FMLA Paperwork Fee Legality

Introduction to FMLA Paperwork Fee Legality

The FAMILY AND MEDICAL LEAVE ACT (FMLA) is a federal law that provides eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons. While the law is designed to protect employees’ jobs and provide them with much-needed time off, the process of applying for and managing FMLA leave can be complex and time-consuming. One issue that has sparked debate is the legality of charging employees a fee for FMLA paperwork. In this article, we will explore the legality of charging employees for FMLA paperwork and what it means for employers and employees alike.

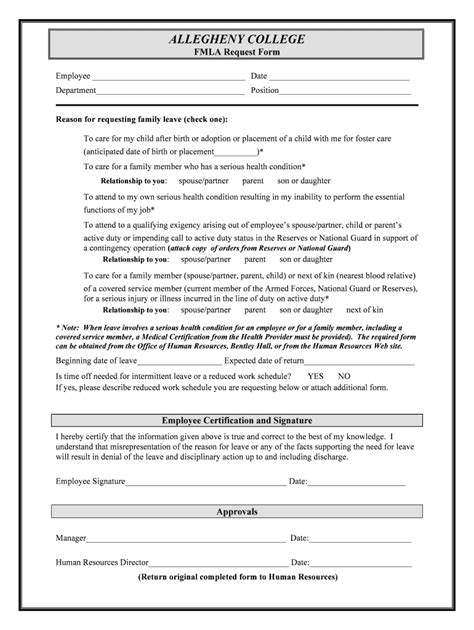

Understanding FMLA Requirements

To understand the issue of FMLA paperwork fees, it’s essential to first understand the requirements of the FMLA. The law requires that employers provide eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons, such as the birth or adoption of a child, a serious health condition, or the need to care for a family member with a serious health condition. Employers must also continue to provide health insurance coverage to employees on FMLA leave and guarantee their job or a similar position upon their return.

