5 Tips Keep Insurance Papers

Introduction to Insurance Paper Management

When it comes to managing insurance papers, many of us find ourselves overwhelmed with the sheer volume of documents that need to be kept track of. From health insurance to auto insurance, and from home insurance to life insurance, each type of insurance comes with its own set of papers that are crucial for making claims, understanding policy terms, and ensuring that you’re adequately covered. In this article, we’ll explore 5 essential tips to help you keep your insurance papers organized and easily accessible when you need them.

Understanding the Importance of Organization

Before diving into the tips, it’s essential to understand why organizing your insurance papers is so important. Disorganized insurance documents can lead to missed payments, overlooked policy details, and even denied claims due to lack of necessary paperwork. By keeping your insurance papers in order, you can avoid these pitfalls and ensure that you’re getting the most out of your insurance policies.

Tips for Managing Insurance Papers

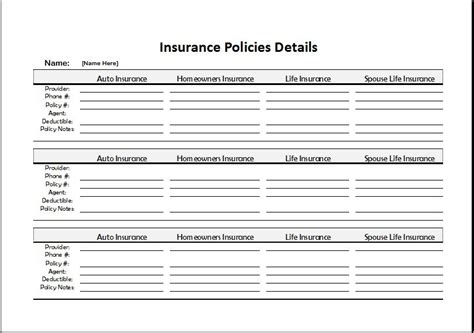

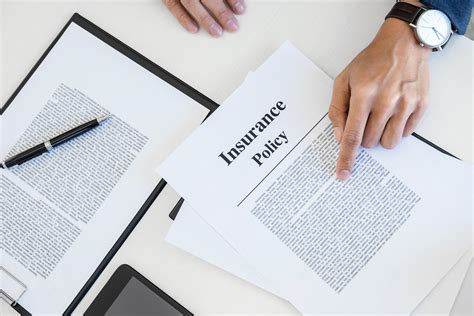

Here are five tips to help you manage your insurance papers effectively: - Create a Dedicated Folder: Designate a specific folder or file cabinet for your insurance papers. This could be a physical folder in your home office or a digital folder on your computer. The key is to have all your insurance documents in one place. - Digitalize Your Documents: Consider scanning your insurance papers and saving them digitally. This not only saves physical space but also makes it easier to access your documents from anywhere and share them with relevant parties when needed. - Use a Color-Coding System: If you have multiple types of insurance, consider using a color-coding system to differentiate between them. For example, you could use a red folder for health insurance, a blue folder for auto insurance, etc. - Keep a Record of Communications: Any communication with your insurance provider, including emails, letters, and notes from phone calls, should be kept with your insurance papers. This can be crucial for resolving disputes or understanding changes to your policy. - Review and Update Regularly: Insurance policies and documents can change over time. Make it a habit to review your insurance papers periodically to ensure you understand any changes, updates, or new requirements.

Implementing a Practical System

Implementing a practical system for managing your insurance papers involves a combination of physical and digital organization methods. Here’s how you can start:

- Begin by gathering all your insurance-related documents and sorting them by type.

- Set up your designated folder, whether physical or digital, and start filing your documents accordingly.

- Consider setting reminders for policy renewals, premium payments, and any other important dates related to your insurance.

- Regularly back up your digital files to prevent loss in case of a technical issue.

Maintaining Your System

Maintaining your insurance paper management system is just as important as setting it up. Here are a few tips to keep in mind: - Consistency is Key: Stick to your system and avoid mixing your insurance papers with other types of documents. - Stay Informed: Keep yourself updated with any changes in insurance laws, policy terms, or provider requirements that might affect your documents. - Review and Adjust: As your insurance needs change, so should your management system. Be open to adjusting your approach as necessary.

📝 Note: Always ensure that you have both physical and digital backups of your insurance papers to protect against loss or damage.

Utilizing Technology for Organization

Technology can be a powerful tool in managing your insurance papers. Consider using:

| Tool | Functionality |

|---|---|

| Cloud Storage | Stores your documents securely online, accessible from anywhere. |

| Document Scanners | Converts physical documents into digital files for easier storage and sharing. |

| Organizational Apps | Helps in categorizing, reminding, and securely storing insurance documents and related communications. |

In essence, leveraging technology can streamline your insurance paper management, making it more efficient and less prone to errors or losses.

To wrap things up, managing your insurance papers effectively is crucial for ensuring that you’re adequately protected and can navigate the sometimes complex world of insurance with confidence. By implementing a robust management system, staying organized, and leveraging technology, you can safeguard your interests and make the most out of your insurance policies.

What is the best way to store insurance papers?

+

The best way to store insurance papers is by using a combination of physical and digital storage. Keep physical copies in a safe and secure location, and digitalize your documents for easy access and sharing.

How often should I review my insurance papers?

+

It’s a good practice to review your insurance papers at least once a year, or whenever there’s a change in your policy or personal circumstances. This ensures you’re always aware of your coverage and any requirements.

Can I throw away old insurance papers?

+

Before throwing away any insurance papers, ensure you have digital copies and that the documents are no longer needed for legal or administrative purposes. It’s often recommended to keep important insurance documents indefinitely.