Buy Bank Paperwork Requirements

Introduction to Buying Bank Paperwork Requirements

When it comes to buying a bank, the process involves a significant amount of paperwork and regulatory compliance. The requirements for buying bank paperwork can vary depending on the jurisdiction, the size and type of the bank, and the specific regulations in place. In this article, we will delve into the details of the paperwork requirements involved in buying a bank, highlighting the key documents, regulatory approvals, and due diligence processes that are typically involved.

Key Documents Required

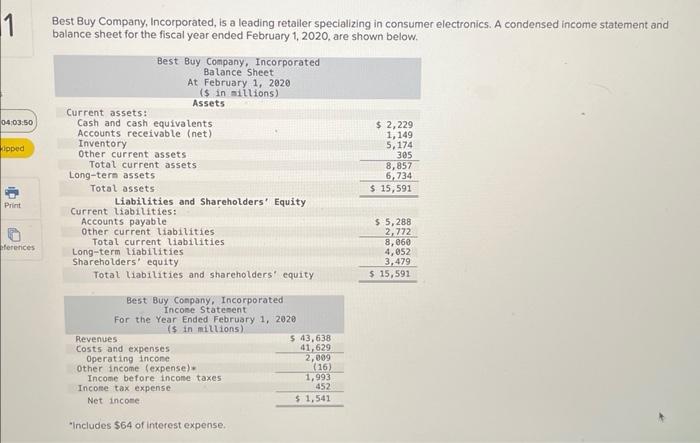

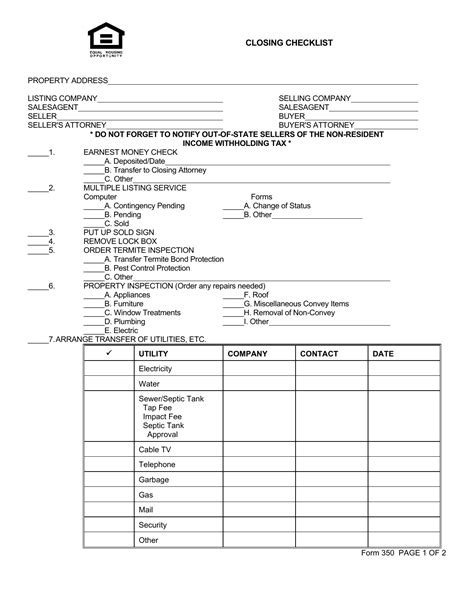

The paperwork requirements for buying a bank typically include a range of documents that provide financial, operational, and regulatory information about the bank. Some of the key documents that are usually required include: * Financial statements: These include the bank’s balance sheet, income statement, and cash flow statement, which provide an overview of the bank’s financial performance and position. * Regulatory filings: These include documents such as the bank’s call report, which provides detailed information about the bank’s financial condition, and the bank’s compliance with regulatory requirements. * Loan documents: These include documents such as loan agreements, promissory notes, and security agreements, which provide information about the bank’s lending activities and credit quality. * Deposit account documents: These include documents such as deposit account agreements, signature cards, and account statements, which provide information about the bank’s deposit base and customer relationships. * Compliance documents: These include documents such as anti-money laundering (AML) policies, Bank Secrecy Act (BSA) compliance programs, and Office of Foreign Assets Control (OFAC) compliance programs, which provide information about the bank’s regulatory compliance.

Regulatory Approvals

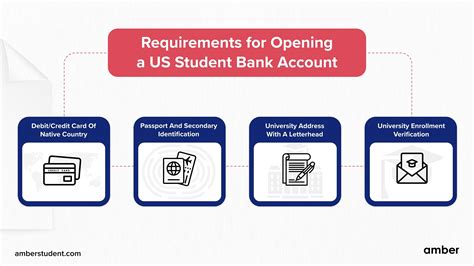

Buying a bank requires regulatory approval from relevant banking authorities, such as the Federal Reserve, the Office of the Comptroller of the Currency (OCC), or state banking regulators. The regulatory approval process typically involves a review of the buyer’s financial condition, business plan, and management team, as well as an assessment of the potential risks and benefits of the acquisition. Some of the key regulatory approvals that are typically required include: * Federal Reserve approval: This is required for acquisitions involving banks with total assets of $1 billion or more. * OCC approval: This is required for acquisitions involving national banks. * State banking regulator approval: This is required for acquisitions involving state-chartered banks.

Due Diligence Process

The due diligence process is a critical component of buying a bank, as it involves a thorough review of the bank’s financial, operational, and regulatory condition. The due diligence process typically involves a review of the bank’s financial statements, regulatory filings, loan documents, deposit account documents, and compliance documents, as well as on-site visits and interviews with bank management and staff. Some of the key areas of focus in the due diligence process include: * Financial condition: This includes a review of the bank’s financial statements, loan portfolio, and deposit base. * Regulatory compliance: This includes a review of the bank’s regulatory filings, compliance programs, and regulatory exam results. * Operational condition: This includes a review of the bank’s operational systems, processes, and controls. * Management and staff: This includes a review of the bank’s management team, staff, and organizational structure.

📝 Note: The due diligence process is a critical component of buying a bank, as it helps to identify potential risks and opportunities, and to inform the buyer's decision-making process.

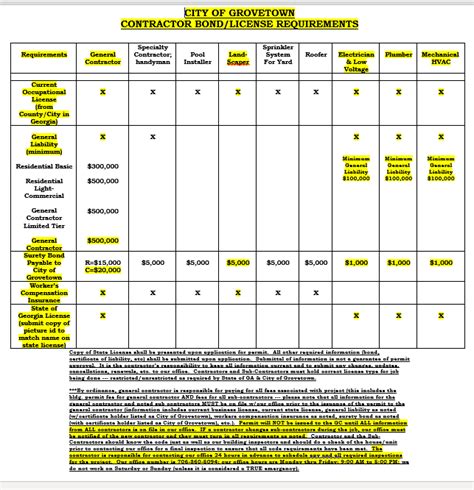

Table of Bank Paperwork Requirements

The following table provides a summary of the key paperwork requirements involved in buying a bank:

| Document Type | Description |

|---|---|

| Financial statements | Balance sheet, income statement, cash flow statement |

| Regulatory filings | Call report, compliance reports, regulatory exam results |

| Loan documents | Loan agreements, promissory notes, security agreements |

| Deposit account documents | Deposit account agreements, signature cards, account statements |

| Compliance documents | AML policies, BSA compliance programs, OFAC compliance programs |

In final thoughts, buying a bank involves a complex and time-consuming process that requires careful planning, due diligence, and regulatory compliance. The paperwork requirements involved in buying a bank are significant, and include a range of documents that provide financial, operational, and regulatory information about the bank. By understanding the key documents, regulatory approvals, and due diligence processes involved in buying a bank, buyers can navigate the process more effectively and make informed decisions about their investment.

What are the key documents required when buying a bank?

+

The key documents required when buying a bank include financial statements, regulatory filings, loan documents, deposit account documents, and compliance documents.

What is the due diligence process involved in buying a bank?

+

The due diligence process involved in buying a bank includes a thorough review of the bank’s financial, operational, and regulatory condition, as well as on-site visits and interviews with bank management and staff.

What are the regulatory approvals required when buying a bank?

+

The regulatory approvals required when buying a bank include Federal Reserve approval, OCC approval, and state banking regulator approval, depending on the jurisdiction and the type of bank being acquired.