Bankruptcy Paperwork Retention Period

Introduction to Bankruptcy Paperwork Retention

When dealing with bankruptcy, whether as an individual or a business, it’s crucial to understand the importance of retaining paperwork. Bankruptcy involves a complex process with numerous documents and records that play a vital role in the proceedings. One of the key aspects of managing bankruptcy effectively is knowing how long to keep these documents. The retention period for bankruptcy paperwork can vary depending on several factors, including the type of bankruptcy, the jurisdiction, and the specific documents in question. In this article, we will delve into the details of bankruptcy paperwork retention periods, exploring the reasons behind these requirements and providing guidance on how to manage these documents effectively.

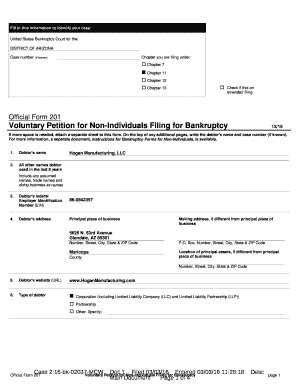

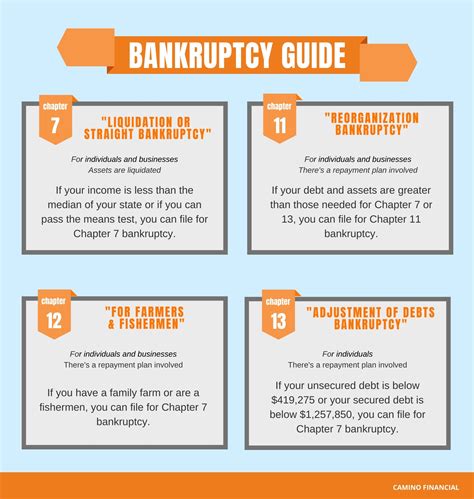

Types of Bankruptcy and Retention Periods

There are several types of bankruptcy, each with its own set of rules and regulations regarding document retention. The most common types of bankruptcy for individuals are Chapter 7 and Chapter 13, while businesses may file for Chapter 7 or Chapter 11. The retention periods for paperwork can differ significantly among these types.

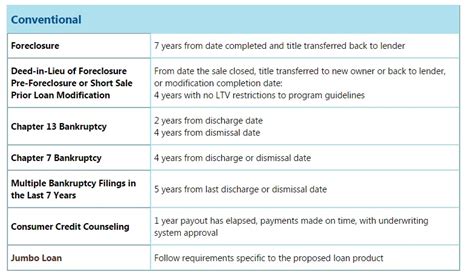

- Chapter 7 Bankruptcy: In a Chapter 7 bankruptcy, also known as liquidation bankruptcy, a trustee is appointed to liquidate the debtor’s assets to pay off creditors. The retention period for documents related to Chapter 7 bankruptcy can range from 3 to 7 years, depending on the specific documents and the tax implications involved.

- Chapter 13 Bankruptcy: Chapter 13 involves a repayment plan where the debtor makes regular payments to a trustee, who then distributes the funds to creditors. The retention period for Chapter 13 bankruptcy documents is typically longer, often recommended to be at least 7 years after the case is closed, due to the complexity of the repayment plans and potential tax implications.

- Chapter 11 Bankruptcy: This type of bankruptcy is usually filed by businesses and involves a reorganization plan. The retention period for Chapter 11 documents can be even longer, often 10 years or more, due to the complexity of the reorganization process and the need to maintain detailed financial records.

