PPP Loan Forgiveness Paperwork Needed

Introduction to PPP Loan Forgiveness

The Paycheck Protection Program (PPP) was introduced to help small businesses and self-employed individuals cope with the economic fallout of the COVID-19 pandemic. One of the most attractive features of the PPP is the potential for loan forgiveness, allowing borrowers to have their loans partially or fully forgiven if they meet certain criteria. However, navigating the PPP loan forgiveness process can be complex, and it requires careful preparation and submission of specific paperwork. In this article, we will delve into the details of the paperwork needed for PPP loan forgiveness, guiding borrowers through the process.

Understanding PPP Loan Forgiveness Eligibility

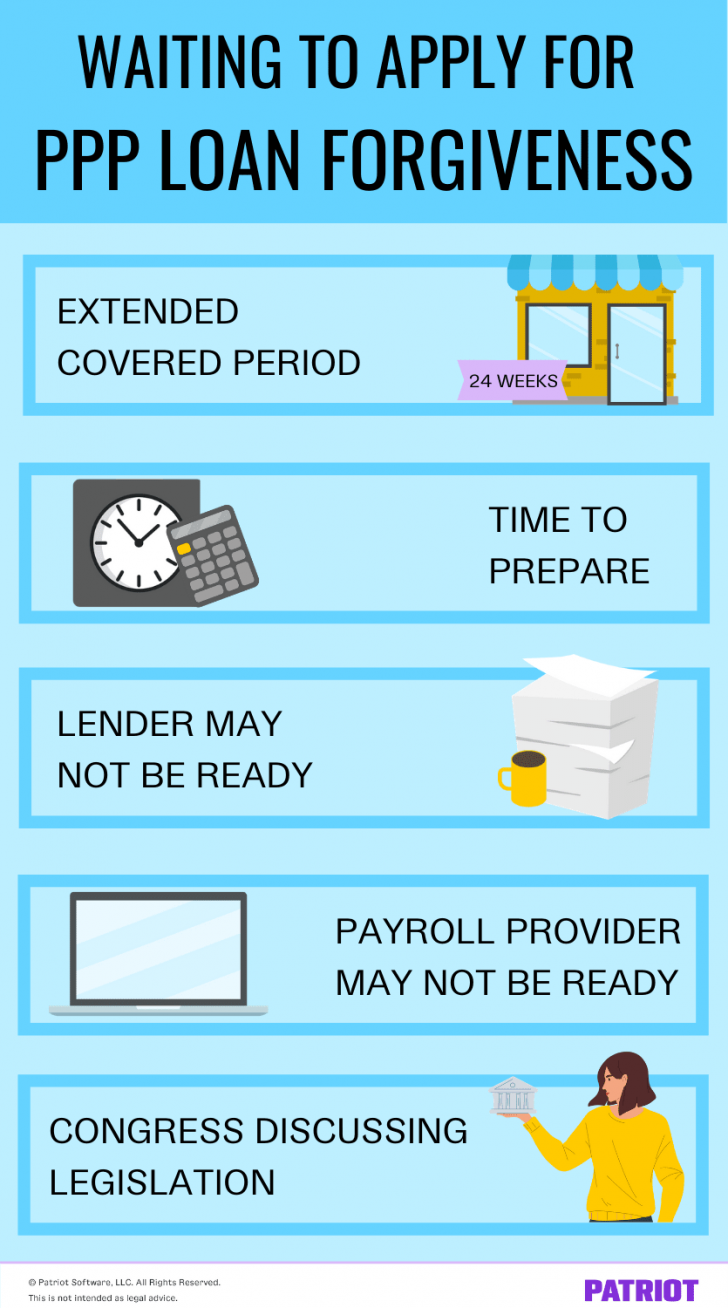

Before diving into the paperwork, it’s essential to understand the eligibility criteria for PPP loan forgiveness. Borrowers are eligible for loan forgiveness if they have used the loan proceeds for eligible expenses during the covered period, which can be either 8 or 24 weeks, depending on the borrower’s choice. Eligible expenses include: - Payroll costs, such as salaries, wages, and benefits. - Rent or lease payments for business properties. - Utilities, including electricity, gas, water, transportation, telephone, and internet access. - Mortgage interest payments (but not prepayments or principal payments). - Certain operations expenditures, like software and cloud computing services. - Worker protection expenditures, which involve investments to protect employees from COVID-19. - Supplier costs on essential goods.

