Paperwork

File Taxes Paperwork Needed

Introduction to Filing Taxes

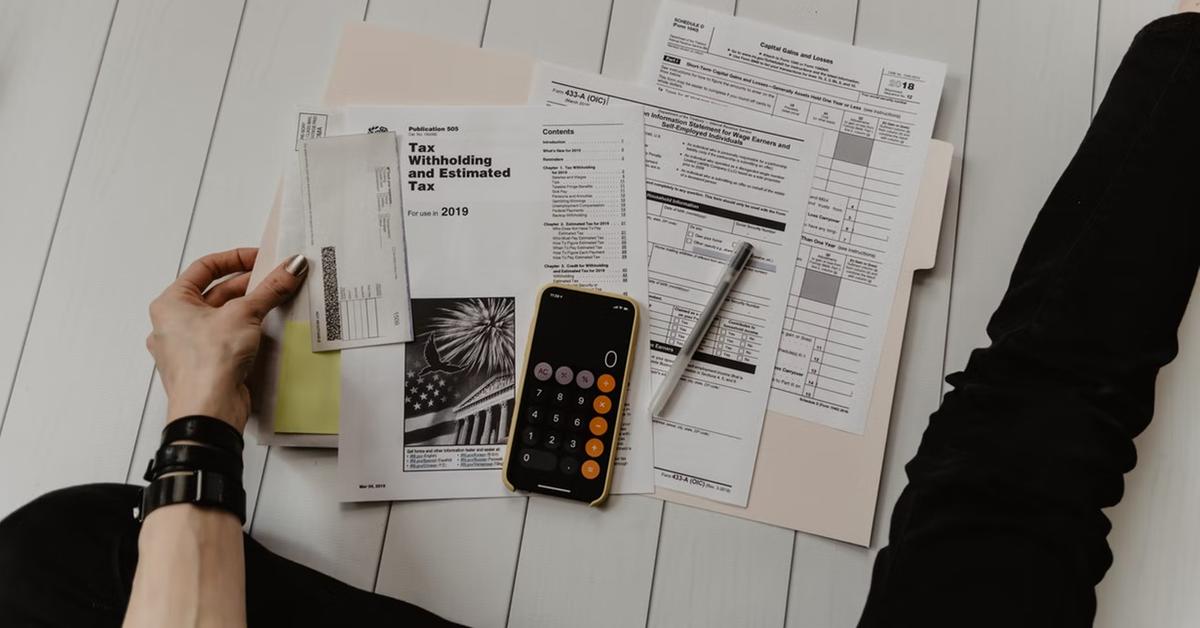

Filing taxes can be a daunting task, especially when it comes to gathering all the necessary paperwork. To ensure a smooth and efficient tax-filing process, it’s essential to have all the required documents ready. In this article, we will guide you through the paperwork needed to file your taxes, making it easier for you to navigate the process.

