Paperwork

Small Business Paperwork Retention Periods

Introduction to Small Business Paperwork Retention Periods

As a small business owner, managing paperwork and maintaining accurate records is crucial for compliance, tax purposes, and business operations. With the ever-increasing amount of paperwork, it can be challenging to determine what documents to keep, for how long, and in what format. Proper paperwork retention is essential to avoid legal and financial issues, ensuring the continuity and success of the business. In this article, we will delve into the world of small business paperwork retention periods, exploring the types of documents, retention periods, and best practices for maintaining a well-organized record-keeping system.

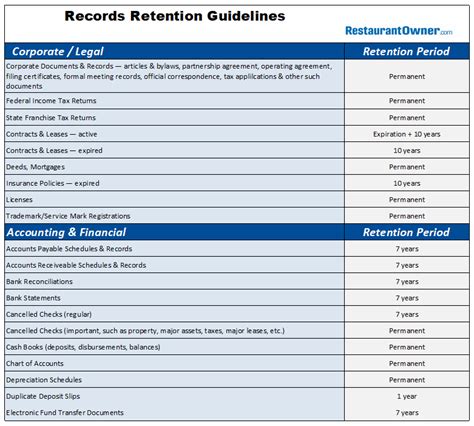

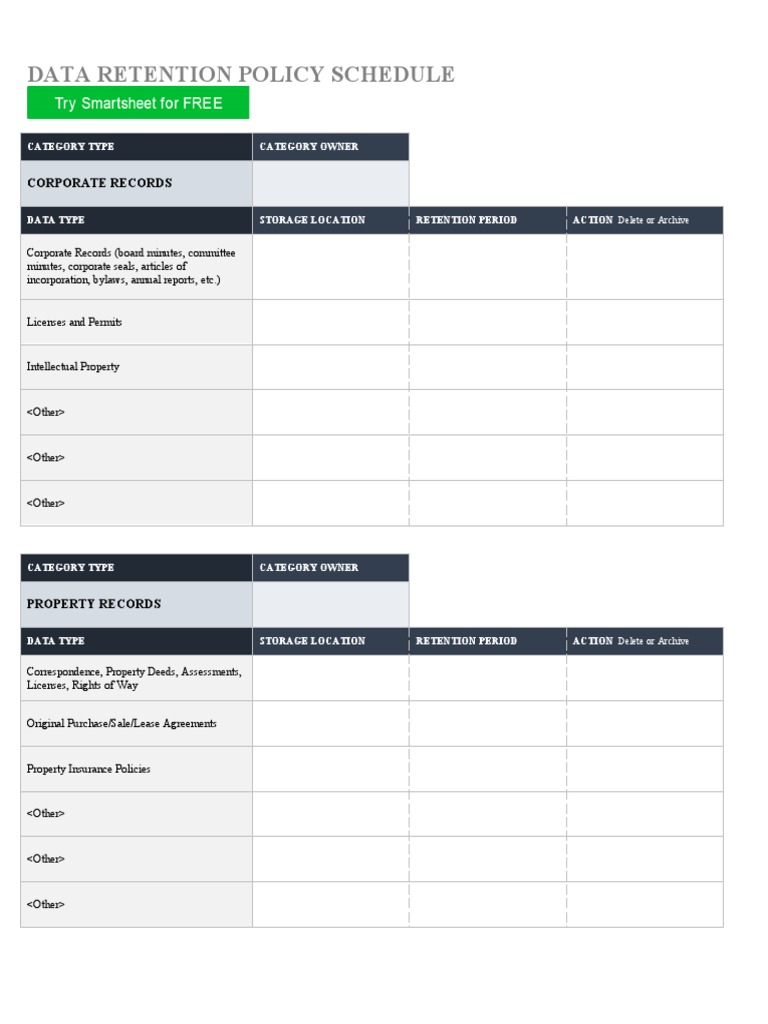

Types of Documents and Their Retention Periods

Small businesses generate a wide range of documents, each with its own retention period. The following are some common types of documents and their recommended retention periods: * Financial documents: 3-7 years + Invoices and receipts: 3 years + Bank statements: 3-5 years + Tax returns: 7 years + Accounts payable and accounts receivable: 3-5 years * Employment documents: 3-7 years + Employee contracts: 3-5 years + Payroll records: 3-5 years + Benefits documentation: 3-5 years * Contractual documents: 3-7 years + Business contracts: 3-5 years + Lease agreements: 3-5 years + Insurance policies: 3-5 years * Compliance documents: 3-7 years + Licenses and permits: 3-5 years + Certifications and accreditations: 3-5 years + Health and safety records: 3-5 years

