5 Steps Aflac Claim

Introduction to Aflac Claims

When unexpected medical bills arise, having the right insurance coverage can provide peace of mind. Aflac, a leading provider of supplemental insurance, offers policies that help cover out-of-pocket expenses related to accidents, illnesses, and other medical conditions. If you’re an Aflac policyholder, understanding the claims process is crucial to ensure you receive the benefits you need. Here, we will break down the 5 steps to file an Aflac claim, making the process as smooth and efficient as possible.

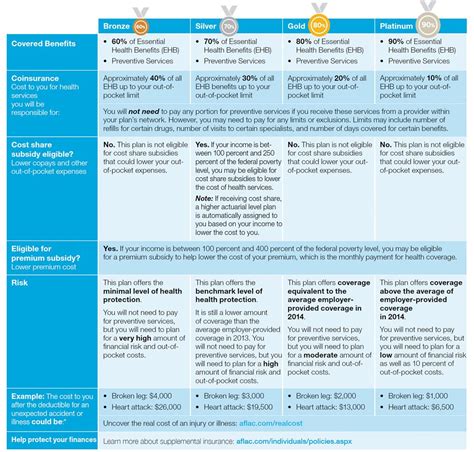

Step 1: Review Your Policy

Before initiating the claim process, it’s essential to review your Aflac policy to understand what is covered and what is not. Look for details such as: - Policy type: What kind of policy do you have? (e.g., accident, cancer, hospital indemnity) - Coverage amounts: How much will Aflac pay for different types of claims? - Deductibles and copays: Are there any deductibles or copays you must meet before Aflac starts paying benefits? - Pre-existing conditions: Are there any pre-existing conditions that might be excluded from coverage? Understanding your policy will help you navigate the claims process more effectively and set realistic expectations about your benefits.

