Whataburger New Hire Paperwork Form

Introduction to Whataburger New Hire Paperwork

When joining the Whataburger team, new employees are required to complete a series of paperwork to ensure a smooth onboarding process. This paperwork is designed to gather essential information, verify eligibility to work, and outline the terms and conditions of employment. In this blog post, we will guide you through the Whataburger new hire paperwork form, highlighting the key sections and providing tips to help you navigate the process.

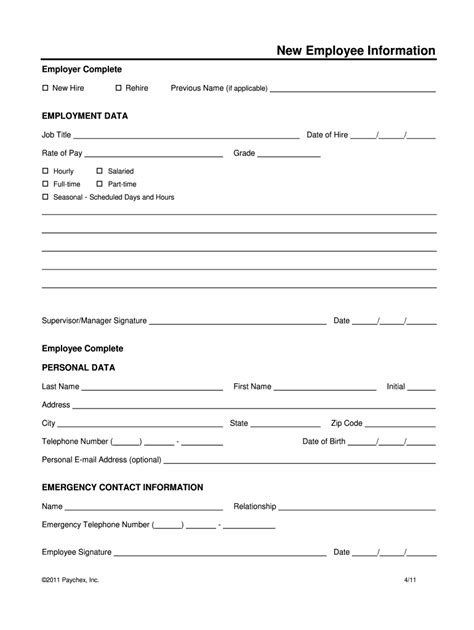

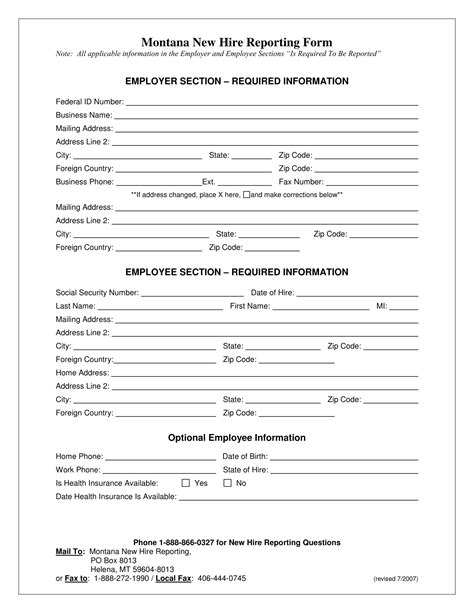

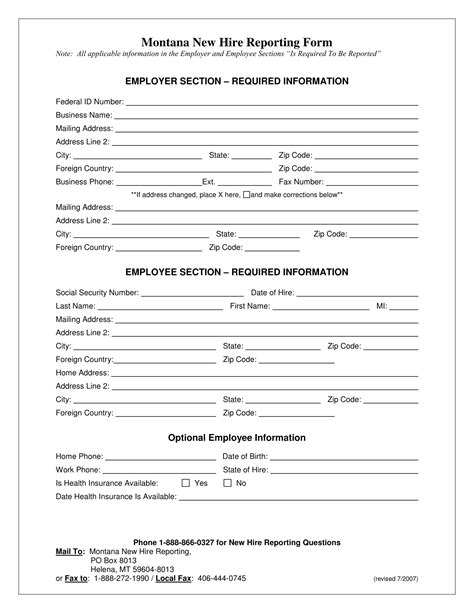

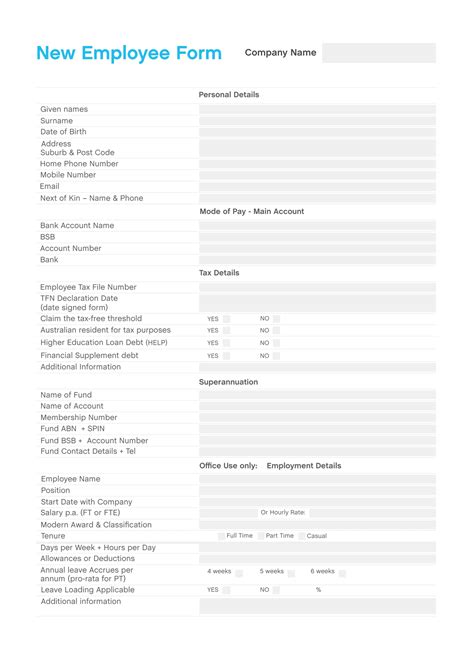

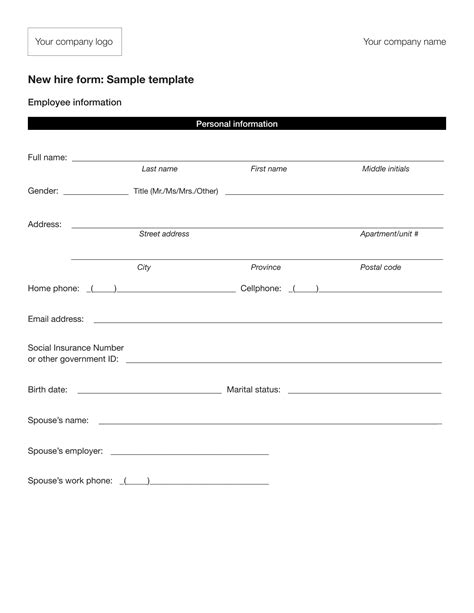

Section 1: Personal Details

The first section of the Whataburger new hire paperwork form requires you to provide your personal details, including: * Full name * Address * Date of birth * Social Security number * Contact information (phone number and email)

