Keep Paperwork for How Long

Introduction to Paperwork Retention

In today’s digital age, paperwork can quickly accumulate and become overwhelming. From receipts and invoices to contracts and tax documents, it’s essential to have a system in place for managing and storing paperwork. One of the most critical aspects of paperwork management is determining how long to keep certain documents. In this article, we’ll explore the guidelines for retaining various types of paperwork, helping you to create a more organized and efficient system.

Understanding the Importance of Paperwork Retention

Proper paperwork retention is crucial for several reasons. Firstly, it helps to ensure compliance with laws and regulations, such as tax laws and contractual obligations. Secondly, it provides a record of important transactions and events, which can be useful in case of disputes or audits. Finally, it enables individuals and businesses to maintain accurate financial records, making it easier to manage finances and make informed decisions. Failure to retain paperwork can result in fines, penalties, and even legal action, emphasizing the importance of establishing a robust paperwork retention system.

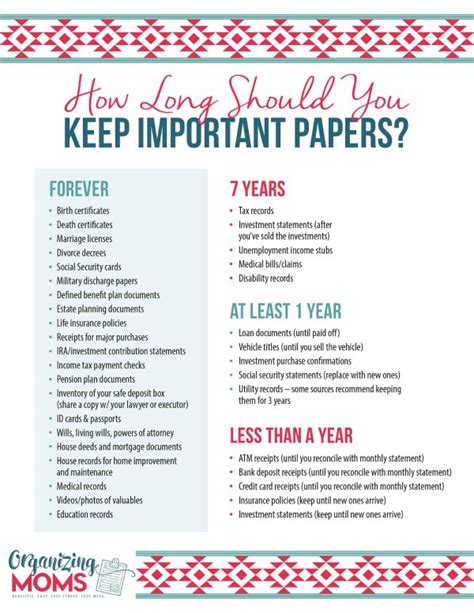

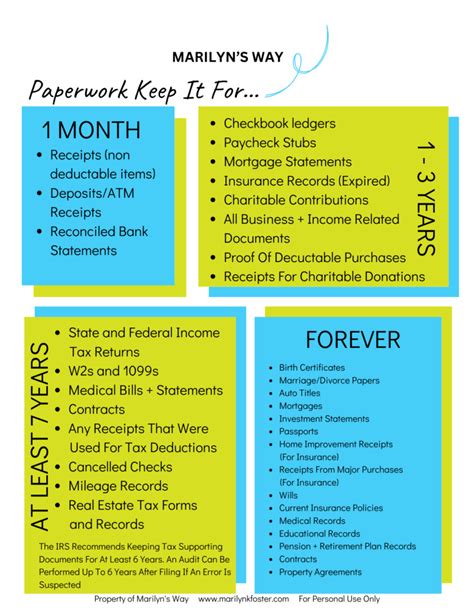

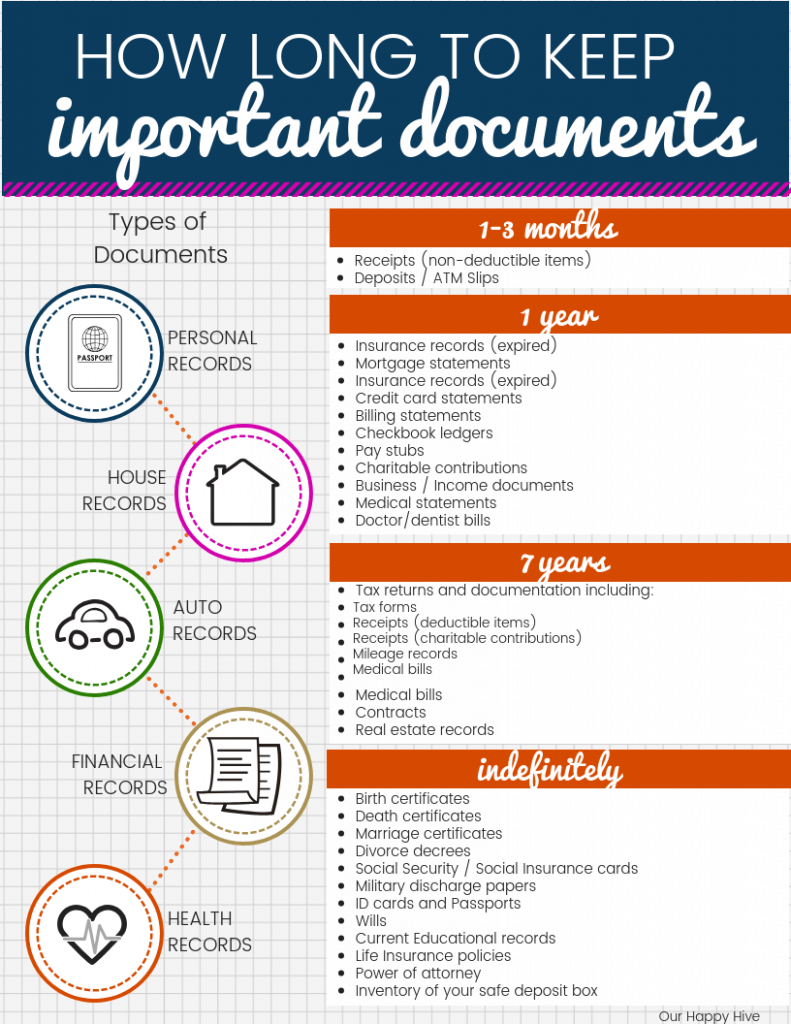

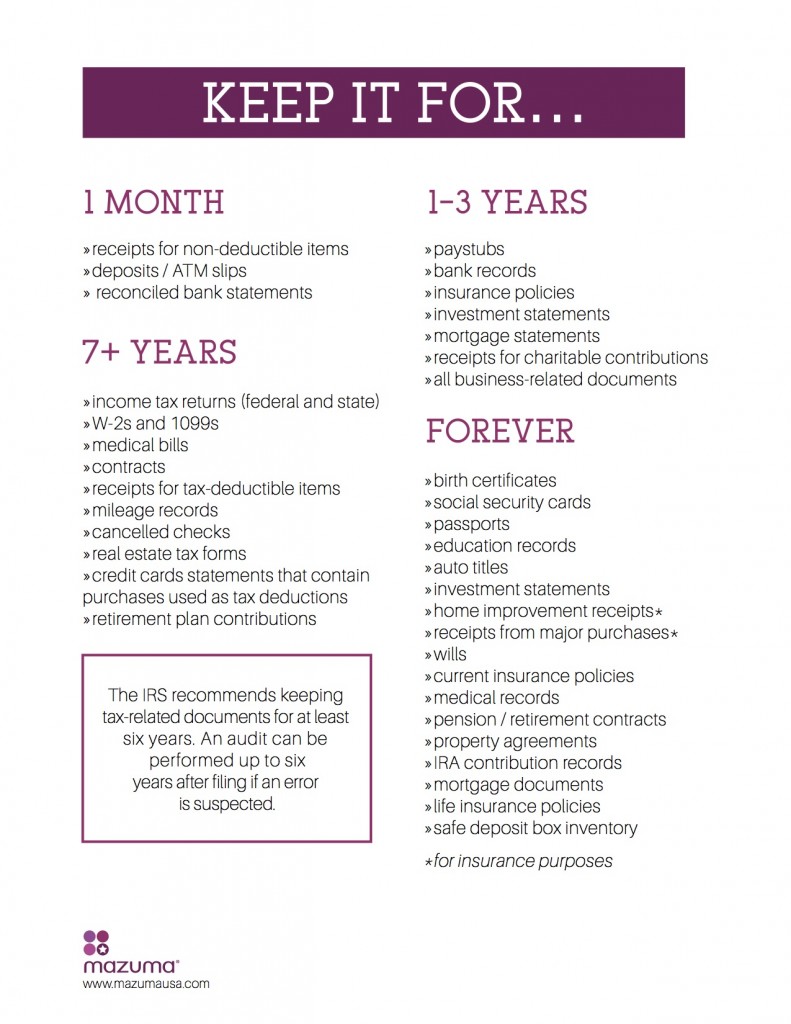

Guidelines for Retaining Common Documents

The length of time you should keep paperwork varies depending on the type of document and its significance. Here are some general guidelines for common documents: * Tax-related documents: 3-7 years * Financial statements and reports: 3-10 years * Contracts and agreements: 3-10 years * Receipts and invoices: 1-3 years * Payroll records: 3-10 years * Insurance policies and claims: 3-10 years It’s essential to note that these are general guidelines, and the specific retention period may vary depending on your location, industry, or other factors.

