Paperwork

DIY Tax Benefits

Introduction to DIY Tax Benefits

When it comes to managing your finances, understanding the benefits of DIY tax can be a game-changer. By taking control of your tax situation, you can potentially save money, reduce stress, and make more informed decisions about your financial future. In this article, we’ll explore the world of DIY tax benefits, including what they are, how they work, and how you can start taking advantage of them today.

What are DIY Tax Benefits?

DIY tax benefits refer to the advantages of handling your own tax-related tasks, such as preparing and filing your tax returns, rather than relying on a professional tax preparer or accountant. By taking a DIY approach to tax, you can gain a better understanding of your financial situation, identify potential areas for savings, and make more informed decisions about your tax strategy. Some of the key benefits of DIY tax include: * Increased control: By handling your own tax tasks, you have more control over the process and can ensure that your returns are accurate and complete. * Cost savings: Preparing and filing your own tax returns can save you money on preparation fees and other costs associated with hiring a professional. * Improved understanding: By taking a hands-on approach to tax, you can gain a deeper understanding of your financial situation and make more informed decisions about your tax strategy.

How to Get Started with DIY Tax Benefits

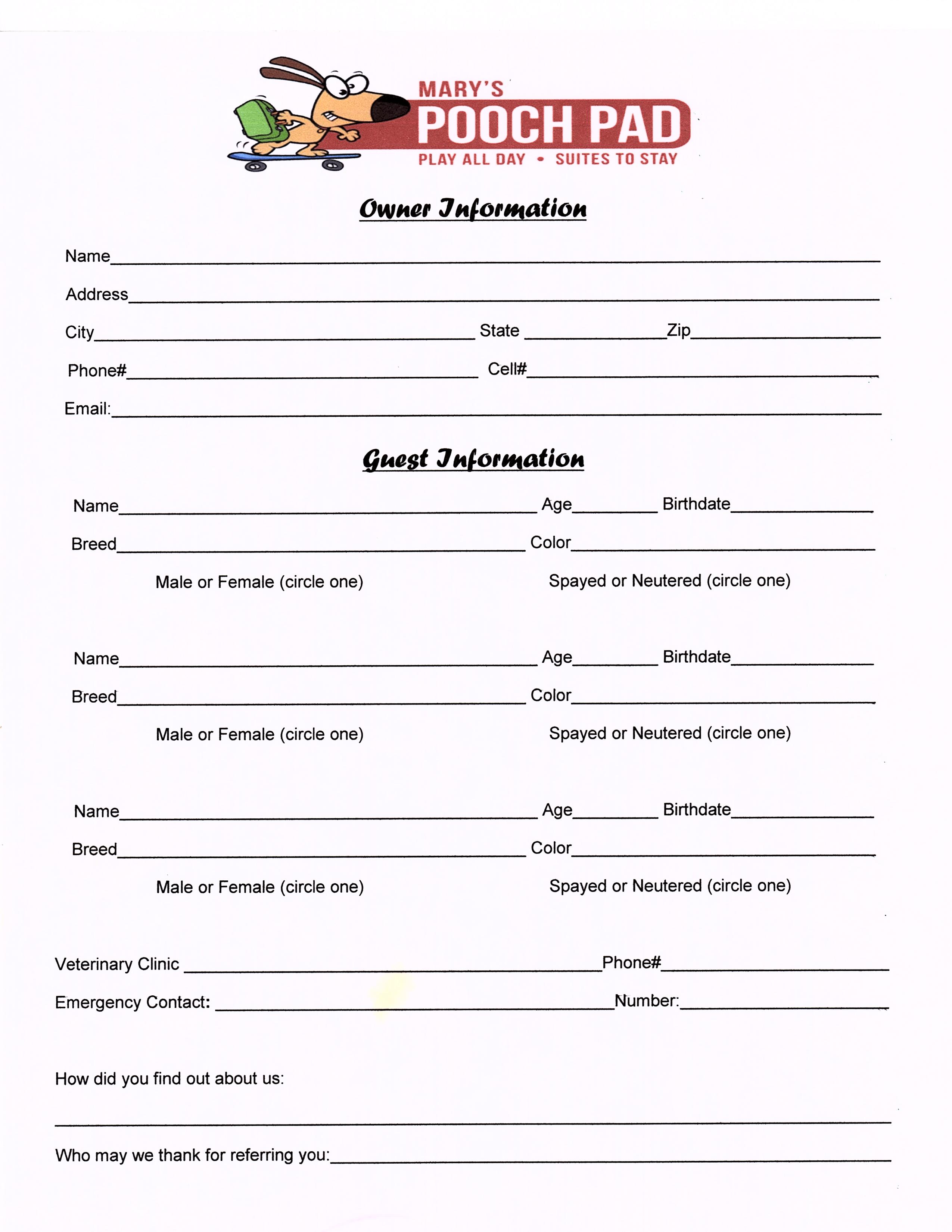

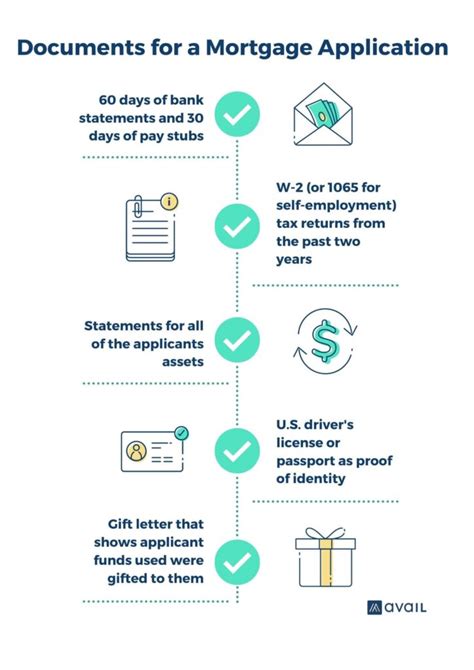

Getting started with DIY tax benefits is easier than you think. Here are some steps to follow: * Gather your documents: Start by gathering all of the necessary documents, including your W-2 forms, 1099 forms, and any other relevant financial information. * Choose a tax preparation method: You can choose to prepare your tax returns manually, using tax preparation software, or by using an online tax preparation service. * Learn about tax deductions and credits: Take some time to learn about the different tax deductions and credits that you may be eligible for, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit. * Stay organized: Keep all of your tax-related documents and information organized, and make sure to stay on top of deadlines and other important tax-related tasks.

Common DIY Tax Benefits

There are many common DIY tax benefits that you can take advantage of, including: * Home office deduction: If you use a dedicated space in your home for business purposes, you may be eligible for the home office deduction. * Charitable donations: Donations to qualified charitable organizations may be eligible for a tax deduction. * Medical expenses: Medical expenses that exceed a certain percentage of your income may be eligible for a tax deduction. * Education credits: There are several education-related tax credits available, including the American Opportunity Tax Credit and the Lifetime Learning Credit.

