1031 Exchange PaperworkRetention Period

Understanding the Importance of 1031 Exchange Paperwork Retention Period

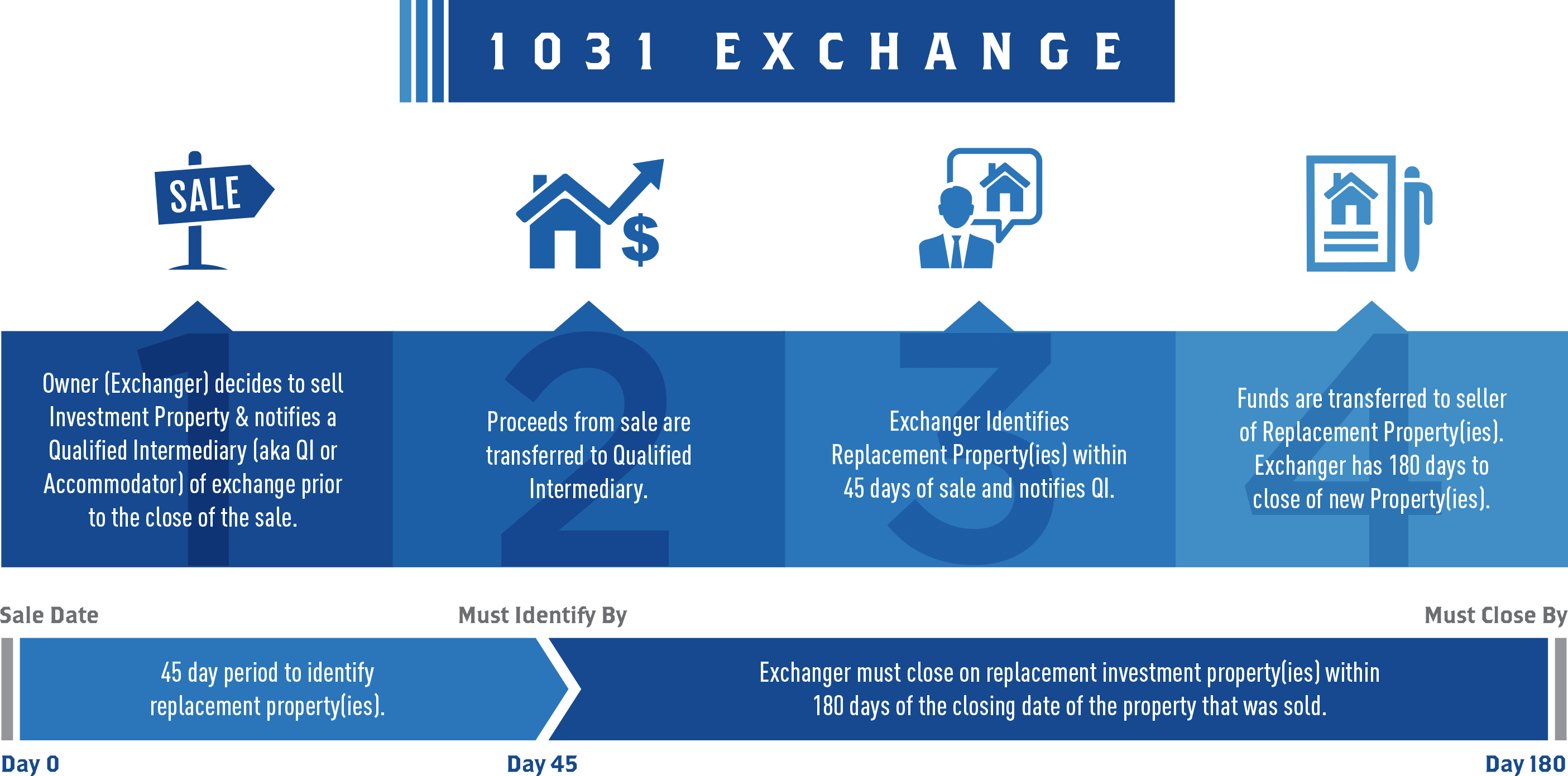

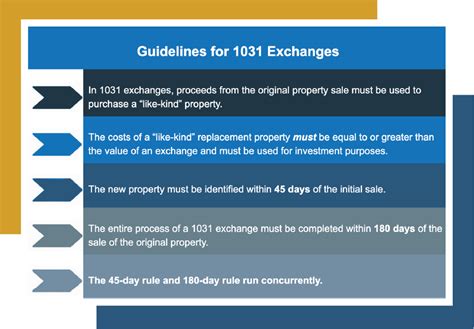

When it comes to 1031 exchanges, also known as like-kind exchanges, the process involves more than just swapping one investment property for another. It requires meticulous planning, execution, and documentation to ensure that the exchange qualifies for tax deferment under Section 1031 of the Internal Revenue Code. A crucial aspect of this process is the retention of paperwork related to the exchange. The retention period for 1031 exchange documents is vital for maintaining compliance with IRS regulations and for potential audits.

