5 Geico Paperwork Facts

Understanding Geico Paperwork: A Comprehensive Guide

When it comes to insurance, paperwork is an inevitable part of the process. Geico, one of the largest auto insurance companies in the United States, has its own set of paperwork requirements that policyholders need to be aware of. In this article, we will delve into the world of Geico paperwork, exploring the key facts that you need to know.

What is Geico Paperwork?

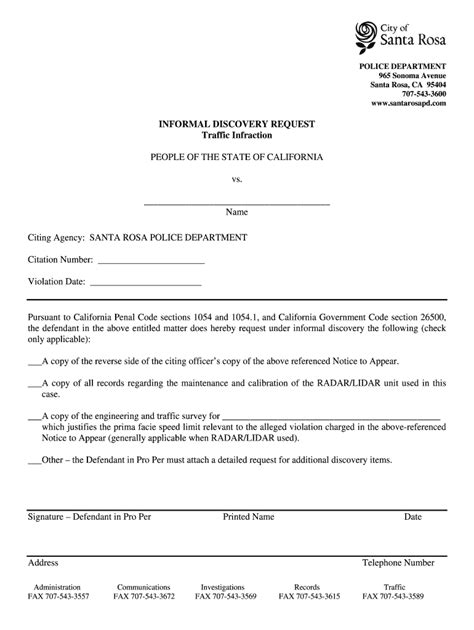

Geico paperwork refers to the various documents and forms that policyholders are required to complete and submit to the company. These documents can include insurance applications, policy renewal forms, claims forms, and proof of insurance. Each of these documents plays a crucial role in the insurance process, and it’s essential to understand what they entail.

