Keep Paperwork Canada Guidelines

Introduction to Paperwork in Canada

When dealing with any official or business matter in Canada, understanding the paperwork involved is crucial. Paperwork encompasses a wide range of documents, from legal contracts and tax returns to immigration forms and employment records. Navigating through this complex system can be daunting, especially for newcomers to the country. This guide aims to provide a comprehensive overview of the key aspects of paperwork in Canada, helping individuals and businesses to manage their documentation effectively.

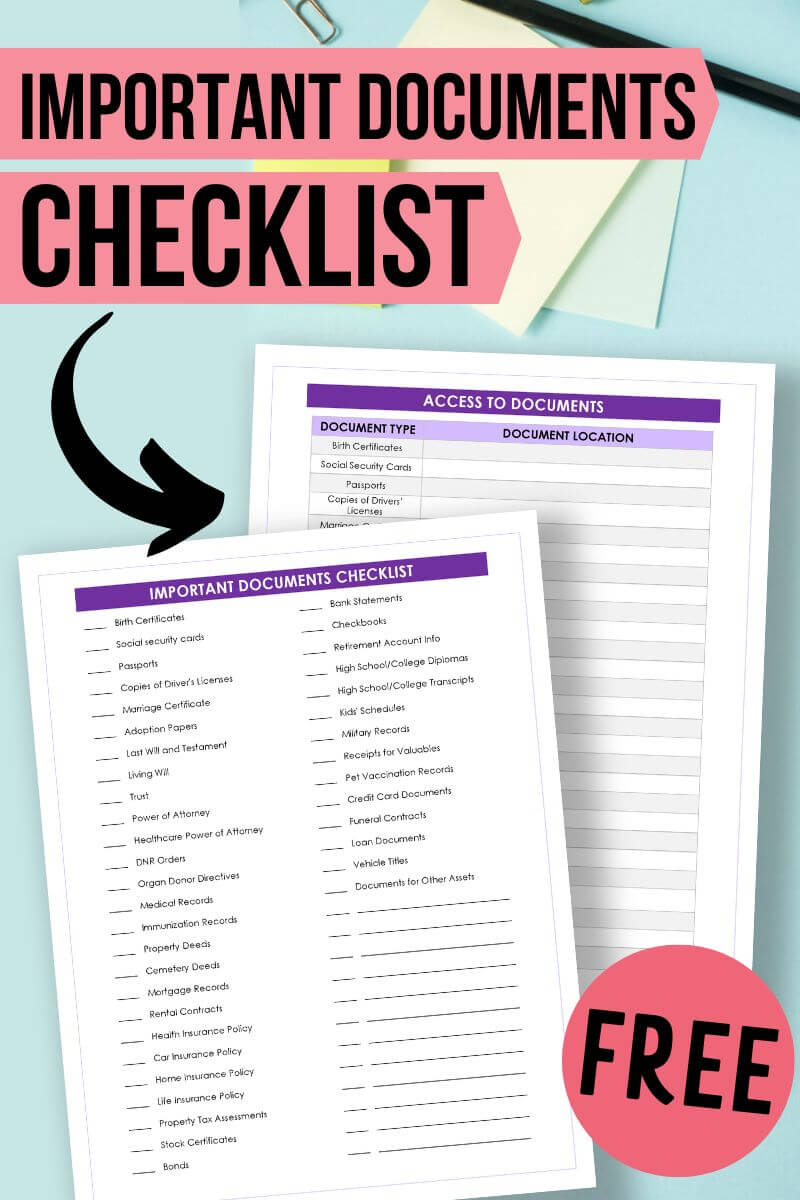

Understanding Canadian Legal Documents

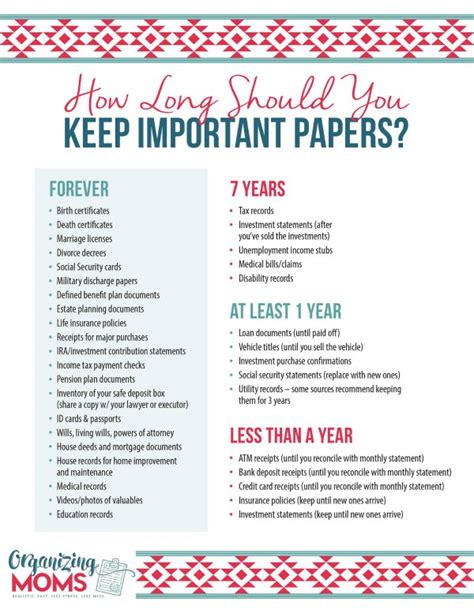

In Canada, legal documents are a fundamental part of both personal and professional life. These include but are not limited to: - Passports and travel documents for identification and travel purposes. - Birth, marriage, and death certificates for proving personal status. - Wills and estates for inheritance and property distribution. - Contracts for agreements between parties, which could be related to employment, purchase of property, or services. - Tax returns for reporting income and claiming deductions.

Each of these documents serves a unique purpose and must be handled with care to avoid any legal complications. Authenticity and accuracy are key when dealing with legal documents, as any discrepancy can lead to severe consequences.

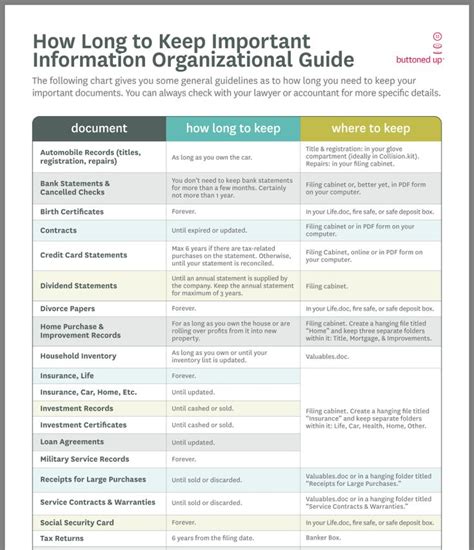

Taxation in Canada

