Add Additional Signor to IRS Filing

Understanding the Importance of Additional Signors on IRS Filings

When dealing with IRS filings, accuracy and completeness are key to avoiding any potential issues or delays. One crucial aspect of this process is ensuring that all required parties have signed the necessary documents. In certain situations, it may be necessary to add an additional signor to an IRS filing. This could be due to a variety of reasons such as a change in business structure, the addition of a new partner, or the requirement for spousal signature on joint returns.

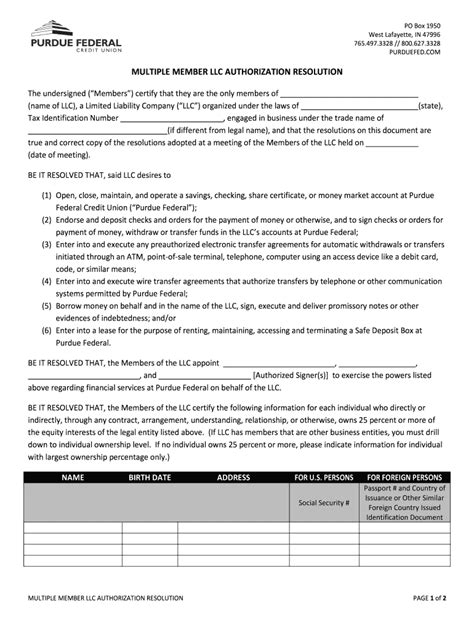

An additional signor refers to any individual who has the authority to sign tax returns on behalf of another person or entity. This could include business partners, spouses, or authorized representatives. The process of adding an additional signor involves several steps and requires careful attention to detail to ensure compliance with all relevant IRS regulations.

Steps to Add an Additional Signor

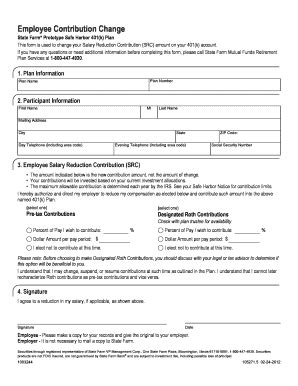

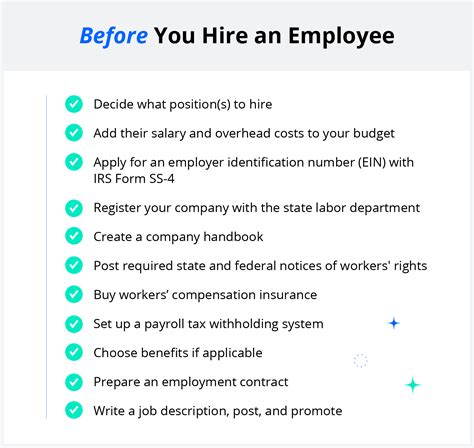

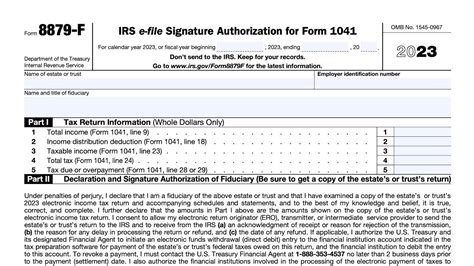

To add an additional signor to an IRS filing, the following steps should be followed: * Gather Required Information: Ensure you have all the necessary details about the additional signor, including their name, address, and tax identification number. * Obtain Required Forms: Depending on the type of filing, you may need to complete specific IRS forms. For example, Form 2848 is used for Power of Attorney, which allows an authorized representative to act on behalf of the taxpayer. * Fill Out Forms Correctly: It is crucial to fill out the forms accurately and completely. Any mistakes could lead to delays or rejection of the filing. * Submit the Forms: Once the forms are completed, they should be submitted to the IRS. This can often be done electronically, but in some cases, paper filing may be required.

📝 Note: Always ensure you have the latest versions of IRS forms and follow the current guidelines for submission, as these can change.

Types of Additional Signors

There are several types of additional signors that may be added to an IRS filing, including: - Spousal Signor: In the case of joint tax returns, both spouses must sign the return. If one spouse is unable to sign, there are procedures in place to allow for this, such as signing with a power of attorney. - Business Partners: For businesses that are partnerships, all partners may need to sign tax returns, depending on the partnership agreement and the nature of the filing. - Authorized Representatives: These are individuals or entities authorized to act on behalf of the taxpayer. They must have a power of attorney or another form of authorization.

| Type of Signor | Description |

|---|---|

| Spousal Signor | Required for joint tax returns. |

| Business Partners | May be required for partnership tax returns. |

| Authorized Representatives | Act on behalf of the taxpayer with proper authorization. |

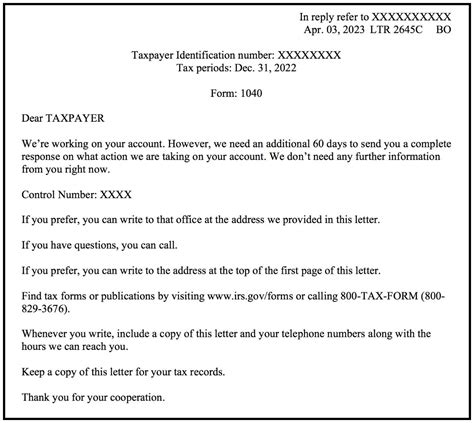

Importance of Accuracy and Timeliness

Accuracy and timeliness are crucial when adding an additional signor to an IRS filing. Any errors or delays can result in the IRS requesting additional information, which can lead to further delays and potentially even penalties. It is also important to keep records of all communications and submissions to the IRS, as these can be helpful in resolving any issues that may arise.

For individuals and businesses, understanding the process and requirements for adding an additional signor can help streamline tax filings and reduce the risk of complications. Seeking professional advice from a tax specialist or accountant can be beneficial, especially in complex situations or for those who are unfamiliar with the process.

In summary, adding an additional signor to an IRS filing is a process that requires careful attention to detail and adherence to IRS regulations. By understanding the steps involved, the types of additional signors, and the importance of accuracy and timeliness, individuals and businesses can navigate this process more effectively. Whether dealing with personal or business tax filings, ensuring all necessary signatures are in place is a critical component of compliance with tax laws and regulations.

What is the purpose of adding an additional signor to an IRS filing?

+

The purpose is to ensure that all parties with the authority to act on behalf of the taxpayer are recognized by the IRS, which is crucial for compliance and to avoid any potential issues with the filing.

Who can be considered an additional signor on an IRS filing?

+

An additional signor can include spouses on joint returns, business partners in partnerships, and authorized representatives who have been granted the power of attorney or another form of authorization to act on behalf of the taxpayer.

What are the consequences of not having all required signors on an IRS filing?

+

The consequences can include delays in processing the return, requests for additional information, and potentially even penalties. It is essential to ensure all required signatures are obtained to avoid these complications.