5 Tips Bankruptcy Papers

Introduction to Bankruptcy Papers

Filing for bankruptcy can be a daunting and complex process, involving a multitude of legal and financial considerations. At the heart of this process are the bankruptcy papers, which are the legal documents that initiate and guide the bankruptcy case through the court system. These papers are crucial as they provide the court with all the necessary information about the individual’s or business’s financial situation, debts, assets, and the reasons for seeking bankruptcy protection. Understanding the importance and the components of these documents is vital for navigating the bankruptcy process successfully.

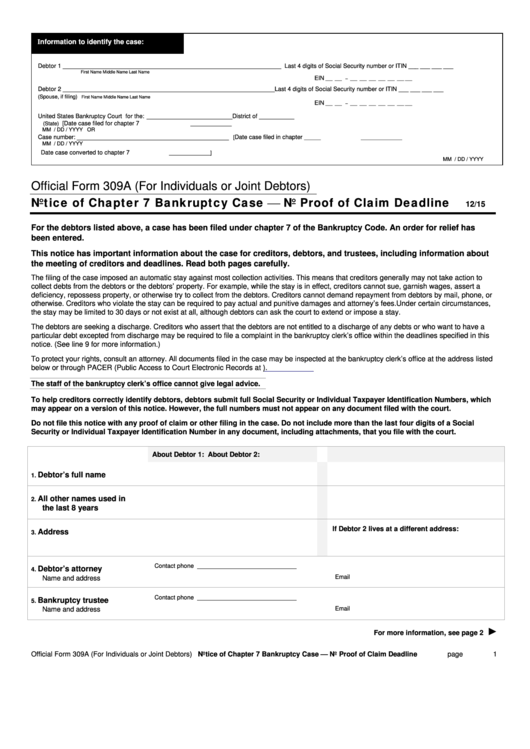

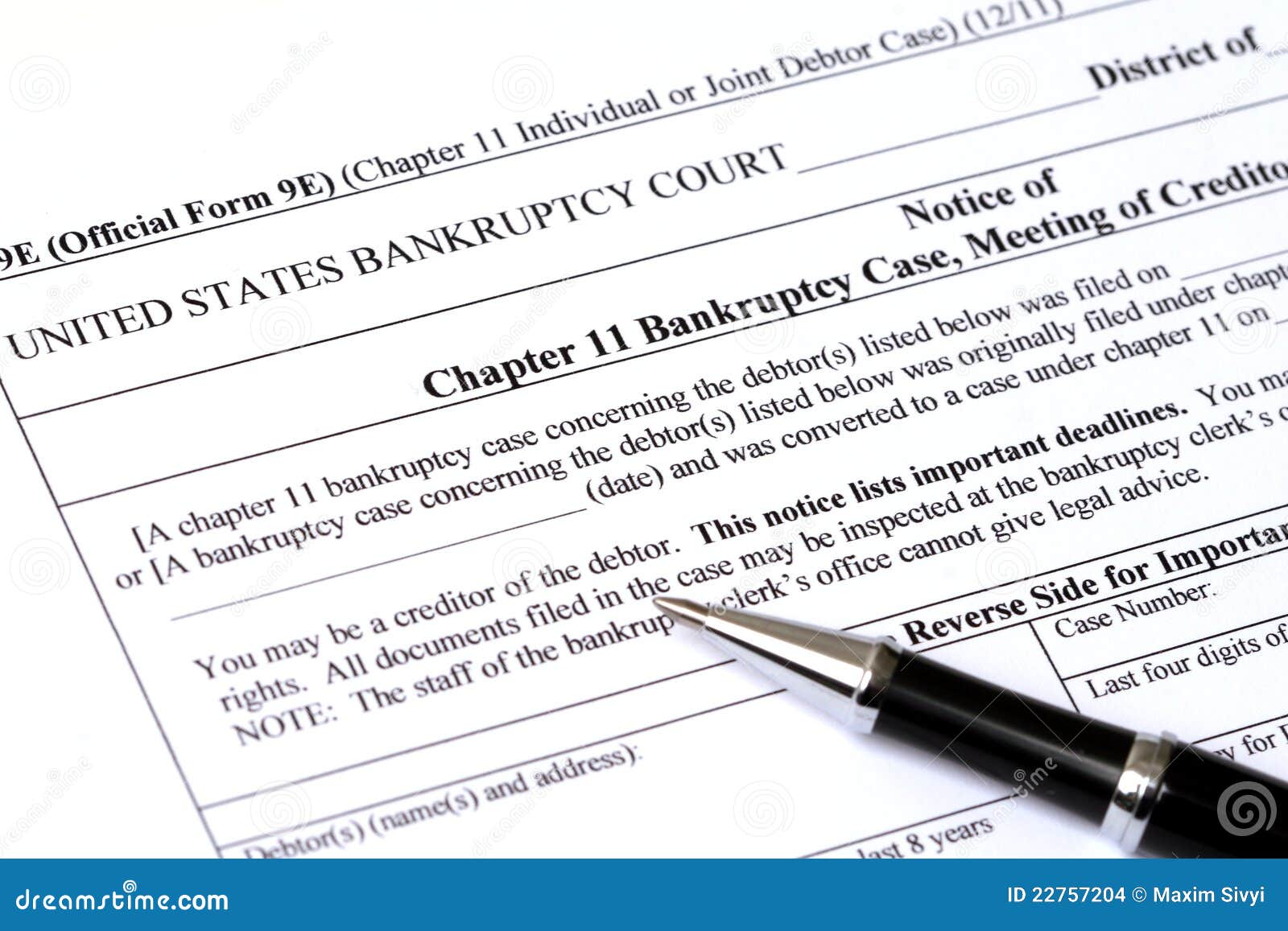

Understanding the Components of Bankruptcy Papers

