Personal Trainer Paperwork Requirements

Introduction to Personal Trainer Paperwork Requirements

As a personal trainer, having the right paperwork in place is crucial for protecting yourself, your clients, and your business. This includes a variety of documents that outline the terms of your services, client information, and emergency procedures. In this article, we will delve into the essential paperwork requirements for personal trainers, including liability waivers, client intake forms, and contracts. We will also discuss the importance of maintaining accurate and up-to-date records, as well as the role of insurance in protecting your business.

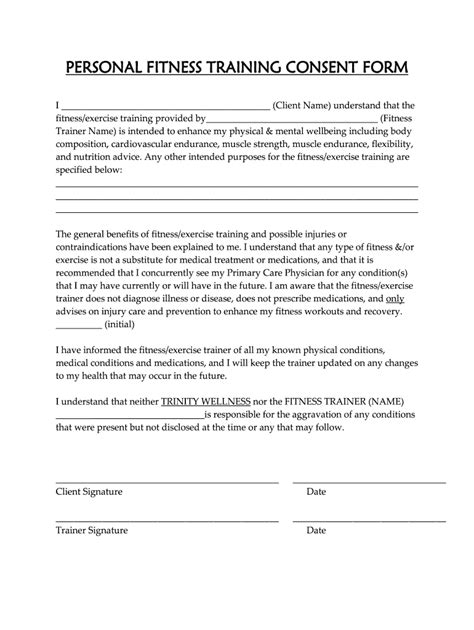

Liability Waivers

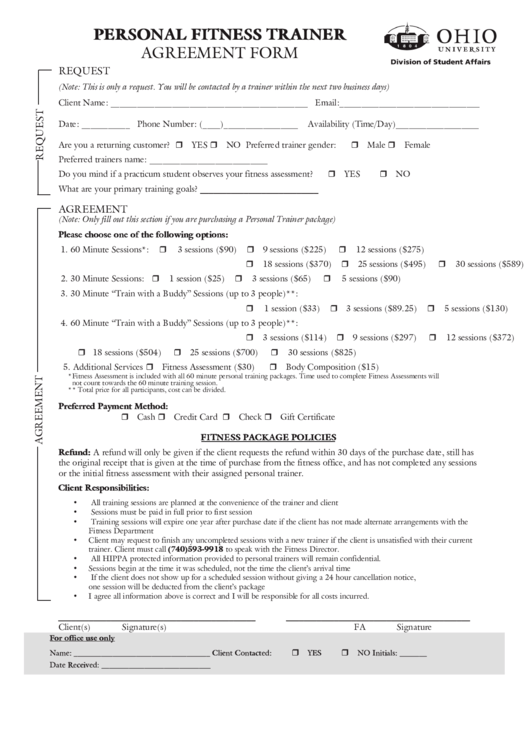

A liability waiver, also known as a release of liability, is a document that clients sign to acknowledge that they are aware of the risks associated with physical activity and release the personal trainer from liability in case of an injury. This document should include the following information: * A description of the risks associated with physical activity * A statement releasing the personal trainer from liability * A statement acknowledging that the client is in good physical health and able to participate in physical activity * A statement requiring the client to inform the personal trainer of any medical conditions or concerns

