5 Tips Chase Auto Loan

Introduction to Chase Auto Loan

Chase Auto Loan is a financial service provided by JPMorgan Chase, one of the largest banking institutions in the United States. The service allows individuals to purchase new or used vehicles by providing them with the necessary financing. With competitive interest rates and flexible repayment terms, Chase Auto Loan has become a popular choice among car buyers. However, navigating the process of obtaining a car loan can be overwhelming, especially for first-time buyers. In this article, we will provide you with 5 tips to help you make the most out of Chase Auto Loan.

Understanding Your Credit Score

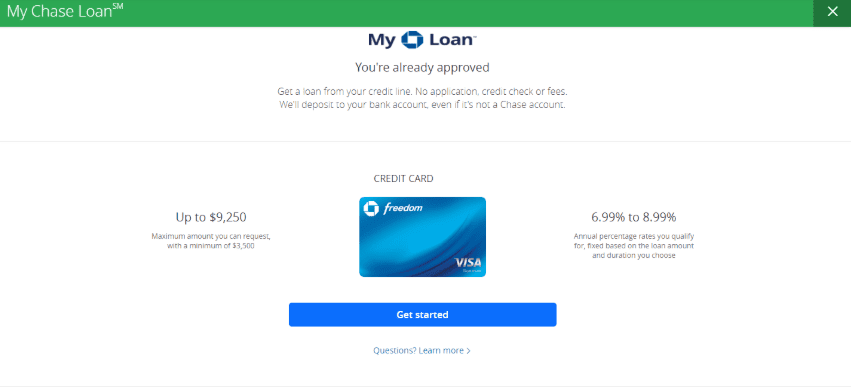

Before applying for a Chase Auto Loan, it’s essential to understand your credit score and how it affects your loan eligibility. Your credit score is a three-digit number that represents your creditworthiness, and it’s used by lenders to determine the interest rate you’ll qualify for. A good credit score can help you qualify for lower interest rates, which can save you money in the long run. You can check your credit score for free on various websites, such as Credit Karma or Credit Sesame. If you have a poor credit score, you may want to consider improving it before applying for a loan.

