7 Papers For Accountant

Introduction to Accounting Papers

As an accountant, it is essential to stay updated with the latest trends, regulations, and best practices in the field. One way to achieve this is by reading and analyzing research papers related to accounting. In this article, we will discuss seven important papers that every accountant should be familiar with. These papers cover various topics, including financial reporting, auditing, taxation, and financial analysis.

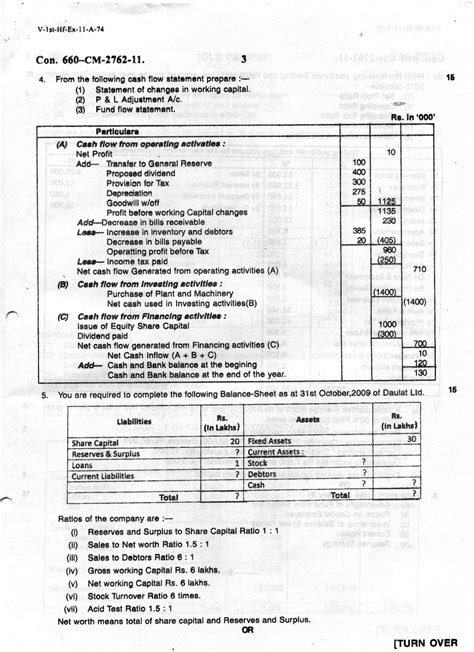

Paper 1: The Impact of Financial Reporting on Investment Decisions

The first paper, titled “The Impact of Financial Reporting on Investment Decisions,” explores the relationship between financial reporting and investment decisions. The authors of this paper argue that high-quality financial reporting is essential for investors to make informed decisions. They also provide evidence that companies with better financial reporting practices tend to have lower cost of capital and higher market value.

Paper 2: Audit Quality and Earnings Management

The second paper, titled “Audit Quality and Earnings Management,” examines the relationship between audit quality and earnings management. The authors find that high-quality audits can reduce earnings management practices, which can lead to more accurate financial reporting. They also discuss the importance of auditor independence and expertise in ensuring high-quality audits.

Paper 3: Taxation and Corporate Financial Policy

The third paper, titled “Taxation and Corporate Financial Policy,” discusses the impact of taxation on corporate financial policy. The authors argue that taxation can affect a company’s capital structure, dividend policy, and investment decisions. They also provide evidence that companies in high-tax environments tend to have higher debt levels and lower dividend payouts.

Paper 4: Financial Analysis and Stock Market Performance

The fourth paper, titled “Financial Analysis and Stock Market Performance,” explores the relationship between financial analysis and stock market performance. The authors find that companies with strong financial performance tend to have higher stock market returns. They also discuss the importance of financial ratio analysis in predicting stock market performance.

Paper 5: Corporate Governance and Financial Reporting Quality

The fifth paper, titled “Corporate Governance and Financial Reporting Quality,” examines the relationship between corporate governance and financial reporting quality. The authors argue that strong corporate governance practices can lead to higher-quality financial reporting. They also provide evidence that companies with independent boards and audit committees tend to have lower levels of earnings management.

Paper 6: Financial Statement Analysis and Credit Risk Assessment

The sixth paper, titled “Financial Statement Analysis and Credit Risk Assessment,” discusses the importance of financial statement analysis in credit risk assessment. The authors provide a framework for analyzing financial statements to predict credit risk. They also discuss the importance of considering both quantitative and qualitative factors in credit risk assessment.

Paper 7: Sustainability Reporting and Financial Performance

The seventh paper, titled “Sustainability Reporting and Financial Performance,” explores the relationship between sustainability reporting and financial performance. The authors find that companies that disclose sustainability information tend to have higher financial performance. They also discuss the importance of considering environmental, social, and governance (ESG) factors in investment decisions.

📝 Note: These papers are essential reading for accountants who want to stay updated with the latest research and trends in the field.

To summarize, these seven papers cover a range of topics related to accounting, including financial reporting, auditing, taxation, financial analysis, corporate governance, credit risk assessment, and sustainability reporting. By reading and analyzing these papers, accountants can gain a deeper understanding of the latest research and trends in the field and apply this knowledge to their work.

The key points from these papers can be summarized as follows: * High-quality financial reporting is essential for investors to make informed decisions. * Audit quality can reduce earnings management practices and lead to more accurate financial reporting. * Taxation can affect a company’s capital structure, dividend policy, and investment decisions. * Financial analysis can predict stock market performance and credit risk. * Corporate governance practices can lead to higher-quality financial reporting. * Sustainability reporting can lead to higher financial performance.

In terms of practical applications, these papers provide insights and guidance for accountants on how to improve financial reporting, auditing, and financial analysis practices. They also highlight the importance of considering ESG factors in investment decisions and the need for strong corporate governance practices.

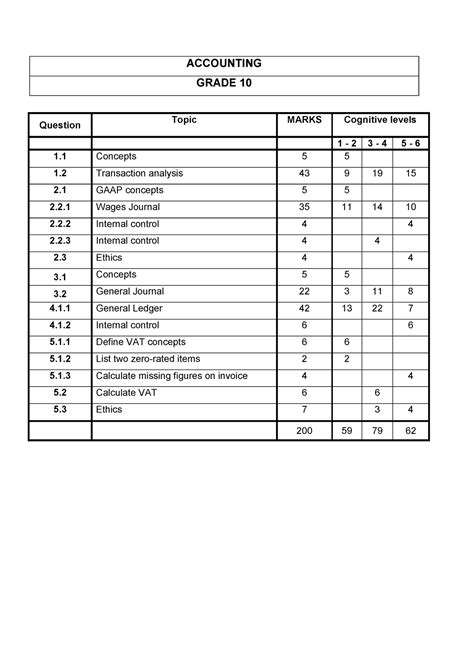

Here is a table summarizing the key points from each paper:

| Paper | Topic | Key Points |

|---|---|---|

| 1 | Financial Reporting | High-quality financial reporting is essential for investors |

| 2 | Audit Quality | Audit quality can reduce earnings management practices |

| 3 | Taxation | Taxation can affect capital structure, dividend policy, and investment decisions |

| 4 | Financial Analysis | Financial analysis can predict stock market performance and credit risk |

| 5 | Corporate Governance | Corporate governance practices can lead to higher-quality financial reporting |

| 6 | Credit Risk Assessment | Financial statement analysis is essential for credit risk assessment |

| 7 | Sustainability Reporting | Sustainability reporting can lead to higher financial performance |

In conclusion, these seven papers provide valuable insights and guidance for accountants on a range of topics related to accounting. By reading and analyzing these papers, accountants can gain a deeper understanding of the latest research and trends in the field and apply this knowledge to their work.

What is the importance of financial reporting in investment decisions?

+

Financial reporting is essential for investors to make informed decisions. High-quality financial reporting provides investors with accurate and reliable information about a company’s financial performance and position.

How can audit quality affect earnings management practices?

+

Audit quality can reduce earnings management practices by providing an independent and objective review of a company’s financial statements. High-quality audits can detect and prevent earnings management practices, leading to more accurate financial reporting.

What is the relationship between taxation and corporate financial policy?

+

Taxation can affect a company’s capital structure, dividend policy, and investment decisions. Companies in high-tax environments may prefer to use debt financing instead of equity financing, and may also reduce their dividend payouts to minimize tax liabilities.