PPP Loan Forgiveness Application Process

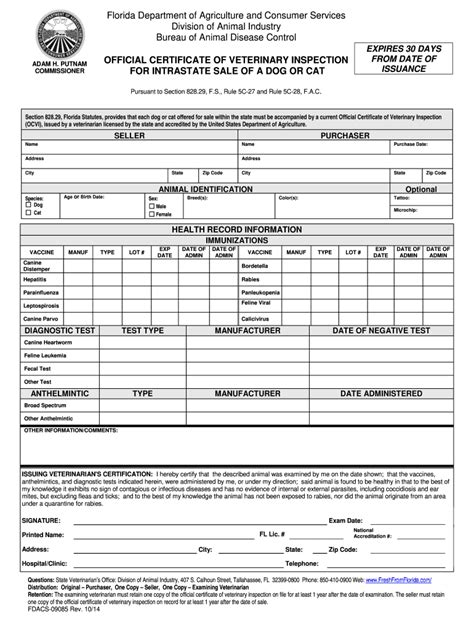

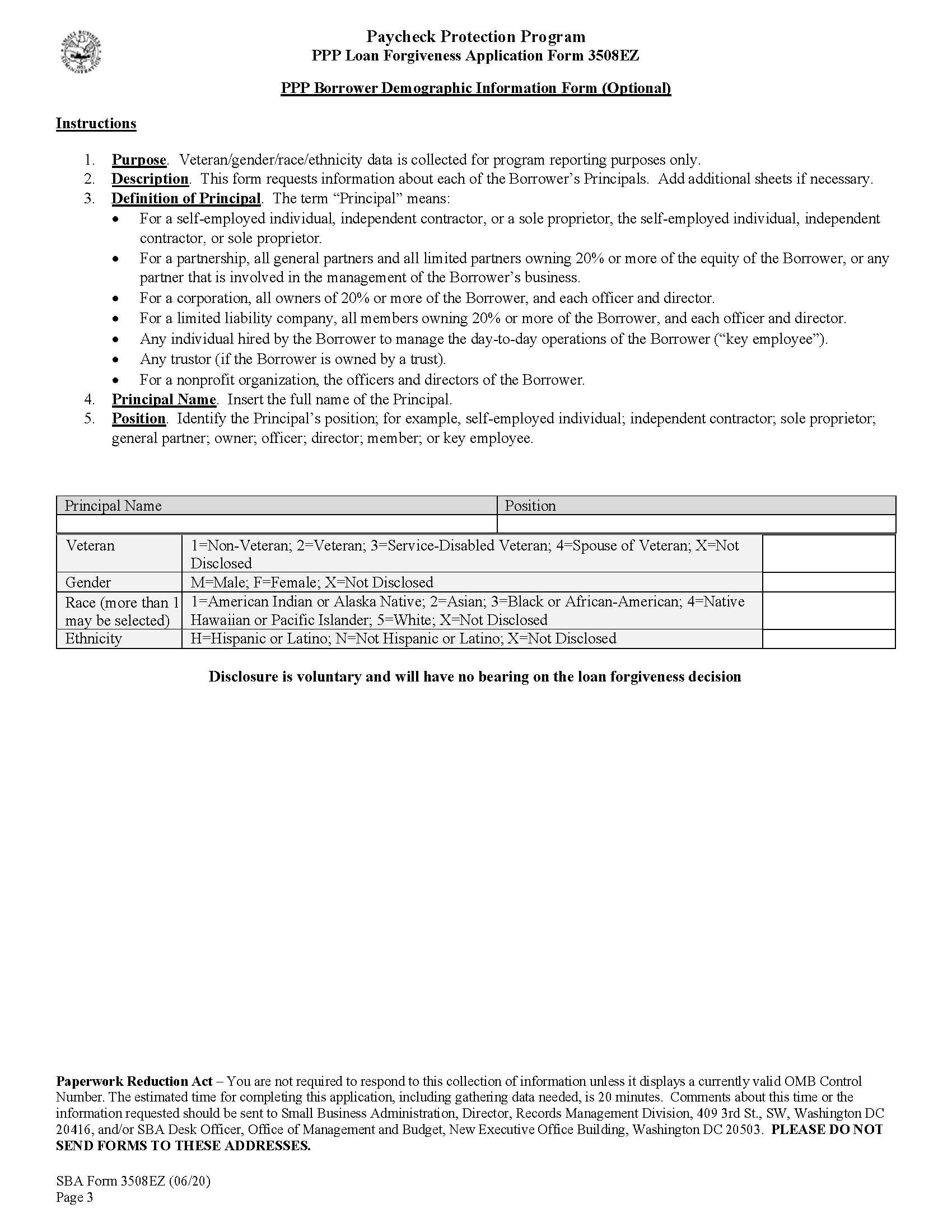

To apply for PPP loan forgiveness, borrowers must submit an application to their lender, which includes detailed documentation to support their request. The application forms are provided by the Small Business Administration (SBA) and come in two versions: the standard Form 3508 and the simplified Form 3508EZ and Form 3508S for borrowers meeting specific criteria.

Required Paperwork for PPP Loan Forgiveness

The specific paperwork needed can vary depending on the borrower’s situation and the type of application form they are eligible to use. However, the following documents are commonly required: - Payroll documentation, including bank statements, payroll tax filings, and records from a payroll processing company. - Non-payroll documentation, such as invoices, contracts, and statements from suppliers, landlords, utility companies, and mortgage lenders. - Certifications and disclosures, which may include a list of all employees and their respective pay rates, among other details.

| Type of Expense | Required Documentation |

|---|---|

| Payroll Costs | Payroll registers, bank statements, tax forms (e.g., 941) |

| Rent or Lease Payments | Lease agreements, payment receipts, lessor verification |

| Utilities | Bills and payment receipts for utilities |

Submission and Review Process

After compiling all the necessary paperwork, borrowers submit their application and supporting documents to their lender. The lender has 60 days to review the application and make a decision regarding forgiveness. If the lender determines that the borrower is eligible for forgiveness, the lender will request payment from the SBA for the forgiven amount. Borrowers should be prepared for potential requests for additional documentation during the review process.

