Save Income Tax Papers

Understanding the Importance of Saving Income Tax Papers

Saving income tax papers is a crucial aspect of personal finance and tax planning. It is essential to maintain a record of all tax-related documents, including receipts, invoices, and bank statements, to ensure that you can claim deductions and credits accurately. Proper documentation can help you avoid penalties and fines imposed by tax authorities. In this article, we will discuss the importance of saving income tax papers, the types of documents to save, and how to organize them efficiently.

Types of Income Tax Papers to Save

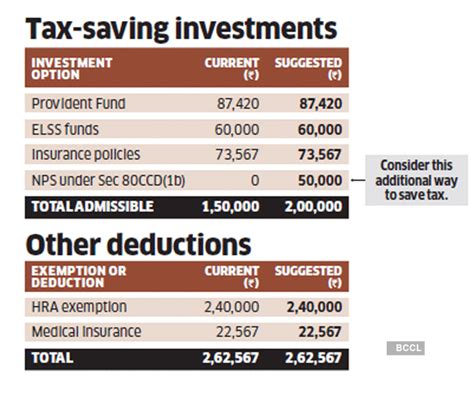

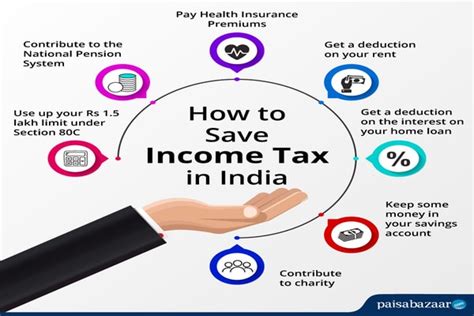

There are several types of income tax papers that you should save, including: * Form 16: This is the certificate of tax deduction at source, issued by your employer. * Form 16A: This is the certificate of tax deduction at source, issued by banks and other financial institutions. * Receipts and invoices: Save receipts and invoices for all expenses, including medical bills, charitable donations, and home loan interest payments. * Bank statements: Save bank statements to prove income, deductions, and credits. * Investment documents: Save documents related to investments, such as mutual fund statements, stock certificates, and bond coupons.

How to Organize Income Tax Papers

Organizing income tax papers can be a daunting task, but it can be made easier by following a few simple steps: * Create a separate folder for each tax year. * Use labels and categories to categorize documents, such as “income,” “deductions,” and “credits.” * Scan and digitize documents to save space and reduce clutter. * Use a password-protected digital storage service to protect sensitive information.

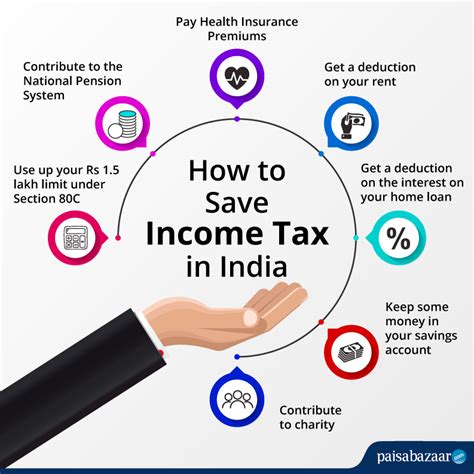

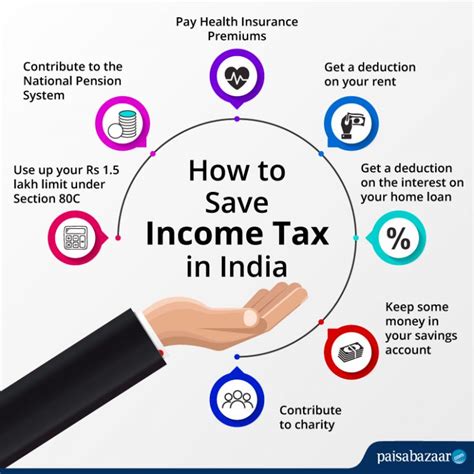

Benefits of Saving Income Tax Papers

Saving income tax papers can have several benefits, including: * Avoiding penalties and fines: Proper documentation can help you avoid penalties and fines imposed by tax authorities. * Claiming deductions and credits: Saving income tax papers can help you claim deductions and credits accurately. * Reducing audit risk: Maintaining accurate and complete records can reduce the risk of audit. * Improving financial planning: Saving income tax papers can help you track your income and expenses, making it easier to create a budget and plan for the future.

Common Mistakes to Avoid

When saving income tax papers, there are several common mistakes to avoid, including: * Failing to save receipts and invoices: Failing to save receipts and invoices can make it difficult to claim deductions and credits. * Not organizing documents properly: Failing to organize documents properly can make it difficult to find the information you need. * Not digitizing documents: Failing to digitize documents can make it difficult to protect sensitive information and reduce clutter. * Not reviewing and updating documents regularly: Failing to review and update documents regularly can make it difficult to ensure accuracy and completeness.

📝 Note: It is essential to review and update income tax papers regularly to ensure accuracy and completeness.

Best Practices for Saving Income Tax Papers

To save income tax papers effectively, follow these best practices: * Save documents in a secure location: Save documents in a secure location, such as a safe or a password-protected digital storage service. * Use a consistent filing system: Use a consistent filing system to make it easier to find the information you need. * Review and update documents regularly: Review and update documents regularly to ensure accuracy and completeness. * Seek professional help when needed: Seek professional help when needed, such as from a tax consultant or accountant.

| Document Type | Description |

|---|---|

| Form 16 | Certificate of tax deduction at source, issued by employer |

| Form 16A | Certificate of tax deduction at source, issued by banks and other financial institutions |

| Receipts and invoices | Receipts and invoices for all expenses, including medical bills, charitable donations, and home loan interest payments |

In summary, saving income tax papers is a crucial aspect of personal finance and tax planning. By understanding the importance of saving income tax papers, the types of documents to save, and how to organize them efficiently, you can avoid penalties and fines, claim deductions and credits accurately, and reduce audit risk. By following best practices and avoiding common mistakes, you can ensure that your income tax papers are accurate, complete, and easily accessible.

As we wrap up this discussion on saving income tax papers, it is essential to remember that proper documentation is key to ensuring that you can claim deductions and credits accurately and avoid penalties and fines. By maintaining a record of all tax-related documents and organizing them efficiently, you can simplify the tax filing process and reduce stress.

What are the benefits of saving income tax papers?

+

The benefits of saving income tax papers include avoiding penalties and fines, claiming deductions and credits accurately, reducing audit risk, and improving financial planning.

What types of income tax papers should I save?

+

You should save Form 16, Form 16A, receipts and invoices, bank statements, and investment documents.

How can I organize my income tax papers efficiently?

+

You can organize your income tax papers efficiently by creating a separate folder for each tax year, using labels and categories, scanning and digitizing documents, and using a password-protected digital storage service.