Keep Old Paperwork How Long

Understanding the Importance of Retaining Old Paperwork

When it comes to managing paperwork, one of the most common dilemmas individuals and businesses face is deciding how long to keep old documents. The duration for retaining paperwork varies greatly depending on the type of document, its significance, and the potential need for future reference. Proper retention of documents is crucial for tax purposes, legal requirements, and personal or business record-keeping.

In this complex landscape, it’s essential to understand the guidelines for different types of paperwork to ensure compliance with legal and financial regulations. Failure to retain necessary documents can lead to missed tax deductions, legal issues, or the inability to support claims when needed.

Categories of Paperwork and Their Retention Periods

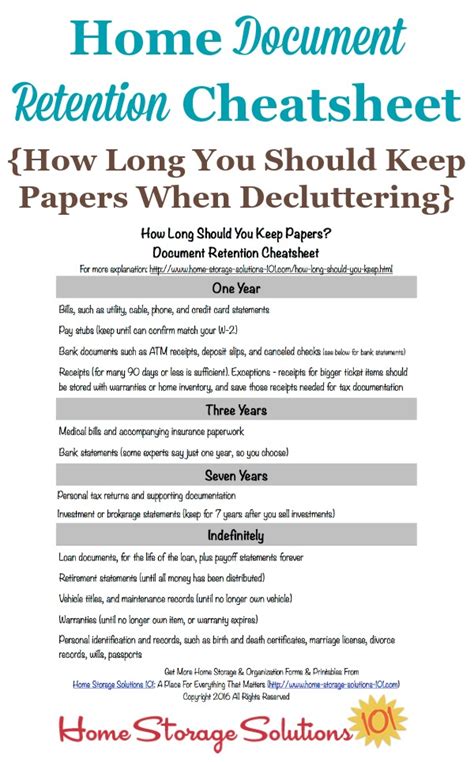

Paperwork can be broadly categorized into personal, financial, tax-related, and business documents. Each category has its recommended retention period, which can be influenced by local laws and personal circumstances.

- Personal Documents: These include identification documents, birth and marriage certificates, divorce and death certificates, and wills. Due to their significance and the potential need for future reference, it’s advisable to keep these documents permanently.

