7 Tips Loan Papers

Understanding the Importance of Loan Papers

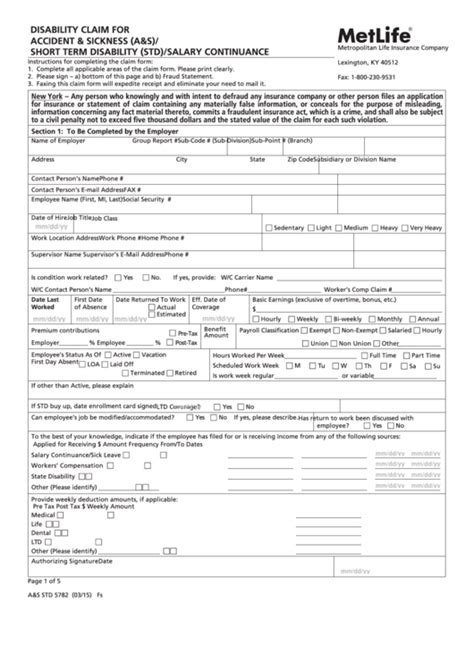

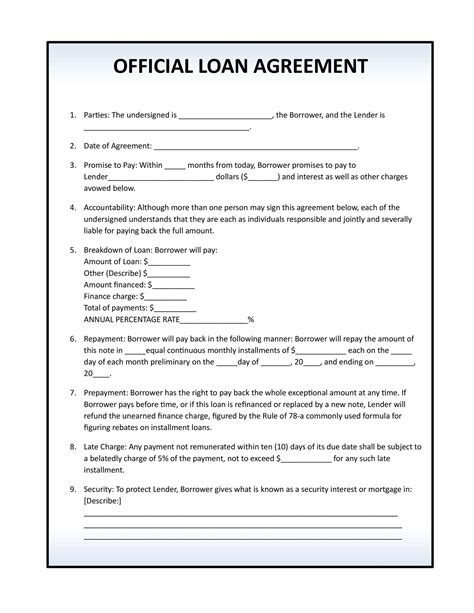

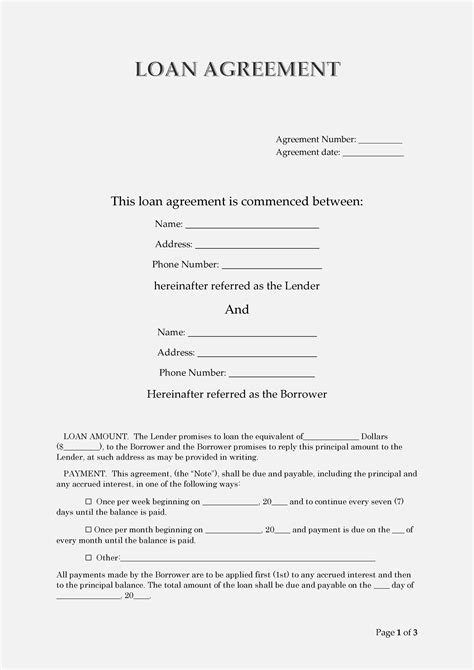

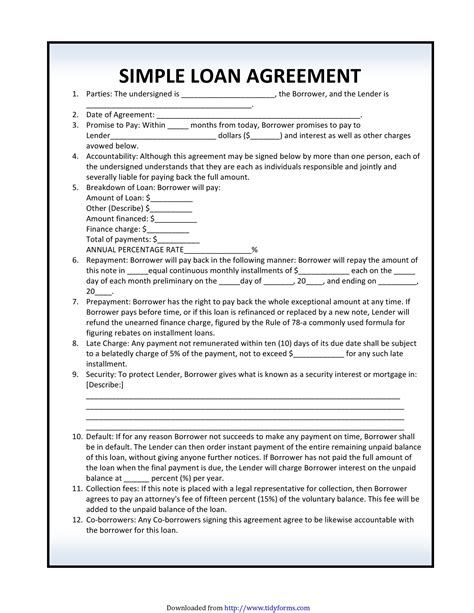

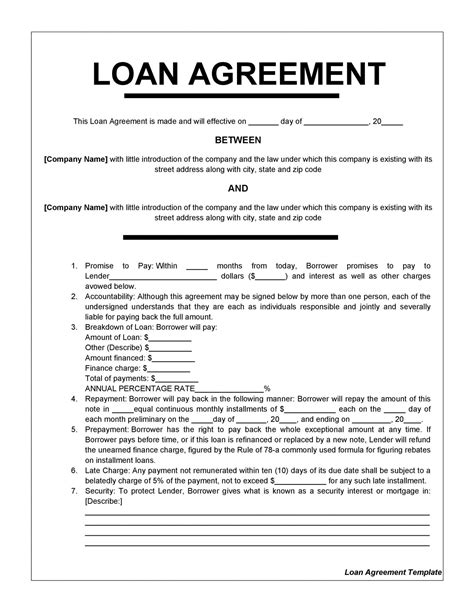

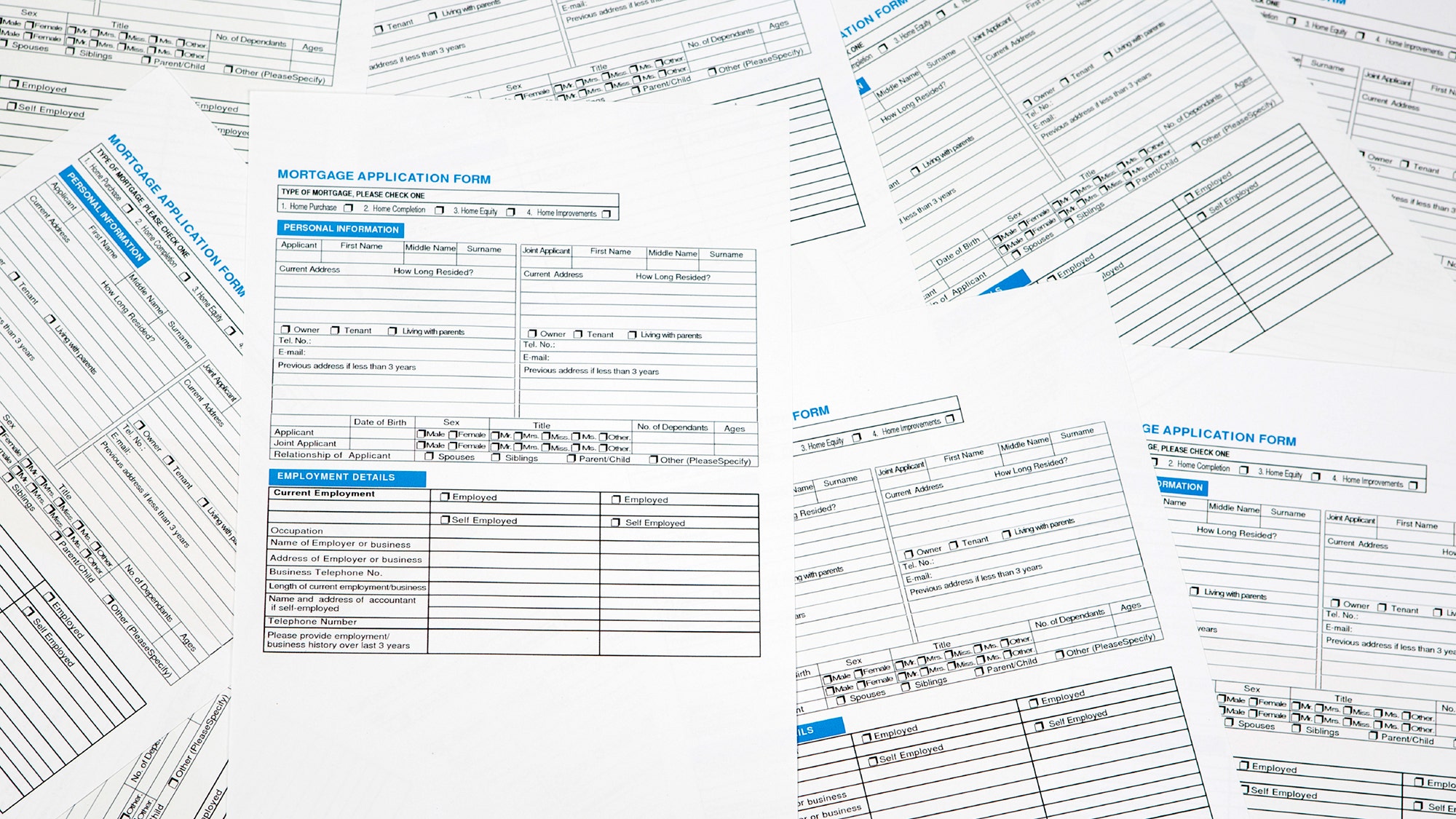

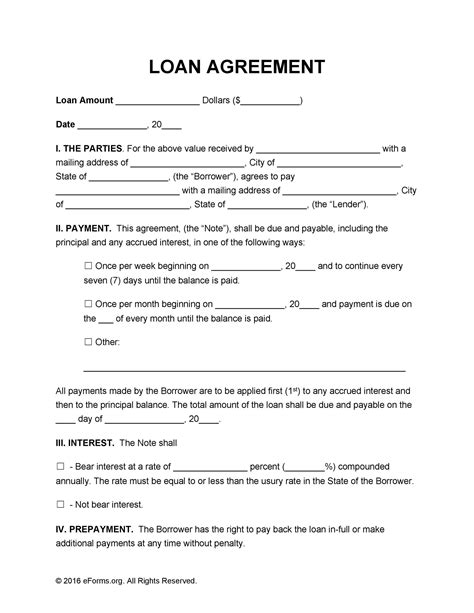

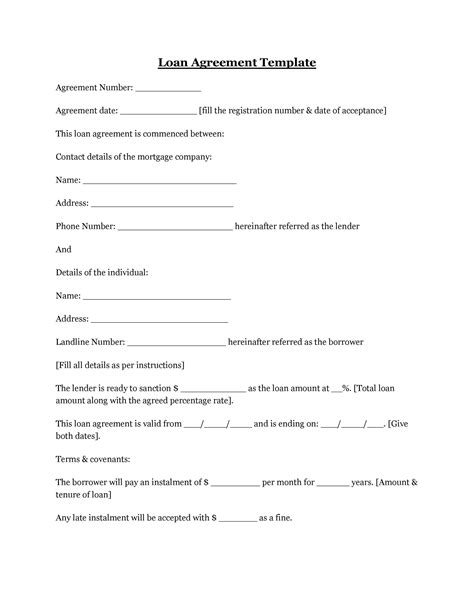

When it comes to borrowing money, whether it’s for a mortgage, a car, or a personal loan, loan papers play a crucial role in the process. These documents outline the terms and conditions of the loan, including the interest rate, repayment schedule, and any penalties for late payments. It’s essential to carefully review and understand the loan papers before signing, as they can have a significant impact on your financial situation. In this article, we’ll explore 7 tips for navigating loan papers and making informed decisions about your borrowing.

Tips for Reviewing Loan Papers

Here are 7 tips to help you review and understand your loan papers: * Read carefully: Take the time to read through the loan papers thoroughly, and don’t be afraid to ask questions if you’re unsure about something. * Understand the interest rate: Make sure you understand the interest rate and how it will be calculated. This can include the annual percentage rate (APR), the monthly payment amount, and any fees associated with the loan. * Check the repayment schedule: Review the repayment schedule to ensure you understand how much you’ll be paying each month and for how long. * Look