Underwriter Decision Timeline

Introduction to Underwriter Decision Timeline

The underwriter decision timeline is a critical component of the loan application process. It refers to the period between the submission of a loan application and the underwriter’s decision to approve or reject the loan. This timeline can vary significantly depending on several factors, including the type of loan, the complexity of the application, and the efficiency of the underwriting process. In this article, we will delve into the world of underwriter decision timelines, exploring the factors that influence them, the typical stages involved, and the ways in which applicants can optimize their chances of a swift and favorable decision.

Factors Influencing the Underwriter Decision Timeline

Several factors can influence the underwriter decision timeline. These include: * Type of loan: Different types of loans have different underwriting requirements. For instance, mortgages and commercial loans often require more extensive documentation and verification than personal loans. * Complexity of the application: Applications involving multiple borrowers, complex income structures, or unusual assets can take longer to process. * Efficiency of the underwriting process: The speed and efficiency of the underwriting team can significantly impact the decision timeline. Modern technology and streamlined processes can reduce this time. * Volume of applications: High volumes of applications can lead to backlogs and longer decision times. * Regulatory requirements: Compliance with regulatory requirements can sometimes slow down the underwriting process.

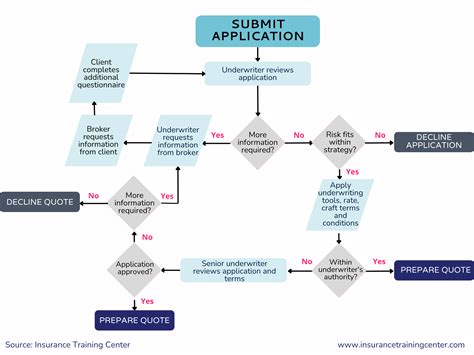

Typical Stages of the Underwriting Process

The underwriting process typically involves several stages, including: * Pre-approval: An initial assessment of the applicant’s creditworthiness. * Application submission: The formal submission of the loan application, including all required documentation. * Processing: Verification of the information provided and collection of any additional required documents. * Underwriting decision: The underwriter reviews the application and makes a decision to approve, reject, or request further information. * Approval and funding: If approved, the loan is finalized, and the funds are disbursed.

Optimizing the Underwriter Decision Timeline

Applicants can take several steps to optimize their chances of a swift and favorable decision: * Ensure completeness of the application: Submitting a complete application with all required documentation can significantly reduce processing times. * Maintain good credit: A good credit score can improve the chances of a favorable decision and may expedite the process. * Choose the right lender: Selecting a lender with an efficient underwriting process can reduce decision times. * Follow up appropriately: Regular, polite inquiries about the status of the application can help keep the process on track without being overly intrusive.

Tools and Technologies Enhancing Efficiency

The integration of technology into the underwriting process has been a key factor in enhancing efficiency and reducing decision timelines. Some of the tools and technologies used include: * Automated Underwriting Systems (AUS): These systems can automatically evaluate applications based on predefined criteria, reducing the need for manual underwriting in some cases. * Digital Documentation: Electronic submission and storage of documents can streamline the application process and reduce paperwork. * Artificial Intelligence (AI) and Machine Learning (ML): AI and ML can be used to analyze complex data sets, predict creditworthiness, and identify potential risks more accurately and quickly than traditional methods.

| Technology | Description | Benefits |

|---|---|---|

| Automated Underwriting Systems (AUS) | Automatically evaluates applications based on predefined criteria | Reduces manual underwriting time, increases consistency |

| Digital Documentation | Electronic submission and storage of documents | Streamlines application process, reduces paperwork |

| Artificial Intelligence (AI) and Machine Learning (ML) | Analyzes complex data sets to predict creditworthiness and identify risks | Enhances accuracy, reduces decision time |

📝 Note: The adoption of these technologies can vary among lenders, and not all may offer the same level of digital integration.

In summary, the underwriter decision timeline is a critical aspect of the loan application process, influenced by a variety of factors including the type of loan, application complexity, and the efficiency of the underwriting process. By understanding these factors and the typical stages of the underwriting process, applicants can take steps to optimize their application and potentially reduce the decision timeline. The integration of technology into underwriting has been a significant factor in enhancing efficiency and reducing decision times, offering a faster and more streamlined experience for applicants.

The essence of navigating the underwriter decision timeline successfully lies in preparation, understanding, and leveraging technology. As the financial sector continues to evolve, the role of technology in underwriting will likely become even more pronounced, leading to more efficient, faster, and more personalized loan application processes.

What is the underwriter decision timeline?

+

The underwriter decision timeline refers to the period between the submission of a loan application and the underwriter’s decision to approve or reject the loan.

How can I optimize my loan application for a swift decision?

+

Ensuring the completeness of your application, maintaining good credit, choosing the right lender, and following up appropriately can help optimize your application for a swift decision.

What role does technology play in the underwriting process?

+

Technology, such as Automated Underwriting Systems, digital documentation, and Artificial Intelligence, plays a significant role in enhancing the efficiency and speed of the underwriting process.