📝 Note: It's always a good idea to consult with a tax professional or financial advisor to ensure that you are taking advantage of all the DIY tax benefits that you are eligible for.

Tax Preparation Software and Tools

There are many tax preparation software and tools available to help you prepare and file your tax returns. Some popular options include: * TurboTax: A comprehensive tax preparation software that guides you through the tax preparation process. * H&R Block: A tax preparation software that offers a range of tools and features to help you prepare and file your tax returns. * TaxAct: A tax preparation software that offers a range of tools and features to help you prepare and file your tax returns.

| Software | Features | Cost |

|---|---|---|

| TurboTax | Comprehensive tax preparation, audit support, and import capabilities | $59.99 - $149.99 |

| H&R Block | Tax preparation, audit support, and import capabilities | $49.99 - $109.99 |

| TaxAct | Tax preparation, audit support, and import capabilities | $29.95 - $94.95 |

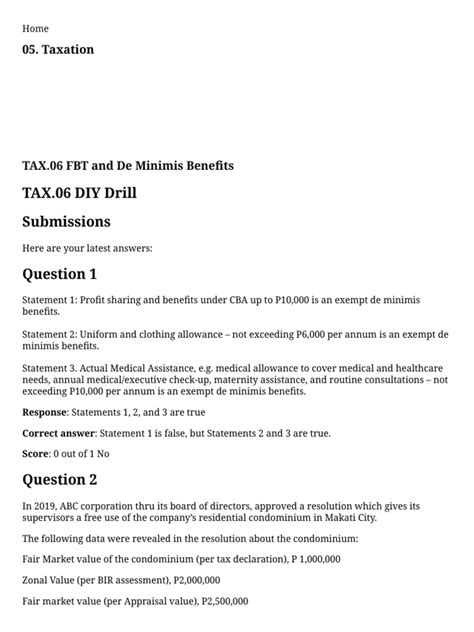

DIY Tax Benefits for Small Business Owners

As a small business owner, there are many DIY tax benefits that you can take advantage of, including: * Business expense deductions: You can deduct business expenses on your tax return, such as office supplies, travel expenses, and equipment purchases. * Home office deduction: If you use a dedicated space in your home for business purposes, you may be eligible for the home office deduction. * Retirement plan contributions: Contributions to a SEP-IRA or Solo 401(k) may be eligible for a tax deduction.

Conclusion and Final Thoughts

In conclusion, DIY tax benefits can be a great way to save money, reduce stress, and take control of your financial future. By understanding the different DIY tax benefits available, using tax preparation software and tools, and staying organized, you can make the most of your tax situation and achieve your financial goals. Whether you’re an individual or a small business owner, there are many DIY tax benefits that you can take advantage of, so start exploring your options today.

What are the benefits of DIY tax preparation?

+

The benefits of DIY tax preparation include increased control, cost savings, and improved understanding of your financial situation.

What tax preparation software is available for DIY tax preparation?

+

Some popular tax preparation software options include TurboTax, H&R Block, and TaxAct.

Can small business owners take advantage of DIY tax benefits?

+

Yes, small business owners can take advantage of DIY tax benefits, including business expense deductions, home office deduction, and retirement plan contributions.