State Taxes Paperwork Made Easy

Introduction to State Taxes Paperwork

When it comes to managing finances, one of the most daunting tasks for individuals and businesses alike is dealing with state taxes paperwork. The process can be overwhelming, with numerous forms to fill out, deadlines to meet, and regulations to comply with. However, with the right approach and understanding, navigating state taxes paperwork can be made easier and less stressful. In this article, we will delve into the world of state taxes, exploring the key aspects, requirements, and tips to simplify the process.

Understanding State Taxes

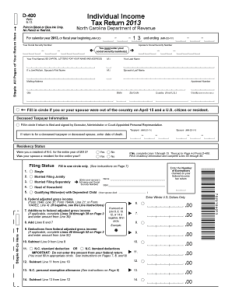

State taxes are levied by individual states on their residents’ income, sales, and other transactions. These taxes are used to fund public services and infrastructure within the state. Each state has its own set of tax laws, rates, and filing requirements, which can make the process complex. It is essential to understand the specific tax laws and regulations of your state to ensure compliance and avoid any potential penalties.

Key Components of State Taxes Paperwork

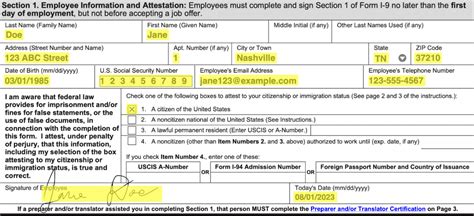

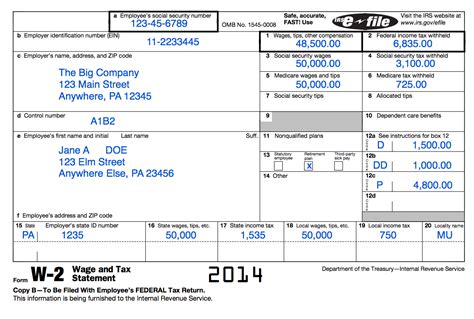

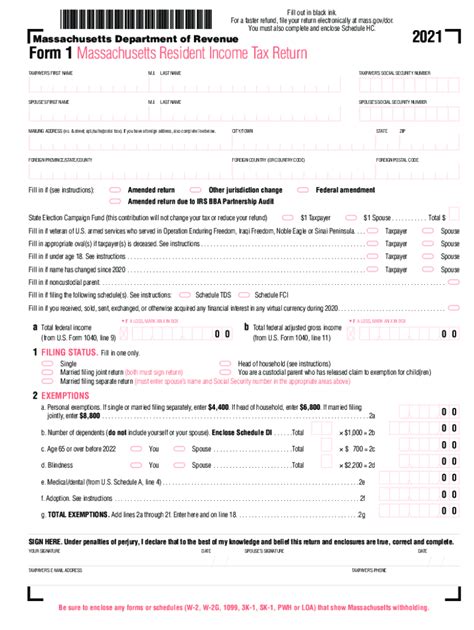

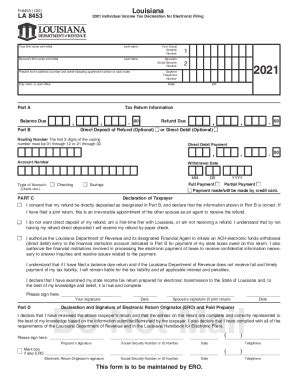

Several components make up the state taxes paperwork, including: - Income Tax Returns: These are filed by individuals and businesses to report their income and claim deductions and credits. - Sales Tax Returns: Businesses that sell tangible personal property or certain services must file sales tax returns to report and pay sales taxes collected. - Employment Tax Returns: Employers must file employment tax returns to report and pay taxes withheld from employees’ wages, as well as pay their portion of employment taxes.

Steps to Simplify State Taxes Paperwork

To make the state taxes paperwork process easier, follow these steps: - Stay Organized: Keep all tax-related documents and records in one place. This includes income statements, receipts for deductions, and any correspondence with tax authorities. - Use Tax Software: Utilize tax software that supports state tax filings. These programs can guide you through the process, ensure you are taking all eligible deductions, and help you file your returns electronically. - Consult a Tax Professional: If you are unsure about any aspect of your state taxes, consider hiring a tax professional. They can provide personalized advice and handle the filing process for you. - File Electronically: Electronic filing is faster, more accurate, and often required for certain types of tax returns. It also provides an immediate confirmation that your return has been received.

Tips for Efficient State Taxes Paperwork Management

Managing state taxes paperwork efficiently requires careful planning and attention to detail. Here are some additional tips: - Keep Up with Tax Law Changes: Tax laws and regulations can change frequently. Stay informed about any updates that might affect your tax situation. - Use Online Resources: Many states offer online resources and portals where you can access your tax account, file returns, and make payments. - Plan Ahead: Do not wait until the last minute to start working on your taxes. Give yourself plenty of time to gather documents, prepare your returns, and file them before the deadline.

📝 Note: Always verify the deadlines for filing state taxes, as they may differ from federal tax deadlines and vary by state.

Common Mistakes to Avoid in State Taxes Paperwork

Avoiding common mistakes can save you time, money, and stress when dealing with state taxes paperwork. Some mistakes to watch out for include: - Incorrect or Missing Information: Ensure all information on your tax returns is accurate and complete. Missing or incorrect information can lead to delays or even audits. - Missing Deadlines: Failing to file your tax returns or make payments on time can result in penalties and interest. - Not Claiming Eligible Deductions: Overlooking deductions you are eligible for can increase your tax liability unnecessarily.

Tools and Resources for State Taxes Paperwork

Several tools and resources are available to help simplify state taxes paperwork: - Tax Preparation Software: Programs like TurboTax, H&R Block, and TaxAct can guide you through the tax preparation and filing process. - State Tax Websites: Official state tax websites often provide forms, instructions, and FAQs that can help with the filing process. - Professional Tax Services: For complex tax situations, consulting a tax professional can provide personalized guidance and support.

| State | Income Tax Rate | Sales Tax Rate |

|---|---|---|

| California | 9.3% | 7.25% |

| New York | 8.82% | 4% |

| Florida | 0% | 6% |

In essence, managing state taxes paperwork requires a combination of understanding, organization, and the right tools. By staying informed, planning ahead, and seeking professional help when needed, individuals and businesses can navigate the complexities of state taxes with ease.

As we reflect on the journey through the world of state taxes paperwork, it becomes clear that while the process can be daunting, it is manageable with the right approach. The key is to stay organized, leverage available resources, and not hesitate to seek help when needed. With these strategies in place, dealing with state taxes paperwork can become a more streamlined and less stressful experience, allowing individuals and businesses to focus on their core activities with confidence.

What is the difference between state and federal taxes?

+

State taxes are levied by individual states on their residents’ income, sales, and other transactions, while federal taxes are imposed by the federal government on income earned by individuals and businesses across the country.

How do I file my state taxes electronically?

+

You can file your state taxes electronically through the official website of your state’s tax authority or by using tax preparation software that supports e-filing for your state.

What happens if I miss the deadline for filing my state taxes?

+

If you miss the deadline, you may be subject to penalties and interest on the amount of taxes you owe. It is advisable to file for an extension if you cannot meet the deadline and to pay any estimated taxes due to minimize penalties.