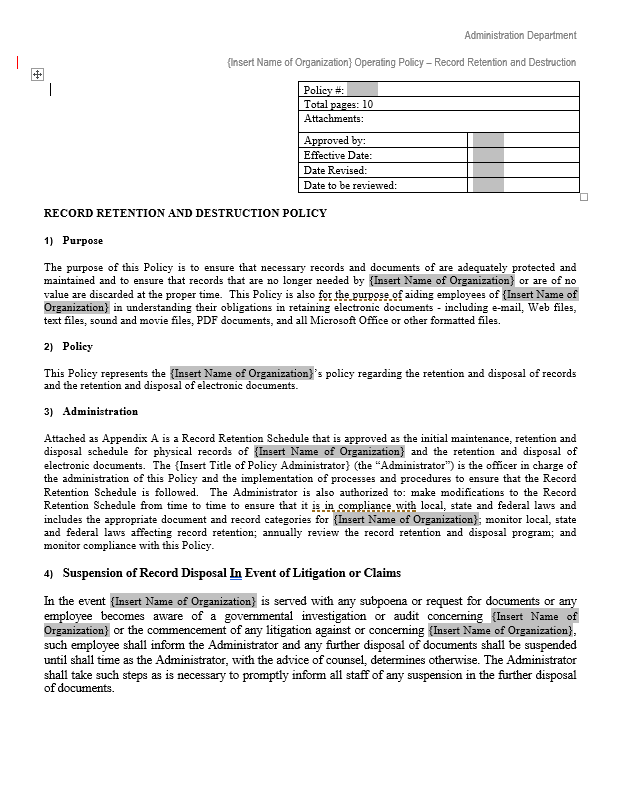

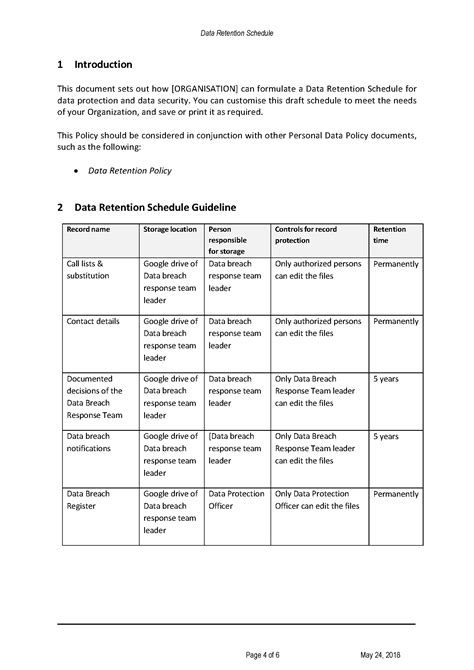

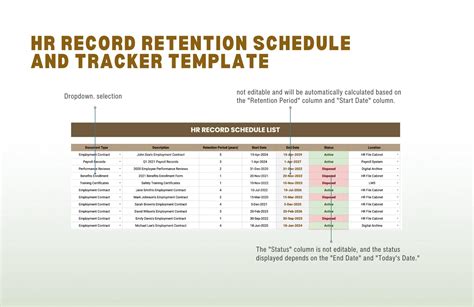

Best Practices for Maintaining a Record-Keeping System

To ensure compliance and efficient record-keeping, small businesses should implement the following best practices: * Centralized storage: Store all documents in a centralized location, such as a file cabinet or digital storage system. * Categorization: Organize documents into categories, such as financial, employment, or contractual documents. * Indexing: Create an index or catalog of documents to facilitate easy retrieval. * Digitalization: Consider digitizing documents to reduce physical storage space and improve accessibility. * Security: Implement security measures, such as encryption and access controls, to protect sensitive documents. * Regular audits: Conduct regular audits to ensure compliance with retention periods and to eliminate unnecessary documents.

Benefits of Proper Paperwork Retention

Proper paperwork retention offers numerous benefits to small businesses, including: * Compliance: Maintaining accurate records helps businesses comply with regulatory requirements and avoid fines or penalties. * Efficient operations: Well-organized records enable businesses to quickly locate and retrieve necessary documents, improving operational efficiency. * Risk management: Proper paperwork retention helps mitigate risks associated with audits, lawsuits, or other disputes. * Cost savings: Reducing the amount of paperwork and implementing digital storage solutions can lead to significant cost savings.

Challenges and Solutions

Small businesses may face several challenges when implementing a paperwork retention system, including: * Limited resources: Small businesses often have limited personnel, budget, and storage space. * Complexity: The variety of documents and retention periods can be overwhelming. * Technological limitations: Small businesses may not have the necessary technology or expertise to implement digital storage solutions. To overcome these challenges, small businesses can consider the following solutions: * Outsourcing: Partner with a third-party provider to manage paperwork retention. * Cloud storage: Utilize cloud storage solutions to reduce physical storage space and improve accessibility. * Automated systems: Implement automated systems, such as document management software, to streamline paperwork retention.

📝 Note: Small businesses should consult with legal and financial experts to determine the specific retention periods and requirements for their industry and location.

Conclusion and Future Directions

In conclusion, proper paperwork retention is essential for small businesses to ensure compliance, efficient operations, and risk management. By understanding the types of documents, retention periods, and best practices for maintaining a record-keeping system, small businesses can implement effective solutions to manage their paperwork. As technology continues to evolve, small businesses should consider adopting digital storage solutions and automated systems to streamline paperwork retention and improve overall business operations.

What is the recommended retention period for financial documents?

+

The recommended retention period for financial documents is 3-7 years, depending on the type of document and the business’s specific needs.

What are the benefits of digitizing documents?

+

Digitizing documents offers several benefits, including reduced physical storage space, improved accessibility, and enhanced security.

How often should small businesses conduct audits to ensure compliance with retention periods?

+

Small businesses should conduct regular audits, at least annually, to ensure compliance with retention periods and to eliminate unnecessary documents.