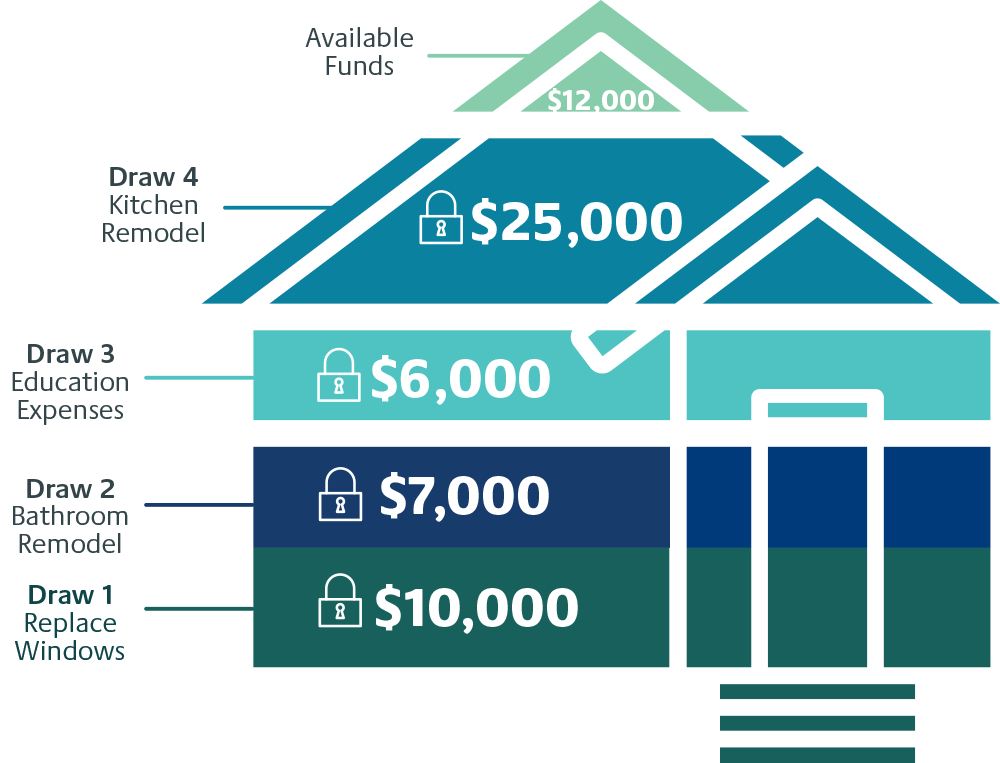

- Financial Documents: This category encompasses bank statements, investment records, and loan documents. The retention period can vary:

- Bank Statements and Canceled Checks: Keep for at least one year, or until the transaction is no longer relevant for tax purposes or potential disputes.

- Investment Records: Retain until the investment is sold, plus the statute of limitations for the relevant tax year.

- Loan Documents: Keep until the loan is paid off, plus the statute of limitations for the relevant tax year.

- Tax-Related Documents: This includes tax returns, W-2 forms, 1099 forms, and any documentation supporting tax deductions or credits. The Internal Revenue Service (IRS) suggests keeping these documents for at least three years from the date the tax return was filed, which is generally the statute of limitations for an audit. However, if you might need to amend a return or if there’s a possibility of an audit, consider keeping them longer.

- Business Documents: For businesses, the retention period can vary based on the type of document and local regulations. Generally, it’s recommended to keep:

- Employment Records: For the duration of employment plus any additional time required by law.

- Financial Statements and Accounting Records: Permanently, as they are crucial for tax purposes and business decision-making.

- Contracts and Agreements: For the duration of the contract plus a reasonable period afterward.

Considerations for Digital Storage

With the advancement of technology, digital storage has become a viable option for retaining paperwork. This method offers the advantages of reduced physical storage needs, enhanced security, and easier access to documents. However, it’s crucial to ensure that digital documents are stored securely, with backup systems in place to prevent data loss.

When opting for digital storage, consider the following: - Security: Ensure that your digital storage method is secure, ideally using encryption and secure access controls. - Accessibility: Choose a format that is likely to remain accessible in the future, avoiding obsolete technologies. - Redundancy: Keep backups of your digital documents in separate locations to protect against data loss.

