Paperwork

Review Conditional Approval Paperwork Time

Introduction to Conditional Approval

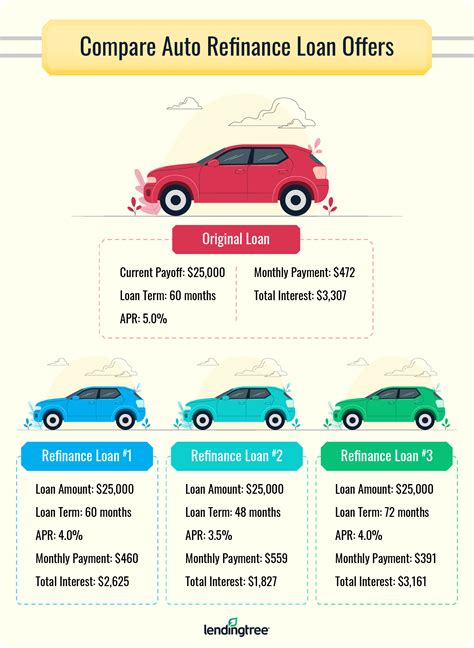

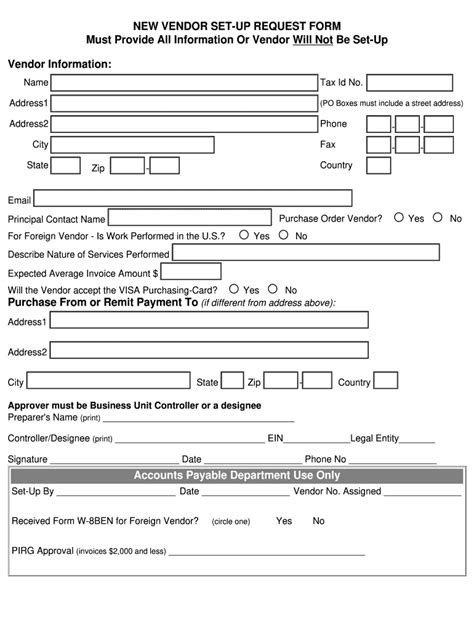

Conditional approval is a process used by lenders to approve a loan or credit application, subject to certain conditions being met. This process is crucial in ensuring that the borrower is creditworthy and can repay the loan. The conditional approval paperwork time can vary depending on the lender, the type of loan, and the complexity of the application. In this article, we will delve into the world of conditional approval, exploring what it entails, the factors that affect the paperwork time, and the steps involved in the process.

Understanding Conditional Approval

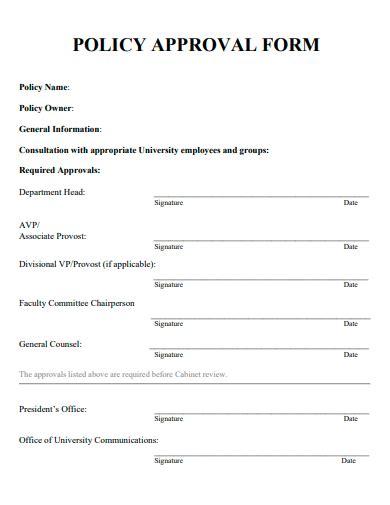

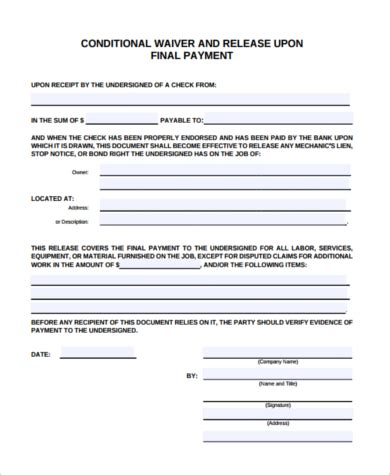

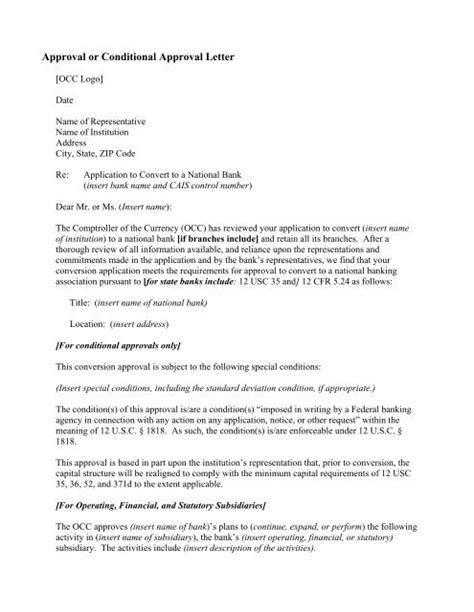

Conditional approval is a preliminary approval given to a borrower, indicating that the lender is willing to lend them money, subject to certain conditions. These conditions may include providing additional documentation, such as proof of income or employment, or meeting specific credit requirements. The lender will typically issue a conditional approval letter, outlining the terms of the loan and the conditions that must be met. It is essential to carefully review this letter, as it will outline the requirements that must be fulfilled to secure the loan.