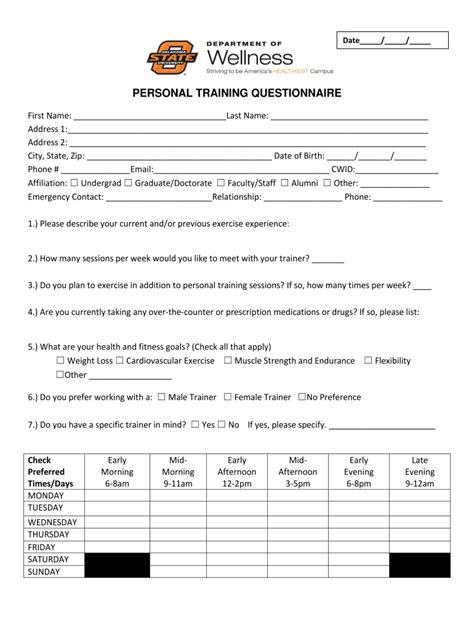

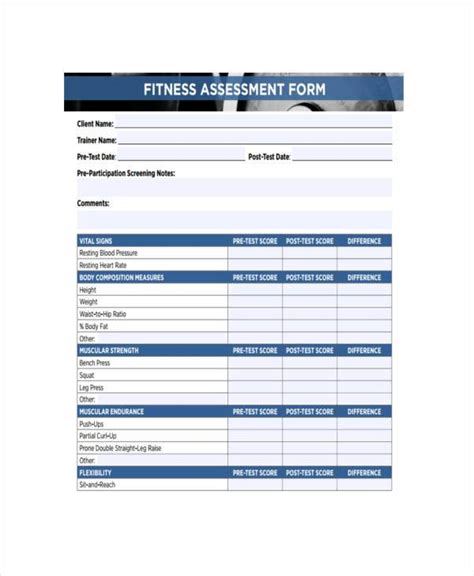

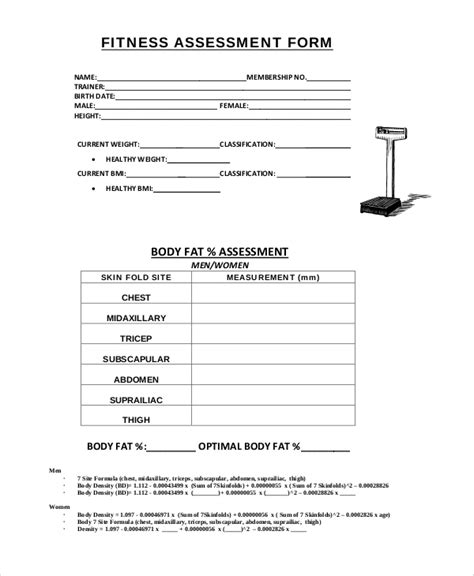

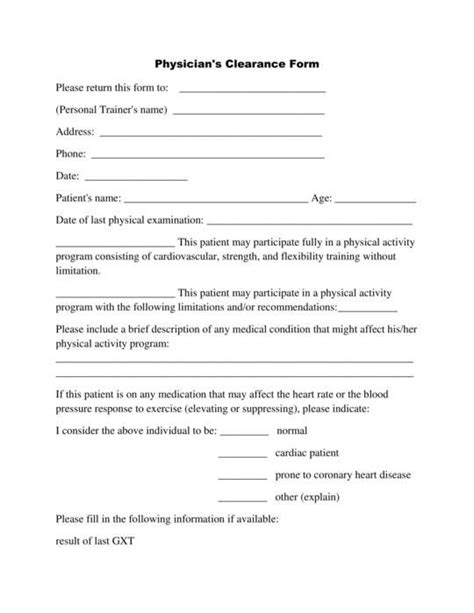

Client Intake Forms

Client intake forms are used to gather information about a client’s medical history, fitness goals, and contact information. This information is essential for creating a safe and effective training program. The following are some examples of information that should be included on a client intake form: * Medical history, including any pre-existing medical conditions * Fitness goals and motivations * Contact information, including emergency contact details * A statement requiring the client to inform the personal trainer of any changes to their medical history or contact information

Contracts

A contract is a legally binding document that outlines the terms of your services, including the scope of work, payment terms, and cancellation policies. The following are some examples of information that should be included in a contract: * A description of the services to be provided * A statement outlining the payment terms, including the amount and method of payment * A statement outlining the cancellation policies, including the notice period and any penalties * A statement requiring the client to comply with the personal trainer’s rules and regulations

