Is New Hire Paperwork Compensable

Introduction to Compensable Time for New Hires

When a new employee joins an organization, there are numerous tasks and paperwork that need to be completed. This process can be time-consuming and may raise questions about whether the time spent on these activities is compensable. The Fair Labor Standards Act (FLSA) requires employers to pay employees for all hours worked, but the definition of “hours worked” can be somewhat ambiguous when it comes to new hire paperwork and orientation. In this article, we will delve into the specifics of whether new hire paperwork is considered compensable time and what factors employers should consider when determining compensation for these activities.

Understanding the Fair Labor Standards Act (FLSA)

The FLSA is a federal law that sets standards for minimum wage, overtime pay, and record-keeping requirements for employers. One of the key provisions of the FLSA is the requirement that employers pay employees for all hours worked. However, the FLSA does not explicitly address whether time spent on new hire paperwork is considered “hours worked.” To determine whether new hire paperwork is compensable, employers must consider the nature of the tasks being performed and whether they are an integral part of the employee’s job.

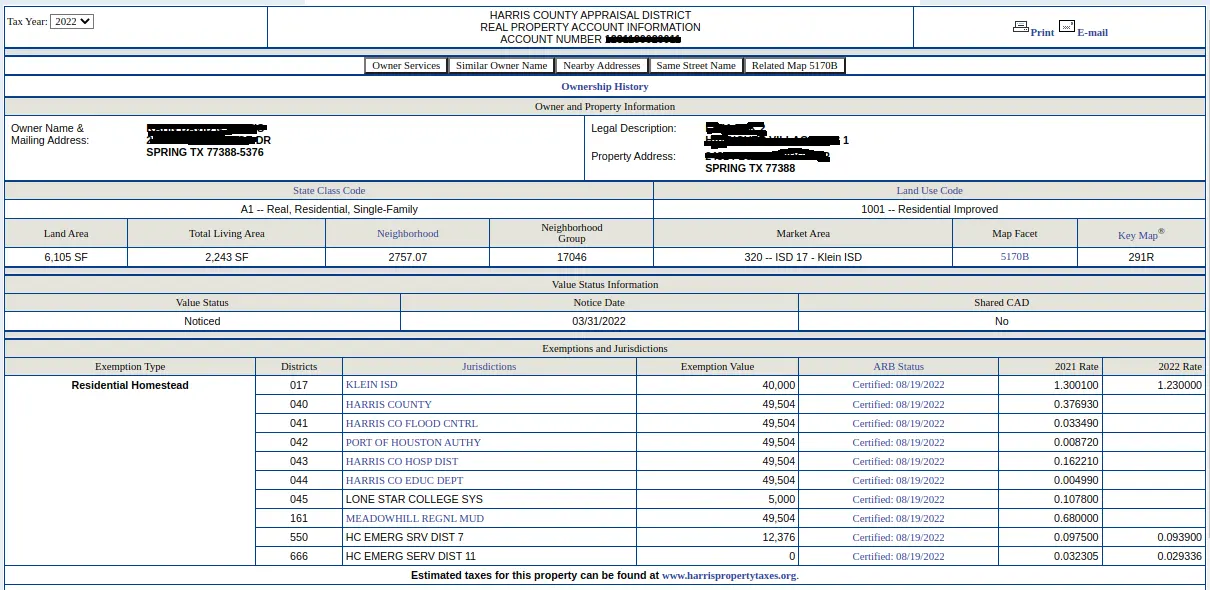

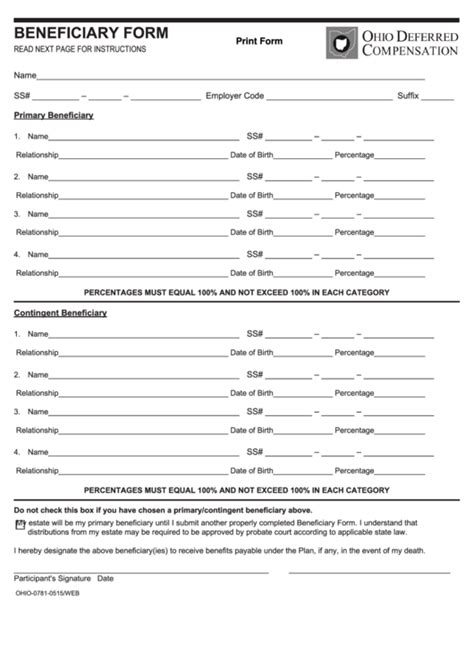

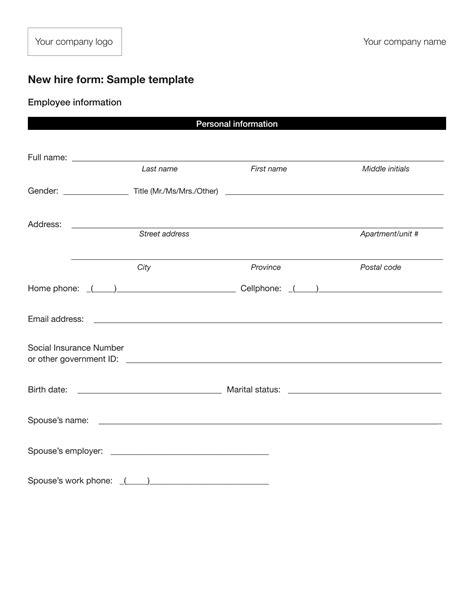

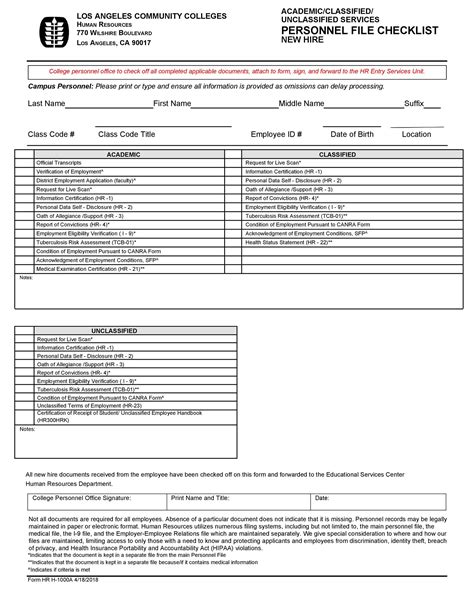

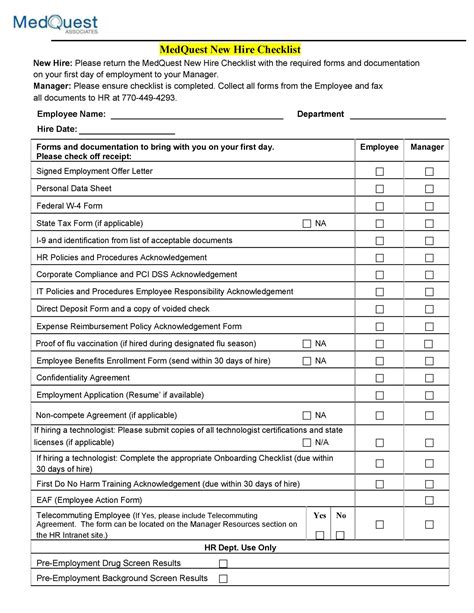

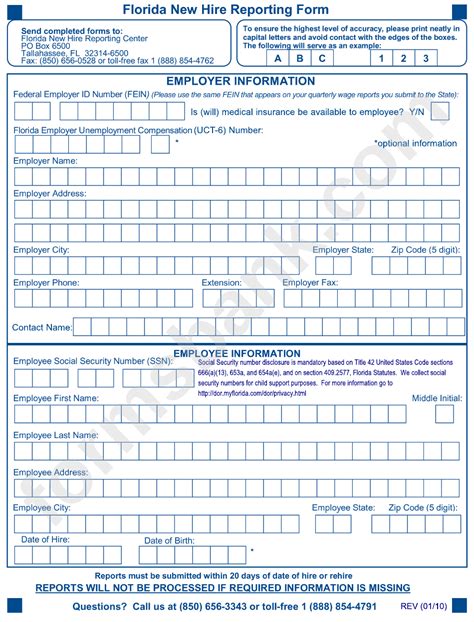

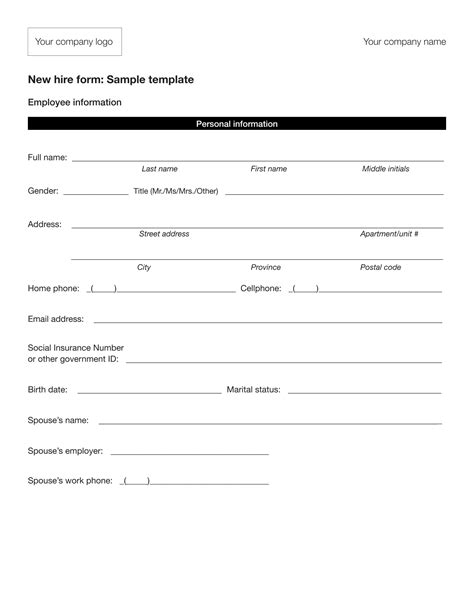

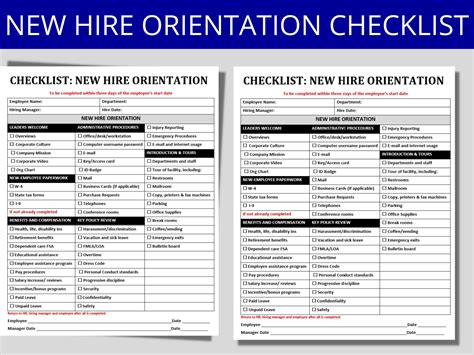

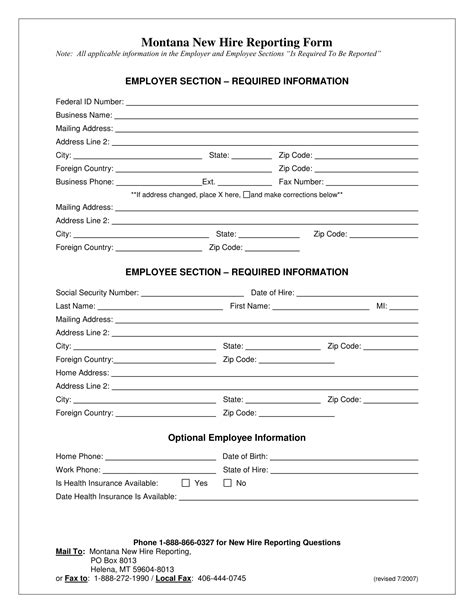

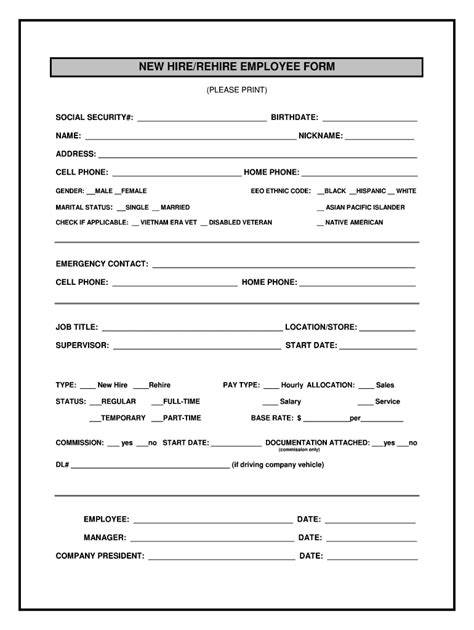

Types of New Hire Paperwork and Activities

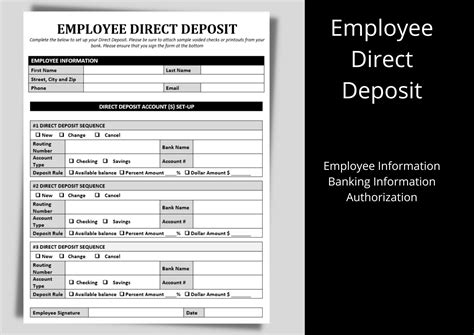

