Keep Tax Paperwork

Introduction to Tax Paperwork

When it comes to managing finances, one of the most critical aspects is keeping track of tax paperwork. Tax paperwork includes all the documents and records that are necessary for filing taxes, and it is essential to keep them organized and easily accessible. In this article, we will discuss the importance of keeping tax paperwork, the different types of documents that need to be kept, and provide tips on how to stay organized.

Why Keep Tax Paperwork?

Keeping tax paperwork is crucial for several reasons. Firstly, it helps to ensure accuracy when filing taxes. By having all the necessary documents in one place, individuals can avoid making mistakes on their tax returns, which can lead to delays or even audits. Secondly, keeping tax paperwork helps to support deductions and credits. The IRS requires documentation to support claims for deductions and credits, and having these documents readily available can make the process much smoother. Finally, keeping tax paperwork can help in case of an audit. If the IRS audits an individual’s tax return, having all the necessary documents can help to resolve the issue quickly and efficiently.

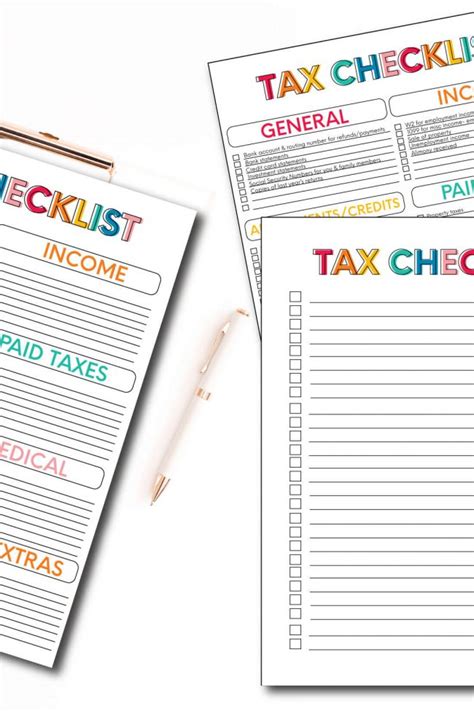

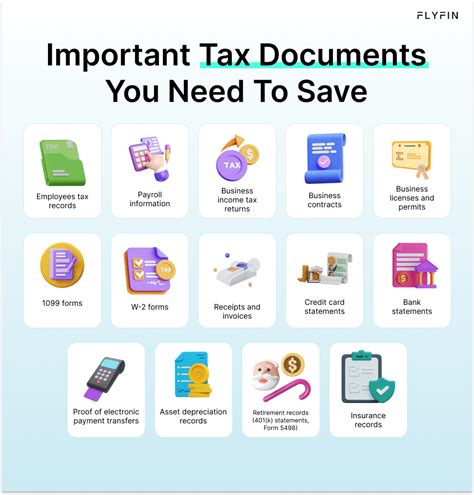

Types of Tax Paperwork to Keep

There are several types of tax paperwork that individuals should keep. These include: * W-2 forms: These forms show an individual’s income and taxes withheld from their employer. * 1099 forms: These forms show income earned from freelance work, investments, or other sources. * Receipts for deductions: These include receipts for charitable donations, medical expenses, and other deductions. * Records of business expenses: These include records of expenses related to a business, such as receipts, invoices, and bank statements. * Tax returns**: Individuals should keep a copy of their tax return for at least three years in case of an audit.

How to Keep Tax Paperwork Organized

Keeping tax paperwork organized can be challenging, but there are several strategies that can help. Here are a few tips: * Use a file cabinet or digital storage system: Keep all tax paperwork in one place, either in a file cabinet or a digital storage system such as a cloud-based storage service. * Create a system for categorizing documents: Use folders or labels to categorize documents by type, such as income, deductions, and business expenses. * Scan documents: Scanning documents can help to reduce clutter and make it easier to access documents electronically. * Keep a list of documents: Keep a list of all the documents that are being kept, including the date and type of document.

📝 Note: It's essential to keep tax paperwork for at least three years in case of an audit, and to keep it in a secure location to prevent loss or theft.

Tips for Staying Organized

Here are a few additional tips for staying organized: * Set aside time each month to review and organize tax paperwork * Use a tax preparation software to help with organization and filing * Consider hiring a tax professional to help with tax preparation and organization * Keep track of deadlines and important dates, such as the tax filing deadline

| Type of Document | Retention Period |

|---|---|

| W-2 forms | At least 3 years |

| 1099 forms | At least 3 years |

| Receipts for deductions | At least 3 years |

| Records of business expenses | At least 3 years |

| Tax returns | At least 3 years |

In summary, keeping tax paperwork is essential for ensuring accuracy, supporting deductions and credits, and helping in case of an audit. By keeping all necessary documents organized and easily accessible, individuals can make the tax filing process much smoother and reduce the risk of errors or audits. By following the tips outlined in this article, individuals can stay organized and ensure that they are prepared for tax season.

What types of tax paperwork should I keep?

+

You should keep all documents related to your income, deductions, and credits, including W-2 forms, 1099 forms, receipts for deductions, records of business expenses, and tax returns.

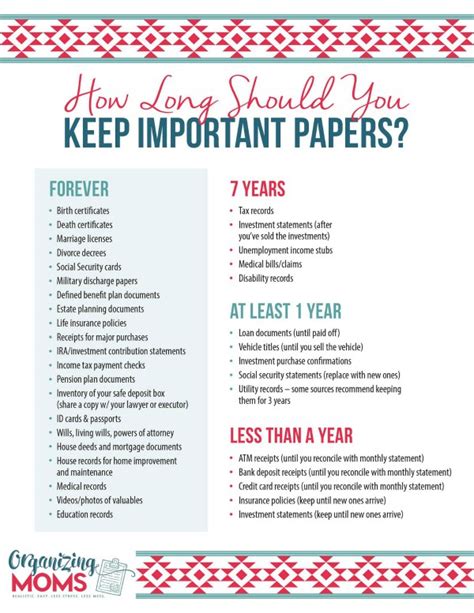

How long should I keep tax paperwork?

+

You should keep tax paperwork for at least three years in case of an audit.

What is the best way to organize tax paperwork?

+

The best way to organize tax paperwork is to use a file cabinet or digital storage system, create a system for categorizing documents, scan documents, and keep a list of documents.