Researching and Comparing Rates

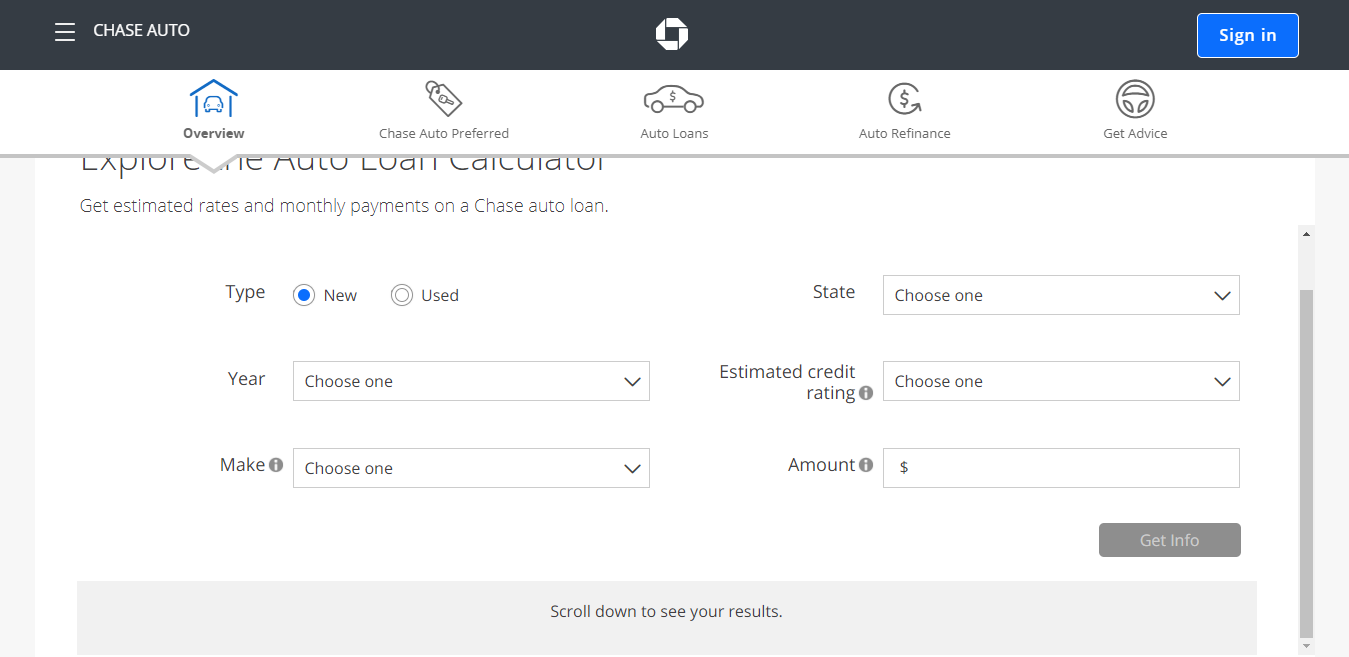

Once you have an idea of your credit score, it’s time to research and compare rates from different lenders. Chase Auto Loan offers competitive interest rates, but it’s still important to shop around and compare rates from other lenders. You can use online tools, such as Bankrate or NerdWallet, to compare rates and find the best deal. Additionally, you can also consider working with a local credit union or community bank, as they may offer more favorable terms.

Choosing the Right Loan Term

When applying for a Chase Auto Loan, you’ll need to choose a loan term that works best for you. Loan terms can range from 24 to 84 months, and the longer the term, the lower the monthly payment. However, a longer loan term also means you’ll pay more in interest over the life of the loan. It’s essential to consider your budget and choose a loan term that allows you to make affordable monthly payments. You can use a loan calculator to determine how much you’ll pay in interest over the life of the loan and choose the term that works best for you.

Considering Additional Costs

In addition to the loan amount, there are other costs associated with purchasing a vehicle. These costs include sales tax, registration fees, and insurance premiums. It’s essential to consider these costs when determining how much you can afford to spend on a vehicle. You can use a budgeting calculator to determine how much you can afford to spend on a vehicle and factor in these additional costs. Additionally, you may want to consider purchasing a vehicle warranty or maintenance package to protect your investment.

Reading the Fine Print

Before signing a loan agreement, it’s essential to read the fine print and understand the terms of the loan. The loan agreement will outline the interest rate, loan term, and monthly payment amount. It will also outline any fees associated with the loan, such as late payment fees or prepayment penalties. It’s essential to carefully review the loan agreement and ask questions if you’re unsure about any of the terms. You can also consider working with a financial advisor or attorney to review the loan agreement and ensure you’re getting a fair deal.

💡 Note: Make sure to review the loan agreement carefully and ask questions if you're unsure about any of the terms.

In summary, obtaining a Chase Auto Loan requires careful planning and consideration. By understanding your credit score, researching and comparing rates, choosing the right loan term, considering additional costs, and reading the fine print, you can make the most out of your loan and drive away in your new vehicle with confidence.

What is the minimum credit score required for a Chase Auto Loan?

+

The minimum credit score required for a Chase Auto Loan varies depending on the loan amount and term. However, a good credit score is typically considered to be 700 or higher.

Can I apply for a Chase Auto Loan online?

+

Yes, you can apply for a Chase Auto Loan online through the Chase website or mobile app. You can also apply in person at a Chase branch or over the phone.

What is the maximum loan amount for a Chase Auto Loan?

+

The maximum loan amount for a Chase Auto Loan varies depending on the vehicle’s purchase price and your creditworthiness. However, Chase typically offers loans up to $100,000 or more for qualified borrowers.