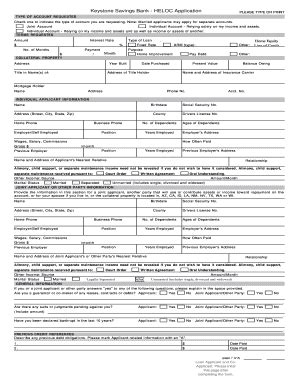

5 HELOC Papers Needed

Introduction to HELOC Papers

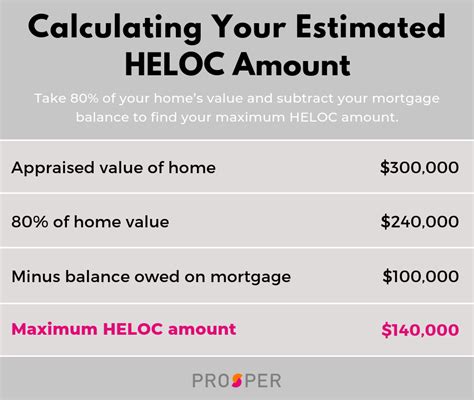

When considering a Home Equity Line of Credit (HELOC), it’s essential to understand the documentation required for the application process. A HELOC allows homeowners to borrow money using the equity in their property as collateral. To secure a HELOC, lenders need to assess the borrower’s creditworthiness and the value of the property. This process involves submitting various documents, which can be overwhelming for some applicants. In this article, we will delve into the necessary papers required for a HELOC application, ensuring a smooth and efficient process.

1. Identification Documents

The first set of documents needed for a HELOC application includes identification papers. These are crucial for verifying the borrower’s identity and ensuring they are who they claim to be. The typical identification documents required include:

- Driver’s license or state ID

- Passport

- Social Security card or number

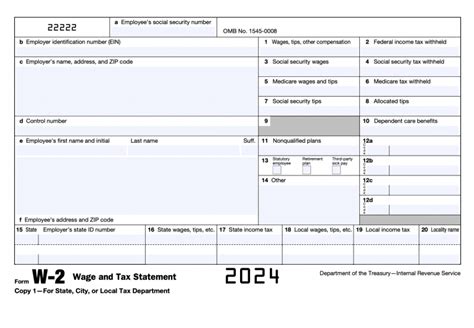

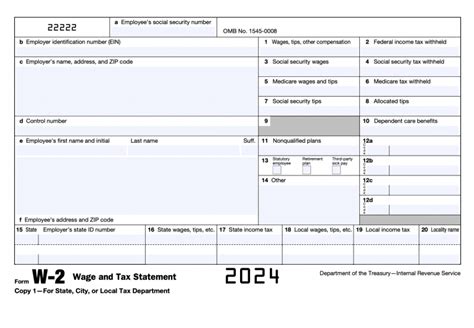

2. Income Verification

Lenders need to assess the borrower’s income to determine their ability to repay the loan. The necessary documents for income verification may include:

- Pay stubs from the past 30 days

- W-2 forms from the previous two years

- Tax returns from the previous two years

- Proof of any additional income, such as investments or retirement accounts

3. Employment Verification

In addition to income verification, lenders often require employment verification to ensure the borrower has a stable job and can maintain their income level. The necessary documents may include:

- Letter from the employer confirming employment status

- Business cards or other professional documents

4. Asset Documentation

To determine the borrower’s overall financial health, lenders need to review their assets. The required documents may include:

