5 Ways to Get Power of Attorney

Introduction to Power of Attorney

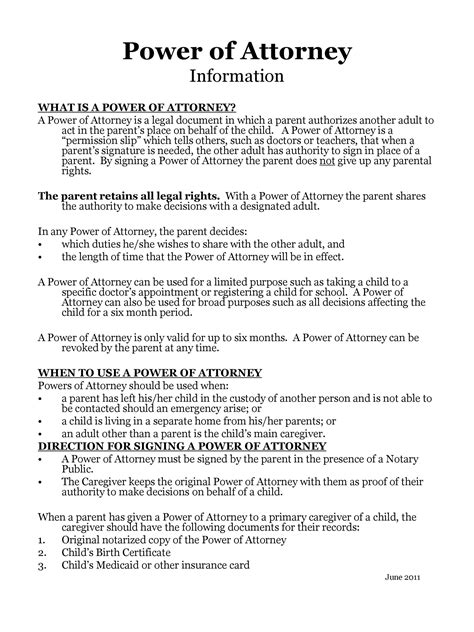

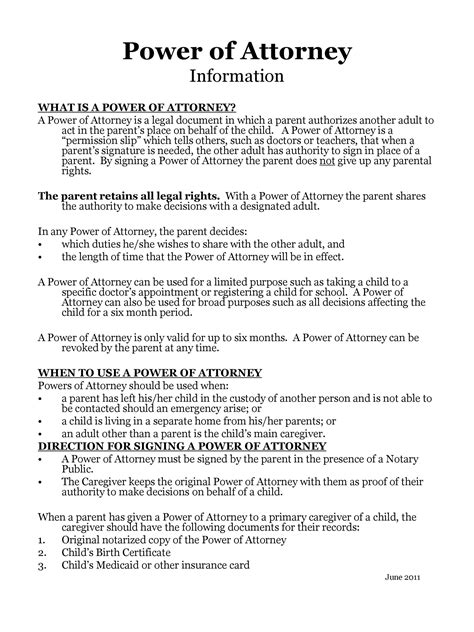

Getting a Power of Attorney (POA) is a crucial step in ensuring that your financial and medical affairs are managed according to your wishes, even if you become incapacitated. A POA is a legal document that grants someone you trust the authority to make decisions on your behalf. In this article, we will explore the different ways to get a Power of Attorney, highlighting the importance of this document and the various options available to individuals.

