Keep Financial Paperwork How Long

Introduction to Financial Record Keeping

Managing financial paperwork is an essential aspect of personal and business finance. It involves keeping track of various documents, such as receipts, invoices, bank statements, and tax returns. The duration for which these documents should be kept varies depending on their type and significance. In this article, we will discuss the guidelines for keeping financial paperwork and the recommended retention periods for different types of documents.

Types of Financial Documents

There are several types of financial documents that individuals and businesses need to keep. These include: * Bank statements: These documents provide a record of all transactions, including deposits, withdrawals, and payments. * Tax returns: Tax returns are essential for tax purposes and may be required for audits or other financial transactions. * Receipts: Receipts are used to track expenses and can be useful for budgeting and tax purposes. * Invoices: Invoices are used to track income and expenses for businesses. * Investment documents: These documents provide information about investments, such as stocks, bonds, and mutual funds.

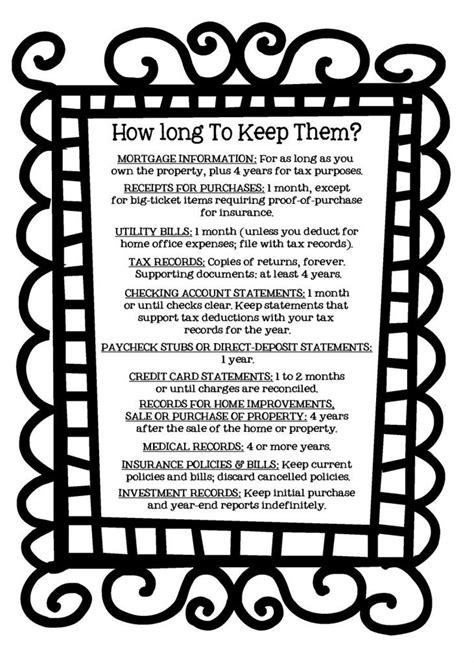

Retention Periods for Financial Documents

The retention period for financial documents varies depending on their type and significance. Here are some general guidelines: * Bank statements: Keep bank statements for at least one year, but it’s recommended to keep them for three to five years in case of audits or disputes. * Tax returns: Keep tax returns and supporting documents for at least three years, but it’s recommended to keep them for seven years in case of audits. * Receipts: Keep receipts for at least one year, but it’s recommended to keep them for three to five years for tax purposes. * Invoices: Keep invoices for at least three to five years for business purposes. * Investment documents: Keep investment documents for at least three to five years, but it’s recommended to keep them for as long as the investment is active.

| Document Type | Retention Period |

|---|---|

| Bank statements | 1-5 years |

| Tax returns | 3-7 years |

| Receipts | 1-5 years |

| Invoices | 3-5 years |

| Investment documents | 3-5 years |

📝 Note: The retention periods mentioned above are general guidelines and may vary depending on individual circumstances or business requirements.

Best Practices for Financial Record Keeping

To ensure that financial paperwork is kept organized and easily accessible, follow these best practices: * Use a filing system: Use a filing system to categorize and store financial documents. * Scan documents: Scan financial documents to create digital copies and reduce storage space. * Shred unnecessary documents: Shred financial documents that are no longer needed to protect sensitive information. * Back up digital files: Back up digital files to prevent loss or damage.

Benefits of Keeping Financial Paperwork

Keeping financial paperwork has several benefits, including: * Improved financial management: Keeping financial paperwork helps to track income and expenses, making it easier to manage finances. * Reduced stress: Keeping financial paperwork organized reduces stress and anxiety related to financial management. * Increased productivity: Keeping financial paperwork organized saves time and increases productivity. * Better decision making: Keeping financial paperwork provides a clear picture of financial situation, making it easier to make informed decisions.

In the end, keeping financial paperwork is essential for managing finances effectively. By following the guidelines and best practices outlined above, individuals and businesses can ensure that their financial documents are kept organized, secure, and easily accessible.

What is the recommended retention period for bank statements?

+

The recommended retention period for bank statements is at least one year, but it’s recommended to keep them for three to five years in case of audits or disputes.

How long should I keep tax returns and supporting documents?

+

Keep tax returns and supporting documents for at least three years, but it’s recommended to keep them for seven years in case of audits.

What are the benefits of keeping financial paperwork?

+

The benefits of keeping financial paperwork include improved financial management, reduced stress, increased productivity, and better decision making.