Get Official IRS Paperwork

Introduction to Obtaining Official IRS Paperwork

When dealing with taxes, it’s essential to have the right documents to ensure compliance with the IRS and to avoid any potential issues. Official IRS paperwork can be necessary for various reasons, such as filing taxes, applying for tax credits, or resolving tax disputes. In this article, we will guide you through the process of obtaining official IRS paperwork, highlighting the importance of accuracy and timeliness in tax-related matters.

Understanding the Types of IRS Paperwork

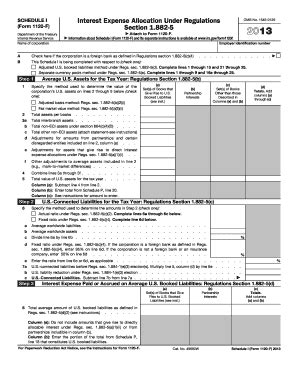

The IRS provides a wide range of forms and documents for different purposes. Some of the most common types of IRS paperwork include:

- W-2 forms: Used to report income and taxes withheld from employees.

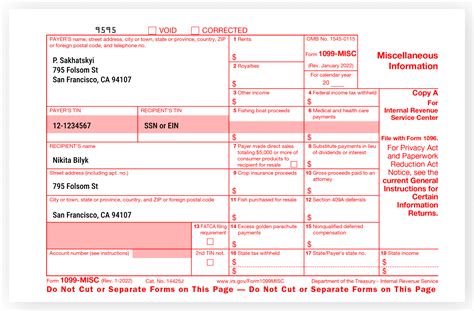

- 1099 forms: Used to report income earned by independent contractors and freelancers.

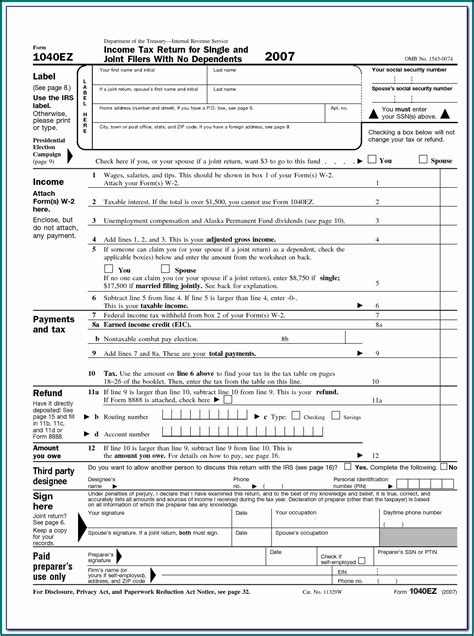

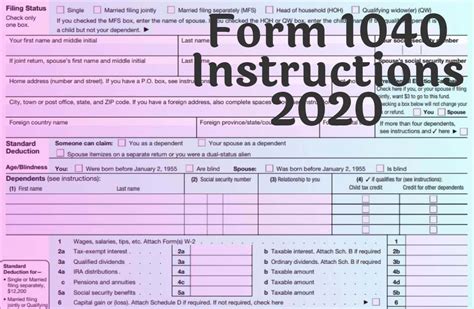

- Form 1040: The standard form used for personal income tax returns.

- Form 941: Used by employers to report employment taxes.

