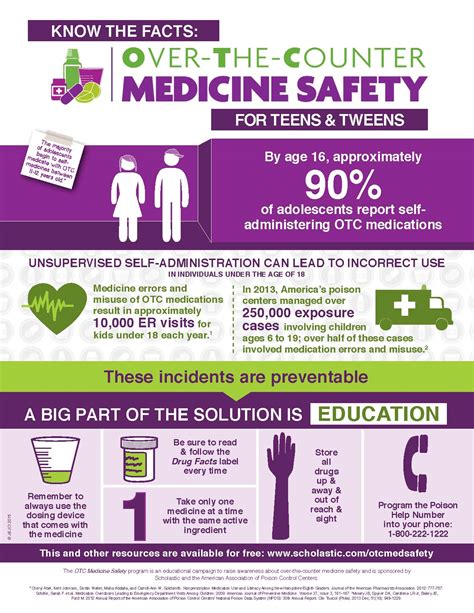

5 Tips To OTC

Introduction to Over-the-Counter (OTC) Trading

Over-the-counter (OTC) trading refers to the process of buying and selling securities or commodities outside of a formal exchange, such as a stock exchange. This type of trading is often used for securities that are not listed on a major exchange or for large, private transactions. In this article, we will provide 5 tips for navigating the world of OTC trading.

Tip 1: Understand the Risks and Benefits

Before entering the world of OTC trading, it is essential to understand the risks and benefits associated with this type of trading. One of the primary benefits of OTC trading is the ability to trade securities that are not listed on a major exchange. However, this also means that there is often less liquidity and more volatility in the market. Additionally, OTC trading can be more susceptible to counterparty risk, which is the risk that the other party in the transaction will default.

Tip 2: Choose a Reputable Broker

When engaging in OTC trading, it is crucial to choose a reputable broker. A good broker will have a strong understanding of the market and will be able to provide valuable guidance and support. Look for a broker that is registered with a regulatory agency and has a proven track record of success. It is also essential to research the broker’s fees and commissions to ensure that they are competitive and transparent.

Tip 3: Understand the Different Types of OTC Trading

There are several different types of OTC trading, including: * OTC derivatives: These are financial instruments that are derived from other assets, such as options and futures contracts. * OTC securities: These are securities that are not listed on a major exchange, such as stocks and bonds. * OTC commodities: These are physical goods, such as oil and gold, that are traded outside of a formal exchange. Understanding the different types of OTC trading will help you to navigate the market and make informed decisions.

Tip 4: Use Risk Management Techniques

OTC trading can be volatile, and it is essential to use risk management techniques to protect your investments. One of the most effective ways to manage risk is to use stop-loss orders, which will automatically sell a security if it falls below a certain price. Additionally, position sizing can help to limit your exposure to any one particular security or market. It is also important to stay up-to-date with market news and trends to ensure that you are making informed decisions.

Tip 5: Stay Informed and Educated

Finally, it is essential to stay informed and educated about the OTC trading market. Read books and articles about OTC trading, and follow industry leaders and experts on social media. Additionally, attend seminars and workshops to learn from experienced traders and stay up-to-date with the latest trends and strategies. By staying informed and educated, you will be better equipped to navigate the world of OTC trading and make informed decisions.

💡 Note: OTC trading can be complex and volatile, and it is essential to approach it with caution and careful consideration. It is also important to consult with a financial advisor or broker before making any investment decisions.

In summary, OTC trading can be a complex and challenging world, but with the right knowledge and strategies, it can also be a lucrative and rewarding one. By understanding the risks and benefits, choosing a reputable broker, understanding the different types of OTC trading, using risk management techniques, and staying informed and educated, you can navigate the world of OTC trading with confidence.

What is the main difference between OTC trading and exchange trading?

+

The main difference between OTC trading and exchange trading is that OTC trading takes place outside of a formal exchange, while exchange trading takes place on a formal exchange, such as a stock exchange.

What are the benefits of OTC trading?

+

The benefits of OTC trading include the ability to trade securities that are not listed on a major exchange, flexibility in terms of contract size and expiration date, and the potential for higher returns due to the lack of liquidity.

What are the risks associated with OTC trading?

+

The risks associated with OTC trading include counterparty risk, liquidity risk, and market risk. Counterparty risk is the risk that the other party in the transaction will default, liquidity risk is the risk that it will be difficult to buy or sell a security, and market risk is the risk that the value of a security will fluctuate.