5 Steps to Close LLC

Introduction to Closing an LLC

When a business is no longer operational or viable, it’s essential to formally close it to avoid potential liabilities and maintain a clean business record. Closing a Limited Liability Company (LLC) involves several steps that must be followed to ensure a smooth and legally compliant process. In this article, we will guide you through the 5 key steps to close an LLC, highlighting important considerations and providing insights into the process.

Step 1: Vote to Dissolve the LLC

The first step in closing an LLC is to hold a vote among the members (owners) to dissolve the company. This vote is typically outlined in the company’s operating agreement, which should specify the procedure for dissolution. If the operating agreement does not provide this information, the company should follow the default rules set forth in the state’s LLC statute. The vote to dissolve the LLC must be recorded in the company’s minutes, and it’s crucial to maintain this documentation for future reference.

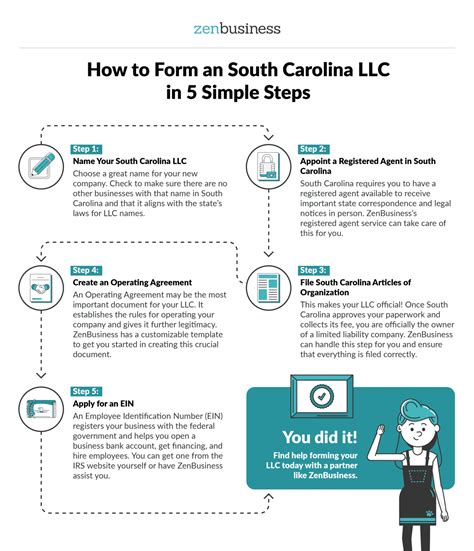

Step 2: File Articles of Dissolution

After the decision to dissolve the LLC has been made and voted upon, the next step is to file Articles of Dissolution with the state where the LLC is registered. This document formally notifies the state of the LLC’s intention to cease operations. The specific requirements for filing Articles of Dissolution vary by state, so it’s essential to check with the state’s business registration office for the exact procedures and fees. Filing this document is a critical step, as it begins the formal process of dissolving the LLC and removing it from the state’s records.

