Mortgage Paperwork Requirements

Introduction to Mortgage Paperwork Requirements

When applying for a mortgage, it’s essential to understand the various paperwork requirements involved in the process. The mortgage application process can be lengthy and complex, requiring a significant amount of documentation to ensure that lenders have a complete picture of an applicant’s financial situation. In this blog post, we will delve into the world of mortgage paperwork requirements, exploring the different types of documents needed, the importance of accuracy and completeness, and providing tips for a smooth application process.

Types of Mortgage Paperwork Requirements

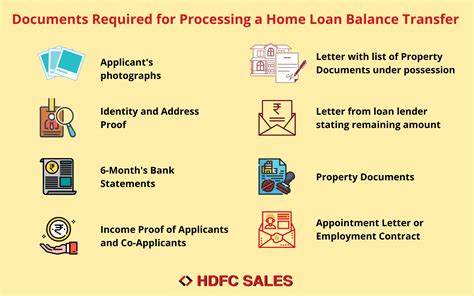

The mortgage application process typically involves submitting a variety of documents to the lender. These documents can be categorized into several groups, including: * Identification documents: These include government-issued IDs, such as a driver’s license or passport, and social security cards. * Income verification documents: Pay stubs, W-2 forms, and tax returns are used to verify an applicant’s income and employment status. * Asset documentation: Bank statements, investment accounts, and retirement accounts are used to verify an applicant’s assets and creditworthiness. * Credit reports: Lenders use credit reports to evaluate an applicant’s credit history and credit score. * Property documentation: Deeds, titles, and appraisals are used to verify the property’s value and ownership.

Importance of Accuracy and Completeness

Accuracy and completeness are crucial when it comes to mortgage paperwork requirements. Incomplete or inaccurate documentation can lead to delays or even rejection of the mortgage application. Lenders rely on the submitted documents to make informed decisions about an applicant’s creditworthiness and ability to repay the loan. Therefore, it’s essential to ensure that all documents are accurate, complete, and submitted in a timely manner.

Tips for a Smooth Application Process

To ensure a smooth mortgage application process, applicants can follow these tips: * Gather all required documents in advance to avoid last-minute delays. * Verify the accuracy and completeness of all documents before submitting them to the lender. * Use a checklist to keep track of the documents submitted and those still pending. * Respond promptly to lender requests for additional information or documentation. * Consider working with a mortgage broker who can guide the applicant through the process and ensure that all documents are in order.

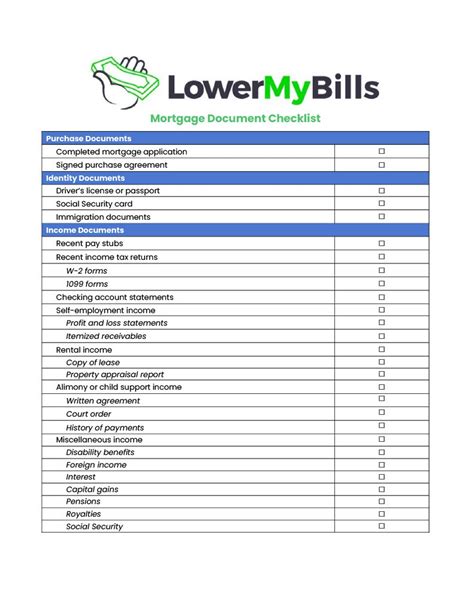

Mortgage Paperwork Requirements Checklist

Here is a sample checklist of mortgage paperwork requirements:

| Document Type | Description |

|---|---|

| Identification documents | Government-issued IDs, social security cards |

| Income verification documents | Pay stubs, W-2 forms, tax returns |

| Asset documentation | Bank statements, investment accounts, retirement accounts |

| Credit reports | Credit history and credit score |

| Property documentation | Deeds, titles, appraisals |

📝 Note: The specific mortgage paperwork requirements may vary depending on the lender and the type of mortgage being applied for.

In the end, understanding the mortgage paperwork requirements is essential for a successful mortgage application process. By gathering all required documents, verifying their accuracy and completeness, and responding promptly to lender requests, applicants can ensure a smooth and efficient application process. With the right mindset and preparation, applicants can navigate the complex world of mortgage paperwork requirements and achieve their goal of becoming a homeowner.

What are the most common mortgage paperwork requirements?

+

The most common mortgage paperwork requirements include identification documents, income verification documents, asset documentation, credit reports, and property documentation.

How long does the mortgage application process typically take?

+

The mortgage application process can take anywhere from a few days to several weeks, depending on the complexity of the application and the efficiency of the lender.

Can I apply for a mortgage online?

+

Yes, many lenders offer online mortgage applications, which can streamline the process and reduce the need for physical paperwork.