Paperwork

Start Job Paperwork Requirements

Introduction to Job Paperwork Requirements

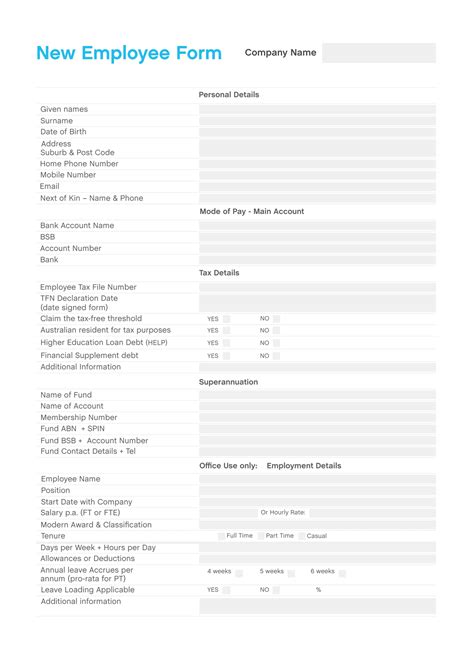

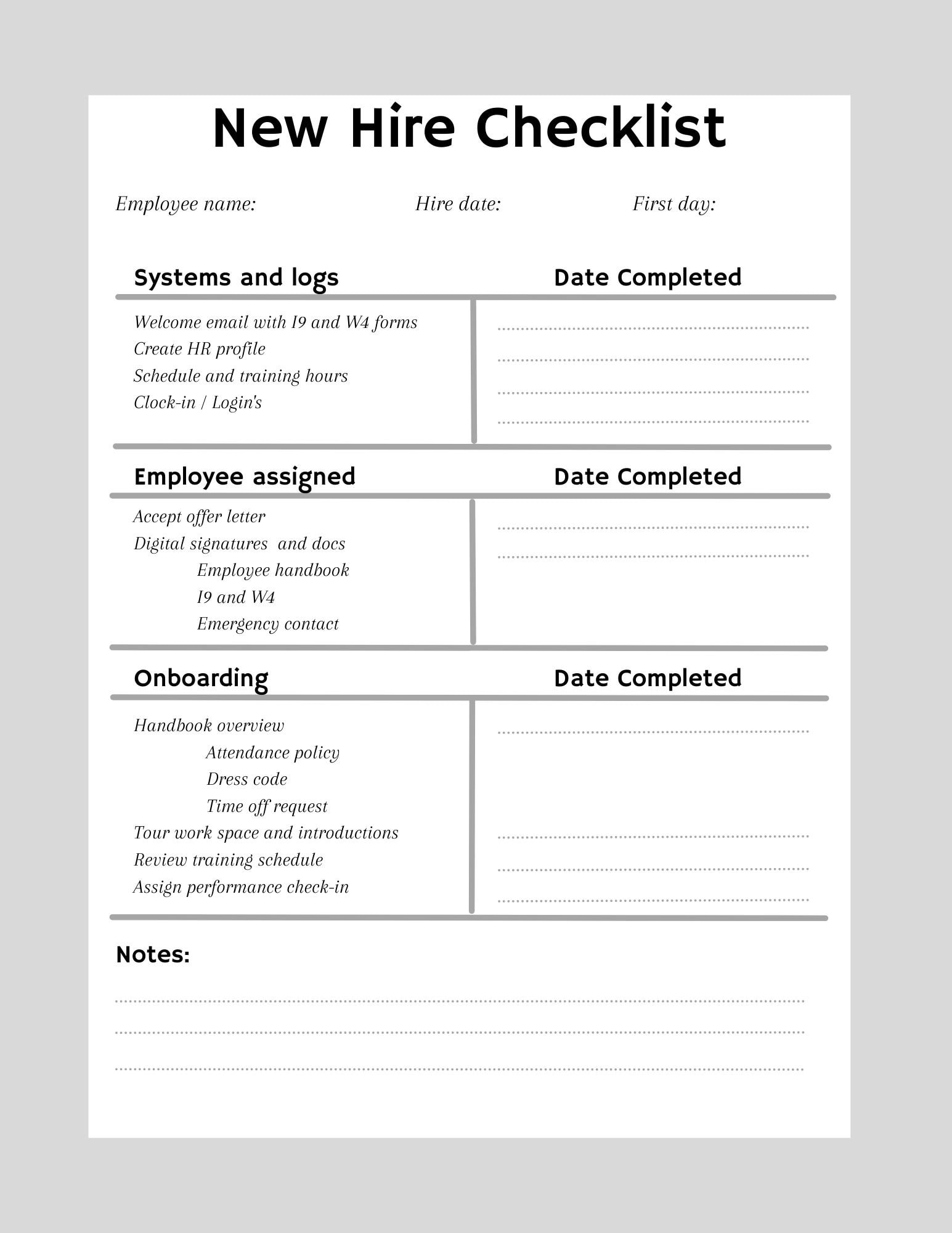

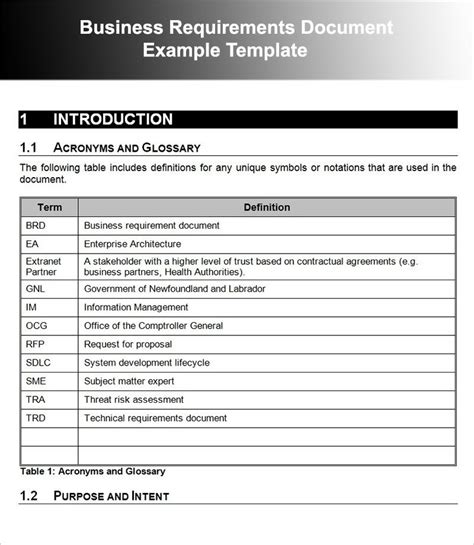

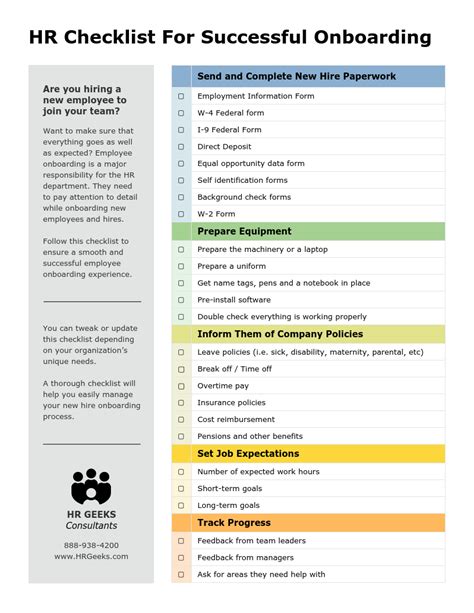

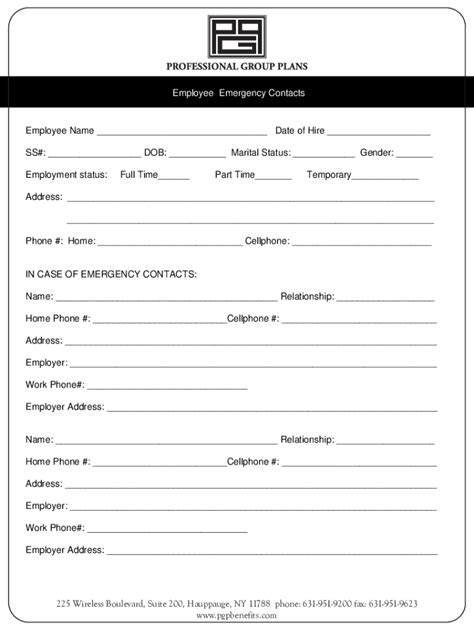

When starting a new job, there are numerous paperwork requirements that must be completed to ensure a smooth transition into the company. These requirements can vary depending on the country, state, or industry, but there are some common documents that are typically required. In this article, we will discuss the various paperwork requirements that are usually needed when starting a new job.