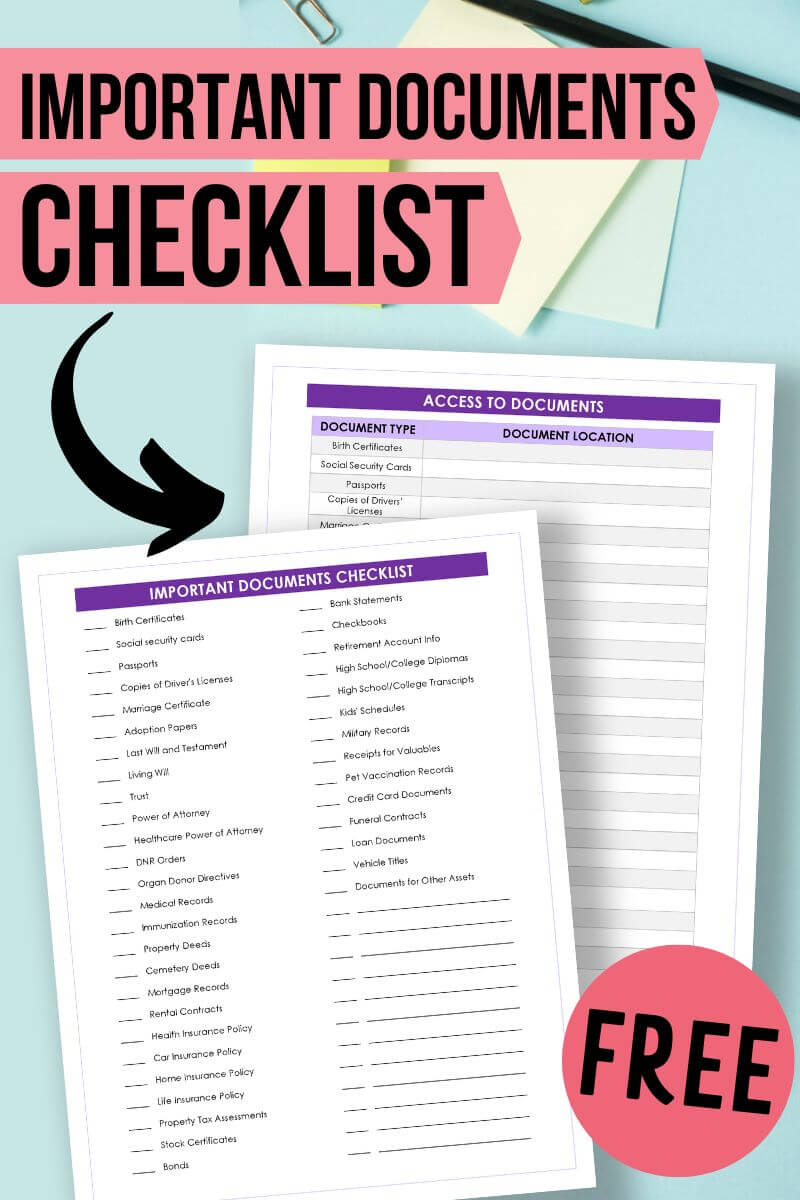

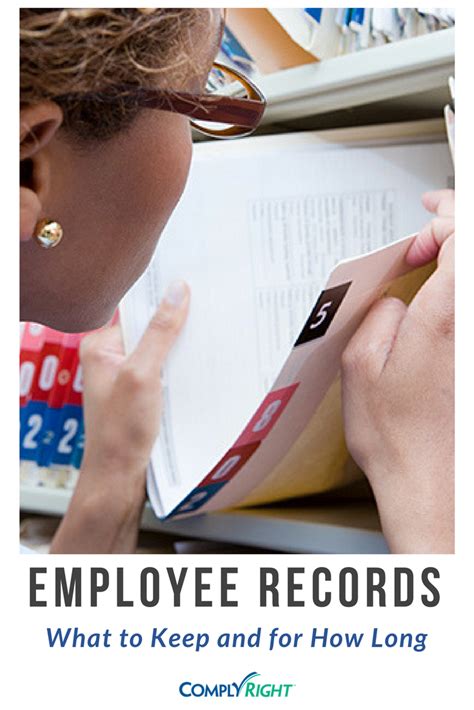

Best Practices for Paperwork Management

To create an efficient paperwork management system, consider the following best practices: * Implement a centralized filing system: Designate a specific area or digital platform for storing paperwork, making it easier to locate and retrieve documents. * Use clear and concise labeling: Label files and documents clearly, including the date, document type, and any relevant details. * Establish a regular review process: Schedule regular reviews of your paperwork to ensure that documents are up-to-date, accurate, and still relevant. * Consider digitizing documents: Scanning and digitizing documents can help reduce physical storage needs and improve accessibility. * Shred or securely dispose of unnecessary documents: Regularly shred or securely dispose of documents that are no longer needed, helping to maintain confidentiality and reduce clutter.

Special Considerations for Digital Documents

In today’s digital age, many documents are created and stored electronically. When it comes to digital documents, consider the following: * Ensure data backup and security: Regularly back up digital documents and implement robust security measures to protect against data loss or unauthorized access. * Use cloud storage or digital filing systems: Consider using cloud storage or digital filing systems to store and manage digital documents, providing easy access and sharing capabilities. * Establish clear policies for digital document retention: Develop clear policies and guidelines for retaining digital documents, including the length of time they should be kept and how they should be stored.

Table of Common Document Retention Periods

