Keep Tax Paperwork How Long

Introduction to Tax Paperwork

When it comes to managing your finances, one of the most critical aspects is dealing with tax paperwork. The IRS requires individuals and businesses to maintain accurate and detailed records of their financial transactions, including tax-related documents. These records serve as proof of income, expenses, and tax payments, and are essential for filing tax returns, auditing, and other financial purposes. The question that often arises is, how long should you keep tax paperwork? The answer to this question depends on various factors, including the type of tax documents, the purpose of keeping them, and the statute of limitations for audits and lawsuits.

Understanding the Importance of Keeping Tax Records

Keeping tax records is crucial for several reasons: * Accurate tax filing: Tax records help you file your tax returns correctly, ensuring you claim the right deductions and credits. * Audit purposes: In case of an audit, having detailed records helps you prove your income, expenses, and tax payments, reducing the risk of penalties and fines. * Financial planning: Tax records provide valuable information for financial planning, such as tracking income and expenses, and making informed investment decisions. * Business management: For businesses, tax records are essential for managing finances, making strategic decisions, and ensuring compliance with tax laws and regulations.

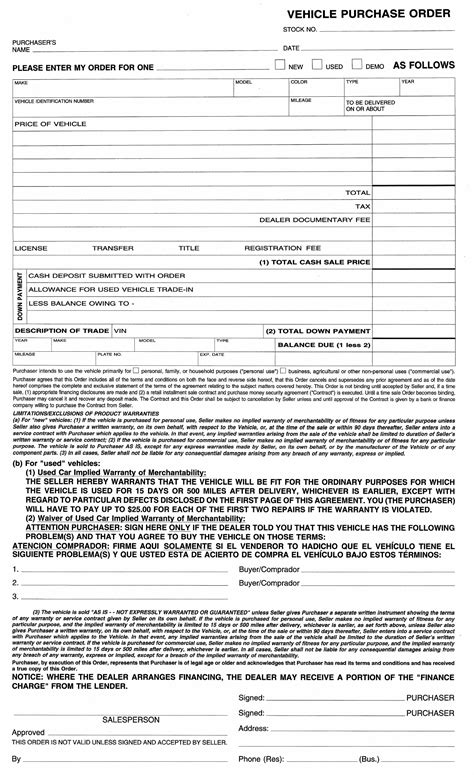

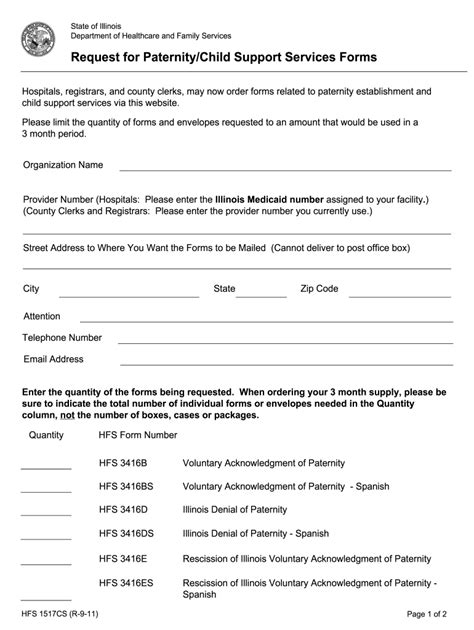

Types of Tax Documents to Keep

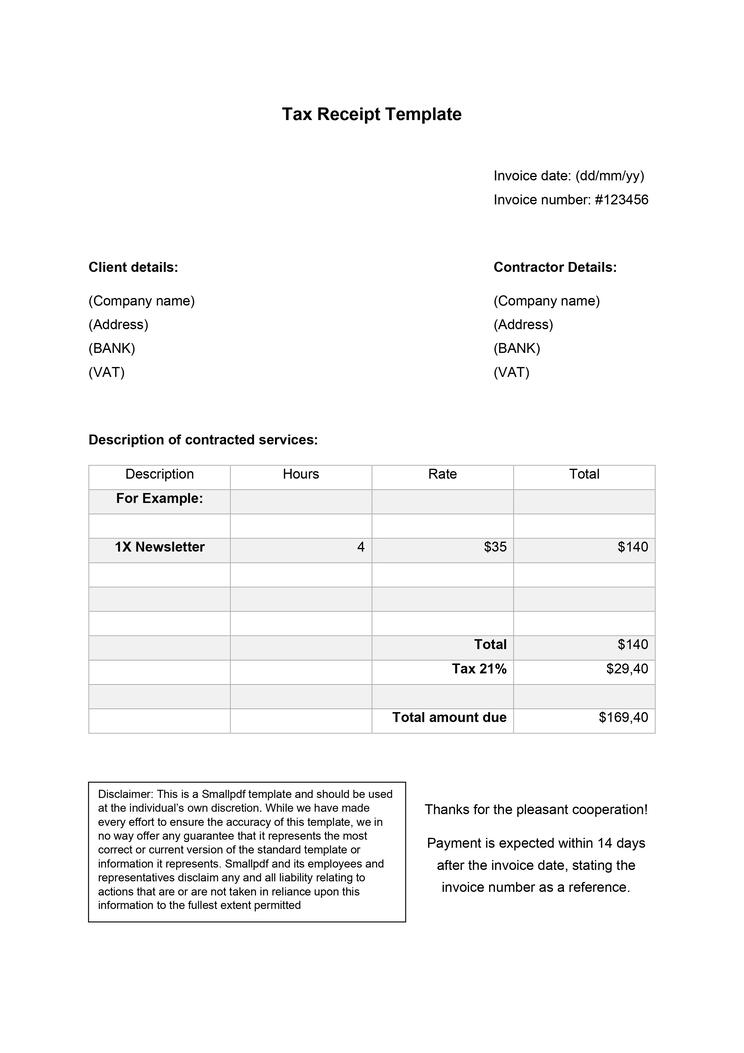

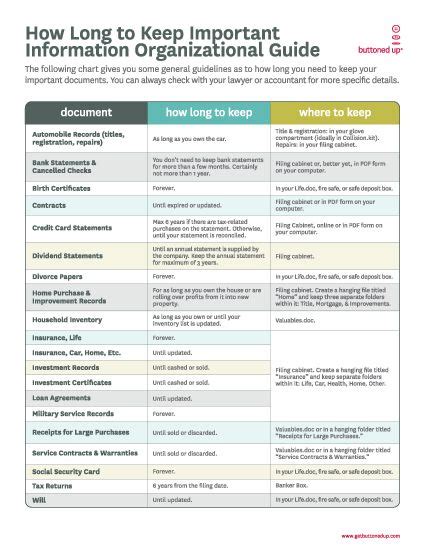

There are various types of tax documents that you should keep, including: * Tax returns: Keep copies of your tax returns, including the W-2 and 1099 forms, for at least three years. * Receipts and invoices: Keep receipts and invoices for business expenses, charitable donations, and medical expenses. * Bank statements: Keep bank statements, including checks, deposit slips, and credit card statements, for at least three years. * Investment records: Keep records of your investments, including stock purchases, sales, and dividend payments. * Business records: Keep records of business income, expenses, and transactions, including payroll records, accounts payable, and accounts receivable.

How Long to Keep Tax Paperwork

The length of time you should keep tax paperwork depends on the type of document and the purpose of keeping it. Here are some general guidelines: * Three years: Keep tax returns, receipts, and invoices for at least three years in case of an audit. * Six years: Keep records of business income, expenses, and transactions for at least six years in case of an audit or lawsuit. * Seven years: Keep records of investments, including stock purchases and sales, for at least seven years. * Indefinitely: Keep records of major purchases, such as a home or business, indefinitely, as these records may be needed for future reference.