for penalties: Check for any penalties for late payments or early repayment. These can add up quickly, so it’s essential to understand the terms. * Review the fees: In addition to the interest rate, review any fees associated with the loan, such as origination fees, closing costs, or prepayment penalties. * Understand the collateral: If the loan requires collateral, such as a car or a house, make sure you understand the terms and conditions of the collateral. * Get everything in writing: Finally, make sure all the terms and conditions of the loan are outlined in the loan papers. This can help prevent misunderstandings or disputes down the line.

Key Components of Loan Papers

Loan papers typically include several key components, including:

| Component | Description |

|---|---|

| Loan amount | The total amount borrowed |

| Interest rate | The annual percentage rate (APR) of the loan |

| Repayment schedule | The schedule for repaying the loan, including the monthly payment amount and the number of payments |

| Fees | Any fees associated with the loan, such as origination fees or closing costs |

| Collateral | Any collateral required for the loan, such as a car or a house |

📝 Note: It's essential to carefully review the loan papers and ask questions if you're unsure about any of the terms or conditions.

Making Informed Decisions

By following these 7 tips and carefully reviewing your loan papers, you can make informed decisions about your borrowing and avoid potential pitfalls. Remember to read carefully, understand the interest rate, and check the repayment schedule to ensure you’re making the best decision for your financial situation.

In summary, loan papers are a critical component of the borrowing process, and it’s essential to understand the terms and conditions outlined in these documents. By following these 7 tips and carefully reviewing your loan papers, you can make informed decisions about your borrowing and avoid potential pitfalls. Whether you’re borrowing for a mortgage, a car, or a personal loan, taking the time to review and understand your loan papers can help you achieve your financial goals and avoid costly mistakes.

What is the importance of loan papers in the borrowing process?

+

Loan papers play a crucial role in the borrowing process, as they outline the terms and conditions of the loan, including the interest rate, repayment schedule, and any penalties for late payments.

How can I ensure I understand the loan papers before signing?

+

To ensure you understand the loan papers, take the time to read through them carefully, and don’t be afraid to ask questions if you’re unsure about something. You can also consider seeking the advice of a financial advisor or attorney.

What are some common mistakes to avoid when reviewing loan papers?

+

Some common mistakes to avoid when reviewing loan papers include not reading the documents carefully, not understanding the interest rate or repayment schedule, and not reviewing the fees associated with the loan. By avoiding these mistakes, you can make informed decisions about your borrowing and avoid potential pitfalls.