The following table summarizes the retention periods for common documents:

| Document Type | Retention Period |

|---|---|

| Tax-related documents | 3-7 years |

| Financial statements and reports | 3-10 years |

| Contracts and agreements | 3-10 years |

| Receipts and invoices | 1-3 years |

| Payroll records | 3-10 years |

| Insurance policies and claims | 3-10 years |

📝 Note: The retention periods listed are general guidelines and may vary depending on your location, industry, or other factors. It's essential to consult with a professional or relevant authorities to determine the specific retention requirements for your situation.

To summarize, the key to effective paperwork management is establishing a system that balances the need for documentation with the need for organization and efficiency. By understanding the guidelines for retaining various types of paperwork and implementing best practices for paperwork management, you can create a more streamlined and compliant system. This, in turn, can help reduce stress, improve productivity, and provide a sense of security and control over your financial and administrative affairs. Ultimately, a well-organized paperwork system is essential for making informed decisions, ensuring compliance, and achieving long-term success.

What is the general retention period for tax-related documents?

+

The general retention period for tax-related documents is 3-7 years.

How long should I keep financial statements and reports?

+

Financial statements and reports should be kept for 3-10 years.

What is the best way to store digital documents?

+

The best way to store digital documents is to use cloud storage or digital filing systems, ensuring data backup and security.