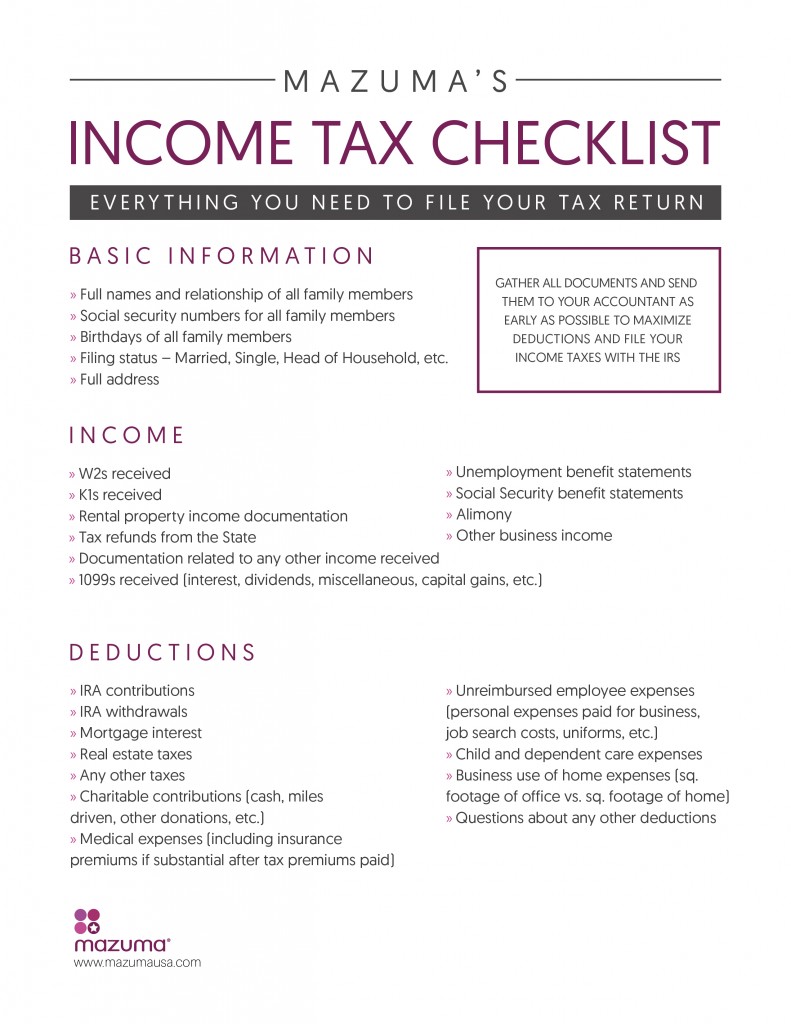

Income-Related Documents

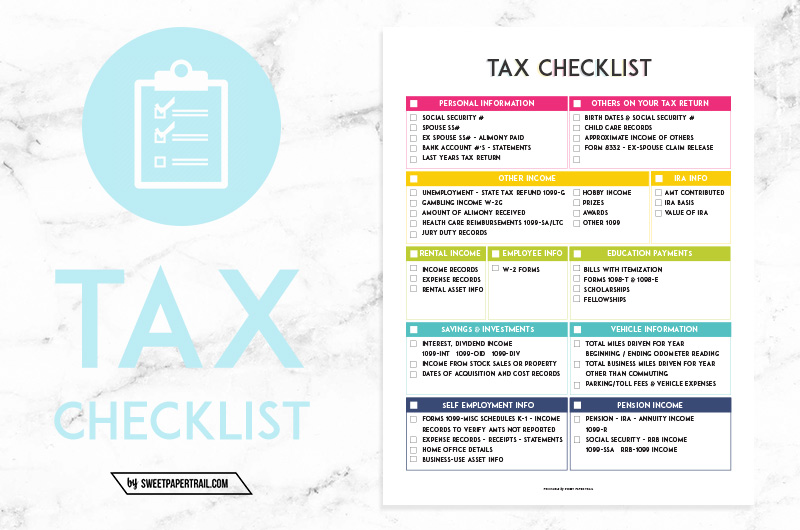

When filing taxes, you will need to provide documentation of your income. This includes:

- W-2 forms: These forms show your income and taxes withheld from your employer.

- 1099 forms: If you’re self-employed or have freelance income, you’ll receive 1099 forms from your clients.

- Interest statements: You’ll need statements from your bank or investment accounts showing interest earned.

- Dividend statements: If you have investments in stocks or mutual funds, you’ll receive dividend statements.

Deduction-Related Documents

To claim deductions, you’ll need to provide supporting documentation. This may include:

- Charitable donation receipts: Keep receipts for donations to qualified charitable organizations.

- Medical expense records: Save records of medical expenses, including receipts and invoices.

- Mortgage interest statements: If you’re a homeowner, you’ll need statements showing mortgage interest paid.

- Property tax records: Keep records of property taxes paid on your primary residence or investment properties.

Credit-Related Documents

You may be eligible for tax credits, which can reduce your tax liability. To claim credits, you’ll need:

- Child care expense records: Keep records of child care expenses, including receipts and invoices.

- Education expense records: Save records of education expenses, including tuition payments and receipts.

- Energy-efficient home improvement records: Keep records of energy-efficient home improvements, including receipts and invoices.

Other Required Documents

In addition to income, deduction, and credit-related documents, you may need to provide other supporting documentation, such as:

- Identification: You’ll need to provide identification, such as a driver’s license or passport.

- Social Security number or Individual Taxpayer Identification Number (ITIN): You’ll need to provide your Social Security number or ITIN.

- Dependent information: If you have dependents, you’ll need to provide their Social Security numbers or ITINs.

💡 Note: It's essential to keep accurate and detailed records of all tax-related documents, as this will make the filing process easier and reduce the risk of errors or audits.