Canada has a complex taxation system, with both federal and provincial governments imposing taxes. Understanding tax obligations is essential for individuals and businesses to comply with the law and benefit from available deductions and credits. The Canada Revenue Agency (CRA) is the primary body responsible for tax administration. Key aspects of taxation in Canada include: - Income Tax: Both individuals and corporations are required to file tax returns, reporting their income and claiming deductions and credits. - Goods and Services Tax (GST): A federal tax applied to the purchase of most goods and services. - Harmonized Sales Tax (HST): A combination of GST and provincial sales tax, applied in some provinces.

Immigration and Citizenship Documents

For those looking to move to Canada, whether temporarily or permanently, immigration and citizenship documents are critical. These include: - Visa applications for temporary residence. - Permanent residence applications for long-term stays. - Citizenship applications for those wishing to become Canadian citizens.

Each application requires meticulous preparation, with detailed paperwork and supporting documents necessary to ensure a smooth process.

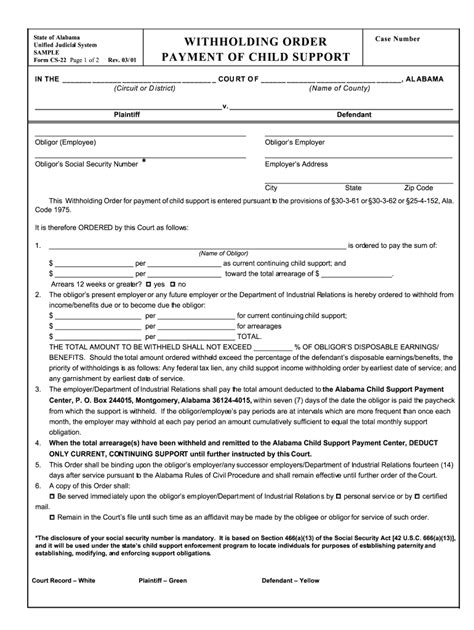

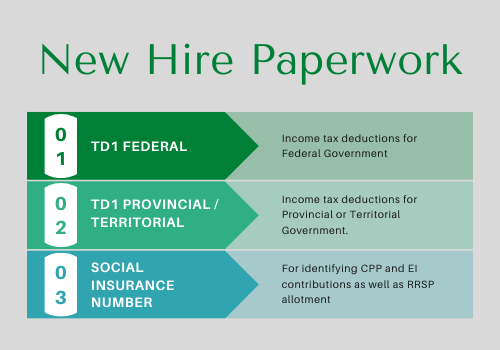

Employment and Labor Law Documents

In the context of employment, several documents play a crucial role in defining the relationship between employers and employees. These include: - Employment contracts, outlining terms of employment, salary, and responsibilities. - Records of employment, necessary for employment insurance benefits. - Health and safety regulations, ensuring a safe working environment.