Understanding the Types of Power of Attorney

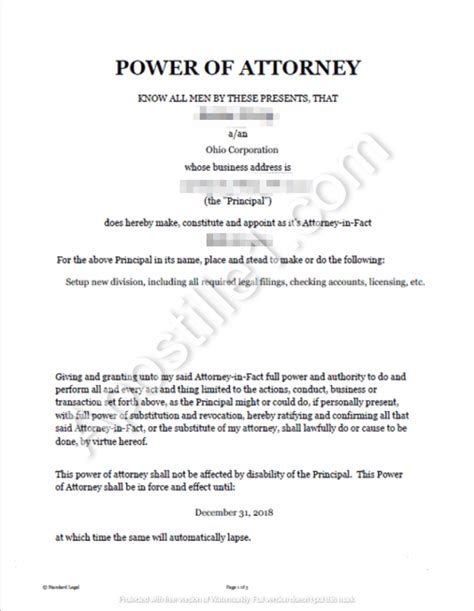

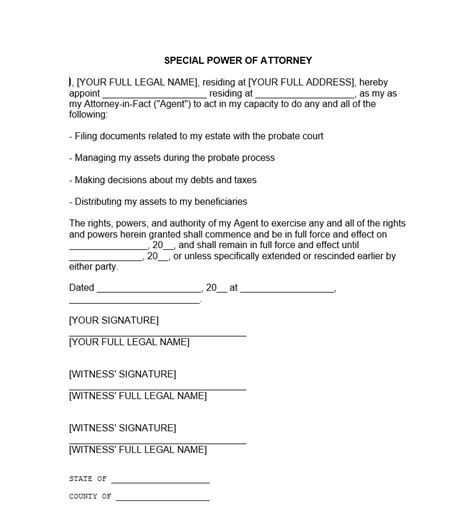

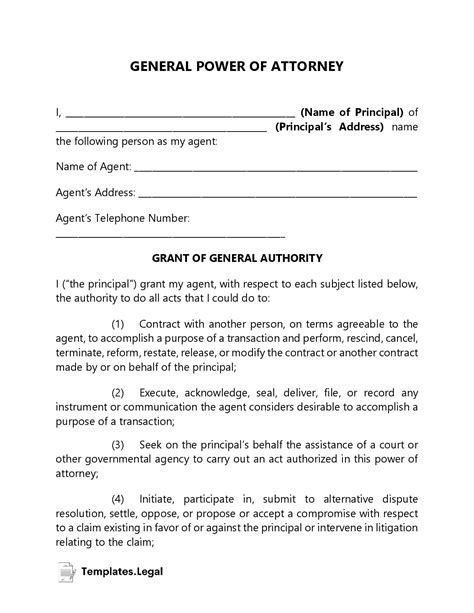

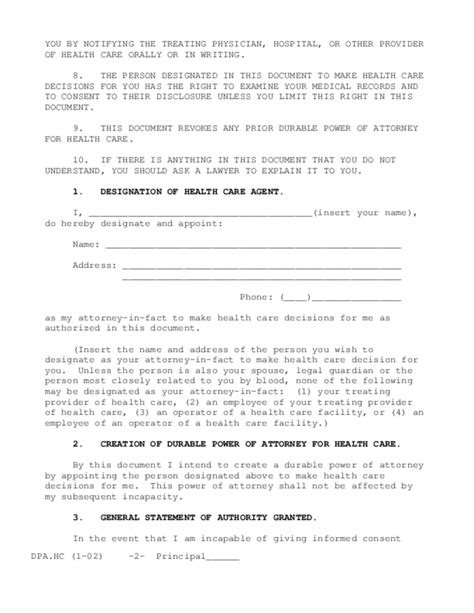

Before we dive into the ways to get a POA, it’s essential to understand the different types of Power of Attorney. The most common types include: * General Power of Attorney: Grants broad powers to manage your financial and personal affairs. * Special Power of Attorney: Limits the powers granted to specific areas, such as managing a particular asset or making medical decisions. * Durable Power of Attorney: Remains in effect even if you become incapacitated. * Springing Power of Attorney: Takes effect only when you become incapacitated.

5 Ways to Get Power of Attorney

Now that we’ve covered the basics, let’s explore the different ways to get a Power of Attorney: * Consult an Attorney: Hiring an attorney specializing in elder law or estate planning can provide you with personalized guidance and ensure that your POA is tailored to your specific needs. * Online Templates and Forms: Utilizing online templates and forms can be a cost-effective and convenient way to create a POA. However, it’s crucial to choose a reputable source and ensure that the document complies with your state’s laws. * Pre-Printed Forms: Pre-printed forms are available at office supply stores or can be downloaded from various websites. These forms are often straightforward and easy to complete, but may not provide the level of customization offered by an attorney or online templates. * Non-Profit Organizations: Some non-profit organizations, such as the American Bar Association or the National Academy of Elder Law Attorneys, offer free or low-cost POA forms and guidance. * State-Specific Resources: Many states provide their own POA forms and resources, which can be accessed through the state’s official website or by contacting the local county clerk’s office.

Key Considerations When Creating a Power of Attorney

When creating a Power of Attorney, it’s essential to consider the following factors: * Choose a trustworthy agent: Select someone you trust to make decisions on your behalf, and ensure they are aware of their responsibilities and your wishes. * Specify powers and limitations: Clearly outline the powers granted to your agent and any limitations or restrictions. * Include a revocation clause: Allow for the POA to be revoked or modified if needed. * Comply with state laws: Ensure that your POA complies with your state’s laws and regulations.

📝 Note: It's crucial to review and update your Power of Attorney regularly to ensure it remains relevant and effective.

Benefits of Having a Power of Attorney

Having a Power of Attorney in place can provide numerous benefits, including: * Peace of mind: Knowing that your affairs are being managed according to your wishes can bring peace of mind and reduce stress. * Protection of assets: A POA can help protect your assets and ensure they are used for your benefit. * Medical decision-making: A POA can grant your agent the authority to make medical decisions on your behalf, ensuring you receive the care you desire. * Convenience and flexibility: A POA can provide convenience and flexibility, allowing your agent to manage your affairs even if you’re unable to do so yourself.

To illustrate the importance of having a Power of Attorney, consider the following example:

| Scenario | With POA | Without POA |

|---|---|---|

| Incurred medical expenses | Agent can pay bills and make medical decisions | Court intervention may be required, leading to delays and added expenses |

| Financial management | Agent can manage finances, including paying bills and taxes | Financial institutions may freeze accounts, causing inconvenience and financial hardship |

As we’ve discussed, having a Power of Attorney in place is essential for ensuring that your affairs are managed according to your wishes, even if you become incapacitated. By understanding the different types of POA, exploring the various ways to get a POA, and considering key factors when creating a POA, you can make informed decisions about your financial and medical well-being.

In summary, getting a Power of Attorney is a crucial step in planning for the future, and it’s essential to approach this process with careful consideration and attention to detail. By doing so, you can ensure that your wishes are respected, and your loved ones are protected from the challenges and uncertainties that may arise.

What is the difference between a General Power of Attorney and a Special Power of Attorney?

+

A General Power of Attorney grants broad powers to manage your financial and personal affairs, while a Special Power of Attorney limits the powers granted to specific areas, such as managing a particular asset or making medical decisions.

Can I create a Power of Attorney online?

+

Yes, you can create a Power of Attorney online using templates and forms available on various websites. However, it’s crucial to choose a reputable source and ensure that the document complies with your state’s laws.

What happens if I become incapacitated without a Power of Attorney?

+

If you become incapacitated without a Power of Attorney, your loved ones may need to seek court intervention to manage your affairs, which can be a lengthy and costly process. Having a POA in place can help avoid this situation and ensure that your wishes are respected.