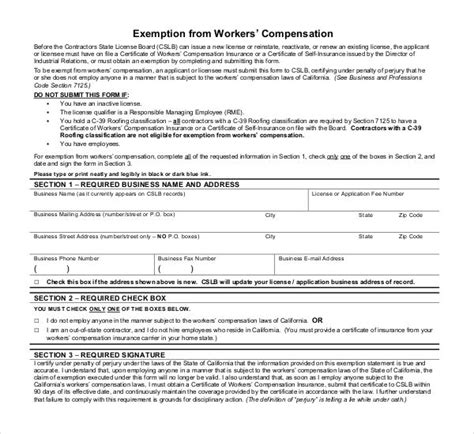

Insurance

Insurance is an essential aspect of any personal training business. It provides protection against liability claims and business interruption. The following are some examples of insurance policies that personal trainers may consider: * Liability insurance, which provides protection against claims of negligence or injury * Business interruption insurance, which provides protection against losses due to business interruption * Equipment insurance, which provides protection against losses due to equipment damage or theft

Maintaining Accurate Records

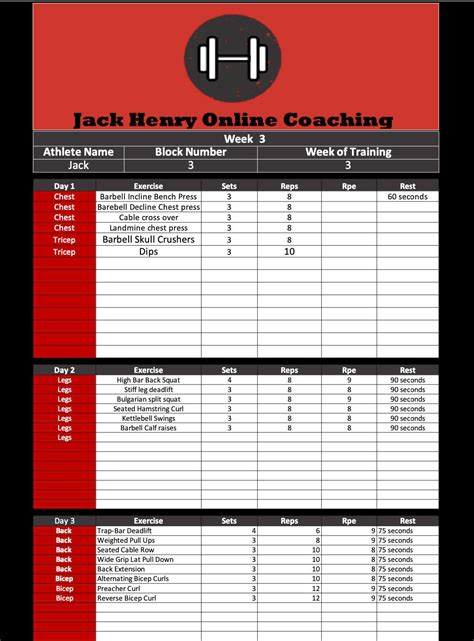

Maintaining accurate and up-to-date records is essential for personal trainers. This includes records of client information, training programs, and payment transactions. The following are some examples of records that personal trainers should keep: * Client files, including intake forms, medical history, and contact information * Training programs, including workout plans and progress tracking * Payment records, including invoices and payment receipts

📝 Note: It is essential to keep accurate and up-to-date records, as this can help to protect you and your business in case of a dispute or liability claim.

Best Practices for Managing Paperwork

The following are some best practices for managing paperwork as a personal trainer: * Use a paperwork management system to keep track of client information and training programs * Use electronic signatures to simplify the signing process and reduce paperwork * Use cloud storage to store and access client files and training programs remotely * Use secure payment processing to protect client payment information

| Document | Description |

|---|---|

| Liability Waiver | A document that clients sign to acknowledge the risks associated with physical activity and release the personal trainer from liability. |

| Client Intake Form | A document used to gather information about a client's medical history, fitness goals, and contact information. |

| Contract | A legally binding document that outlines the terms of your services, including the scope of work, payment terms, and cancellation policies. |

In summary, having the right paperwork in place is essential for protecting yourself, your clients, and your business as a personal trainer. This includes liability waivers, client intake forms, contracts, and insurance policies. By following best practices for managing paperwork, you can reduce the risk of liability claims and ensure a successful and profitable business.

To finalize, it’s crucial to remember that paperwork is a vital aspect of any personal training business, and it’s essential to stay organized and up-to-date with all the necessary documents. By doing so, you can focus on providing excellent services to your clients while minimizing potential risks and liabilities. With the right paperwork in place, you can build a strong foundation for your business and ensure long-term success.

What is a liability waiver, and why is it important for personal trainers?

+

A liability waiver is a document that clients sign to acknowledge the risks associated with physical activity and release the personal trainer from liability. It’s essential for personal trainers to have a liability waiver in place to protect themselves from potential lawsuits.

What information should be included on a client intake form?

+

A client intake form should include information about the client’s medical history, fitness goals, and contact information. This information is essential for creating a safe and effective training program.

Why is insurance important for personal trainers?

+

Insurance is essential for personal trainers to protect themselves against liability claims and business interruption. It provides financial protection in case of unexpected events, such as injuries or equipment damage.