Factors Affecting Conditional Approval Paperwork Time

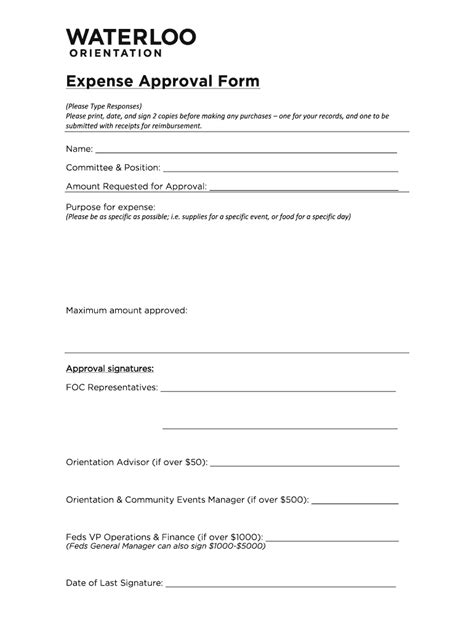

The conditional approval paperwork time can be affected by several factors, including: * The type of loan: Different types of loans, such as mortgages or personal loans, may have varying paperwork requirements and processing times. * The lender: Each lender has its own processes and procedures, which can impact the paperwork time. * The complexity of the application: Applications with multiple borrowers or complex financial situations may require more time to process. * The availability of documentation: The speed at which the borrower can provide required documentation can significantly impact the paperwork time.

Steps Involved in Conditional Approval

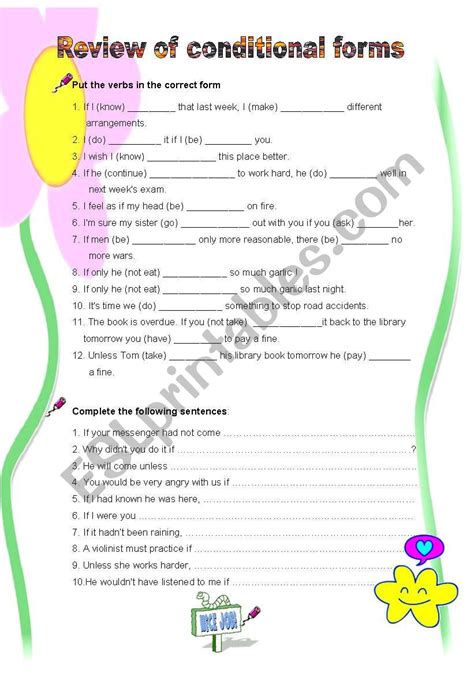

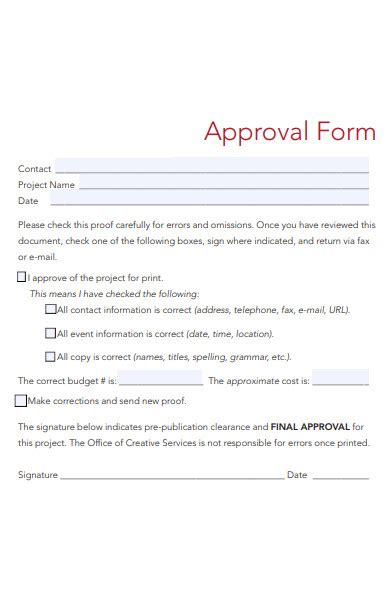

The conditional approval process typically involves the following steps: * Pre-approval: The borrower submits an application, and the lender provides a pre-approval, indicating the amount they are willing to lend. * Application submission: The borrower submits a full application, including all required documentation. * Credit check: The lender conducts a credit check to assess the borrower’s creditworthiness. * Conditional approval: The lender issues a conditional approval letter, outlining the terms of the loan and the conditions that must be met. * Fulfillment of conditions: The borrower must meet the conditions outlined in the conditional approval letter. * Final approval: Once the conditions are met, the lender provides final approval, and the loan is disbursed.

📝 Note: It is crucial to carefully review the conditional approval letter and ensure that all conditions are met to avoid delays or potential rejection of the loan application.

Timeline for Conditional Approval

The timeline for conditional approval can vary significantly, depending on the factors mentioned earlier. However, here is a general outline of what to expect: * Pre-approval: 1-3 days * Application submission: 1-5 days * Credit check: 1-3 days * Conditional approval: 1-5 days * Fulfillment of conditions: 1-14 days * Final approval: 1-3 days

| Step | Timeline |

|---|---|

| Pre-approval | 1-3 days |

| Application submission | 1-5 days |

| Credit check | 1-3 days |

| Conditional approval | 1-5 days |

| Fulfillment of conditions | 1-14 days |

| Final approval | 1-3 days |

Conclusion and Next Steps

In conclusion, the conditional approval process is a critical step in securing a loan. Understanding the factors that affect the paperwork time and the steps involved in the process can help borrowers navigate the system more efficiently. By carefully reviewing the conditional approval letter and fulfilling the conditions outlined, borrowers can increase their chances of securing the loan. It is essential to stay organized, provide required documentation promptly, and communicate effectively with the lender to ensure a smooth and efficient process.

What is conditional approval?

+

Conditional approval is a preliminary approval given to a borrower, subject to certain conditions being met.

How long does the conditional approval process take?

+

The conditional approval process can take anywhere from a few days to several weeks, depending on the lender, the type of loan, and the complexity of the application.

What are the steps involved in the conditional approval process?

+

The conditional approval process typically involves pre-approval, application submission, credit check, conditional approval, fulfillment of conditions, and final approval.