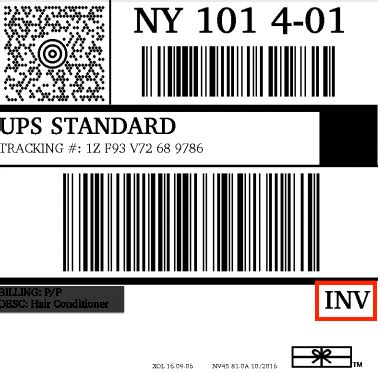

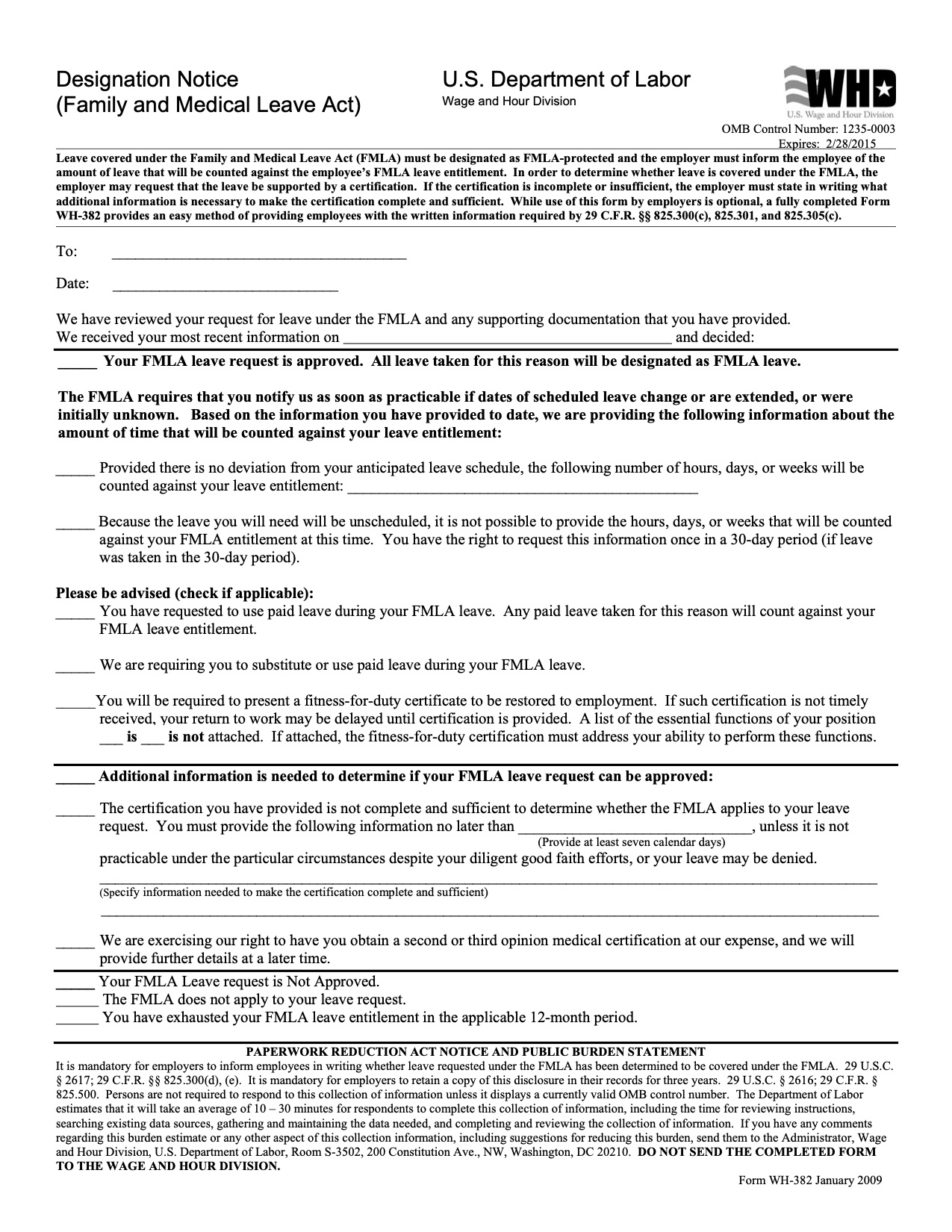

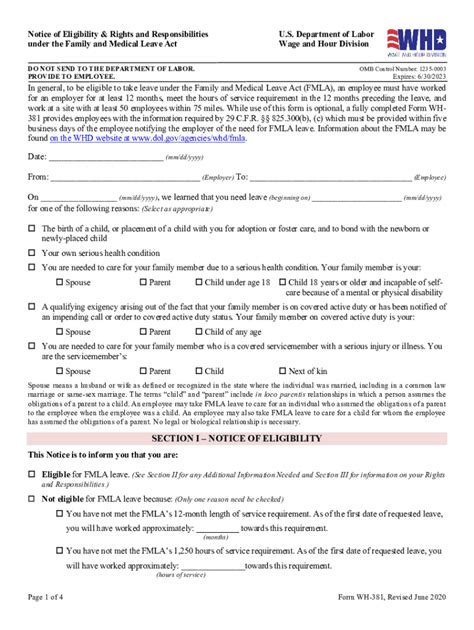

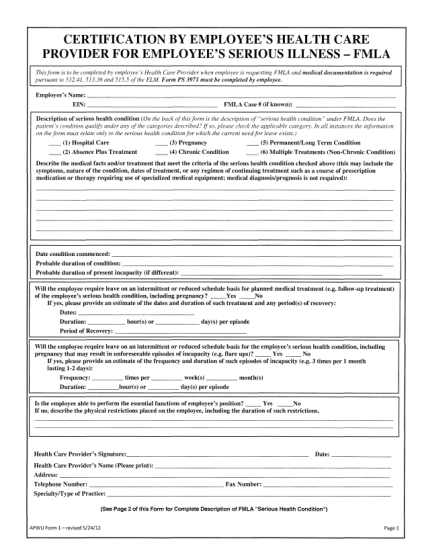

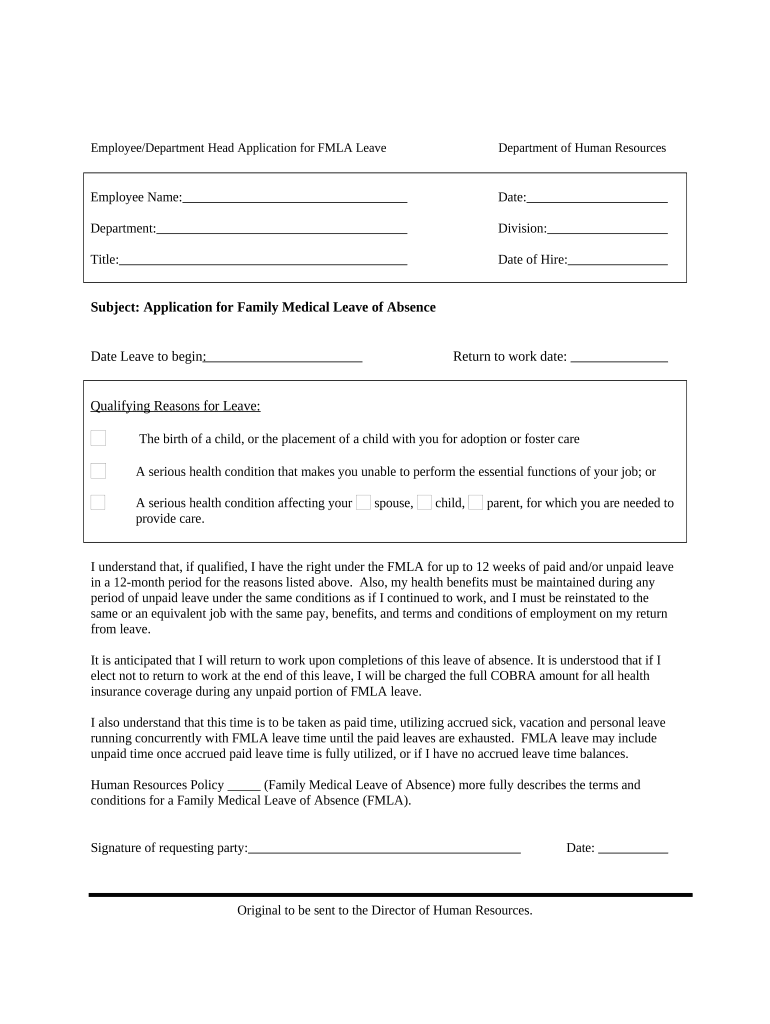

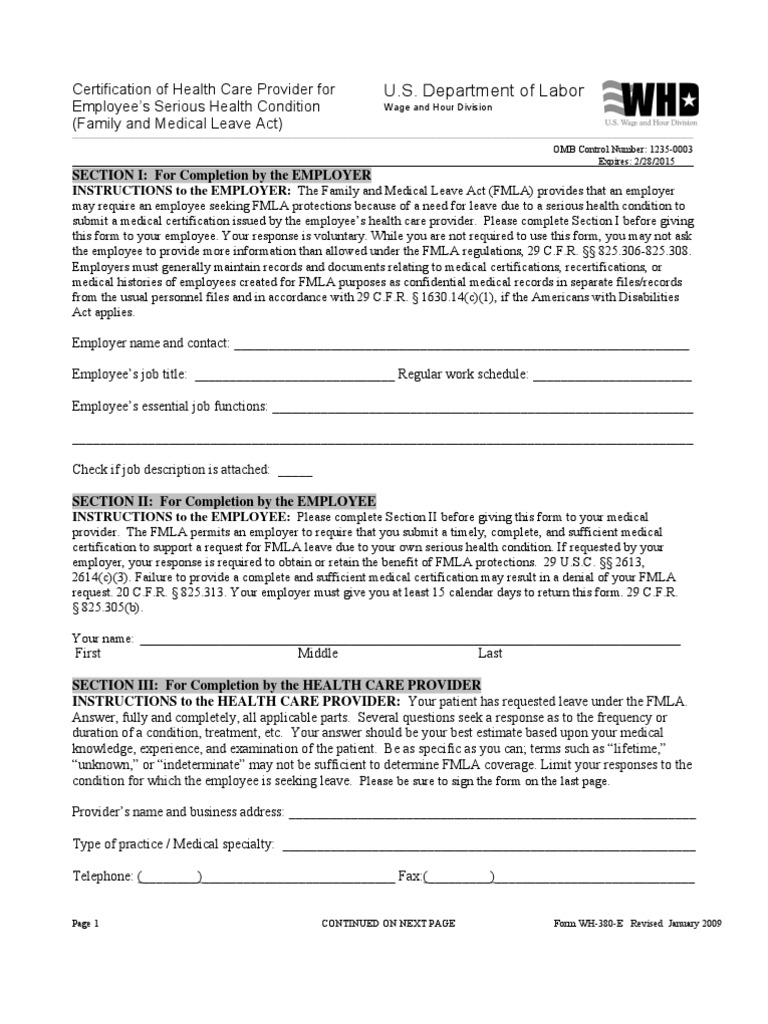

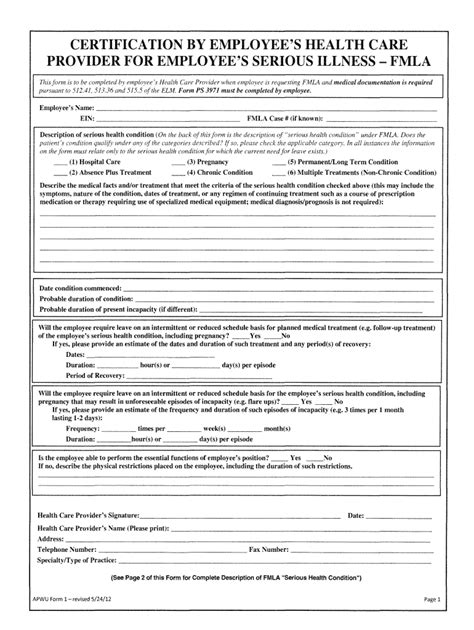

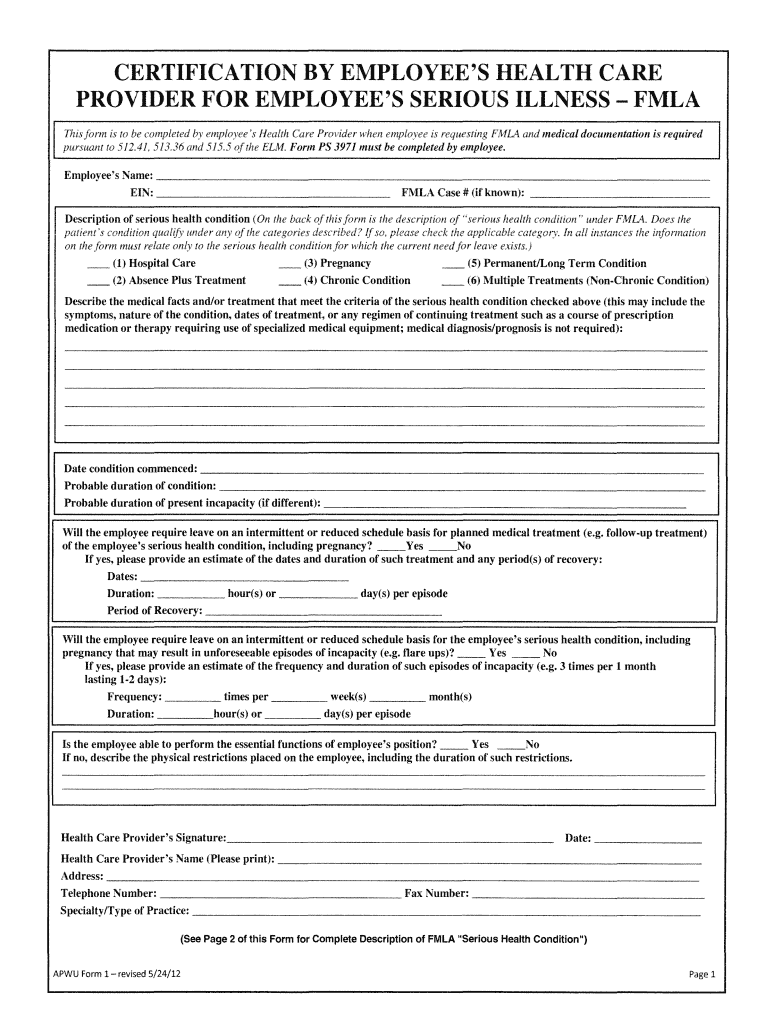

FMLA Paperwork Process

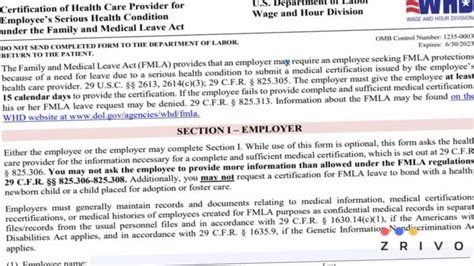

The FMLA paperwork process typically involves several steps, including: * Employee Request: The employee requests FMLA leave and provides the employer with sufficient notice, usually 30 days. * Employer Response: The employer responds to the employee’s request and provides them with an eligibility notice and a rights and responsibilities notice. * Certification: The employer may require the employee to provide certification from a healthcare provider to support their leave request. * Leave Approval: The employer approves or denies the employee’s leave request.

FMLA Paperwork Fees: Legality and Implications

