7 Tips Mortgage Papers

Understanding the Mortgage Process

When it comes to purchasing a home, one of the most crucial steps is navigating the mortgage process. This involves a significant amount of paperwork, which can be overwhelming for many individuals. To simplify this process, it’s essential to have a clear understanding of the various documents involved and the steps required to complete a mortgage application. In this article, we will explore seven tips for managing mortgage papers effectively, ensuring a smooth and stress-free experience for homebuyers.

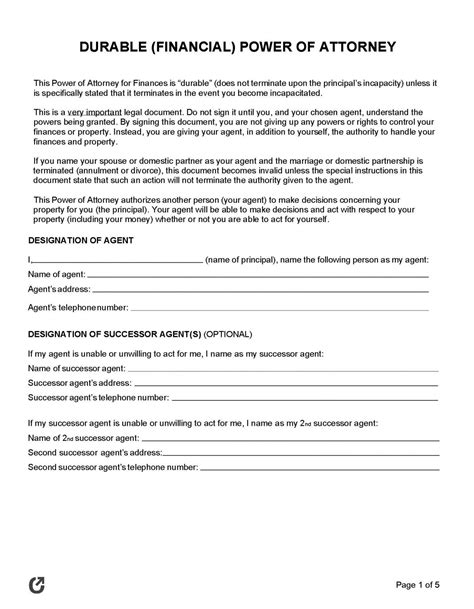

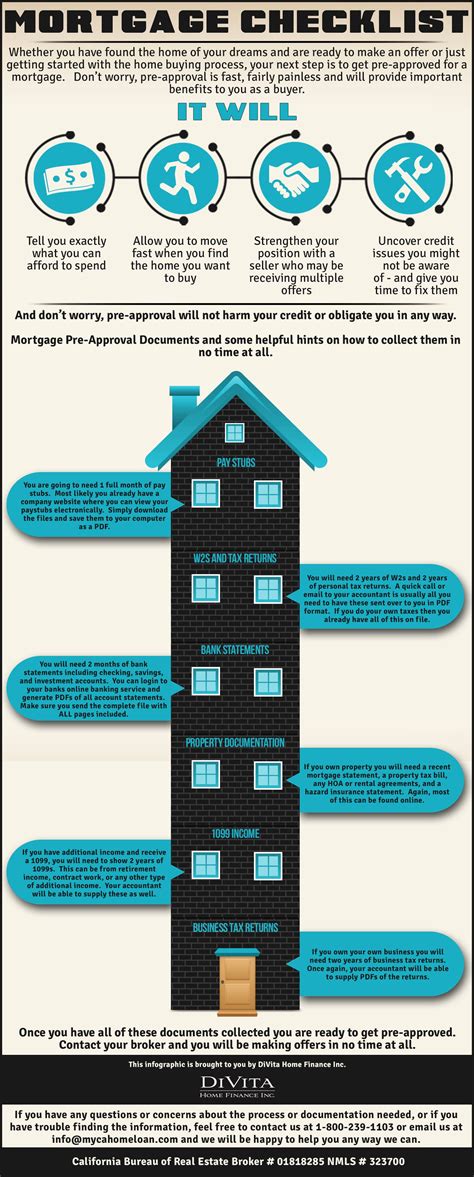

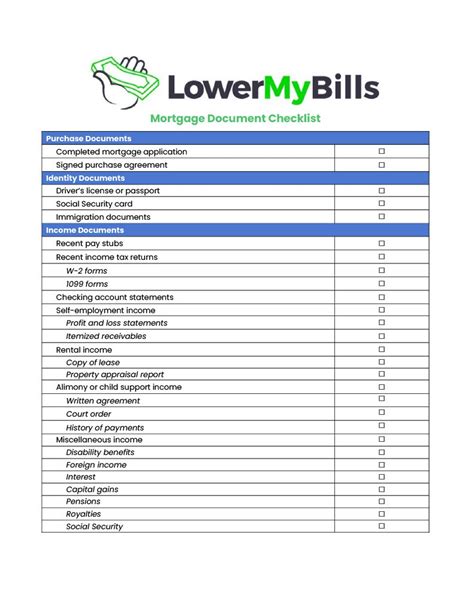

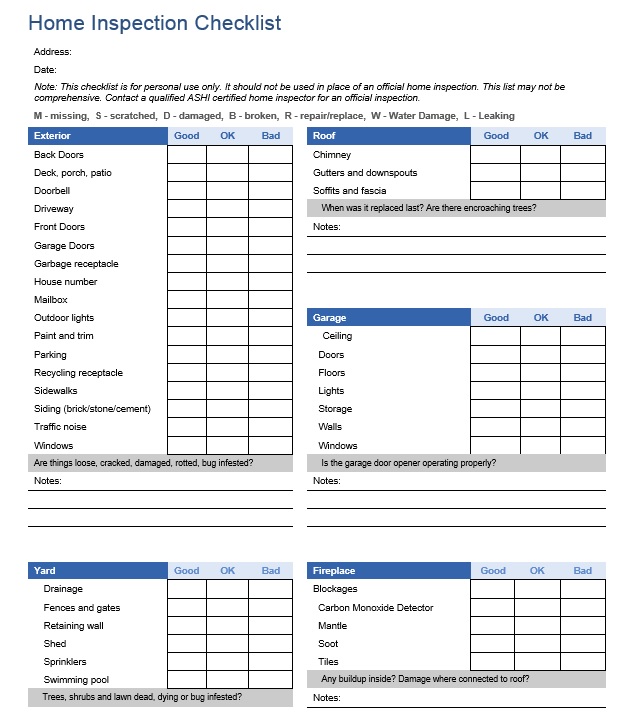

Tip 1: Gather Necessary Documents

The first step in the mortgage process is to gather all the necessary documents. These typically include:

- Identification documents: Such as a driver’s license or passport

- Income verification: Pay stubs, W-2 forms, and tax returns

- Bank statements: To verify savings and assets

- Credit reports: To assess creditworthiness

Tip 2: Understand Mortgage Options

Before proceeding with the application, it’s crucial to understand the different types of mortgages available. This includes:

- Fixed-rate mortgages: Offering predictable monthly payments

- Adjustable-rate mortgages: With potential for lower initial payments but risks of rate increases

- Government-backed loans: Such as FHA, VA, and USDA loans, each with their own set of benefits and eligibility criteria

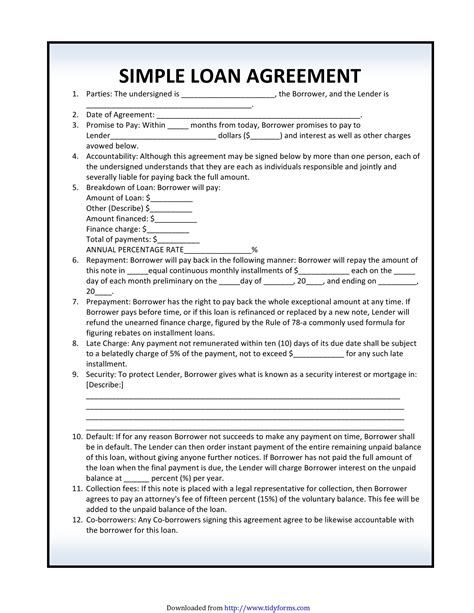

Tip 3: Review and Understand Loan Estimates

Once the application is submitted, lenders provide a Loan Estimate (LE) within three business days. This document outlines the terms of the loan, including:

- Loan amount

- Interest rate

- Monthly payment

- Total closing costs

Tip 4: Manage Closing Costs

Closing costs are fees associated with the home buying process, typically ranging from 2% to 5% of the purchase price. These can include:

- Title insurance and escrow fees

- Appraisal fees

- Credit report fees

- Underwriting fees

Tip 5: Maintain Good Credit

A good credit score can significantly impact the interest rate offered by lenders and the overall cost of the mortgage. Maintaining good credit involves:

