7 Tips Tax Papers

Introduction to Tax Paper Preparation

Preparing tax papers can be a daunting task, especially for those who are new to the process. With the numerous forms, deadlines, and regulations to keep track of, it’s easy to feel overwhelmed. However, with the right approach and understanding, tax paper preparation can be made simpler and less stressful. In this article, we will explore 7 tips to help you prepare your tax papers efficiently and effectively.

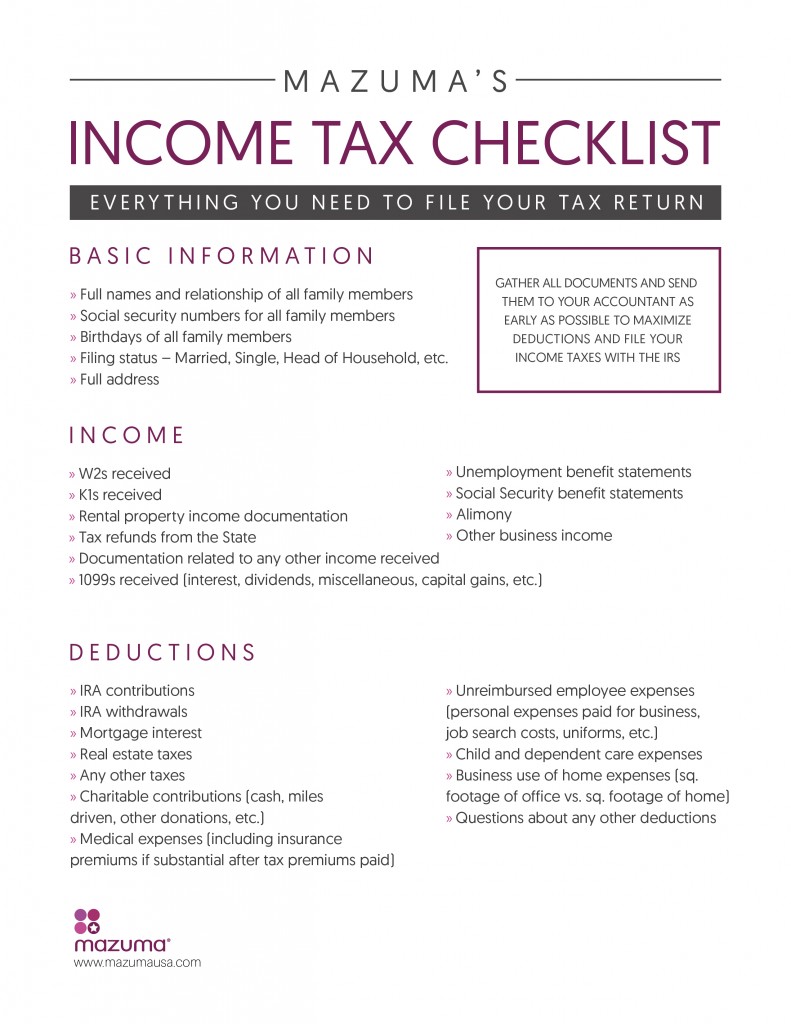

Tip 1: Gather All Necessary Documents

Before starting the tax preparation process, it’s essential to gather all the necessary documents. These may include:

- W-2 forms from your employer

- 1099 forms for freelance or contract work

- Interest statements from banks and investments

- Charitable donation receipts

- Medical expense receipts

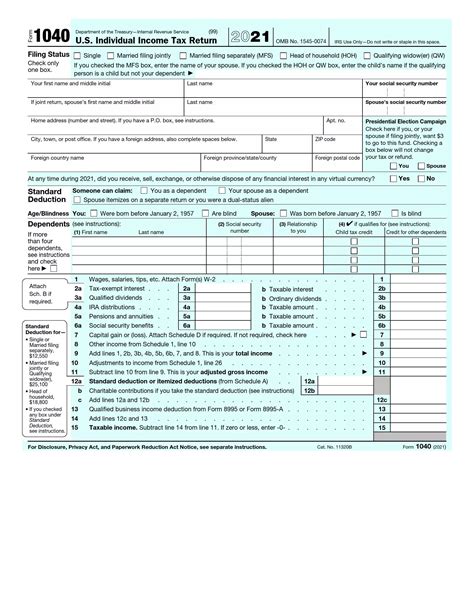

Tip 2: Choose the Right Filing Status

Your filing status can significantly impact your tax liability. The most common filing statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Tip 3: Take Advantage of Tax Deductions and Credits

