Keep Important Paperwork How Long

Introduction to Keeping Important Paperwork

When it comes to managing personal and financial documents, one of the most common questions people ask is how long they should keep their important paperwork. The answer to this question can vary depending on the type of document, its significance, and the potential need for future reference. In this article, we will delve into the world of document management, exploring the different types of important paperwork and the recommended retention periods for each.

Understanding the Types of Important Paperwork

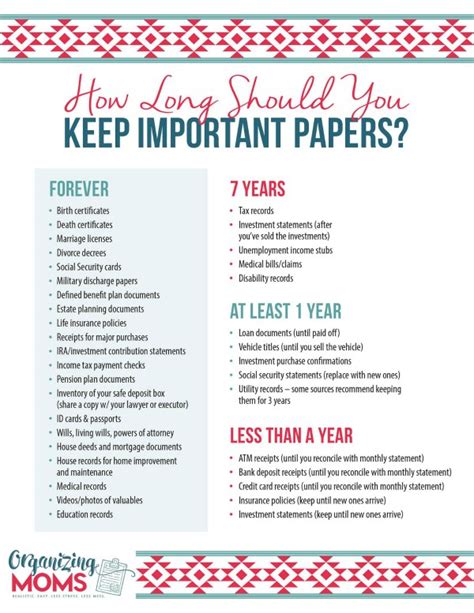

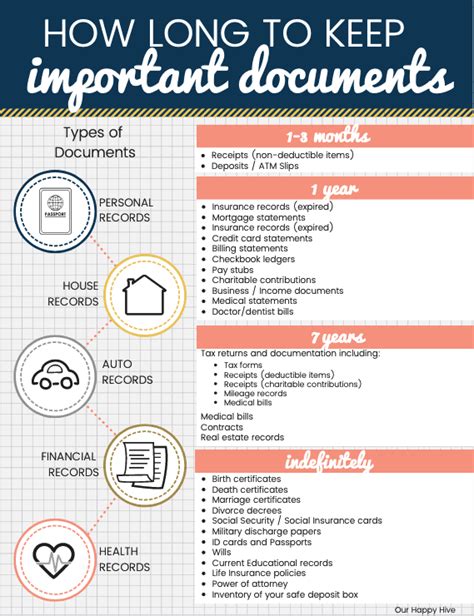

There are several categories of important paperwork that individuals and businesses should be aware of. These include: * Financial documents: such as tax returns, bank statements, and investment records * Personal documents: including identification, insurance policies, and medical records * Business documents: like contracts, invoices, and employee records * Tax-related documents: such as W-2 forms, 1099 forms, and receipts for deductions

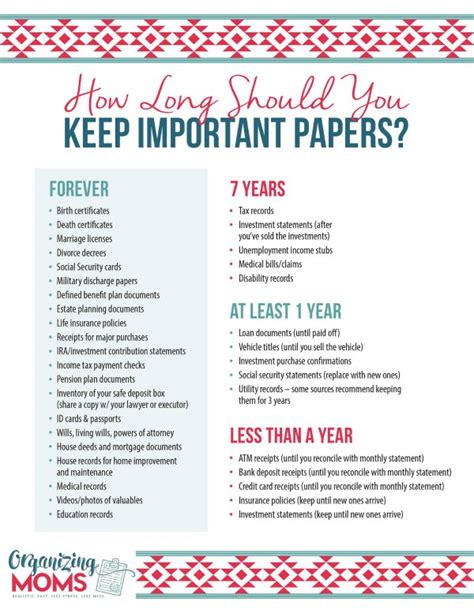

Retention Periods for Financial Documents

Financial documents are some of the most critical paperwork that individuals need to keep. The retention periods for these documents can vary: * Tax returns: it is recommended to keep tax returns for at least three years in case of an audit * Bank statements: keep bank statements for one year to ensure you have a record of your financial transactions * Investment records: retain investment records for as long as you own the investment, plus seven years after you sell it