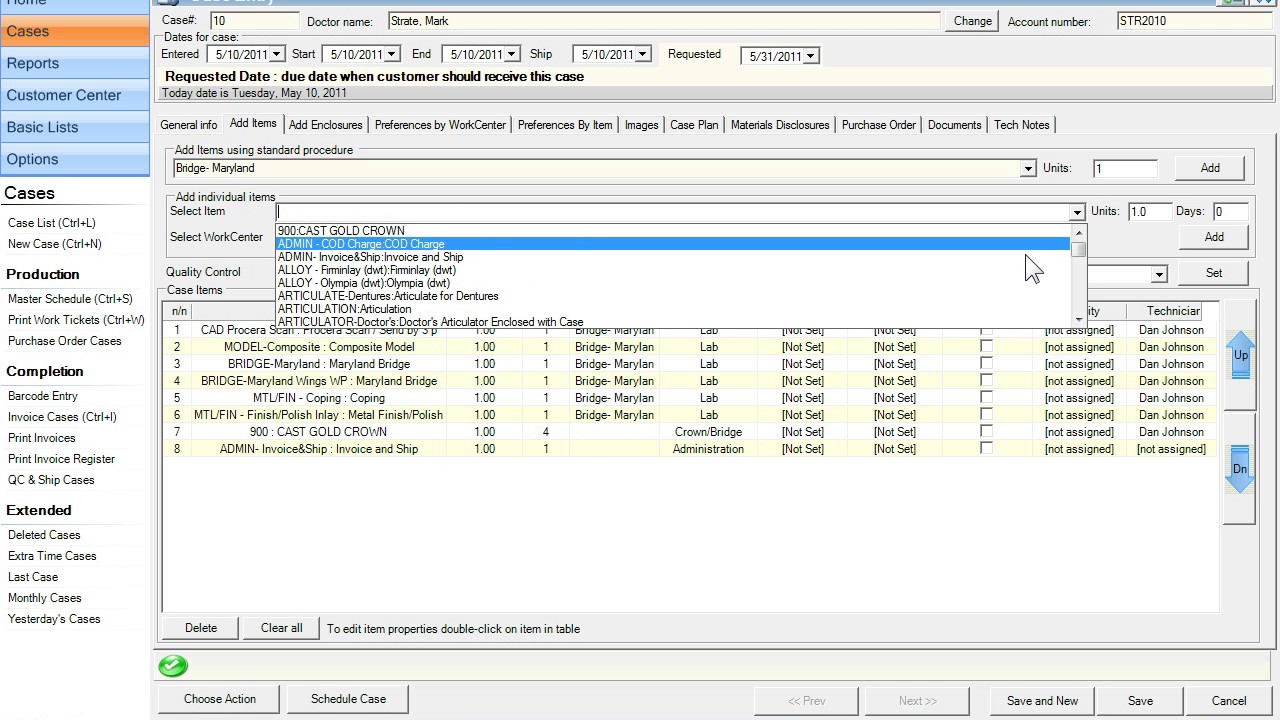

Step 3: Notify Creditors and Settle Debts

Once the Articles of Dissolution have been filed, the LLC must notify its creditors of its intention to dissolve. This notification process is crucial for settling any outstanding debts and ensuring that all financial obligations are met before the LLC is officially closed. The LLC should: - Notify known creditors directly, usually by mail, to inform them of the dissolution. - Publish a notice in a local newspaper, as required by some states, to reach unknown creditors. - Settle debts or make arrangements for their payment to avoid any future complications.

Step 4: Distribute Assets

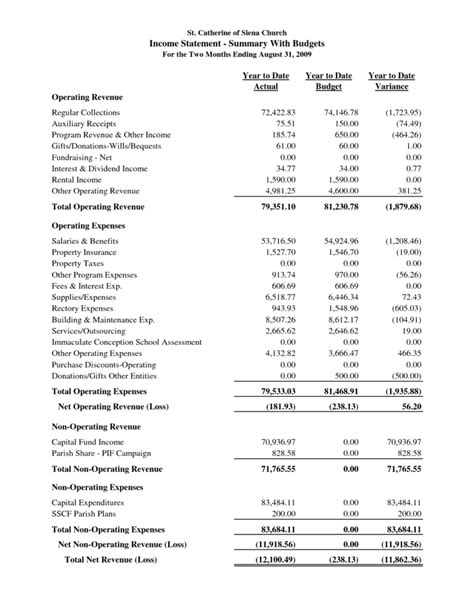

After notifying creditors and settling debts, the LLC must distribute its remaining assets to its members. The distribution of assets should be done according to the company’s operating agreement or, if not specified, according to the state’s LLC laws. Typically, assets are distributed in the following order: - Payment of debts to creditors. - Distribution of assets to members based on their ownership percentage. It’s vital to document the distribution of assets accurately to avoid disputes among members and to comply with tax requirements.

Step 5: File Final Tax Returns

The final step in closing an LLC is to file the company’s final tax returns with the appropriate tax authorities. This includes both federal and state tax returns, as applicable. The LLC must obtain a tax clearance certificate from the state where it is registered, which confirms that all tax obligations have been met. Filing final tax returns and obtaining a tax clearance certificate are essential for formally closing the LLC and ensuring that it is in good standing with tax authorities.

📝 Note: It's highly recommended to consult with an attorney or accountant during the dissolution process to ensure compliance with all legal and tax requirements.

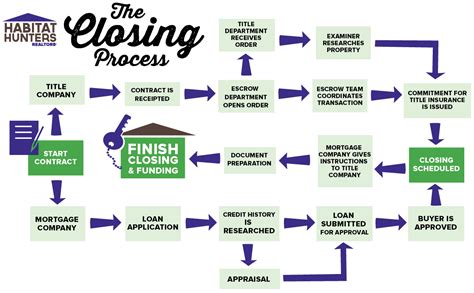

To further illustrate the process, consider the following table outlining key steps and responsibilities:

| Step | Description | Responsibility |

|---|---|---|

| 1. Vote to Dissolve | Vote among members to dissolve the LLC | LLC Members |

| 2. File Articles of Dissolution | File with the state to formally start the dissolution process | Authorized Representative |

| 3. Notify Creditors and Settle Debts | Inform creditors and settle outstanding debts | LLC Management |

| 4. Distribute Assets | Distribute remaining assets to members | LLC Management |

| 5. File Final Tax Returns | Submit final tax returns and obtain a tax clearance certificate | Accountant or Tax Professional |

In summary, closing an LLC involves a series of crucial steps that must be carefully executed to ensure a smooth transition and compliance with legal and tax requirements. By following these steps and seeking professional advice when necessary, businesses can formally close their LLCs and avoid potential liabilities. The process, while detailed, is a necessary part of winding down a business and moving forward.

What is the first step in closing an LLC?

+

The first step in closing an LLC is to hold a vote among the members to dissolve the company, as outlined in the operating agreement or according to the state’s LLC statute.

Why is it important to notify creditors during the dissolution process?

+

Notifying creditors is crucial for settling any outstanding debts and ensuring that all financial obligations are met before the LLC is officially closed, avoiding future complications.

What happens to the assets of the LLC during the dissolution process?

+

The assets of the LLC are distributed according to the operating agreement or state laws, typically first to creditors to settle debts, and then to members based on their ownership percentage.