Tax deductions and credits can help reduce your tax liability. Some common deductions include:

- Mortgage interest

- Charitable donations

- Medical expenses

- Business expenses

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

Tip 4: Consider Hiring a Tax Professional

While tax preparation software can be helpful, it may not be suitable for everyone, especially those with complex tax situations. Hiring a tax professional can provide peace of mind and ensure your tax papers are prepared accurately and efficiently. A tax professional can also help you:

- Identify potential deductions and credits

- Navigate complex tax laws and regulations

- Represent you in case of an audit

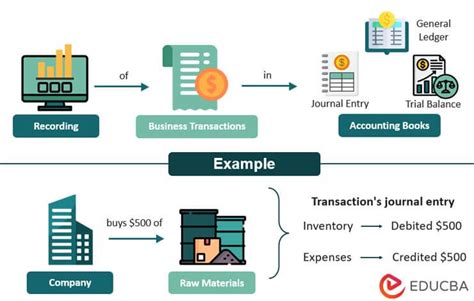

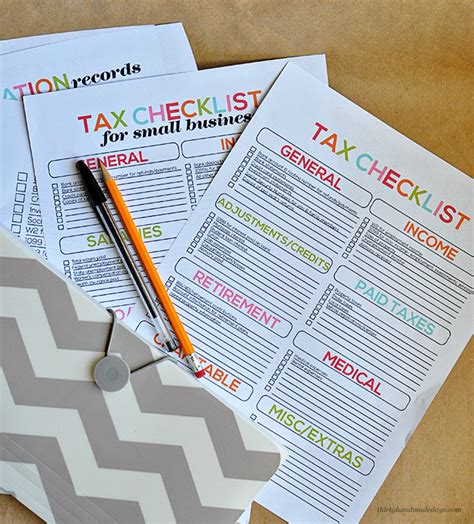

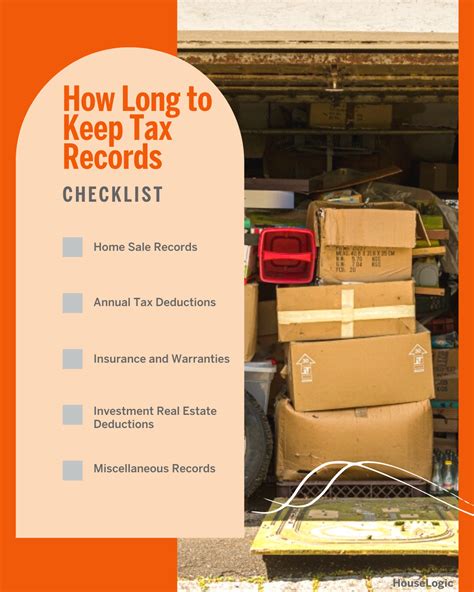

Tip 5: Stay Organized and Keep Records

Keeping accurate and detailed records is crucial for tax preparation. This includes:

- Income statements

- Expense receipts

- Bank statements

- Investment records

Tip 6: Be Aware of Tax Deadlines

Tax deadlines can vary depending on your location and filing status. It’s essential to be aware of the following deadlines:

- April 15th for individual tax returns

- March 15th for business tax returns

- October 15th for extended individual tax returns

Tip 7: Review and Double-Check Your Return

Before submitting your tax return, it’s essential to review and double-check your work. This includes:

- Verifying your personal and financial information

- Ensuring you’ve claimed all eligible deductions and credits

- Checking for any mathematical errors

📝 Note: It's essential to stay up-to-date with the latest tax laws and regulations to ensure you're taking advantage of all the deductions and credits available to you.

In summary, preparing tax papers requires attention to detail, organization, and a thorough understanding of tax laws and regulations. By following these 7 tips, you can ensure your tax papers are prepared efficiently and effectively, and you receive the maximum refund you’re eligible for. With the right approach and mindset, tax preparation can be made simpler and less stressful, allowing you to focus on your financial goals and well-being.

What is the deadline for filing individual tax returns?

+

The deadline for filing individual tax returns is typically April 15th.

What are some common tax deductions and credits?

+

Common tax deductions include mortgage interest, charitable donations, and medical expenses. Common tax credits include the Earned Income Tax Credit (EITC), Child Tax Credit, and education credits.

Why is it important to keep accurate and detailed records for tax preparation?

+

Keeping accurate and detailed records is essential for tax preparation as it helps you quickly locate the necessary documents, ensure you don’t miss any important deadlines, and provide proof of income and expenses in case of an audit.