5 Key Facts About Geico Paperwork

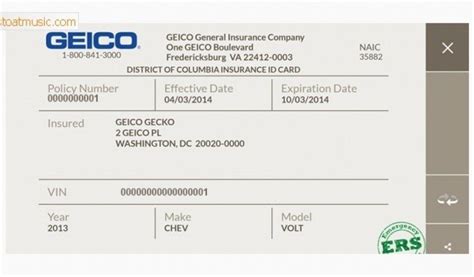

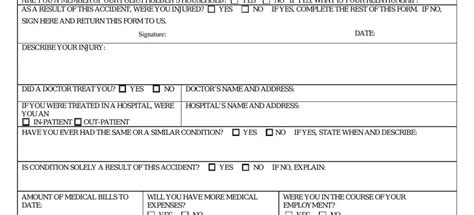

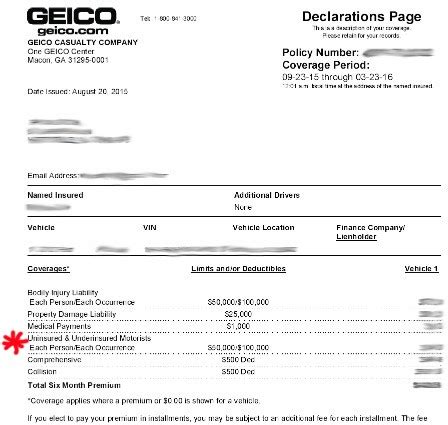

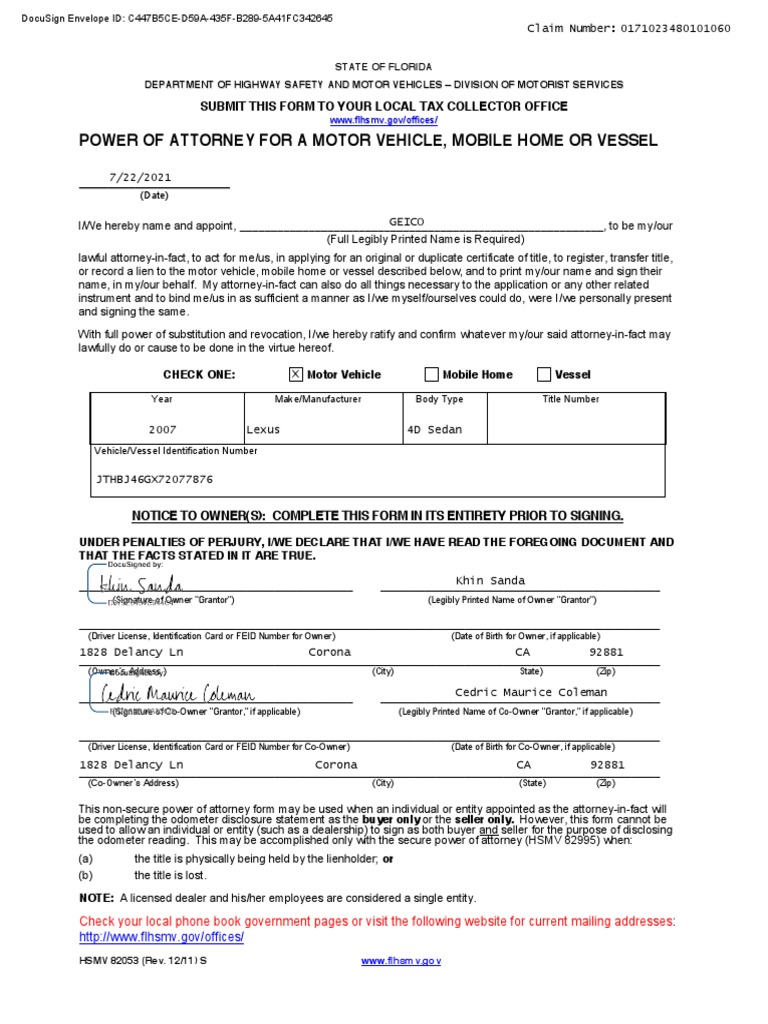

Here are five key facts about Geico paperwork that you should be aware of: * Electronic Signatures: Geico allows policyholders to sign documents electronically, making it easier to complete paperwork online. This feature saves time and reduces the need for physical signatures. * Required Documents: Geico requires policyholders to provide certain documents, such as a valid driver’s license and vehicle registration, to verify their identity and vehicle ownership. * Policy Renewal: Geico policyholders can renew their policies online, over the phone, or by mail. The company sends renewal notices to policyholders before their policy expires, outlining the required paperwork and deadlines. * Claims Process: If you need to file a claim with Geico, you’ll need to complete a claims form and provide supporting documentation, such as police reports and repair estimates. Geico’s claims process is designed to be efficient and straightforward. * Proof of Insurance: Geico policyholders can access their proof of insurance cards online or through the Geico mobile app. These cards serve as proof of insurance and should be kept in your vehicle at all times.

Benefits of Geico Paperwork

While paperwork can be tedious, Geico’s paperwork process has several benefits, including: * Convenience: Geico’s online platform allows policyholders to complete paperwork at their own pace, 24⁄7. * Efficiency: Geico’s electronic signatures and online submission process reduce the time and effort required to complete paperwork. * Accuracy: Geico’s paperwork process helps ensure that policyholders provide accurate and complete information, reducing the risk of errors or omissions.

Common Geico Paperwork Mistakes

When completing Geico paperwork, it’s essential to avoid common mistakes, such as: * Inaccurate information: Providing incorrect or incomplete information can lead to delays or even policy cancellation. * Missing signatures: Failing to sign required documents can render them invalid. * Incomplete documentation: Not providing all required documents can slow down the insurance process.

📝 Note: It's crucial to carefully review and complete all Geico paperwork to avoid mistakes and ensure a smooth insurance process.

Geico Paperwork Tips

To make the Geico paperwork process easier, follow these tips: * Keep records organized: Keep all insurance-related documents, including paperwork and correspondence, in a safe and easily accessible place. * Read instructions carefully: Take the time to read and understand the instructions and requirements for each document. * Ask questions: If you’re unsure about any aspect of the paperwork process, don’t hesitate to contact Geico customer support.

| Document | Description |

|---|---|

| Insurance Application | Initial application for insurance coverage |

| Policy Renewal Form | Form used to renew existing insurance policies |

| Claims Form | Form used to report and process insurance claims |

| Proof of Insurance | Card or document proving insurance coverage |

In summary, Geico paperwork is an essential part of the insurance process. By understanding the key facts, benefits, and common mistakes, policyholders can navigate the paperwork process with ease. Remember to stay organized, read instructions carefully, and ask questions when needed.

What is the purpose of Geico paperwork?

+

The purpose of Geico paperwork is to verify policyholders’ information, process insurance claims, and provide proof of insurance.

Can I complete Geico paperwork online?

+

Yes, Geico allows policyholders to complete paperwork online, including electronic signatures and document submission.

What documents do I need to provide to Geico?

+

Geico requires policyholders to provide documents such as a valid driver’s license, vehicle registration, and proof of insurance.