New hire paperwork can include a variety of tasks, such as: * Completing employment applications and contracts * Reviewing and signing company policies and procedures * Filling out tax forms and benefits enrollment * Participating in orientation and training sessions * Setting up employee accounts and accessing company systems

These activities can be time-consuming and may require the employee to spend several hours or even days completing them. Employers must determine whether these activities are considered “hours worked” and therefore compensable under the FLSA.

Determining Compensable Time for New Hires

To determine whether new hire paperwork is compensable, employers should consider the following factors: * Is the activity an integral part of the employee’s job? If the activity is necessary for the employee to perform their job duties, it is likely considered compensable time. * Is the activity performed primarily for the benefit of the employer? If the activity is primarily for the benefit of the employer, such as completing paperwork or attending orientation, it is likely considered compensable time. * Is the employee required to be present at a specific location or time? If the employee is required to be present at a specific location or time to complete the paperwork or attend orientation, it is likely considered compensable time.

📝 Note: Employers should keep accurate records of the time spent on new hire paperwork and activities to ensure compliance with the FLSA and to avoid potential disputes over compensable time.

Best Practices for Managing New Hire Paperwork and Compensable Time

To avoid potential issues with compensable time, employers should consider the following best practices: * Develop a comprehensive onboarding process that includes all necessary paperwork and activities * Clearly communicate expectations to new hires regarding compensable time and the onboarding process * Keep accurate records of the time spent on new hire paperwork and activities * Consider implementing electronic onboarding systems to streamline the process and reduce paperwork

| Activity | Compensable Time |

|---|---|

| Completing employment application | Yes |

| Reviewing company policies and procedures | Yes |

| Attending orientation and training sessions | Yes |

| Setting up employee accounts and accessing company systems | Yes |

In conclusion, new hire paperwork can be considered compensable time under the FLSA, depending on the nature of the tasks being performed and whether they are an integral part of the employee’s job. Employers should consider the factors outlined above and develop best practices for managing new hire paperwork and compensable time to ensure compliance with the FLSA and to avoid potential disputes.

What is the Fair Labor Standards Act (FLSA)?

+

The Fair Labor Standards Act (FLSA) is a federal law that sets standards for minimum wage, overtime pay, and record-keeping requirements for employers.

Is new hire paperwork considered compensable time under the FLSA?

+

Yes, new hire paperwork can be considered compensable time under the FLSA, depending on the nature of the tasks being performed and whether they are an integral part of the employee’s job.

How can employers determine whether new hire paperwork is compensable time?

+

Employers can determine whether new hire paperwork is compensable time by considering factors such as whether the activity is an integral part of the employee’s job, whether it is performed primarily for the benefit of the employer, and whether the employee is required to be present at a specific location or time.