7 Tips Keep Investment Papers

Introduction to Investment Paper Organization

Investing in the stock market or other financial instruments can be a great way to grow your wealth over time. However, it comes with its own set of challenges, one of which is keeping track of your investment papers. These papers can include stock certificates, bond certificates, mutual fund statements, and other documents related to your investments. Keeping these papers organized is crucial for several reasons, including tax purposes, audits, and estates planning. In this article, we will discuss 7 tips to help you keep your investment papers in order.

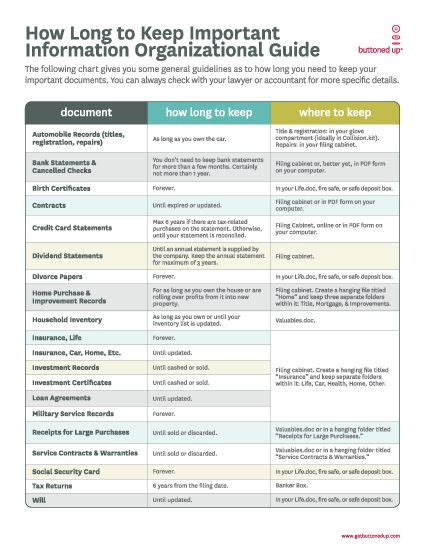

Tip 1: Designate a Specific Storage Area

The first step in organizing your investment papers is to designate a specific area for storing them. This could be a file cabinet in your home office or a safe deposit box at your bank. The key is to choose a location that is secure, easily accessible, and protected from natural disasters. Once you have chosen a location, make sure to inform a trusted family member or friend about it, in case you are unable to access it yourself.

Tip 2: Use a Filing System

A filing system is essential for keeping your investment papers organized. You can use file folders or accordian files to categorize your documents. For example, you can have separate folders for stock certificates, bond certificates, and mutual fund statements. Within each folder, you can further categorize your documents by date or investment type. This will make it easy to find a specific document when you need it.

Tip 3: Go Digital

In today’s digital age, there is no need to keep physical copies of all your investment papers. Many brokerages and financial institutions offer online access to your account statements and other documents. You can also scan your physical documents and store them electronically. This will not only save space but also reduce the risk of losing your documents. Just make sure to password protect your electronic files and back them up regularly.

Tip 4: Keep a Inventory

Keeping an inventory of your investment papers can help you keep track of what you have and what you need to update. You can create a spreadsheet or use a note-taking app to list all your investment documents, including the type of investment, date of purchase, and current value. This will make it easy to identify any missing documents and take action to replace them.

Tip 5: Review and Update Regularly

Your investment papers are not static documents. They need to be reviewed and updated regularly to reflect changes in your investments. For example, if you sell a stock, you will need to update your records to reflect the sale. Similarly, if you receive a dividend or interest payment, you will need to update your records to reflect the income. Regular reviews will also help you identify any errors or discrepancies in your records.