Now, let’s address the issue of FMLA paperwork fees. Can employers charge employees a fee for FMLA paperwork? The answer is no. The FMLA regulations prohibit employers from charging employees a fee for FMLA paperwork, including the cost of certification or other documentation required to support an employee’s leave request. This means that employers cannot pass on the costs of administering FMLA leave to employees, including the cost of paperwork, certification, or other documentation.

🚨 Note: Employers who charge employees for FMLA paperwork may be in violation of the FMLA and subject to penalties, including back pay, benefits, and other damages.

Best Practices for Employers

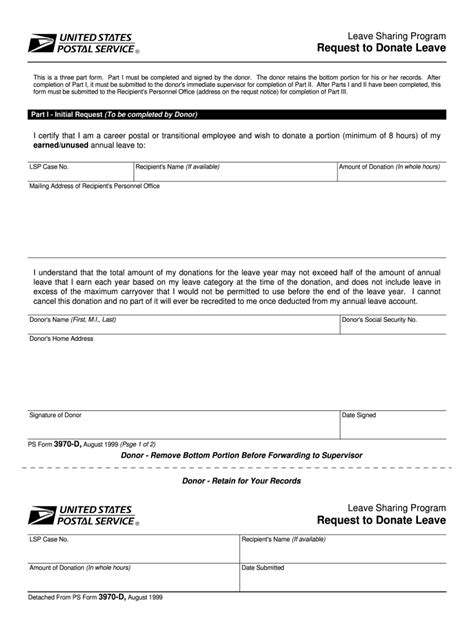

So, what can employers do to ensure compliance with the FMLA and avoid charging employees for FMLA paperwork? Here are some best practices: * Develop a Clear FMLA Policy: Develop a clear and concise FMLA policy that outlines the procedures for requesting and