Check N Go papers carefully?

+

Reviewing Check N Go papers carefully helps borrowers understand the terms and conditions of the loan, including interest rates, fees, and repayment terms, to avoid potential pitfalls.

What are some potential risks associated with Check N Go papers?

+

Potential risks include debt cycles, late payment fees, and damage to credit scores if the loan is not repaid on time.