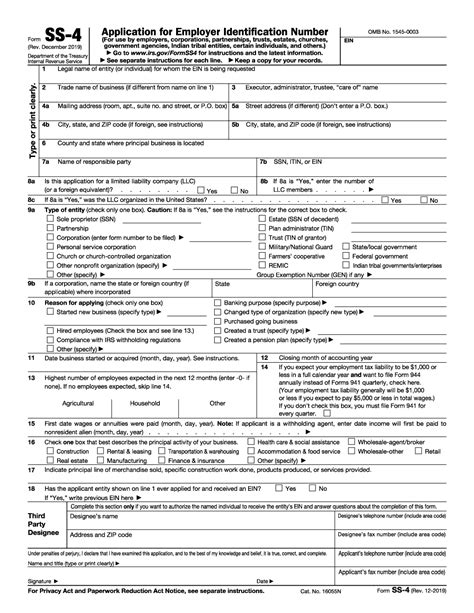

How to Obtain Official IRS Paperwork

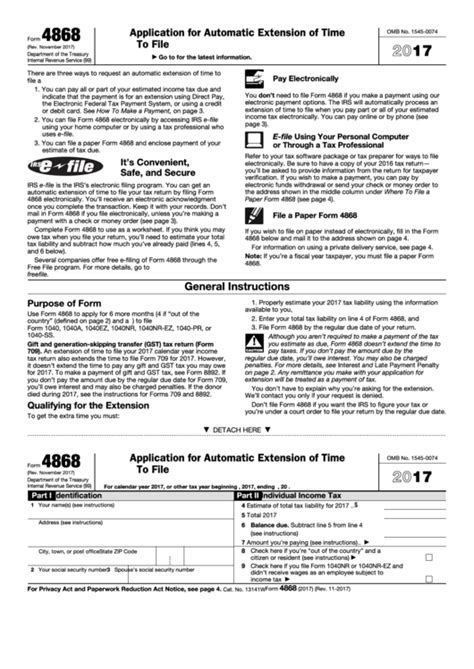

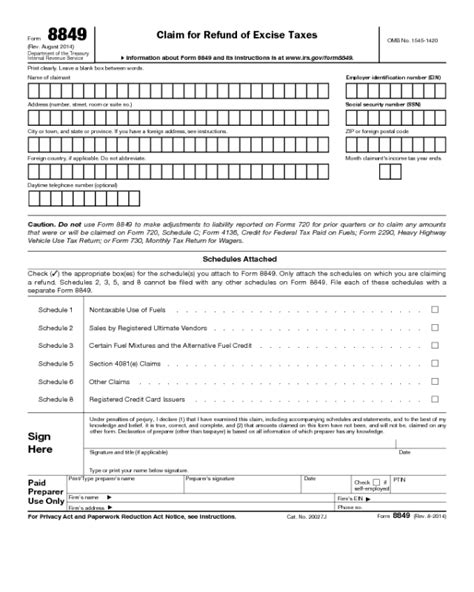

There are several ways to obtain official IRS paperwork, depending on your needs and preferences. Here are some common methods:

- IRS Website: The official IRS website (irs.gov) offers a wide range of forms and publications that can be downloaded and printed.

- IRS Taxpayer Assistance Centers: These centers provide face-to-face assistance and can provide forms and other tax-related documents.

- Mail: You can order forms and publications by mail by calling the IRS toll-free at 1-800-829-3676.

- IRS2Go App: The IRS offers a mobile app that allows you to access tax information, including forms and publications, on your smartphone or tablet.

Importance of Accuracy and Timeliness

When dealing with official IRS paperwork, accuracy and timeliness are critical. Inaccurate or late filings can result in penalties, fines, and even audits. It’s essential to double-check your forms and submissions for errors and ensure that you meet the deadlines for filing and payment. The IRS provides various resources and tools to help taxpayers ensure accuracy and compliance, including:

| Resource | Description |

|---|---|

| IRS Taxpayer Advocate Service | Provides assistance to taxpayers experiencing issues with the IRS. |

| IRS Free File | Offers free tax filing options for eligible taxpayers. |

| IRS Taxpayer Education | Provides educational resources and workshops on tax-related topics. |

By utilizing these resources and taking the time to ensure accuracy and timeliness, you can minimize the risk of issues with your tax filings and ensure a smooth experience with the IRS.

📝 Note: It's essential to keep accurate records of your tax-related documents and correspondence with the IRS, as this can help resolve any issues that may arise.

Common Issues and Solutions

Despite the best efforts, issues can still arise when dealing with official IRS paperwork. Some common problems include:

- Lost or missing forms: If you lose or misplace a form, you can request a replacement from the IRS or download a new copy from the IRS website.

- Incorrect filings: If you realize you made an error on your tax return, you can file an amended return (Form 1040X) to correct the mistake.

- Delinquent payments: If you miss a payment or are unable to pay your tax bill in full, you can set up a payment plan with the IRS or seek assistance from a tax professional.

In the end, obtaining official IRS paperwork is a critical step in managing your tax obligations and ensuring compliance with the IRS. By understanding the types of forms available, knowing how to obtain them, and prioritizing accuracy and timeliness, you can navigate the tax filing process with confidence and avoid potential issues. Remember to stay organized, seek help when needed, and take advantage of the resources and tools provided by the IRS to ensure a smooth and successful tax filing experience.

What is the deadline for filing Form 1040?

+

The deadline for filing Form 1040 is typically April 15th of each year, but it may be extended in certain circumstances.

How can I get a copy of my W-2 form?

+

You can obtain a copy of your W-2 form from your employer or by contacting the IRS directly.

What is the penalty for late payment of taxes?

+

The penalty for late payment of taxes can vary depending on the circumstances, but it is typically a percentage of the unpaid tax amount, plus interest and fees.