Closing Paperwork Time on a House

Introduction to Closing Paperwork

When purchasing a house, the process involves several steps, from finding the perfect property to finally moving in. One of the most critical phases of this journey is the closing process. The closing process, also known as settlement, is where the buyer and seller sign the final documents, and the ownership of the property is transferred. This phase is crucial as it involves a significant amount of paperwork and legal obligations that must be understood and fulfilled by both parties. Understanding the closing paperwork is essential to ensure a smooth transaction and avoid any potential issues down the line.

Pre-Closing Preparations

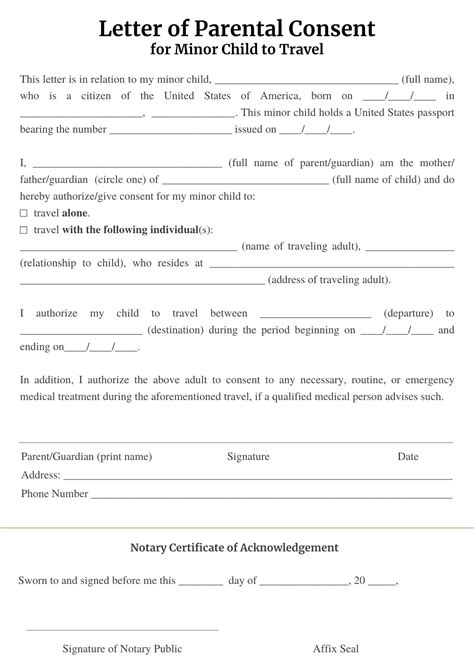

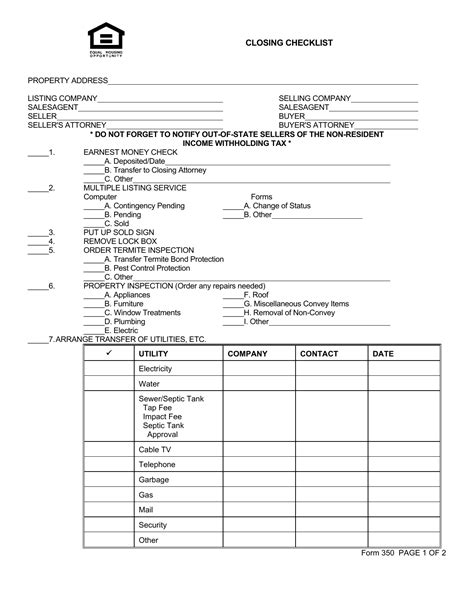

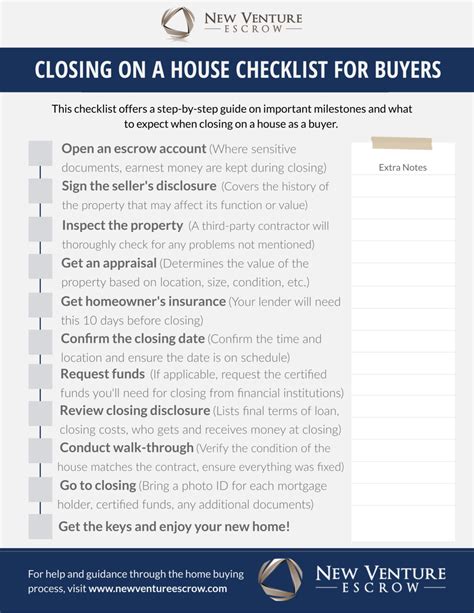

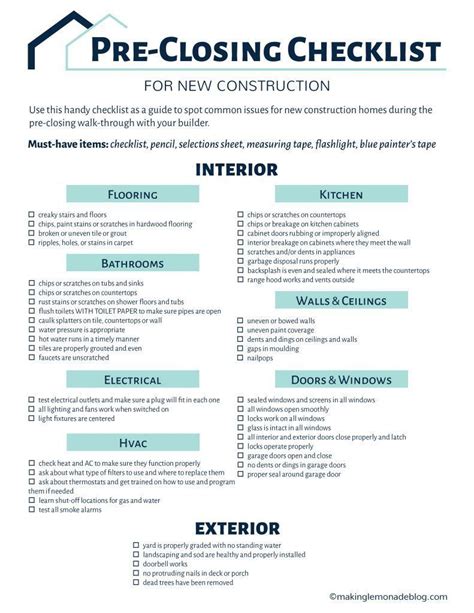

Before the actual closing day, several preparations need to be made. This includes the buyer conducting a final walk-through of the property to ensure it is in the agreed-upon condition, reviewing and understanding all the documents that will be signed, and arranging for the payment of the closing costs. The seller, on the other hand, needs to ensure that all repairs agreed upon have been completed and that the property is vacant and ready for transfer. This preparation phase is vital as it sets the stage for a successful closing process.

