Buying a House Paperwork

Introduction to Buying a House Paperwork

When it comes to buying a house, the process can be overwhelming, especially when dealing with the paperwork involved. Buying a house is a significant investment, and understanding the paperwork is crucial to ensure a smooth transaction. In this article, we will guide you through the various documents and procedures involved in buying a house, helping you to navigate the process with confidence.

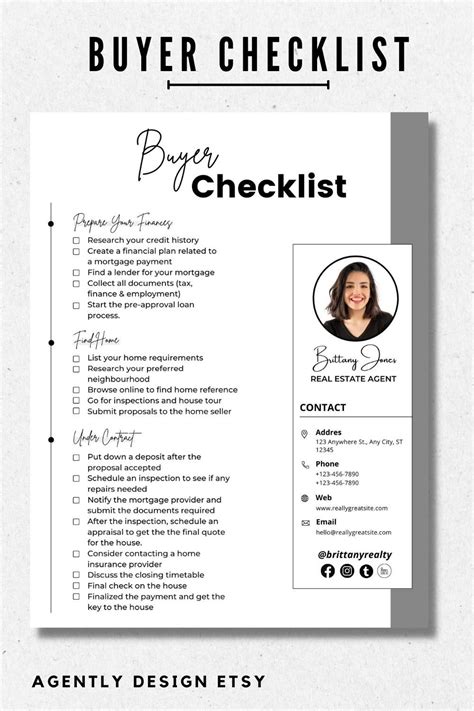

Pre-Purchase Paperwork

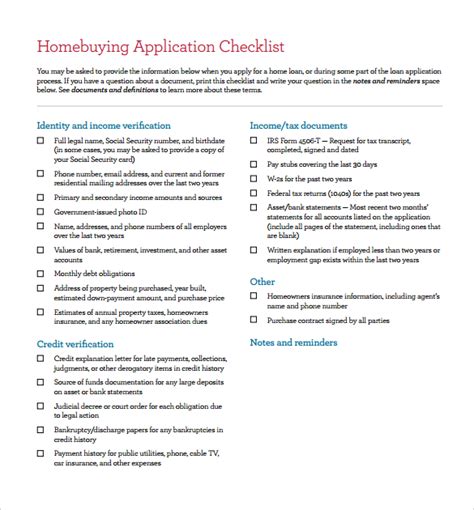

Before starting your house hunt, it’s essential to get your finances in order. This involves checking your credit score, gathering financial documents, and getting pre-approved for a mortgage. The pre-purchase paperwork includes: * Pay stubs to prove your income * Bank statements to show your savings and assets * Tax returns to demonstrate your financial stability * Identification documents, such as a driver’s license or passport

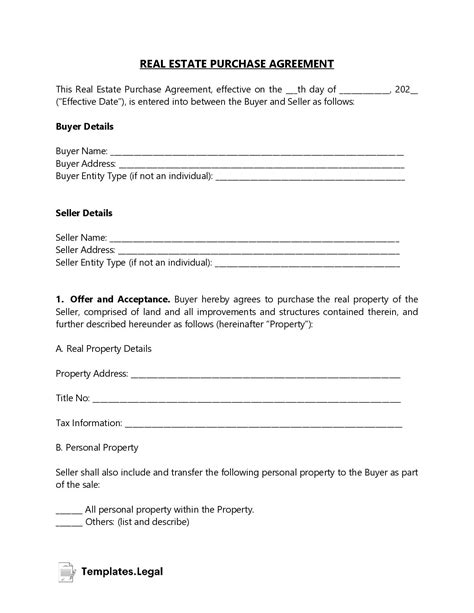

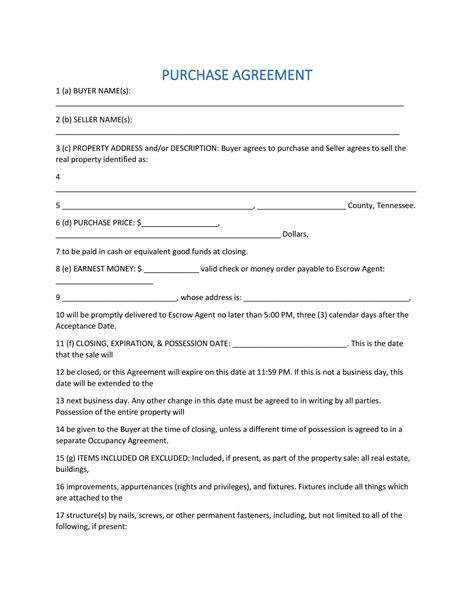

Offer and Acceptance Paperwork

Once you’ve found your dream home, it’s time to make an offer. The offer paperwork typically includes: * Offer letter: outlining the price you’re willing to pay, contingencies, and other terms * Earnest money deposit: a deposit to demonstrate your commitment to the purchase * Inspection contingency: allowing you to withdraw your offer if the inspection reveals significant issues