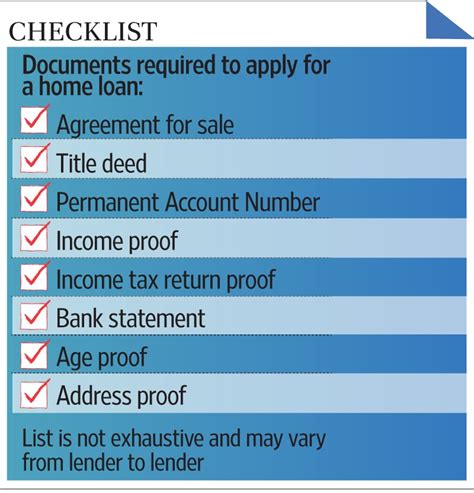

Essential Documents

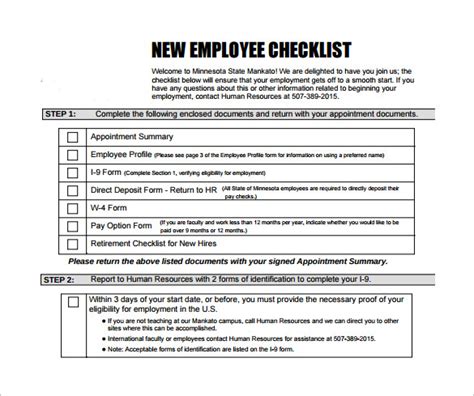

The following are some of the essential documents that are typically required when starting a new job: * Identification documents: This can include a passport, driver’s license, or state ID. * Social Security number or tax ID number: This is required for tax purposes and to verify identity. * Proof of address: This can include a utility bill, lease agreement, or bank statement. * Resume and cover letter: These documents provide an overview of the employee’s education, work experience, and skills. * References: Employers often require professional references to verify an employee’s previous work experience and performance.