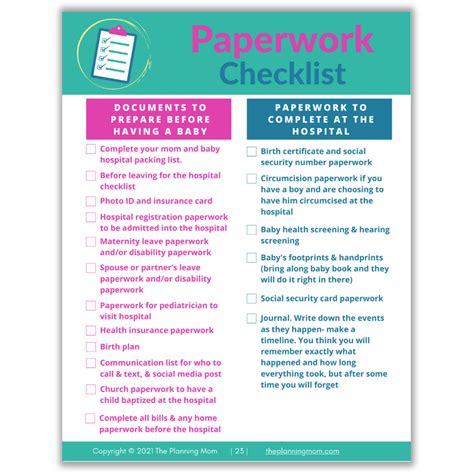

Important Documents to Retain

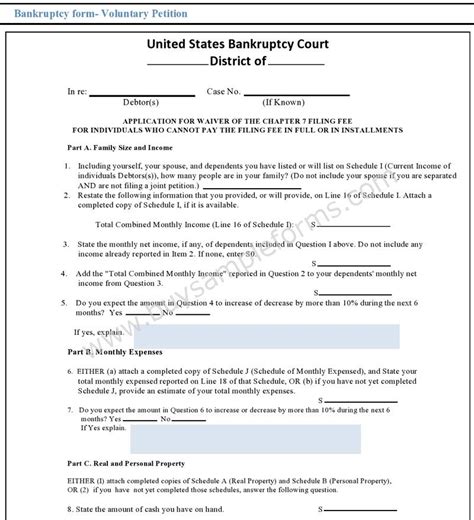

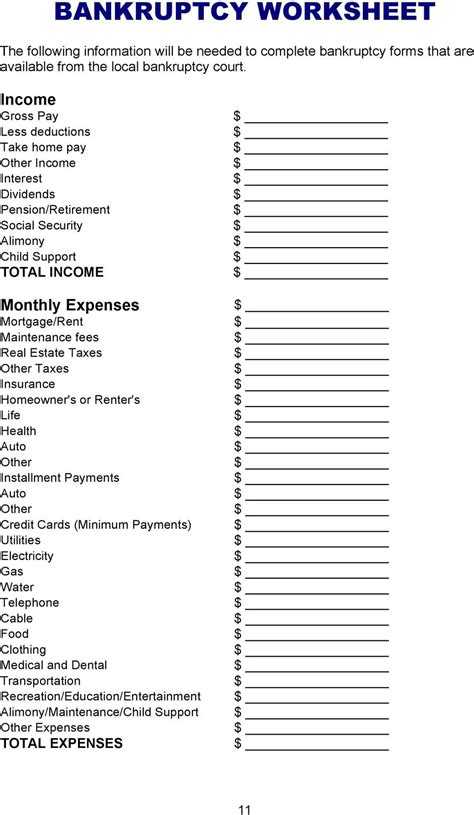

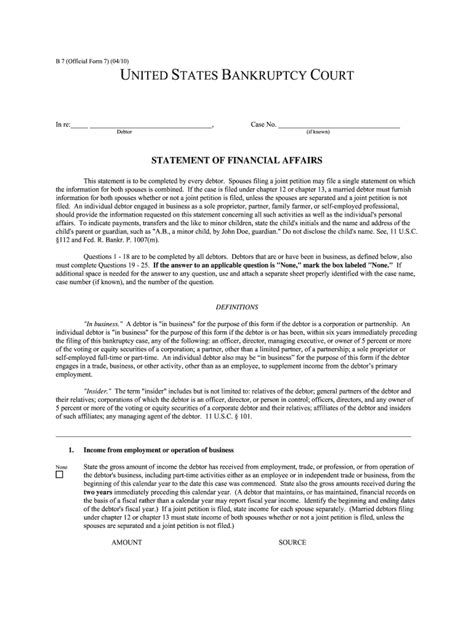

During bankruptcy proceedings, numerous documents are generated, each serving a critical purpose. Some of the most important documents to retain include:

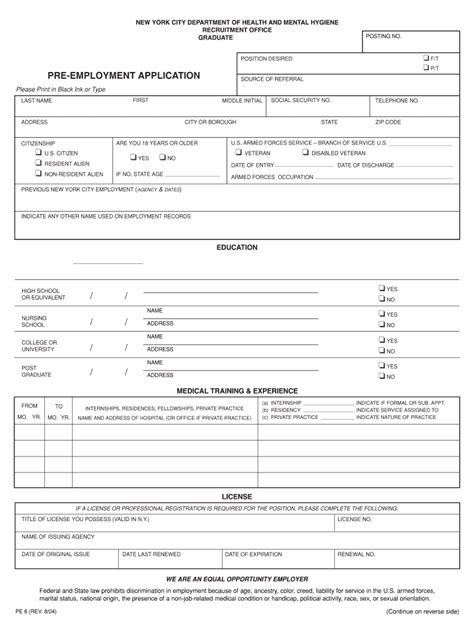

- Petition for Bankruptcy: The initial document filed to commence the bankruptcy process.

- Schedules and Statements: Detailed lists of assets, liabilities, income, and expenses.

- Plan of Reorganization (for Chapter 11 and Chapter 13): Outlines how debts will be repaid.

- Discharge Order: The court order that officially discharges debts.

- Tax Returns: Especially those related to the bankruptcy period, as they may be subject to audit.

- Communication with Creditors and the Trustee: Records of all correspondence.

These documents are essential for tracking the progress of the bankruptcy case, complying with legal requirements, and potentially defending against audits or disputes.

Reasons for Retaining Bankruptcy Paperwork

Retaining bankruptcy paperwork is crucial for several reasons: * Tax Purposes: Bankruptcy can have significant tax implications, and retained documents can help in preparing tax returns and defending against audits. * Audit Defense: In case of an audit, having detailed records can help justify the bankruptcy filing and the valuation of assets and liabilities. * Dispute Resolution: Retained documents can serve as evidence in disputes with creditors or other parties involved in the bankruptcy. * Future Credit Applications: Understanding the details of a past bankruptcy can be helpful when applying for new credit, as it demonstrates a willingness to confront and resolve financial issues.

Best Practices for Document Retention

To manage bankruptcy paperwork effectively, consider the following best practices: * Digital Storage: Scan documents and store them digitally in a secure, encrypted environment. * Physical Storage: Keep original documents in a safe, fireproof location. * Organization: Use a clear, consistent filing system to ensure easy access to documents. * Backup: Regularly back up digital files to prevent loss in case of technical issues.

📝 Note: It's essential to consult with a bankruptcy attorney or financial advisor to determine the specific retention periods and best practices tailored to your situation.

Conclusion Summary

In summary, the retention period for bankruptcy paperwork varies significantly depending on the type of bankruptcy, the jurisdiction, and the specific documents involved. Understanding these requirements and implementing effective document management strategies are crucial for navigating the complexities of bankruptcy proceedings. By retaining necessary documents for the appropriate period, individuals and businesses can better protect themselves against potential legal and financial challenges, ensuring a smoother transition through the bankruptcy process.

What is the typical retention period for Chapter 7 bankruptcy documents?

+

The typical retention period for Chapter 7 bankruptcy documents can range from 3 to 7 years, depending on the specific documents and tax implications involved.

Why is it important to retain bankruptcy paperwork?

+

Retaining bankruptcy paperwork is crucial for tax purposes, defending against audits, resolving disputes, and demonstrating financial responsibility for future credit applications.

How should I store my bankruptcy documents?

+

Consider using both digital storage, such as encrypted cloud services, and physical storage in a safe, fireproof location. Ensure your documents are well-organized and backed up regularly.