Employee Paperwork Requirements

Introduction to Employee Paperwork Requirements

When it comes to hiring new employees, there are numerous legal and administrative requirements that employers must adhere to. One of the most critical aspects of this process is the completion of necessary paperwork. Employee paperwork is essential for ensuring compliance with labor laws, tax regulations, and other statutory requirements. In this blog post, we will delve into the various types of employee paperwork, their importance, and the steps employers can take to ensure that all necessary documents are completed accurately and efficiently.

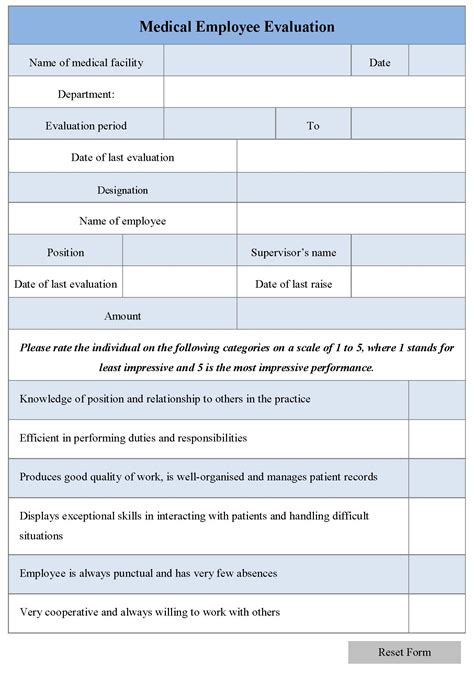

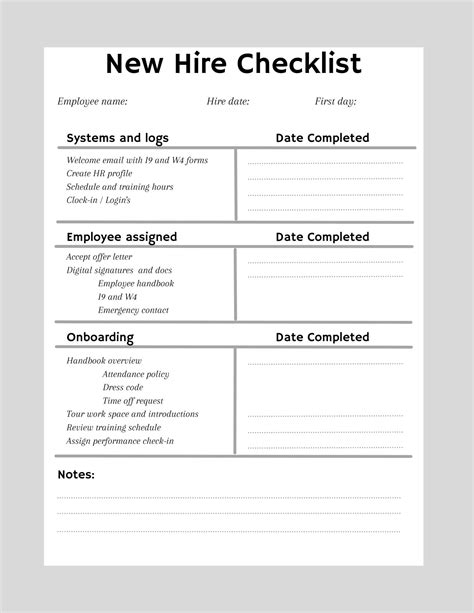

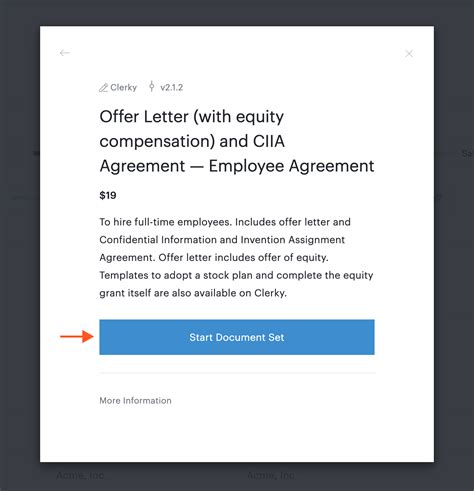

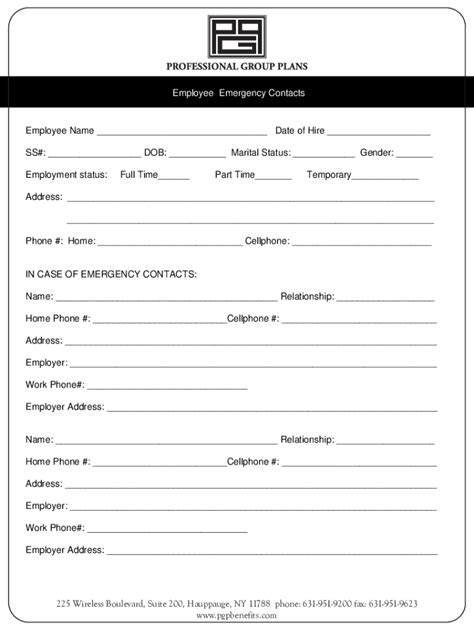

Types of Employee Paperwork

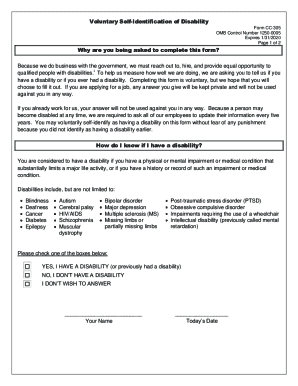

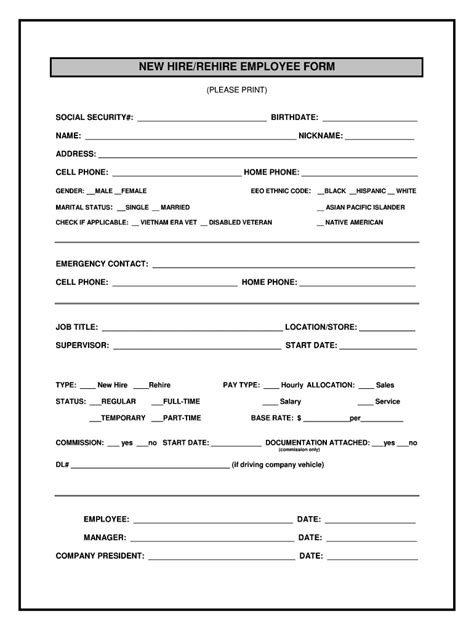

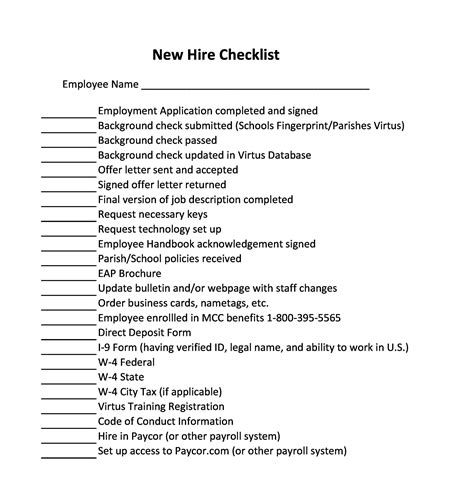

There are several types of employee paperwork that employers must complete when hiring new staff members. Some of the most common types of paperwork include: * Employment contracts: These outline the terms and conditions of employment, including job responsibilities, salary, benefits, and termination procedures. * Tax forms: Employers must complete tax forms, such as the W-4 and I-9, to ensure that employees are properly taxed and to verify their eligibility to work in the country. * Benefits enrollment forms: These forms are used to enroll employees in company-sponsored benefits, such as health insurance, retirement plans, and life insurance. * Emergency contact information: Employers must collect emergency contact information from employees, including names, addresses, and phone numbers of next of kin. * Employee handbook acknowledgments: Employers must provide employees with a copy of the company’s employee handbook and obtain a signed acknowledgment that the employee has read and understood the policies and procedures outlined in the handbook.

Importance of Employee Paperwork

Employee paperwork is crucial for several reasons: * Compliance with labor laws: Completing necessary paperwork helps employers comply with labor laws and regulations, reducing the risk of legal disputes and penalties. * Tax compliance: Accurate completion of tax forms ensures that employees are properly taxed, and employers are not liable for any tax errors or omissions. * Benefits administration: Completing benefits enrollment forms ensures that employees are properly enrolled in company-sponsored benefits, reducing the risk of errors or omissions. * Emergency preparedness: Collecting emergency contact information helps employers respond quickly and effectively in the event of an emergency.

Best Practices for Completing Employee Paperwork