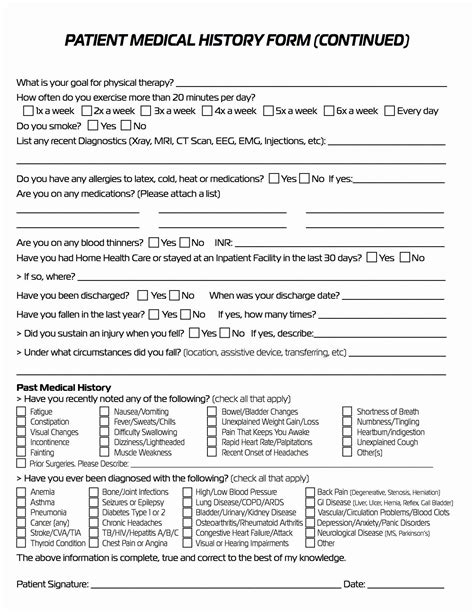

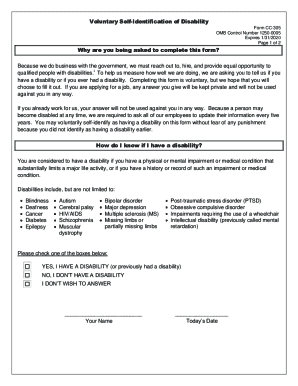

Retention Periods for Personal Documents

Personal documents are also crucial, and their retention periods can vary: * Identification documents: such as passports and driver’s licenses, should be kept indefinitely * Insurance policies: retain insurance policies for as long as the policy is in effect, plus one year after it expires * Medical records: keep medical records for at least five years after the last treatment

Retention Periods for Business Documents

Business documents have different retention periods: * Contracts: retain contracts for as long as the contract is in effect, plus seven years after it expires * Invoices: keep invoices for three years in case of an audit * Employee records: retain employee records for at least three years after the employee leaves the company

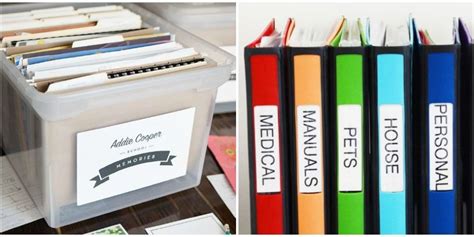

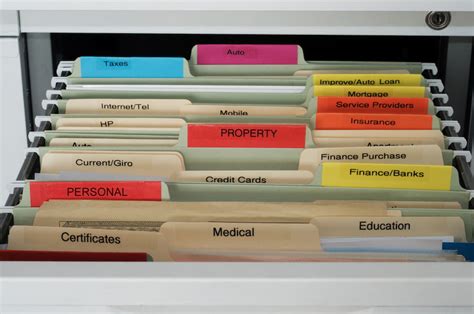

Creating a Document Management System

To keep track of your important paperwork, it is essential to create a document management system. This can include: * Physical storage: such as a file cabinet or safe * Digital storage: like a cloud storage service or external hard drive * Labeling and categorization: to ensure easy access and retrieval of documents

📝 Note: It is crucial to regularly review and update your document management system to ensure that it remains effective and efficient.

Best Practices for Document Storage

When storing important paperwork, it is essential to follow best practices: * Use acid-free materials: to prevent damage to your documents * Keep documents in a cool, dry place: to prevent deterioration * Use a fireproof safe: to protect your documents from fire damage * Make digital copies: to ensure that you have a backup of your important paperwork

| Document Type | Retention Period |

|---|---|

| Tax returns | At least three years |

| Bank statements | One year |

| Investment records | As long as you own the investment, plus seven years |

In summary, keeping important paperwork for the right amount of time is crucial for personal and financial management. By understanding the different types of paperwork and their recommended retention periods, individuals and businesses can create an effective document management system. This system should include physical and digital storage, labeling and categorization, and regular review and update. By following best practices for document storage, you can ensure that your important paperwork remains safe and accessible for years to come.

What is the recommended retention period for tax returns?

+

The recommended retention period for tax returns is at least three years in case of an audit.

How long should I keep bank statements?

+

You should keep bank statements for at least one year to ensure you have a record of your financial transactions.

What is the best way to store important paperwork?

+

The best way to store important paperwork is to use a combination of physical and digital storage, such as a file cabinet and a cloud storage service.