Organizing and Purging Paperwork

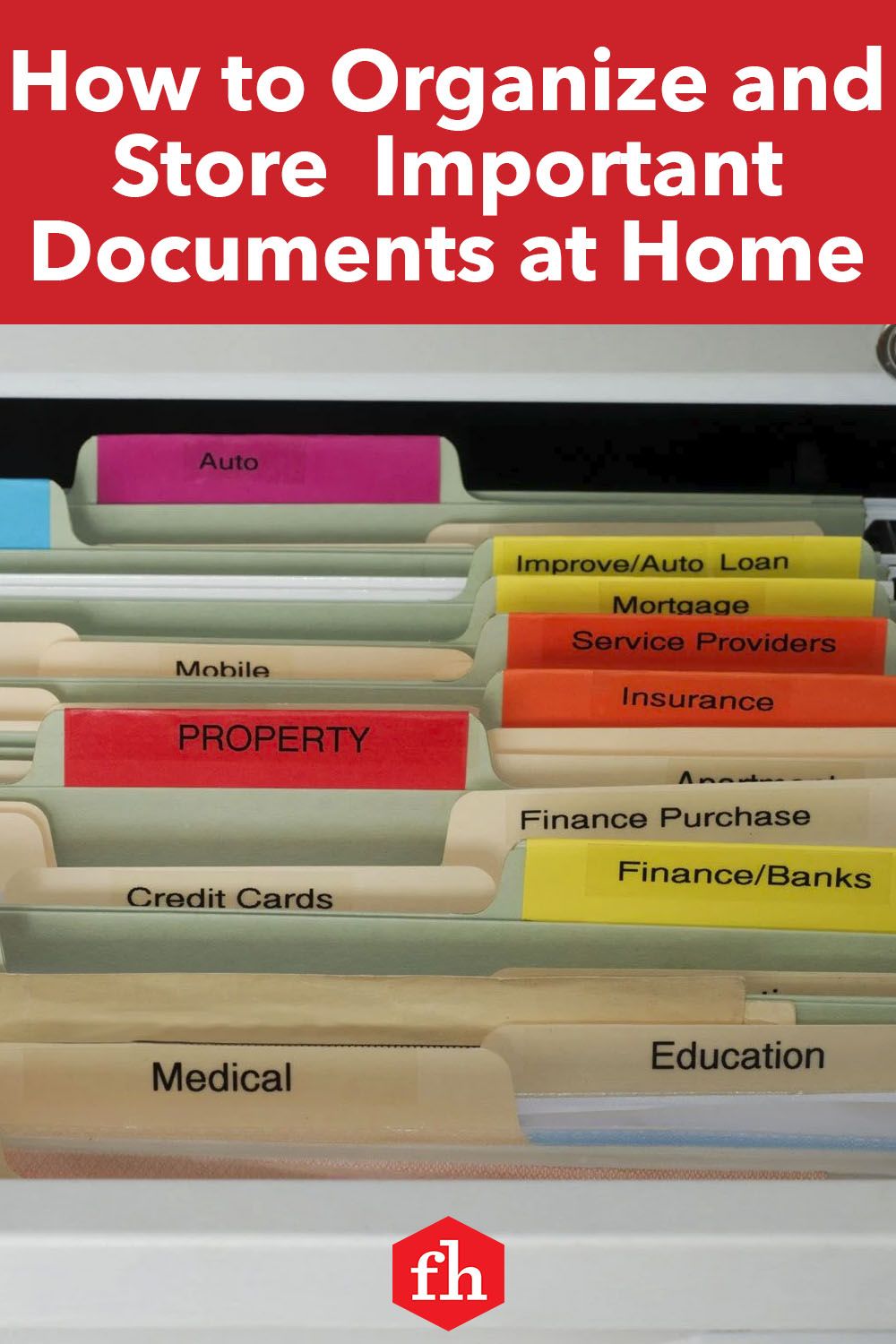

To manage paperwork effectively, it’s essential to have a system for organizing and periodically purging unnecessary documents. Here are some steps to consider: - Categorize Documents: Group similar documents together (e.g., tax returns, bank statements). - Review Regularly: Schedule regular reviews of your paperwork to identify documents that can be safely discarded. - Shred Unnecessary Documents: Use a shredder to dispose of sensitive documents that are no longer needed, to protect against identity theft.

Tools for Managing Paperwork

Several tools and strategies can aid in managing paperwork, including: - File Organizers: Physical or digital folders and labels can help keep documents categorized and easily accessible. - Scanners and Digital Storage Services: Tools like scanners and cloud storage services can facilitate the transition to digital storage. - Document Management Software: Programs designed to manage and organize digital documents can provide enhanced security and accessibility features.

| Document Type | Recommended Retention Period |

|---|---|

| Personal Documents | Permanently |

| Financial Documents | Varies (1 year to permanently) |

| Tax-Related Documents | At least 3 years |

| Business Documents | Varies (duration of employment or contract to permanently) |

📝 Note: The retention periods mentioned are general guidelines and may vary based on specific laws, regulations, or personal circumstances. It's always a good idea to consult with a legal or financial advisor for personalized advice.

In the end, the decision on how long to keep old paperwork should be based on a careful consideration of legal requirements, potential future needs, and personal or business circumstances. By understanding the different categories of paperwork and their recommended retention periods, individuals and businesses can ensure they are meeting their obligations while also maintaining a manageable and secure document management system. The key to effective paperwork management is finding a balance between retaining necessary documents and avoiding unnecessary clutter, all while ensuring the security and accessibility of important information.