Paperwork

Save Paperwork How Long

Introduction to Saving Paperwork

When it comes to managing paperwork, one of the most common questions people ask is how long they should save their documents. The answer to this question can vary greatly depending on the type of paperwork, its significance, and the potential need for future reference. In this article, we will explore the different types of paperwork and provide guidance on how long to save each type.

Understanding the Importance of Saving Paperwork

Saving paperwork is essential for several reasons. It can serve as proof of transactions, agreements, or events, and can be crucial in resolving disputes or audits. Moreover, keeping records of important documents can help individuals and businesses stay organized and ensure compliance with regulatory requirements. Proper storage and maintenance of paperwork can also help prevent loss or damage to critical documents.

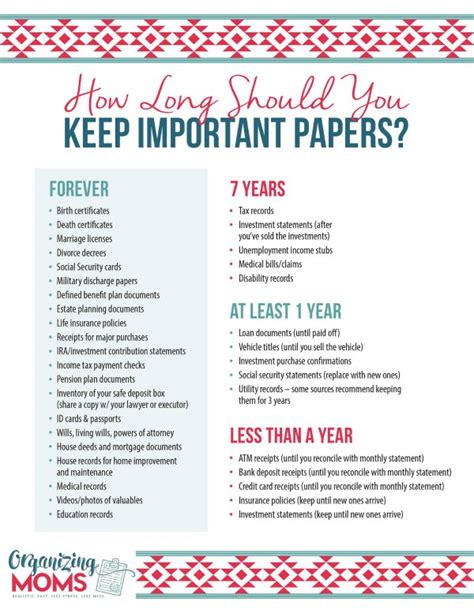

Types of Paperwork and Retention Periods

Here are some common types of paperwork and the recommended retention periods: * Tax Returns and Supporting Documents: 3 to 7 years * Financial Statements and Bank Records: 1 to 5 years * Insurance Policies and Claims: 1 to 5 years * Employment Records and Pay Stubs: 1 to 5 years * Medical Records and Bills: 1 to 5 years * Contracts and Agreements: 1 to 10 years * Property Deeds and Mortgage Documents: permanently

📝 Note: The retention periods mentioned above are general guidelines and may vary depending on the specific laws and regulations in your jurisdiction.

Best Practices for Saving Paperwork

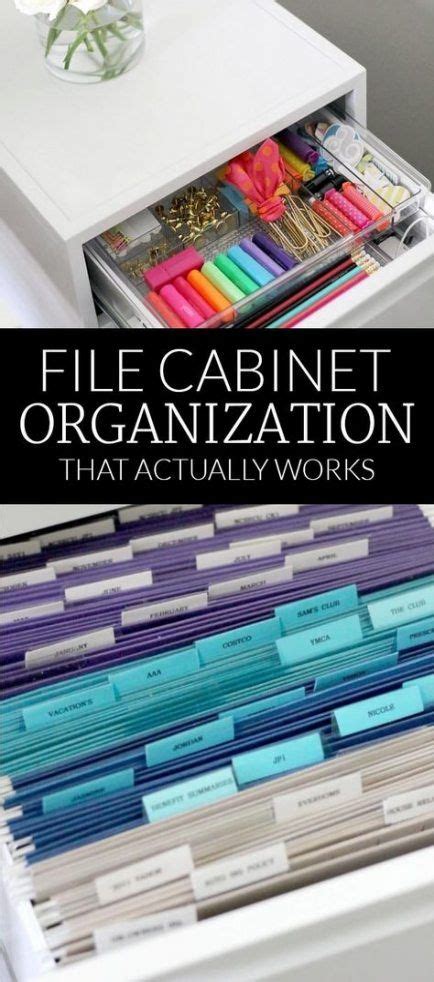

To ensure that your paperwork is properly saved and maintained, follow these best practices: * Organize your documents in a logical and consistent manner * Use a secure storage system, such as a fireproof safe or a locked cabinet * Make digital copies of important documents and store them in a secure location, such as an external hard drive or cloud storage * Shred or destroy documents that are no longer needed or are past their retention period * Review and update your paperwork regularly to ensure that it remains accurate and relevant

Conclusion

In summary, saving paperwork is an essential part of managing your personal and professional life. By understanding the different types of paperwork and their recommended retention periods, you can ensure that you are properly saving and maintaining your documents. Remember to follow best practices for saving paperwork, such as organizing your documents, using a secure storage system, and making digital copies. By taking these steps, you can help protect yourself and your business from potential risks and ensure that you are compliant with regulatory requirements.

What is the recommended retention period for tax returns and supporting documents?

+

The recommended retention period for tax returns and supporting documents is 3 to 7 years.

How should I store my paperwork to ensure it remains secure?

+

You should store your paperwork in a secure location, such as a fireproof safe or a locked cabinet, and make digital copies of important documents.

What is the best way to organize my paperwork?

+

The best way to organize your paperwork is to use a logical and consistent system, such as categorizing documents by type or date.