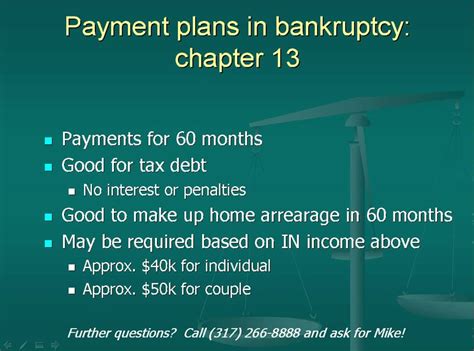

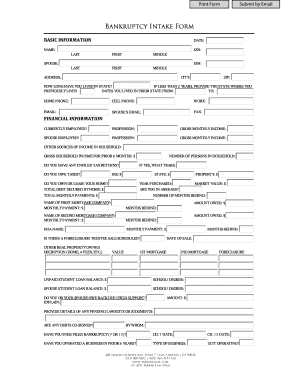

Bankruptcy papers typically include a petition, schedules, and statements. The petition is the initial document filed with the court to commence the bankruptcy case. It includes basic information about the debtor, such as name, address, and the type of bankruptcy being filed (e.g., Chapter 7 or Chapter 13 for individuals). Schedules provide detailed information about the debtor’s assets, liabilities, income, and expenses. These are critical as they give a comprehensive view of the debtor’s financial situation. Statements of financial affairs require the debtor to list all financial transactions that have occurred within a specified period before the bankruptcy filing, such as income, payments to creditors, and transfers of property.