It is essential to ensure that the information provided is accurate and up-to-date, as it will be used for payroll, tax, and benefits purposes.

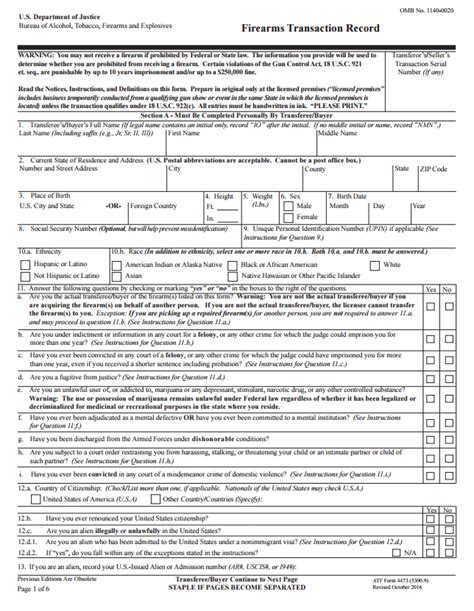

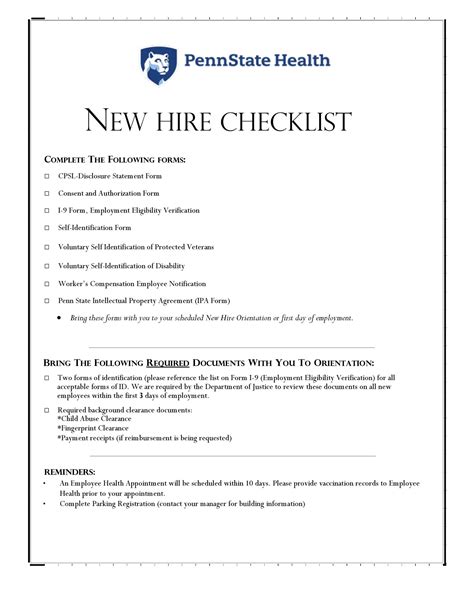

Section 2: Employment Eligibility

The next section verifies your eligibility to work in the United States. You will be required to: * Provide proof of citizenship or immigration status * Complete Form I-9, which confirms your identity and employment authorization * Provide documentation, such as a passport, driver’s license, or state ID

This section is crucial, as it ensures that Whataburger complies with federal laws and regulations regarding employment eligibility.

Section 3: Tax Withholding

In this section, you will need to complete Form W-4, which determines the amount of federal income tax to be withheld from your paycheck. You will be required to: * Claim your filing status (single, married, head of household, etc.) * Claim dependents and exemptions * Specify any additional tax withholding

It is essential to accurately complete this section to avoid any tax-related issues or penalties.