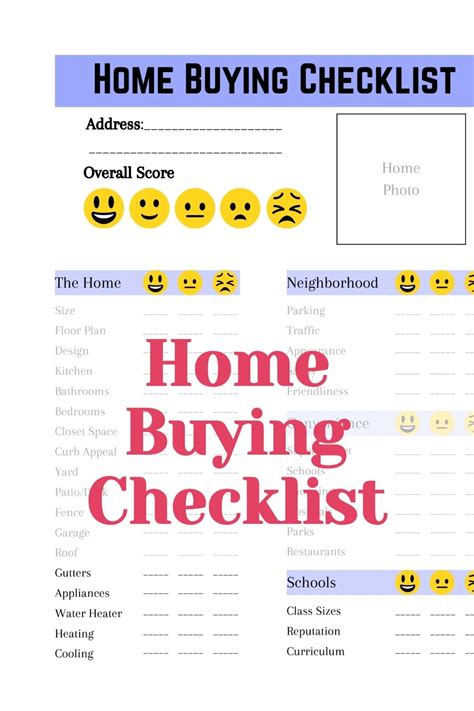

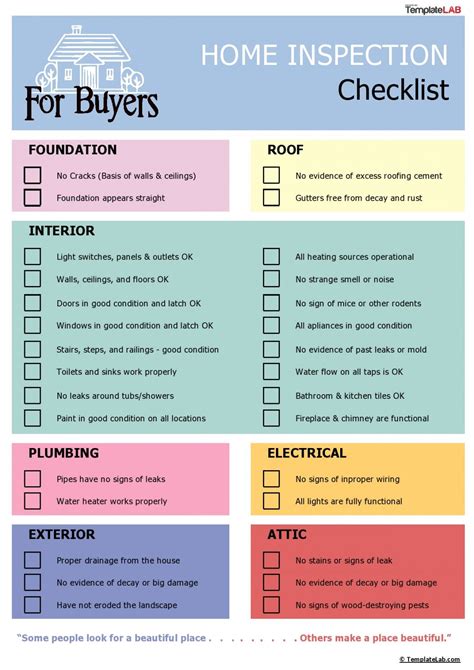

Inspection and Due Diligence Paperwork

After your offer is accepted, it’s essential to conduct inspections and due diligence to ensure the property is in good condition. The paperwork involved in this stage includes: * Inspection reports: detailing any defects or issues found during the inspection * Repair requests: outlining any repairs or credits you’re requesting from the seller * Disclosure documents: providing information about the property’s condition, including any known defects or hazards

Mortgage and Financing Paperwork

To secure financing for your home purchase, you’ll need to provide extensive documentation to your lender. The mortgage paperwork includes: * Loan application: providing personal and financial information * Appraisal report: valuing the property to ensure it’s worth the loan amount * Title search: verifying the seller’s ownership and checking for any liens or encumbrances

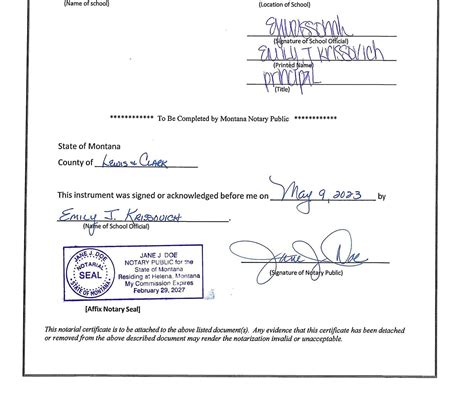

Closing Paperwork

The final stage of the home-buying process involves closing the deal. The closing paperwork includes: * Settlement statement: outlining the final terms of the sale, including the price, taxes, and fees * Deed: transferring ownership of the property from the seller to you * Mortgage deed: securing the property as collateral for the loan

📝 Note: It's essential to carefully review all the paperwork involved in the home-buying process to ensure you understand the terms and conditions of the sale.

Post-Purchase Paperwork

After the sale is complete, you’ll need to update your records and obtain any necessary documents. The post-purchase paperwork includes: * Updating the property records: notifying the local government of the change in ownership * Obtaining a new title insurance policy: protecting you against any future title disputes * Reviewing and updating your insurance policies: ensuring you have adequate coverage for your new home

| Document | Purpose |

|---|---|

| Offer letter | To make an offer on a property |

| Inspection report | To identify any defects or issues with the property |

| Mortgage application | To secure financing for the property |

| Settlement statement | To outline the final terms of the sale |

In the end, buying a house involves a significant amount of paperwork, but understanding the process and being prepared can make all the difference. By familiarizing yourself with the various documents and procedures involved, you’ll be better equipped to navigate the process and ensure a smooth transaction.

What is the first step in the home-buying process?

+

The first step in the home-buying process is to get your finances in order, which includes checking your credit score, gathering financial documents, and getting pre-approved for a mortgage.

What is the purpose of the inspection report?

+

The inspection report is used to identify any defects or issues with the property, allowing you to withdraw your offer or request repairs from the seller.

What is the settlement statement?

+

The settlement statement outlines the final terms of the sale, including the price, taxes, and fees, and is used to transfer ownership of the property from the seller to the buyer.