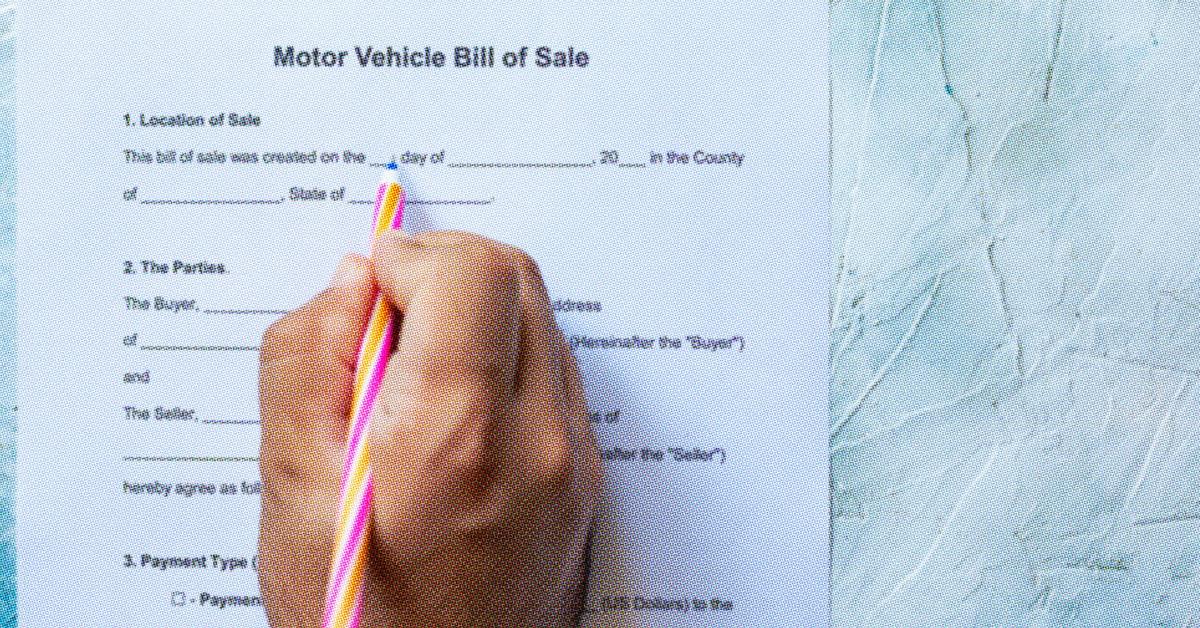

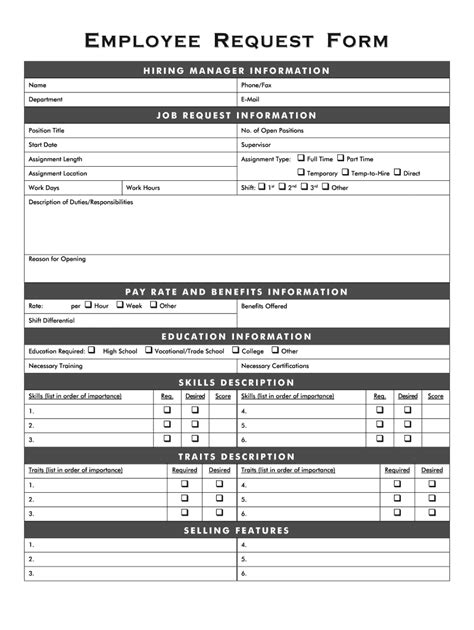

Employment Contracts and Agreements

Employment contracts and agreements are critical documents that outline the terms and conditions of employment. These documents can include: * Employment contract: This document outlines the terms and conditions of employment, including job title, salary, benefits, and termination procedures. * Non-disclosure agreement: This document requires employees to keep confidential any sensitive information related to the company. * Non-compete agreement: This document prohibits employees from working for a competitor or starting a similar business.

Tax-Related Documents

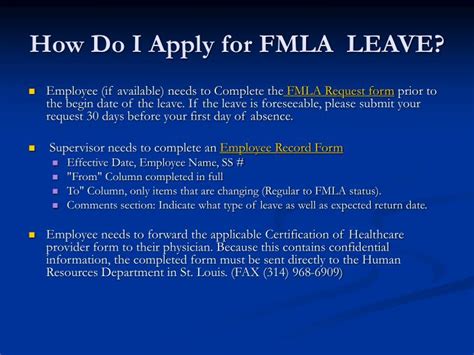

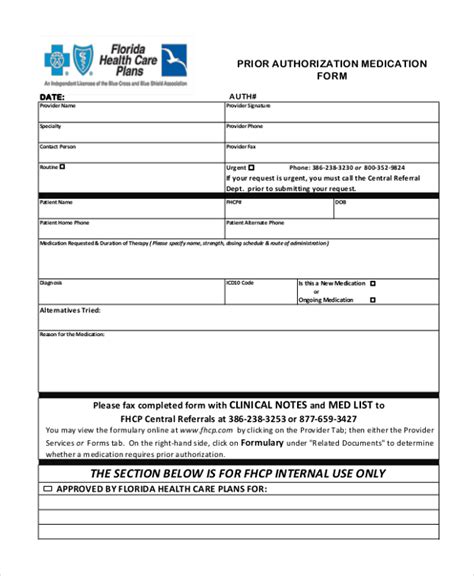

The following are some of the tax-related documents that are typically required when starting a new job: * W-4 form: This document is used to determine the amount of taxes to be withheld from an employee’s paycheck. * State tax withholding form: This document is used to determine the amount of state taxes to be withheld from an employee’s paycheck. * Benefits enrollment forms: These documents are used to enroll employees in benefits such as health insurance, retirement plans, and life insurance.

| Document | Description |

|---|---|

| W-4 form | Used to determine the amount of taxes to be withheld from an employee's paycheck |

| State tax withholding form | Used to determine the amount of state taxes to be withheld from an employee's paycheck |

| Benefits enrollment forms | Used to enroll employees in benefits such as health insurance, retirement plans, and life insurance |

📝 Note: The specific paperwork requirements may vary depending on the company, industry, or location. It's essential to review and complete all required documents to ensure a smooth transition into the company.

Additional Requirements

Some companies may require additional documents or information, such as: * Background check: This is a thorough investigation into an employee’s past, including their criminal history and credit report. * Drug test: This is a test to determine if an employee is using illicit substances. * Medical examination: This is a physical examination to determine if an employee is fit for work.

Conclusion and Final Thoughts

In conclusion, starting a new job requires a significant amount of paperwork to ensure a smooth transition into the company. It’s essential to review and complete all required documents, including identification documents, employment contracts, tax-related documents, and additional requirements. By understanding the various paperwork requirements, employees can ensure a successful onboarding process and a positive start to their new job.

What is the purpose of a W-4 form?

+

The W-4 form is used to determine the amount of taxes to be withheld from an employee’s paycheck.

What is the difference between a non-disclosure agreement and a non-compete agreement?

+

A non-disclosure agreement requires employees to keep confidential any sensitive information related to the company, while a non-compete agreement prohibits employees from working for a competitor or starting a similar business.

What are the consequences of not completing the required paperwork?

+

The consequences of not completing the required paperwork can include delays in the onboarding process, incorrect tax withholding, and even termination of employment.