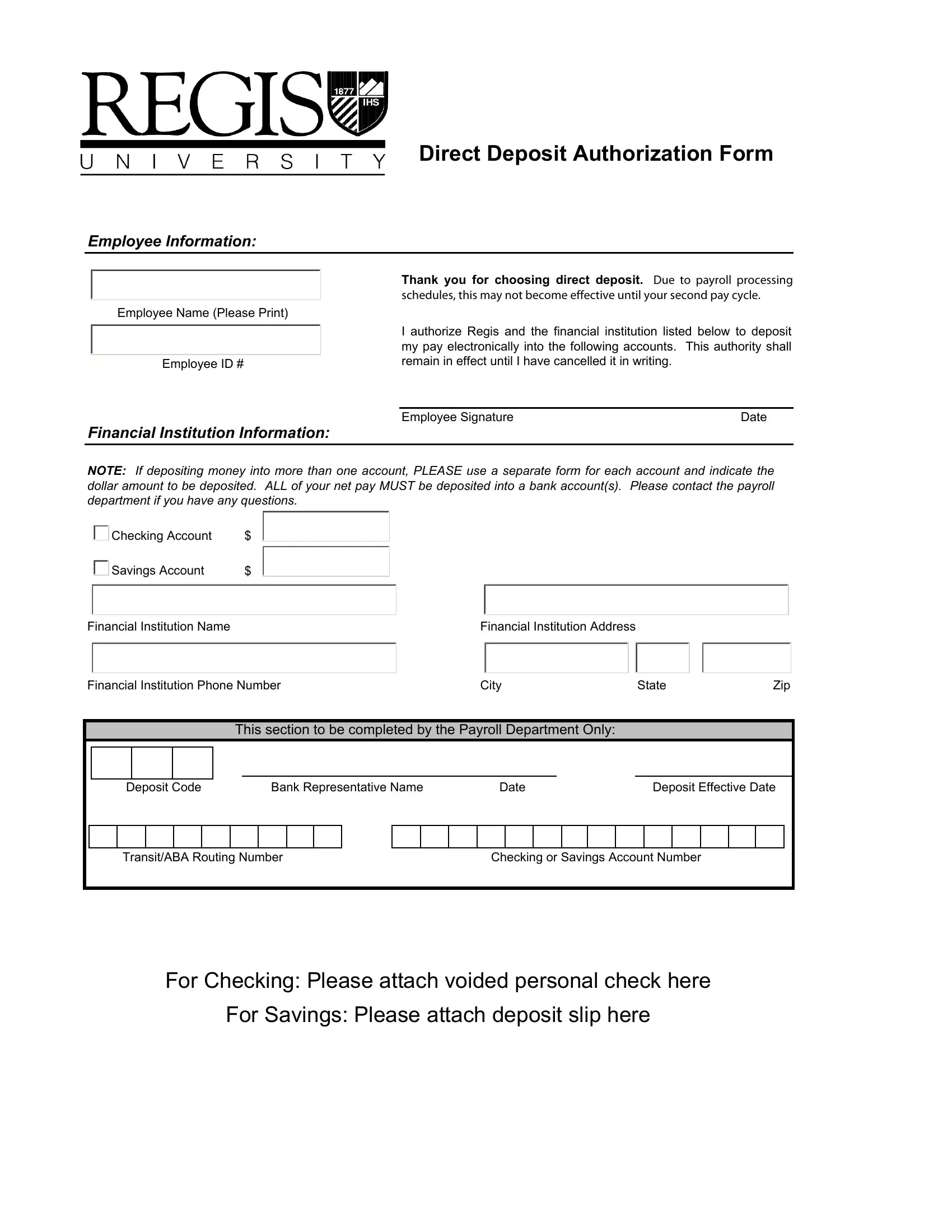

Section 4: Benefits and Payroll

The following section outlines the benefits and payroll information, including: * Pay rate and pay schedule * Benefits eligibility (health, dental, vision, etc.) * 401(k) or other retirement plan information * Direct deposit information

This section provides an overview of the compensation and benefits package offered by Whataburger.

Section 5: Company Policies and Acknowledgments

The final section requires you to acknowledge and agree to Whataburger’s company policies, including: * Code of conduct * Confidentiality and non-disclosure agreements * Workplace safety and harassment policies * Acknowledgment of receipt of employee handbook

It is crucial to carefully review and understand these policies, as they outline the expectations and responsibilities of Whataburger employees.

| Section | Description |

|---|---|

| Personal Details | Provides personal information for payroll and tax purposes |

| Employment Eligibility | Verifies eligibility to work in the United States |

| Tax Withholding | Determines federal income tax withholding |

| Benefits and Payroll | Outlines compensation and benefits package |

| Company Policies and Acknowledgments | Requires acknowledgment and agreement to company policies |

📝 Note: It is essential to carefully review and complete all sections of the Whataburger new hire paperwork form to ensure a smooth onboarding process and to avoid any delays or issues with payroll, benefits, or employment eligibility.

In summary, the Whataburger new hire paperwork form is a comprehensive document that requires new employees to provide personal details, verify employment eligibility, complete tax withholding forms, outline benefits and payroll information, and acknowledge company policies. By carefully reviewing and completing each section, new hires can ensure a seamless transition into their new role and start their Whataburger journey on the right foot.

What documents do I need to provide for employment eligibility?

+

You will need to provide proof of citizenship or immigration status, such as a passport, driver’s license, or state ID, as well as complete Form I-9.

How do I complete Form W-4 for tax withholding?

+

You will need to claim your filing status, claim dependents and exemptions, and specify any additional tax withholding. It is recommended to consult with a tax professional or financial advisor for guidance.

What benefits does Whataburger offer to its employees?

+

Whataburger offers a range of benefits, including health, dental, and vision insurance, 401(k) or other retirement plans, and direct deposit. The specific benefits package may vary depending on the location and job position.