Closing Paperwork Signing Time

Introduction to Closing Paperwork Signing Time

When it comes to finalizing a real estate transaction, the closing paperwork signing time is a crucial step. This is the moment when the buyer and seller sign the necessary documents to transfer ownership of the property. The process can be complex and time-consuming, but understanding what to expect can help make it smoother. In this article, we will delve into the details of closing paperwork signing time, including the necessary documents, the roles of the parties involved, and the potential issues that may arise.

Understanding the Closing Process

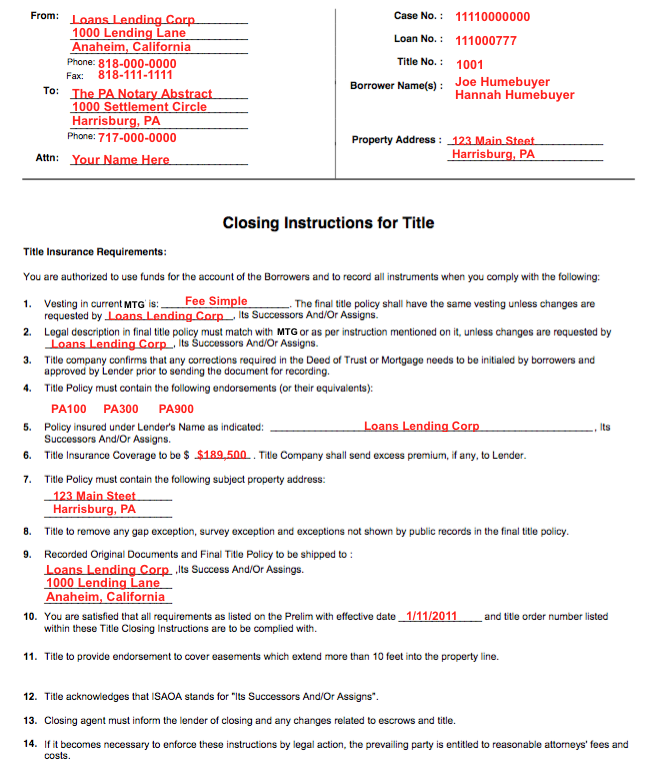

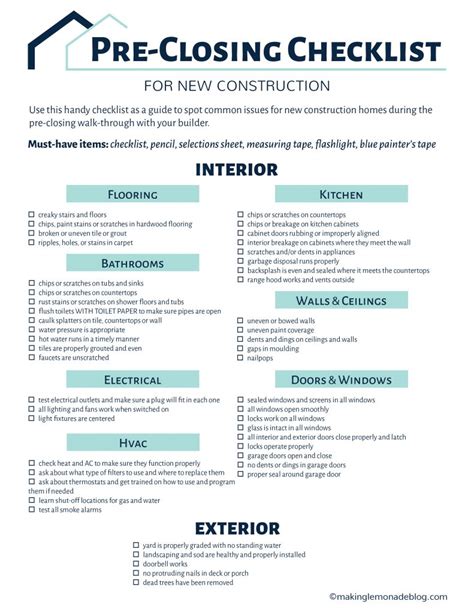

The closing process typically begins several days before the actual signing. During this time, the buyer’s lender will prepare the loan documents, and the title company will conduct a title search to ensure the seller has the right to sell the property. The buyer and seller will also review and sign a number of documents, including the deed, title insurance policy, and loan documents. It is essential for both parties to carefully review these documents to ensure they understand their obligations and responsibilities.