The Closing Process

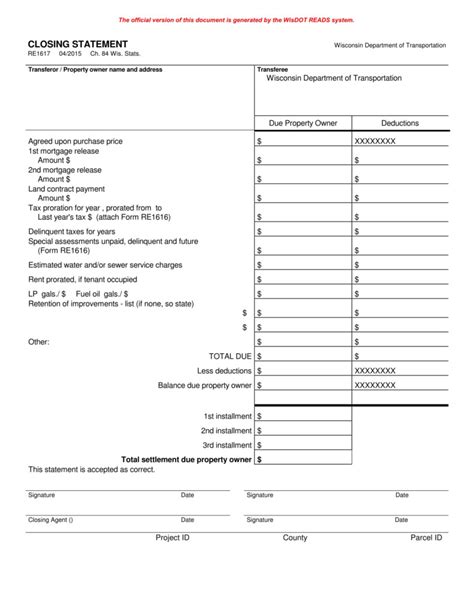

The closing process typically takes place at a title company or attorney’s office and involves the buyer, seller, and their respective representatives. The key documents that are signed during this process include: - The Deed: This document transfers the ownership of the property from the seller to the buyer. - The Mortgage: If the buyer is financing the purchase, they will sign a mortgage note, promising to repay the loan, and a mortgage deed, which gives the lender a lien on the property. - The Title: The title to the property is also transferred during the closing process, ensuring the buyer receives a clear title to the property.

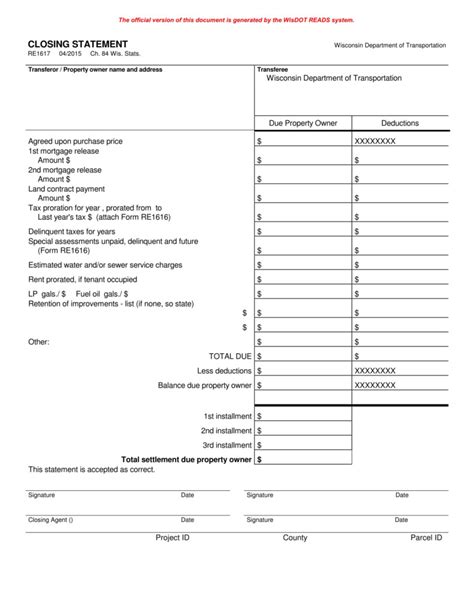

Understanding Closing Costs

Closing costs are fees associated with the home buying and selling process. These costs can vary widely depending on the location and other factors but typically range from 2% to 5% of the purchase price of the home. Both buyers and sellers have costs they must pay, although the buyer usually pays the bulk of the closing costs. Understanding who pays what and negotiating these costs as part of the purchase agreement can help manage the financial impact of closing costs.

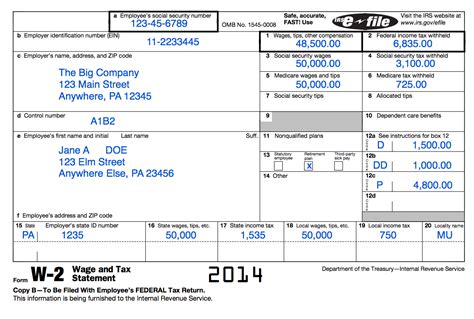

Navigating the Paperwork

The paperwork involved in closing on a house can be overwhelming. It includes but is not limited to: - Loan Estimates and Closing Disclosures: These documents outline the terms of the loan and the costs associated with the closing. - Title Search and Insurance: These ensure the buyer is receiving a clear title to the property and protect against any future title issues. - Property Tax and Insurance: Arrangements for the payment of property taxes and insurance need to be made.

📝 Note: It is crucial for both buyers and sellers to carefully review all documents before signing to ensure everything is in order and as agreed upon.

Post-Closing Responsibilities

After the closing process is complete, and the ownership of the property has been transferred, there are still several responsibilities that both buyers and sellers need to attend to. For the buyer, this includes updating the property records, arranging for utility transfers, and possibly making any agreed-upon repairs or changes to the property. For the seller, ensuring that all personal belongings have been removed and that the property has been vacated as agreed upon is key.

| Document | Purpose |

|---|---|

| Deed | Transfers ownership of the property |

| Mortgage | Secures the loan for the property |

| Title | Ensures clear ownership of the property |

Finalizing the Process

The closing paperwork time on a house is a complex and detailed process. It requires careful preparation, understanding, and execution to ensure that the transfer of ownership is smooth and legally binding. By thoroughly reviewing all documents, understanding the roles and responsibilities of all parties involved, and being prepared for the closing costs, buyers and sellers can navigate this process with confidence.

As the process comes to a close, and the keys are handed over, it marks the beginning of a new chapter for both the buyer and the seller. For the buyer, it’s the start of a new life in their home, filled with possibilities and memories to be made. For the seller, it’s the end of one chapter and possibly the beginning of another, as they move on to new adventures. The closing paperwork, though tedious, is a necessary step in this journey, ensuring that the transition is legitimate, secure, and satisfactory for all parties involved. The journey to owning a home is filled with anticipation and excitement, and understanding the closing process is key to making this dream a reality. With patience, knowledge, and the right support, navigating the closing paperwork can be a manageable and worthwhile experience, leading to the joy and satisfaction of homeownership.