5 Bankruptcy Paper Tips

Understanding Bankruptcy Papers: A Comprehensive Guide

When dealing with bankruptcy, whether personally or as a business, the paperwork involved can be overwhelming. Bankruptcy papers are legal documents that must be filed with the court to initiate the bankruptcy process. These documents provide detailed financial information about the individual or business, including assets, liabilities, income, and expenses. The accuracy and completeness of these papers are crucial for a successful bankruptcy filing. In this article, we will delve into the world of bankruptcy papers, exploring their importance, the types of bankruptcy, and tips for preparing these documents.

Types of Bankruptcy

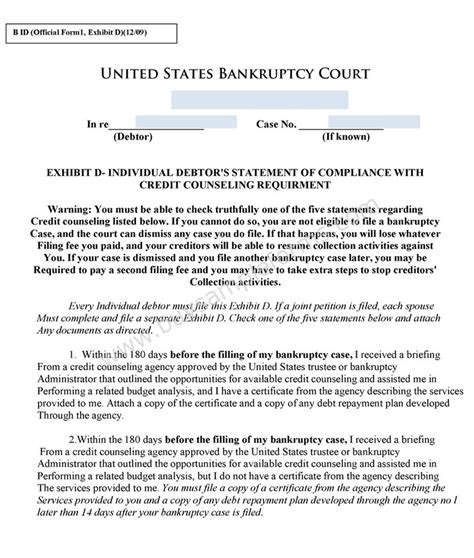

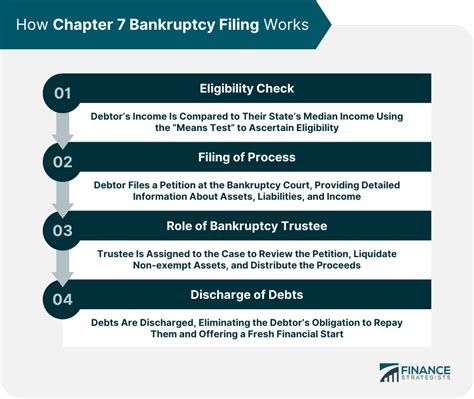

Before diving into the tips for preparing bankruptcy papers, it’s essential to understand the different types of bankruptcy. The most common types for individuals are Chapter 7 and Chapter 13, while businesses often file under Chapter 11. - Chapter 7 Bankruptcy: This type of bankruptcy involves the liquidation of non-exempt assets to pay off creditors. It’s often referred to as “straight bankruptcy.” - Chapter 13 Bankruptcy: Designed for individuals with a regular income, Chapter 13 allows debtors to keep their property and pay part or all of their debts over time through a repayment plan. - Chapter 11 Bankruptcy: Typically used by businesses, Chapter 11 bankruptcy allows companies to restructure their debts and continue operating.

Preparing Bankruptcy Papers: 5 Essential Tips

Preparing bankruptcy papers requires meticulous attention to detail and a thorough understanding of the bankruptcy process. Here are five tips to help you navigate this complex task:

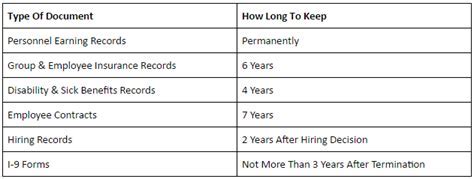

Gather All Financial Documents: The first step in preparing bankruptcy papers is to gather all relevant financial documents. This includes bank statements, tax returns, wage stubs, credit card statements, loans, and any other documents related to your income, expenses, assets, and debts. Having all these documents in order will make the process of filling out the bankruptcy forms much easier.

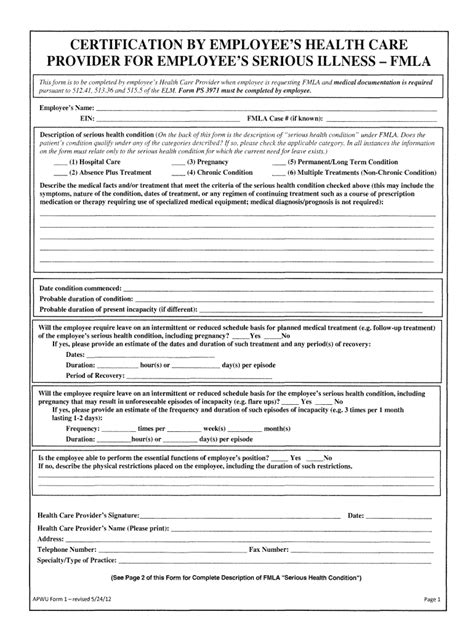

Understand the Bankruptcy Forms: The bankruptcy court provides official forms that must be used for filing. These forms are detailed and require specific information about your financial situation. It’s crucial to understand what each form requires to ensure you fill them out correctly. The most common forms include the Voluntary Petition, Statement of Financial Affairs, and Schedules of Assets and Liabilities.

List All Creditors: One of the critical aspects of bankruptcy papers is the list of creditors. You must provide detailed information about each creditor, including their name, address, and the amount you owe. This is essential for the bankruptcy process, as it ensures all creditors are notified and given the opportunity to participate in the bankruptcy proceedings.

Be Honest and Accurate: Honesty and accuracy are paramount when filling out bankruptcy papers. Concealing assets or providing false information can lead to serious consequences, including the dismissal of your bankruptcy case or even criminal charges. It’s essential to disclose all assets, liabilities, and financial transactions honestly.

Consider Hiring a Bankruptcy Attorney: While it’s possible to file for bankruptcy without an attorney, hiring a professional can significantly simplify the process and reduce the risk of errors. A bankruptcy attorney can guide you through the complex legal requirements, ensure your papers are filled out correctly, and represent you in court.

Importance of Accuracy

The accuracy of bankruptcy papers cannot be overstated. Inaccurate or incomplete filings can lead to delays, additional costs, or even the dismissal of the bankruptcy case. It’s essential to take the time to review your papers carefully before submitting them to the court.

📝 Note: Always keep a copy of your bankruptcy papers for your records, as you may need to refer to them during the bankruptcy process or in the future.

Conclusion Summary

In summary, preparing bankruptcy papers is a critical step in the bankruptcy process. It requires a thorough understanding of the different types of bankruptcy, meticulous attention to detail, and honesty in disclosing financial information. By following the tips outlined above and considering the assistance of a bankruptcy attorney, individuals and businesses can navigate the complex world of bankruptcy papers with greater ease and confidence. Remember, the goal of bankruptcy is to provide a fresh start, and accurate, well-prepared papers are the first step towards achieving this goal.

What is the main purpose of filing bankruptcy papers?

+

The main purpose of filing bankruptcy papers is to initiate the bankruptcy process, which provides individuals and businesses with a legal way to eliminate or repay debts under the protection of the bankruptcy court.

Can I file for bankruptcy without an attorney?

+

Yes, it is possible to file for bankruptcy without an attorney, which is known as filing “pro se.” However, given the complexity of the process, hiring a bankruptcy attorney is often recommended to ensure that all paperwork is filled out correctly and to represent you in court.

What happens to my assets in a Chapter 7 bankruptcy?

+

In a Chapter 7 bankruptcy, a trustee is appointed to oversee the liquidation of non-exempt assets to pay off creditors. However, many assets are exempt from liquidation, such as primary residences, vehicles, and personal belongings, depending on the state’s exemption laws.