approving FMLA leave. * Provide Necessary Forms and Documentation: Provide employees with the necessary forms and documentation to support their leave request, including certification forms and other required documentation. * Train HR Staff and Managers: Train HR staff and managers on the FMLA regulations and procedures to ensure that they understand the requirements and can administer the law correctly. * Avoid Charging Employees for Paperwork: Avoid charging employees for FMLA paperwork, including the cost of certification or other documentation required to support an employee’s leave request.

Conclusion

In conclusion, charging employees a fee for FMLA paperwork is not only illegal but also unfair. Employers must ensure that they comply with the FMLA regulations and provide employees with the necessary forms and documentation to support their leave request without charging them a fee. By following best practices and understanding the FMLA requirements, employers can avoid penalties and ensure that employees receive the benefits they are entitled to under the law. The key to successful FMLA administration is to develop a clear and concise policy, provide necessary forms and documentation, train HR staff and managers, and avoid charging employees for paperwork.

What is the purpose of the FMLA?

+

The purpose of the FMLA is to provide eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons, such as the birth or adoption of a child, a serious health condition, or the need to care for a family member with a serious health condition.

Can employers charge employees for FMLA paperwork?

+

No, employers cannot charge employees for FMLA paperwork, including the cost of certification or other documentation required to support an employee’s leave request.

What are the consequences of charging employees for FMLA paperwork?

+

Employers who charge employees for FMLA paperwork may be in violation of the FMLA and subject to penalties, including back pay, benefits, and other damages.