7 Tax Paperwork Tips

Introduction to Tax Paperwork

When it comes to dealing with tax paperwork, many individuals and businesses find the process to be overwhelming and time-consuming. With the numerous forms, deadlines, and regulations to keep track of, it’s easy to get bogged down in the details. However, by following a few simple tips and strategies, you can make the process of handling tax paperwork much more manageable. In this article, we’ll explore seven tax paperwork tips that can help you stay organized, avoid common pitfalls, and ensure that you’re in compliance with all relevant tax laws and regulations.

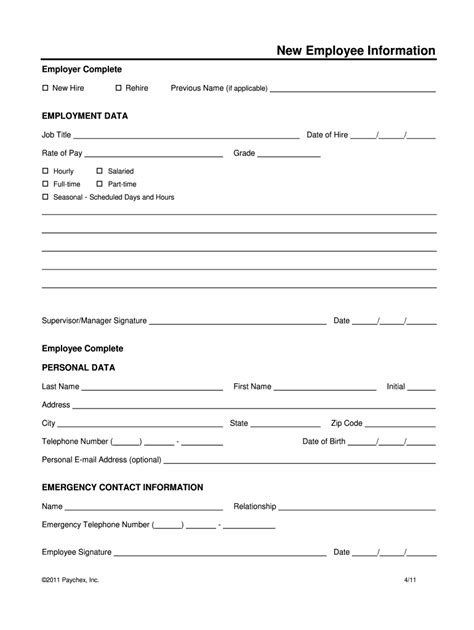

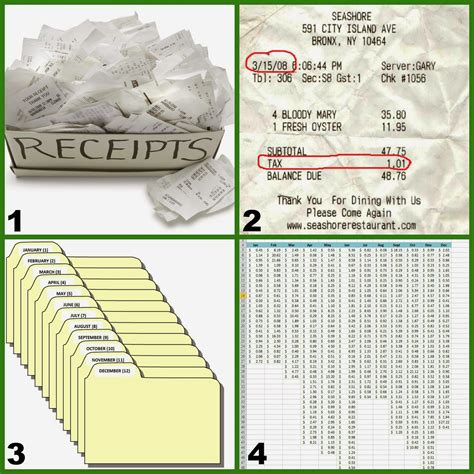

Tip 1: Keep Accurate Records

One of the most important things you can do when it comes to tax paperwork is to keep accurate and detailed records. This includes receipts, invoices, bank statements, and any other documents that may be relevant to your tax situation. By keeping all of your records in one place, you’ll be able to easily access the information you need when it’s time to file your taxes. Consider using a cloud-based storage system or a physical file cabinet to keep all of your documents organized and secure.

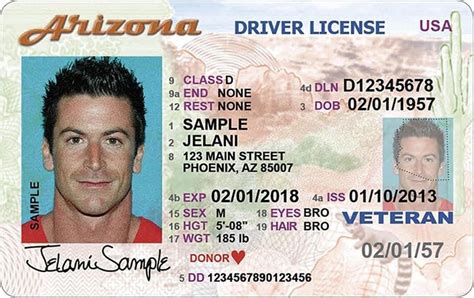

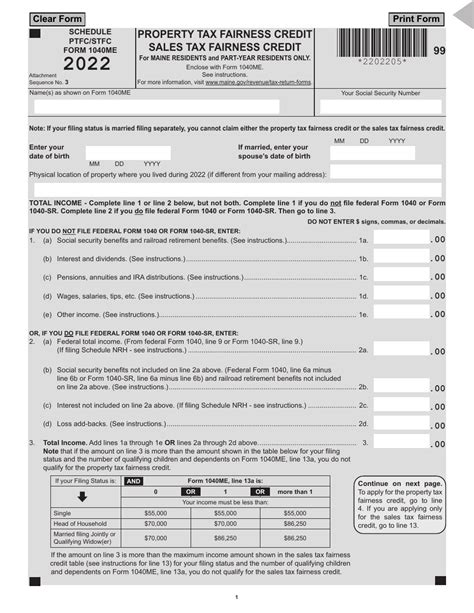

Tip 2: Understand Your Tax Obligations

It’s essential to have a clear understanding of your tax obligations, including which forms you need to file and by when. This can vary depending on your individual circumstances, such as your income level, marital status, and business ownership. Take the time to review the tax code and consult with a tax professional if you’re unsure about any aspect of your tax obligations. This will help you avoid potential penalties and ensure that you’re taking advantage of all the deductions and credits you’re eligible for.