To ensure that employee paperwork is completed accurately and efficiently, employers should follow these best practices: * Use standardized forms: Employers should use standardized forms to collect employee information, reducing the risk of errors or omissions. * Provide clear instructions: Employers should provide clear instructions to employees on how to complete paperwork, reducing the risk of errors or omissions. * Use electronic signatures: Employers can use electronic signatures to streamline the paperwork process, reducing the need for physical signatures and increasing efficiency. * Store paperwork securely: Employers must store employee paperwork securely, protecting sensitive employee information from unauthorized access or disclosure.

| Type of Paperwork | Purpose | Frequency |

|---|---|---|

| Employment contracts | Outlines terms and conditions of employment | Upon hiring |

| Tax forms | Verifies eligibility to work and ensures proper taxation | Upon hiring |

| Benefits enrollment forms | Enrolls employees in company-sponsored benefits | Upon hiring or during open enrollment |

| Emergency contact information | Provides contact information for emergency situations | Upon hiring |

| Employee handbook acknowledgments | Acknowledges receipt and understanding of company policies | Upon hiring |

📝 Note: Employers must ensure that all employee paperwork is completed accurately and efficiently to avoid errors or omissions that could lead to legal disputes or penalties.

In summary, employee paperwork is a critical aspect of the hiring process, ensuring compliance with labor laws, tax regulations, and other statutory requirements. Employers must complete various types of paperwork, including employment contracts, tax forms, benefits enrollment forms, emergency contact information, and employee handbook acknowledgments. By following best practices, such as using standardized forms, providing clear instructions, and storing paperwork securely, employers can ensure that employee paperwork is completed accurately and efficiently.

What is the purpose of employee paperwork?

+

The purpose of employee paperwork is to ensure compliance with labor laws, tax regulations, and other statutory requirements, as well as to provide a record of employee information and benefits enrollment.

What types of paperwork are required for new employees?

+

The types of paperwork required for new employees include employment contracts, tax forms, benefits enrollment forms, emergency contact information, and employee handbook acknowledgments.

How can employers ensure that employee paperwork is completed accurately and efficiently?

+

Employers can ensure that employee paperwork is completed accurately and efficiently by using standardized forms, providing clear instructions, using electronic signatures, and storing paperwork securely.