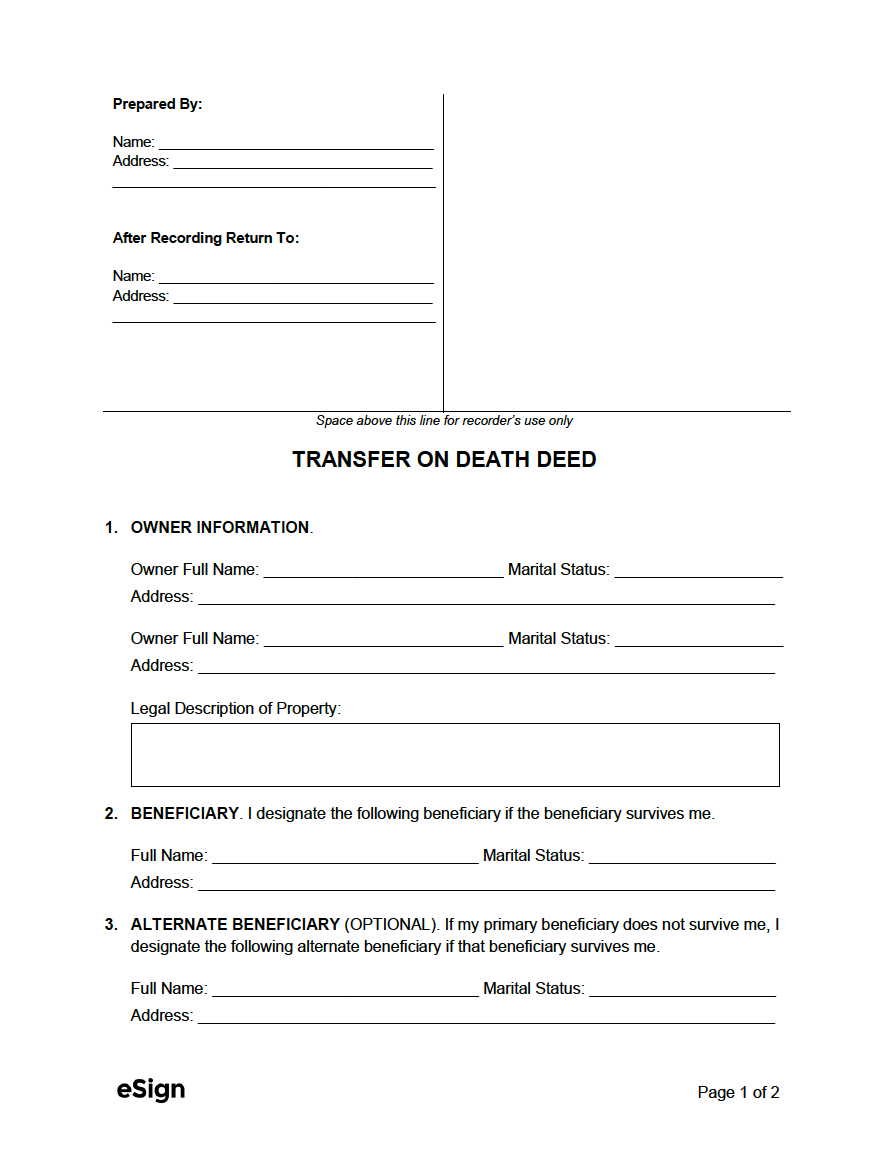

Tip 6: Consider a Safe Deposit Box

A safe deposit box is a secure location where you can store your valuable documents, including your investment papers. Safe deposit boxes are typically located at banks and are protected by alarms and video cameras. They are also fireproof and waterproof, which means your documents will be protected in case of a natural disaster. If you have a large number of investment papers or valuable documents, a safe deposit box may be a good option for you.

Tip 7: Shred Unnecessary Documents

Finally, it’s essential to shred unnecessary documents to protect yourself from identity theft and financial fraud. If you have documents that are no longer needed, such as old bank statements or cancelled checks, shred them immediately. You can also consider shredding services that will come to your home or office to shred your documents. This will give you peace of mind and help you stay organized.

📝 Note: Always keep your investment papers in a secure location, such as a safe or a locked cabinet, to protect them from theft or damage.

In summary, keeping your investment papers organized is crucial for several reasons, including tax purposes, audits, and estate planning. By following these 7 tips, you can keep your investment papers in order and ensure that you have access to the information you need when you need it. Remember to designate a specific storage area, use a filing system, go digital, keep an inventory, review and update regularly, consider a safe deposit box, and shred unnecessary documents.

What is the best way to store investment papers?

+

The best way to store investment papers is in a secure location, such as a safe or a locked cabinet, or in a safe deposit box at a bank.

How often should I review my investment papers?

+

You should review your investment papers regularly, at least once a year, to ensure that they are up to date and accurate.

What should I do with unnecessary investment papers?

+

You should shred unnecessary investment papers to protect yourself from identity theft and financial fraud.