📝 Note: It's essential to keep tax paperwork for the recommended period, even if you're not required to file a tax return. This will help you prove your income and expenses in case of an audit or lawsuit.

Organizing and Storing Tax Paperwork

To keep your tax paperwork organized and easily accessible, consider the following tips: * Use a filing system: Use a filing system, such as a file cabinet or digital storage, to keep your tax paperwork organized and easily accessible. * Label and date documents: Label and date each document, so you can easily identify and retrieve the information you need. * Store documents securely: Store your tax paperwork in a secure location, such as a safe or locked cabinet, to protect your sensitive financial information. * Consider digital storage: Consider using digital storage, such as a cloud-based service, to store your tax paperwork and reduce clutter.

Best Practices for Managing Tax Paperwork

To manage your tax paperwork effectively, follow these best practices: * Keep accurate records: Keep accurate and detailed records of your financial transactions, including tax-related documents. * Stay organized: Stay organized and keep your tax paperwork easily accessible. * Seek professional help: Seek professional help, such as a tax accountant or financial advisor, if you’re unsure about how to manage your tax paperwork. * Stay up-to-date: Stay up-to-date with changes in tax laws and regulations, and adjust your tax paperwork management accordingly.

| Type of Document | Retention Period |

|---|---|

| Tax returns | At least 3 years |

| Receipts and invoices | At least 3 years |

| Bank statements | At least 3 years |

| Investment records | At least 7 years |

| Business records | At least 6 years |

In summary, keeping tax paperwork is essential for managing your finances, filing tax returns, and ensuring compliance with tax laws and regulations. By understanding the importance of keeping tax records, the types of tax documents to keep, and the recommended retention periods, you can effectively manage your tax paperwork and reduce the risk of penalties and fines.

What is the minimum retention period for tax returns?

+

The minimum retention period for tax returns is at least 3 years.

What types of tax documents should I keep?

+

You should keep tax returns, receipts, invoices, bank statements, investment records, and business records.

How long should I keep business records?

+

You should keep business records for at least 6 years in case of an audit or lawsuit.