5 Tips Transfer Property

Understanding the Process of Transferring Property

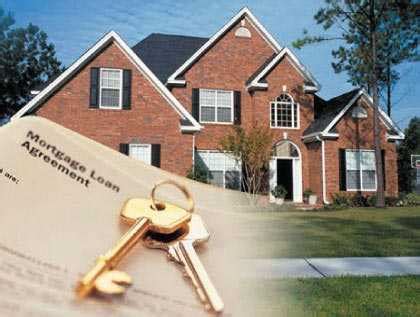

Transferring property, whether it’s a residential home, a commercial building, or a piece of land, is a complex process that involves several legal and administrative steps. The process can vary significantly depending on the jurisdiction, the type of property, and the circumstances under which the transfer is taking place. For individuals looking to transfer property, whether as a buyer, seller, or as part of an inheritance, understanding the basics of property transfer is crucial. In this article, we will explore five key tips to consider when transferring property, highlighting the importance of preparation, legal compliance, and seeking professional advice.

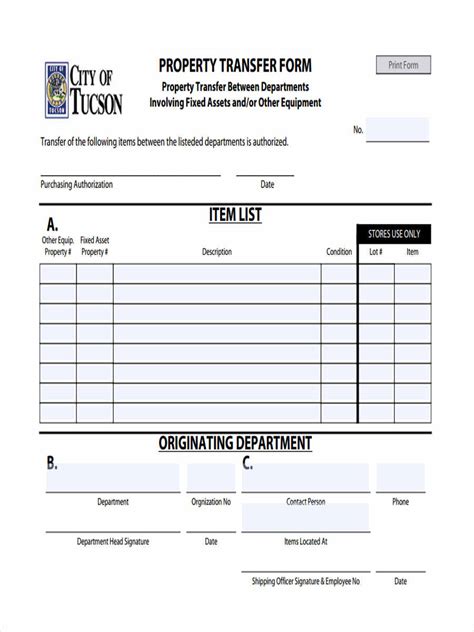

Tip 1: Prepare All Necessary Documents

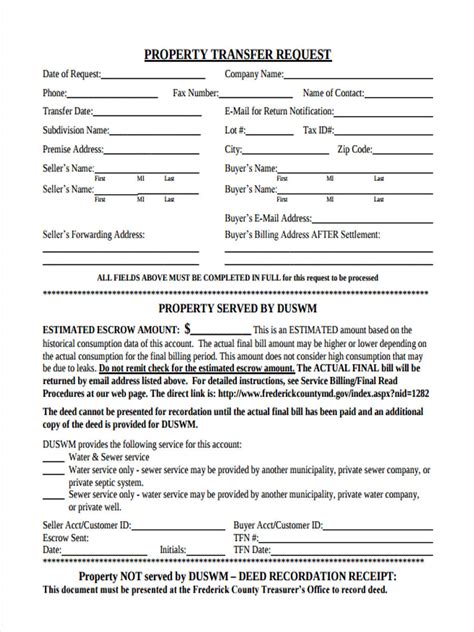

The first and perhaps most critical step in transferring property is ensuring that all necessary documents are in order. This includes the title deed, which proves ownership, identification documents for all parties involved, and any mortgage documents if the property is currently mortgaged. Additionally, a sales agreement outlining the terms of the sale, including the price and any conditions, is essential. It’s also important to have documents related to any outstanding taxes or liens on the property. Preparing these documents in advance can significantly streamline the transfer process.

Tip 2: Conduct a Title Search and Obtain Title Insurance

A title search is a thorough examination of public records to confirm the seller’s right to sell the property and to identify any potential issues that could affect the transfer, such as liens, easements, or disputes over ownership. Obtaining title insurance can protect both the buyer and the lender from potential risks or defects in the title that were not discovered during the search. This step is vital for ensuring a clean transfer of ownership and for avoiding future legal disputes.

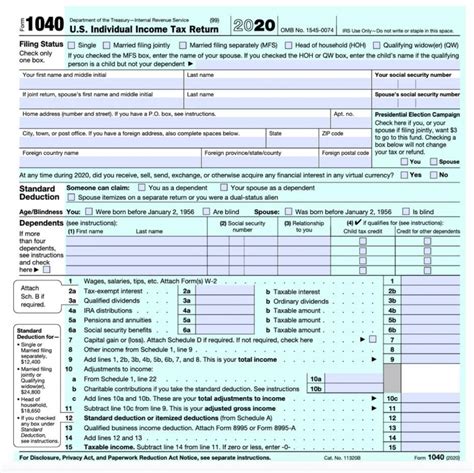

Tip 3: Consider the Tax Implications

Transferring property can have significant tax implications, both for the seller and the buyer. Sellers may face capital gains tax on the profit made from the sale, while buyers need to consider stamp duty and other taxes associated with the purchase. Understanding these tax implications in advance can help both parties plan financially and potentially minimize their tax liabilities. It’s often beneficial to consult with a tax professional to get personalized advice on managing tax obligations related to the property transfer.

Tip 4: Seek Professional Advice

Given the complexity and legal nature of property transfer, seeking professional advice is highly recommended. Real estate attorneys can guide you through the process, ensuring that all legal requirements are met, and that your rights are protected. Additionally, real estate agents can assist in finding a buyer or a property, negotiating the sale, and facilitating the transfer process. Their expertise can be invaluable in navigating potential issues and in ensuring a smooth transaction.

Tip 5: Plan for Future Contingencies

Finally, it’s essential to plan for future contingencies when transferring property. This includes considering zoning laws and how they might affect the property’s use or value, environmental concerns that could impact the property, and future market trends that could influence the property’s value. Buyers should also think about insurance options to protect their investment against unforeseen events. Planning for these contingencies can help mitigate risks and ensure that the property transfer is a successful long-term investment.

📝 Note: The process of transferring property can vary significantly depending on local laws and regulations, so it's crucial to consult with local professionals to ensure compliance with all applicable laws.

In summary, transferring property is a multifaceted process that requires careful planning, legal compliance, and often the assistance of professionals. By preparing necessary documents, conducting a title search, considering tax implications, seeking professional advice, and planning for future contingencies, individuals can navigate the property transfer process with confidence. Whether you’re a seasoned investor or a first-time buyer, understanding these key aspects can make all the difference in ensuring a successful and stress-free transaction.

What documents are required for property transfer?

+

The necessary documents include the title deed, identification documents for all parties, any mortgage documents, a sales agreement, and documents related to outstanding taxes or liens on the property.

Why is a title search important?

+

A title search is crucial for confirming the seller’s right to sell the property and identifying any potential issues that could affect the transfer, such as liens, easements, or disputes over ownership.

What are the tax implications of transferring property?

+

Transferring property can have significant tax implications, including capital gains tax for sellers and stamp duty for buyers. Understanding these implications in advance can help plan financially and minimize tax liabilities.