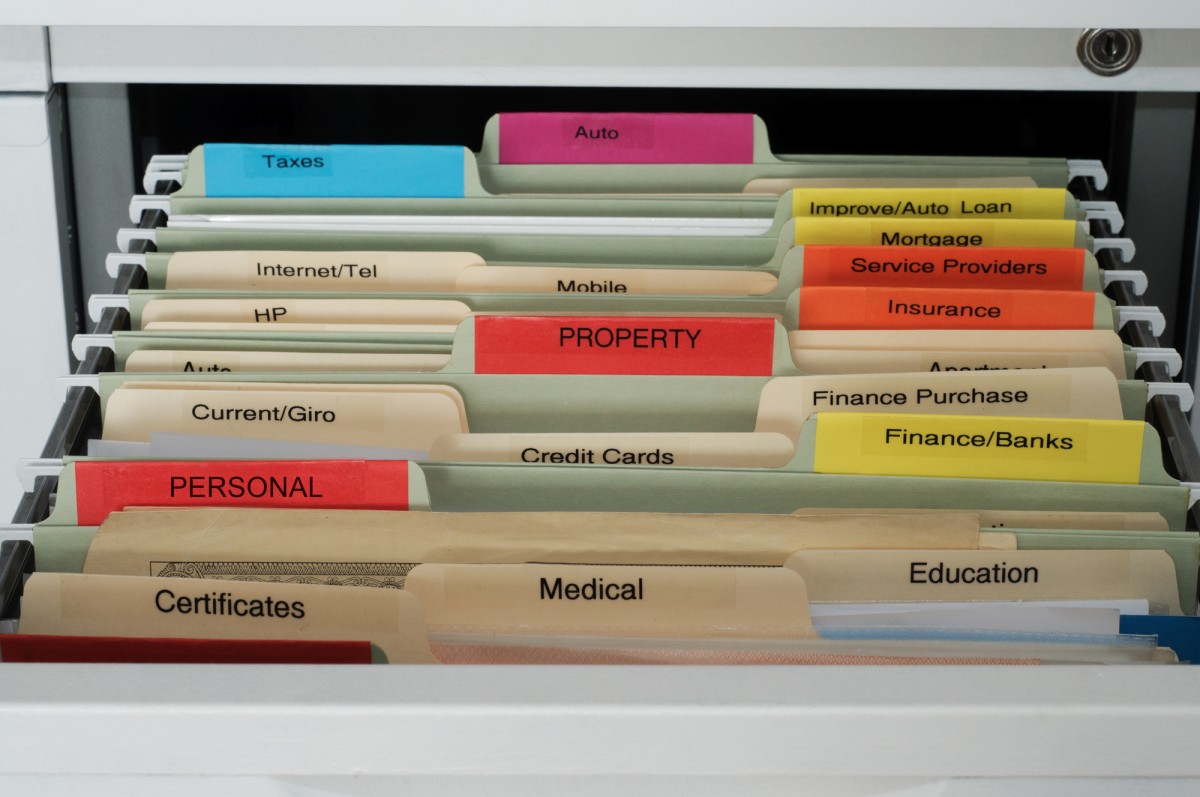

Organizing Your Paperwork

To make the tax-filing process more efficient, consider organizing your paperwork in a logical and systematic way. You can use a folder or binder to keep all your documents together, or consider using tax preparation software that allows you to upload and store your documents electronically.

| Document Type | Description |

|---|---|

| W-2 forms | Shows income and taxes withheld from employer |

| 1099 forms | Shows freelance or self-employment income |

| Interest statements | Shows interest earned from bank or investment accounts |

Conclusion and Final Thoughts

Filing taxes requires careful planning and attention to detail. By gathering all the necessary paperwork and organizing it in a logical way, you can make the process easier and reduce the risk of errors or audits. Remember to keep accurate and detailed records of all tax-related documents, and consider using tax preparation software to make the process more efficient. With the right paperwork and planning, you can navigate the tax-filing process with confidence.

What is the deadline for filing taxes?

+

The deadline for filing taxes varies by country and region, but in the United States, the typical deadline is April 15th.

What documents do I need to file taxes?

+

You’ll need to provide documentation of your income, deductions, and credits, including W-2 forms, 1099 forms, interest statements, and charitable donation receipts.

Can I file taxes electronically?

+

Yes, you can file taxes electronically using tax preparation software or by visiting the website of your country’s tax authority.