- Bank statements from the past 60 days

- Investment account statements

- Retirement account statements

- Proof of any other assets, such as real estate or vehicles

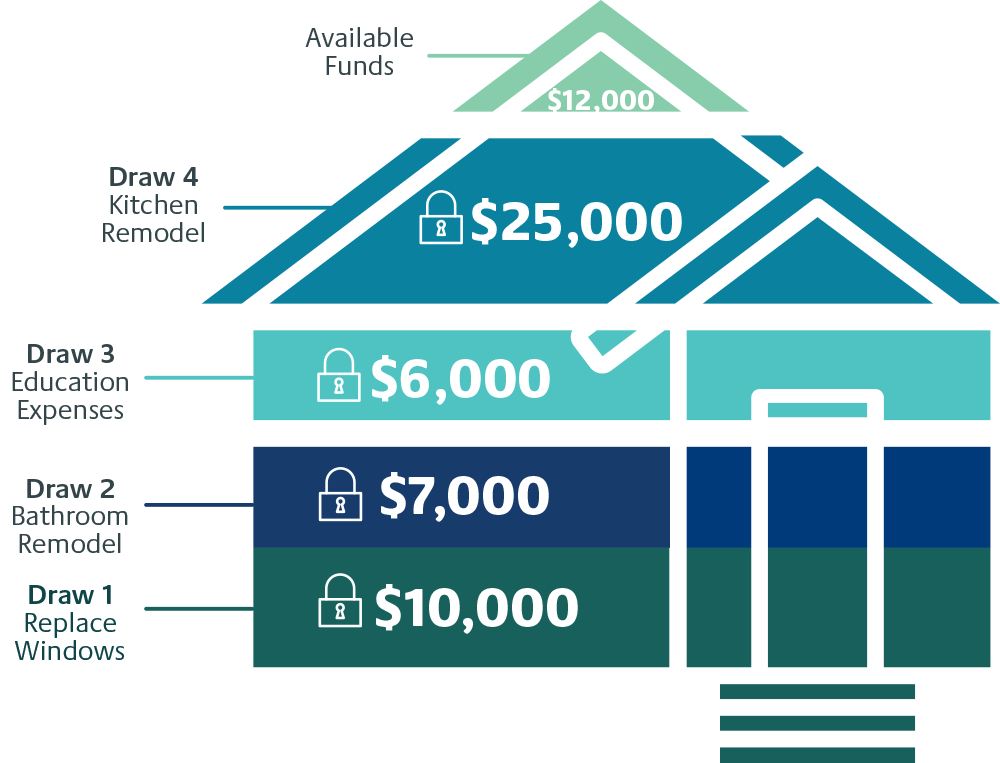

5. Property-Related Documents

Since a HELOC uses the borrower’s property as collateral, lenders require documents related to the property. These may include:

- Mortgage statements

- Property tax bills

- Homeowners insurance documents

- Appraisal or valuation reports (if required by the lender)

📝 Note: The specific documents required may vary depending on the lender and the borrower's individual circumstances. It's essential to check with the lender to confirm the necessary documents and ensure a smooth application process.

Additional Considerations

While the above documents are typically required for a HELOC application, lenders may request additional information or paperwork in certain situations. For example, self-employed borrowers may need to provide business financial statements or tax returns. Similarly, borrowers with complex income situations or multiple properties may need to provide extra documentation.

| Document Type | Description |

|---|---|

| Identification | Verifies the borrower's identity |

| Income Verification | Confirms the borrower's income and employment status |

| Employment Verification | Confirms the borrower's job security and potential for future income |

| Asset Documentation | Provides a comprehensive view of the borrower's financial situation |

| Property-Related Documents | Evaluates the property's value and ensures it can serve as collateral |

In summary, the HELOC application process involves submitting various documents to verify the borrower’s identity, income, employment, assets, and property value. By understanding the necessary paperwork and being prepared, borrowers can navigate the application process more efficiently and increase their chances of securing a HELOC.

To finalize the discussion on the necessary documents for a HELOC application, it’s crucial to reiterate the importance of verifying the specific requirements with the lender. This ensures that all necessary documents are submitted, and the application process proceeds without unnecessary delays. With the right documents in hand, borrowers can confidently apply for a HELOC and take the first step towards achieving their financial goals.

What is a HELOC, and how does it work?

+

A HELOC is a type of loan that allows homeowners to borrow money using the equity in their property as collateral. It works by providing a line of credit that can be used as needed, with the borrower repaying the loan with interest.

What are the benefits of a HELOC?

+

The benefits of a HELOC include access to a flexible line of credit, potentially lower interest rates compared to other loan options, and the ability to use the funds for various purposes, such as home improvements or debt consolidation.

How long does the HELOC application process typically take?

+

The HELOC application process can take anywhere from a few days to several weeks, depending on the lender and the complexity of the application. It’s essential to submit all required documents promptly to ensure a smooth and efficient process.