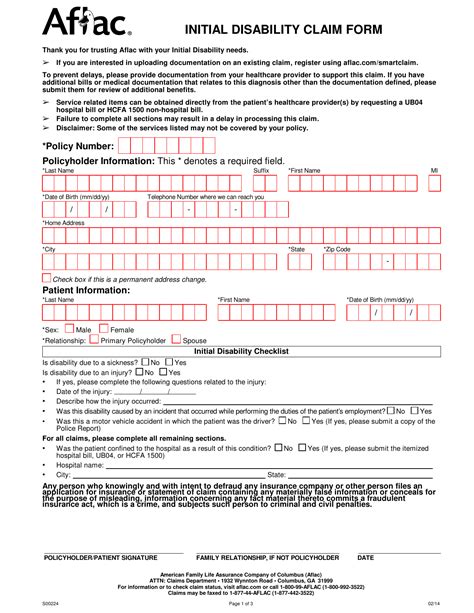

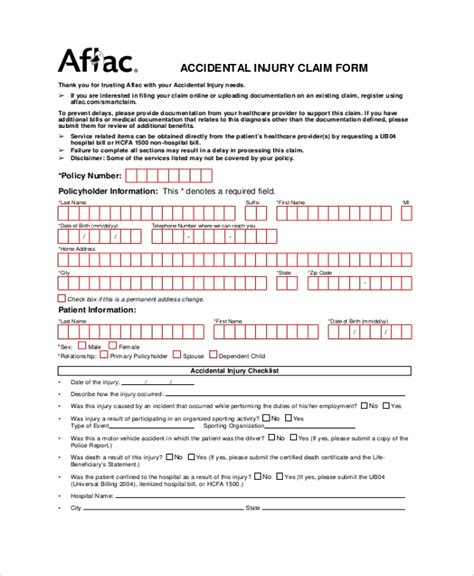

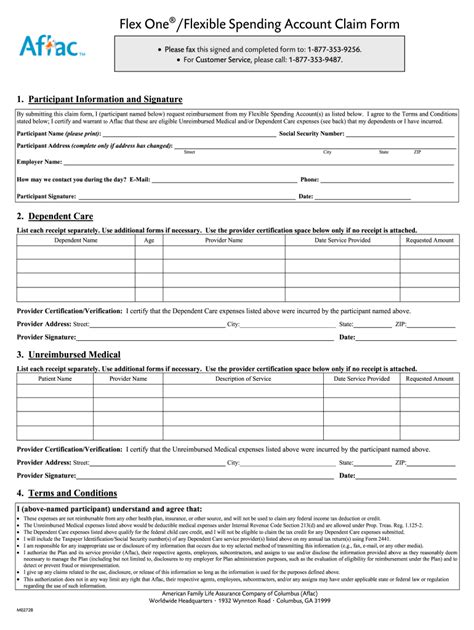

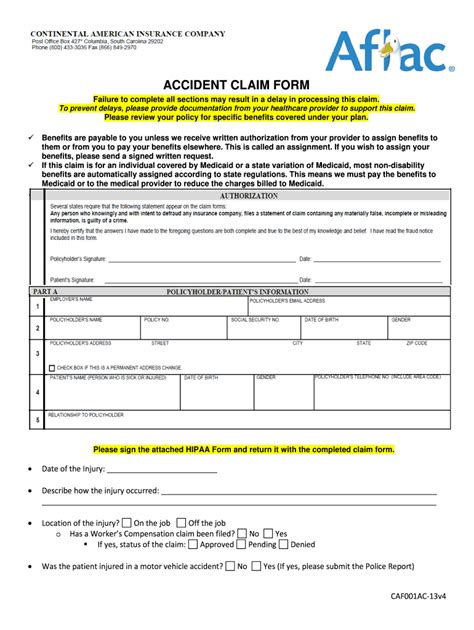

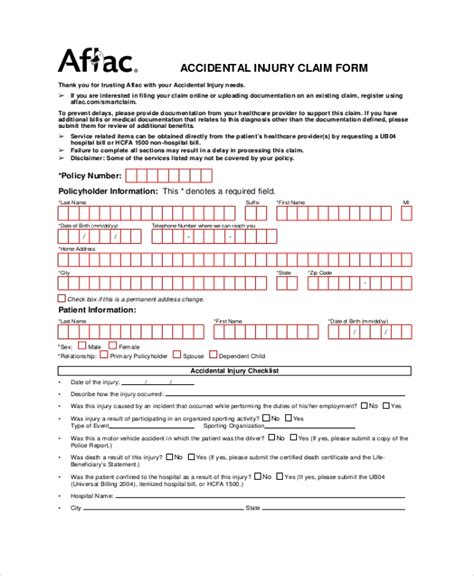

Step 2: Gather Necessary Documents

To file a claim, you’ll need to provide Aflac with certain documents. These may include: - Claim form: You can download this from the Aflac website or request one from your agent. - Medical records: Documentation from your healthcare provider detailing your diagnosis, treatment, and any hospital stays. - Itemized bills: Detailed bills from your healthcare providers showing the costs of services. - Proof of diagnosis: A letter from your doctor confirming your diagnosis. - Other supporting documents: Depending on the nature of your claim, you might need to provide additional documentation, such as police reports for accidents. Having all necessary documents ready will speed up the processing of your claim.

Step 3: Submit Your Claim

With your documents in hand, you’re ready to submit your claim. Aflac offers several ways to do this: - Online: You can submit your claim through the Aflac website. This is often the quickest method and allows you to track the status of your claim. - Mail: If you prefer, you can mail your claim to Aflac. Make sure to use certified mail to ensure proof of delivery. - Fax: Faxed claims are also accepted, but be sure to follow up to confirm receipt. - Through your agent: Your Aflac agent can assist you with submitting your claim, providing guidance and support throughout the process. Choose the method that is most convenient for you, but be aware that online submission is generally the fastest way to get your claim processed.

Step 4: Claim Review and Approval

After submitting your claim, Aflac will review it to determine if it meets the criteria outlined in your policy. This process typically involves: - Verification of policy details: Aflac checks your policy to confirm what benefits you’re eligible for. - Review of medical records: Aflac examines your medical records to verify your diagnosis and treatment. - Calculation of benefits: If your claim is approved, Aflac calculates how much you’re eligible to receive based on your policy. This step can take several days to a few weeks, depending on the complexity of your claim and how quickly Aflac receives all necessary documentation.

Step 5: Receiving Your Benefits

If your claim is approved, Aflac will pay your benefits according to the terms of your policy. Benefits are typically paid directly to you, unless you’ve assigned them to your healthcare provider. You can expect: - Direct deposit: Many policyholders opt for direct deposit for faster access to their benefits. - Check by mail: If you prefer or if direct deposit isn’t available, Aflac can mail a check to you. It’s essential to review the payment details carefully to ensure everything is correct and to follow up with Aflac if you have any questions or concerns.

📝 Note: Always keep a record of your claim submission, including the date and method of submission, and follow up with Aflac if you haven't received an update within the expected timeframe.

As you navigate the Aflac claims process, remember that understanding your policy and gathering all necessary documents upfront can significantly reduce delays. If you’re unsure about any part of the process, don’t hesitate to reach out to your Aflac agent or contact Aflac directly for assistance. Their support can make a big difference in ensuring you receive the benefits you’re entitled to.

In summary, filing an Aflac claim involves reviewing your policy, gathering necessary documents, submitting your claim, waiting for the claim to be reviewed and approved, and finally receiving your benefits. By following these steps and staying informed, you can make the most of your Aflac coverage and focus on your recovery, knowing that you have support for the unexpected expenses that come with medical care.

How long does it take to process an Aflac claim?

+

The processing time for an Aflac claim can vary depending on the complexity of the claim and how quickly all necessary documentation is received. Generally, you can expect it to take several days to a few weeks.

Can I submit my Aflac claim online?

+

Yes, Aflac allows policyholders to submit claims online through their website. This is often the quickest method and provides the added convenience of being able to track the status of your claim.

What documents do I need to submit an Aflac claim?

+

To submit an Aflac claim, you will typically need a claim form, medical records, itemized bills, proof of diagnosis, and possibly other supporting documents depending on the nature of your claim.