- Paying bills on time

- Keeping credit utilization low

- Monitoring credit reports for errors

Tip 6: Consider Working with a Mortgage Broker

Mortgage brokers act as intermediaries between borrowers and lenders, offering:

- Access to multiple lenders

- Comparisons of loan options

- Guidance through the application process

Tip 7: Keep Records Organized

Finally, keeping all mortgage-related documents and communications organized is crucial. This includes:

- Loan applications and approvals

- Loan estimates and closing disclosures

- Correspondence with lenders and brokers

| Mortgage Document | Description |

|---|---|

| Loan Estimate | Outlines the terms of the loan |

| Closing Disclosure | Finalizes the loan terms and costs |

| Identification Documents | Verifies the borrower's identity |

📝 Note: Keeping detailed records of all mortgage documents and communications can help in tracking the progress of the application and addressing any issues promptly.

In the end, navigating the mortgage process requires careful planning, understanding of the various documents involved, and attention to detail. By following these seven tips, homebuyers can ensure a smoother and more efficient experience, setting them up for success in their home ownership journey. The key is to stay informed, organized, and proactive throughout the process, from gathering necessary documents to maintaining good credit and understanding loan options. With the right approach, individuals can find the perfect mortgage for their needs, making their dream of homeownership a reality.

What are the main documents required for a mortgage application?

+

The main documents required include identification, income verification, bank statements, and credit reports.

How can I improve my chances of getting a good mortgage deal?

+

Maintaining a good credit score, shopping around for lenders, and considering working with a mortgage broker can improve your chances of getting a good deal.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

+

A fixed-rate mortgage offers predictable monthly payments, while an adjustable-rate mortgage may offer lower initial payments but comes with the risk of rate increases over time.