Compliance with labor laws is essential for both employers and employees, and understanding the relevant paperwork can help prevent disputes and ensure fair treatment.

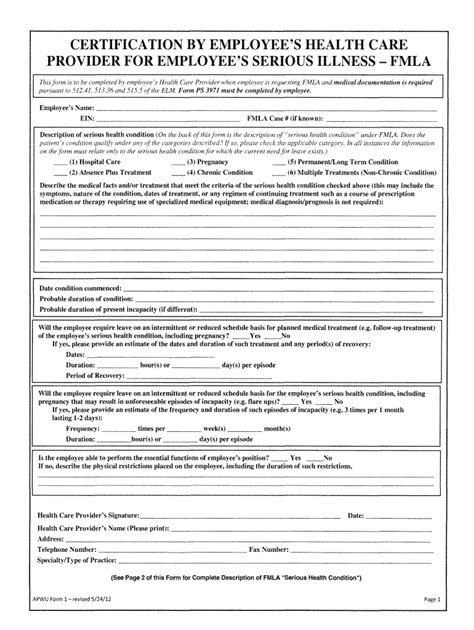

Healthcare and Insurance Documents

Canada’s healthcare system, while largely publicly funded, requires individuals to have health insurance cards and, in some cases, private insurance for services not covered by the public system. Documents related to healthcare and insurance include: - Health insurance cards, providing access to medical services. - Private insurance policies, for additional coverage. - Medical records, containing personal health information.

Maintaining accurate and up-to-date health and insurance documents is vital for receiving proper care and avoiding bureaucratic hurdles.

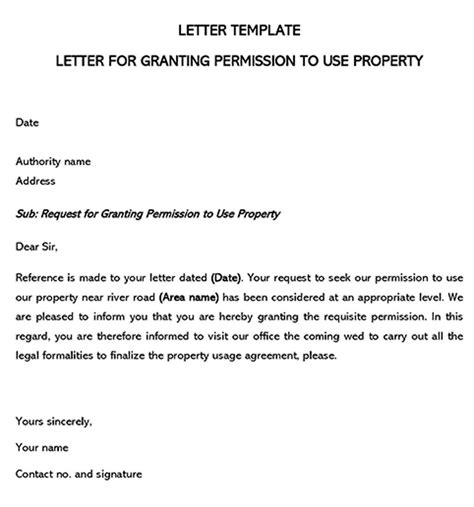

Real Estate and Property Documents

When it comes to purchasing, selling, or renting property in Canada, the paperwork can be overwhelming. Key documents include: - Deeds and titles, proving ownership. - Mortgage agreements, outlining the terms of a loan. - Lease agreements, defining the terms of rental properties.

Understanding these documents and the process of transferring property is essential for a successful transaction.

📝 Note: It is always advisable to consult with professionals, such as lawyers and accountants, when dealing with complex paperwork to ensure everything is handled correctly and legally.

In conclusion, navigating the world of paperwork in Canada requires patience, attention to detail, and a good understanding of the legal and administrative systems in place. By being informed and prepared, individuals and businesses can manage their documentation efficiently, avoid potential pitfalls, and ensure compliance with Canadian laws and regulations. Whether it’s dealing with legal documents, taxation, immigration, employment, healthcare, or real estate, the ability to handle paperwork effectively is a valuable skill that can make a significant difference in personal and professional life.

What are the most common legal documents in Canada?

+

The most common legal documents in Canada include passports, birth certificates, marriage certificates, wills, contracts, and tax returns. Each serves a unique purpose and must be handled with care.

How does the taxation system work in Canada?

+

Canada has a complex taxation system with both federal and provincial governments imposing taxes. The Canada Revenue Agency (CRA) administers tax laws, and individuals and corporations must file tax returns to report income and claim deductions and credits.

What documents are required for immigration to Canada?

+

Documents required for immigration to Canada include visa applications, permanent residence applications, citizenship applications, and supporting documents such as passports, birth certificates, and proof of language proficiency.