What Documents Should Be Retained?

The list of documents that need to be retained is extensive and includes, but is not limited to:

- Exchange Agreement: The document that outlines the terms of the exchange between the parties involved.

- Identification Letter: A letter used to identify the replacement property within the 45-day identification period.

- Assignment of Contract: Assigns the contract for the sale of the relinquished property to the Qualified Intermediary (QI).

- Notice of Assignment: Notifies the buyer of the relinquished property of the assignment.

- Qualification Certificate: Provided by the QI, certifying that the exchange is qualified under Section 1031.

- Accounting Records: Detailed financial records of the exchange, including receipts, invoices, and bank statements.

Retention Period Guidelines

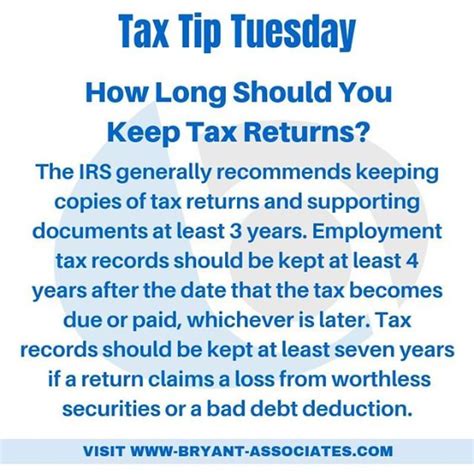

The IRS recommends retaining all documents related to a 1031 exchange for at least three years after the due date of the tax return that reports the exchange. However, considering the complexity and potential for audit, it’s advisable to retain these documents for a longer period, often up to six years or more, depending on individual circumstances. The retention period starts from the date the exchange is completed, which is typically when the replacement property is acquired.

Best Practices for Document Retention

To ensure compliance and ease of access in case of an audit, consider the following best practices:

- Digital Storage: Store documents electronically in a secure, accessible format.

- Physical Storage: Keep physical copies of critical documents in a safe, secure location.

- Organization: Organize documents in a logical, easily searchable manner.

- Backup: Regularly backup electronic documents to prevent loss.

Consequences of Inadequate Document Retention

Failure to properly retain 1031 exchange documents can lead to severe consequences, including:

- Disqualification of the Exchange: If documents cannot be produced to support the exchange, the IRS may disqualify it, leading to immediate tax liability.

- Audit Penalties: Inability to provide required documentation during an audit can result in penalties and fines.

- Litigation Risks: Inadequate documentation can complicate legal disputes related to the exchange.

📝 Note: It's essential to consult with a tax professional or attorney specializing in 1031 exchanges to ensure all specific documentation needs are met and that the retention period aligns with current IRS guidelines and individual circumstances.

Technological Advancements in Document Retention

With advancements in technology, document retention has become more efficient and secure. Cloud storage and specialized software for managing exchange documents offer enhanced security, accessibility, and compliance features. These solutions can automatically organize documents, provide secure access, and send reminders for critical deadlines, reducing the risk of non-compliance.

Conclusion and Future Considerations

In conclusion, the retention period for 1031 exchange paperwork is a critical component of ensuring tax compliance and avoiding potential penalties. As regulations evolve and technology advances, it’s essential for individuals and businesses involved in like-kind exchanges to stay informed and adapt their document retention strategies accordingly. By understanding the importance of document retention and implementing best practices, parties can navigate the complex process of 1031 exchanges with confidence.

What is the primary purpose of retaining 1031 exchange documents?

+

The primary purpose is to maintain compliance with IRS regulations and to provide evidence in case of an audit, ensuring the exchange qualifies for tax deferment.

How long should 1031 exchange documents be retained?

+

It is recommended to retain these documents for at least three years after the due date of the tax return that reports the exchange, but considering potential audits, a longer retention period of up to six years or more is advisable.

What are the consequences of failing to retain 1031 exchange documents properly?

+

Failure to properly retain documents can lead to the disqualification of the exchange, audit penalties, and increased litigation risks.