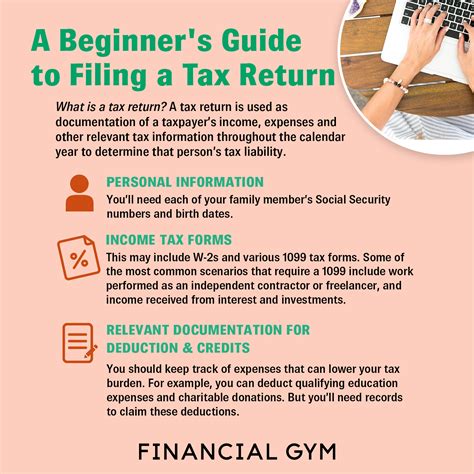

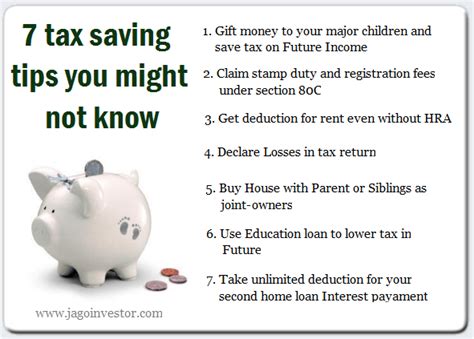

Tip 3: Take Advantage of Tax Deductions

Tax deductions can be a great way to reduce your tax liability and save money. There are many different types of deductions available, including those for charitable donations, home office expenses, and business travel expenses. Make sure you’re taking advantage of all the deductions you’re eligible for by keeping accurate records and consulting with a tax professional.

Tip 4: Use Tax Preparation Software

Tax preparation software can be a huge help when it comes to handling tax paperwork. These programs can guide you through the tax preparation process, help you identify potential deductions and credits, and even file your taxes electronically. Some popular options include TurboTax and H&R Block. By using tax preparation software, you can save time and reduce the stress associated with tax paperwork.

Tip 5: Don’t Miss Deadlines

Missing tax deadlines can result in penalties and fines, so it’s essential to stay on top of your tax filing schedule. Make sure you know when your taxes are due and plan accordingly. You can even set reminders or hire a tax professional to help you stay on track.

Tip 6: Consider Hiring a Tax Professional

If you’re feeling overwhelmed by tax paperwork or are unsure about any aspect of the tax preparation process, consider hiring a tax professional. These individuals have the knowledge and expertise to help you navigate the tax code and ensure that you’re in compliance with all relevant regulations. They can also help you identify potential deductions and credits, reducing your tax liability and saving you money.

Tip 7: Stay Organized

Finally, it’s essential to stay organized when it comes to tax paperwork. This means keeping all of your documents in one place, using a calendar to keep track of deadlines, and reviewing your tax return carefully before filing. By staying organized, you can reduce the stress associated with tax paperwork and ensure that you’re taking advantage of all the deductions and credits you’re eligible for.

📝 Note: It's essential to stay up-to-date with changes in tax laws and regulations to ensure you're in compliance and taking advantage of all available deductions and credits.

In summary, handling tax paperwork doesn’t have to be a daunting task. By keeping accurate records, understanding your tax obligations, taking advantage of tax deductions, using tax preparation software, meeting deadlines, considering hiring a tax professional, and staying organized, you can make the process much more manageable. Remember to always review your tax return carefully before filing and seek professional help if you’re unsure about any aspect of the tax preparation process.

What is the deadline for filing taxes?

+

The deadline for filing taxes typically falls on April 15th of each year, but this can vary depending on your individual circumstances and the tax laws in your area.

How can I reduce my tax liability?

+

There are several ways to reduce your tax liability, including taking advantage of tax deductions and credits, donating to charity, and investing in a retirement account.

What are the benefits of hiring a tax professional?

+

Hiring a tax professional can help you navigate the tax code, identify potential deductions and credits, and ensure that you’re in compliance with all relevant regulations, reducing your tax liability and saving you money.