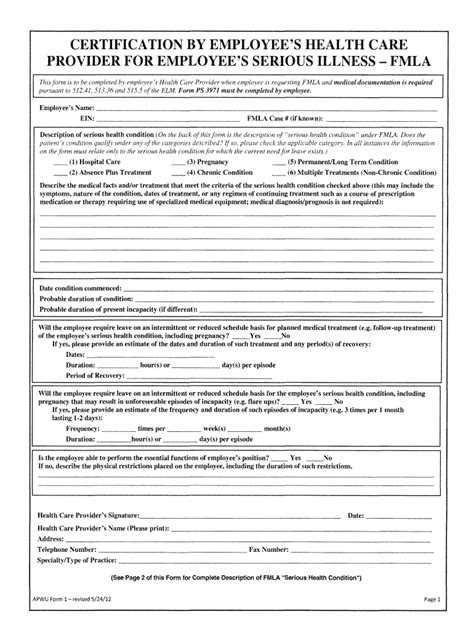

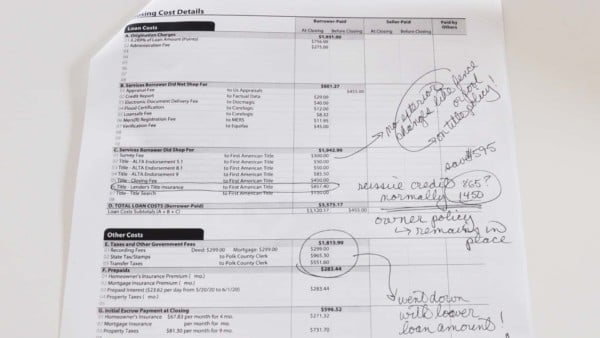

Necessary Documents for Closing

The following documents are typically required for closing: * Deed: This document transfers ownership of the property from the seller to the buyer. * Title insurance policy: This policy protects the buyer and lender from any potential title issues. * Loan documents: These documents outline the terms of the loan, including the interest rate, repayment terms, and any other conditions. * Promissory note: This document is a promise by the buyer to repay the loan. * Mortgage deed: This document gives the lender a lien on the property as security for the loan.

Risks and Challenges Associated with Closing Paperwork

While the closing process is designed to be straightforward, there are potential risks and challenges that can arise. For example: * Title issues: If the title search reveals any unexpected issues, such as unpaid liens or encumbrances, it can delay the closing. * Loan problems: If the buyer’s lender discovers any issues with the loan application, it can cause delays or even lead to the loan being denied. * Communication breakdowns: Poor communication between the parties involved can lead to misunderstandings and delays.

📝 Note: It is essential for both the buyer and seller to carefully review the closing documents and ask questions if they are unsure about any aspect of the process.

Best Practices for a Smooth Closing

To ensure a smooth closing, the following best practices can be helpful: * Communicate clearly: All parties involved should communicate clearly and promptly to avoid misunderstandings. * Review documents carefully: Both the buyer and seller should carefully review the closing documents to ensure they understand their obligations and responsibilities. * Plan ahead: The buyer and seller should plan ahead and allow plenty of time for the closing process to avoid last-minute delays.

Role of Technology in Closing Paperwork

Technology is playing an increasingly important role in the closing process. For example: * E-signatures: Many documents can now be signed electronically, reducing the need for physical paperwork. * Online platforms: Online platforms can facilitate communication and document sharing between the parties involved. * Digital storage: Digital storage solutions can help to keep track of documents and reduce the risk of lost or misplaced paperwork.

| Document | Description |

|---|---|

| Deed | Transfers ownership of the property |

| Title insurance policy | Protects the buyer and lender from title issues |

| Loan documents | Outlines the terms of the loan |

In the end, the closing paperwork signing time is a critical step in the real estate transaction process. By understanding the necessary documents, the roles of the parties involved, and the potential issues that may arise, buyers and sellers can navigate the process with confidence. With careful planning, clear communication, and the use of technology, the closing process can be smooth and efficient, allowing both parties to move forward with their respective goals.

What is the purpose of the closing process?

+

The closing process is designed to transfer ownership of the property from the seller to the buyer, and to ensure that the buyer has a clear title to the property.

What documents are typically required for closing?

+

The documents typically required for closing include the deed, title insurance policy, loan documents, promissory note, and mortgage deed.

How can technology facilitate the closing process?

+

Technology can facilitate the closing process by allowing for e-signatures, online platforms for communication and document sharing, and digital storage solutions.