5 Tips for Preparing Bankruptcy Papers

Preparing bankruptcy papers requires meticulous attention to detail and a thorough understanding of the legal requirements. Here are five tips to consider: - Accuracy is Key: Ensuring that all information provided is accurate and complete is paramount. Inaccurate or incomplete filings can lead to delays, additional costs, or even the dismissal of the bankruptcy case. - Seek Professional Help: Given the complexity of bankruptcy laws and the potential consequences of errors, it is highly recommended to seek the assistance of a bankruptcy attorney. They can guide you through the process, ensure that all necessary documents are properly prepared and filed, and represent you in court. - Understand the Types of Bankruptcy: Before filing, it’s essential to understand the differences between the types of bankruptcy (Chapter 7, Chapter 13, etc.) and which one is most appropriate for your situation. Each chapter has its own set of rules and requirements. - Gather All Necessary Documents: This includes financial records, tax returns, paycheck stubs, and any other documentation that might be required to support the information provided in the bankruptcy papers. - Be Prepared for the Process: Filing bankruptcy papers is just the beginning of the process. Be prepared to attend court hearings, potentially deal with creditor objections, and comply with all court orders and requirements throughout the bankruptcy case.

Importance of Compliance

Compliance with the bankruptcy code and the rules of the court is essential. Failure to comply can result in severe consequences, including the denial of discharge, which means that the debts will not be forgiven. It’s also important to be aware of the automatic stay, which goes into effect as soon as the bankruptcy petition is filed, and temporarily stops most collection activities by creditors.

| Type of Bankruptcy | Description |

|---|---|

| Chapter 7 | Known as liquidation bankruptcy, it involves the sale of non-exempt assets to pay off creditors. |

| Chapter 13 | Known as reorganization bankruptcy, it involves creating a repayment plan to pay off debts over time. |

📝 Note: The decision to file for bankruptcy should not be taken lightly and should be considered after exploring all other debt relief options.

Conclusion and Final Thoughts

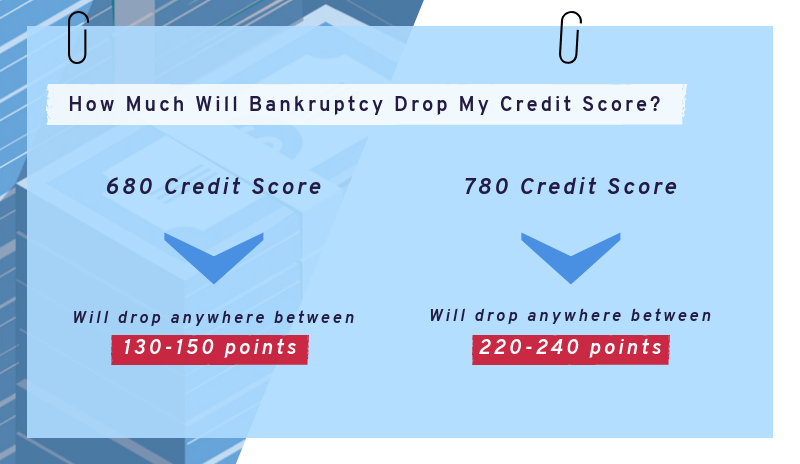

In conclusion, the process of preparing and filing bankruptcy papers is complex and requires careful consideration. It’s a significant step that can have lasting impacts on one’s financial future. By understanding the components of bankruptcy papers, seeking professional advice, and ensuring accuracy and compliance, individuals and businesses can navigate this challenging process more effectively. It’s also crucial to approach this decision with a clear understanding of the implications and the potential for rebuilding credit and financial stability afterward.

What is the main purpose of filing bankruptcy papers?

+

The main purpose of filing bankruptcy papers is to initiate a legal process that provides individuals or businesses with relief from debts, through either the liquidation of assets to pay off creditors or the creation of a repayment plan.

Can I file bankruptcy papers without an attorney?

+

While it is possible to file bankruptcy papers without an attorney, it is generally not recommended due to the complexity of bankruptcy laws and the potential for errors that could negatively impact the outcome of the case.

How long does the bankruptcy process typically take?

+

The length of the bankruptcy process can vary significantly depending on the type of bankruptcy filed and the complexity of the case. Chapter 7 cases are typically faster, often taking a few months, while Chapter 13 cases involve a repayment plan that can last several years.