📝 Note: It is crucial to maintain accurate and detailed records of all expenses and to submit a complete and accurate application to ensure a smooth forgiveness process.

Best Practices for Borrowers

To navigate the PPP loan forgiveness process successfully, borrowers should: - Keep meticulous records of all expenses related to the loan. - Consult with financial advisors or accountants to ensure compliance with all requirements. - Review SBA guidelines regularly for any updates or changes in the forgiveness process. - Communicate openly with their lender about the status of their application and any issues that may arise.

Future Considerations

As the economic landscape continues to evolve, it’s essential for businesses to plan for the future while addressing current challenges. This includes considering other forms of financial assistance, strategic planning for post-pandemic operations, and investment in resilience and adaptability to face future challenges.

In summarizing the key aspects of PPP loan forgiveness paperwork, it’s clear that preparation, attention to detail, and compliance with SBA guidelines are paramount. By understanding the eligibility criteria, required documentation, and submission process, borrowers can navigate the complexities of PPP loan forgiveness with confidence.

What is the deadline for applying for PPP loan forgiveness?

+

The deadline for applying for PPP loan forgiveness can vary, but borrowers should apply before the maturity date of their loan to avoid repayment. It’s also recommended to apply as soon as possible after the end of the covered period to ensure timely processing.

Can I apply for PPP loan forgiveness if I have already started repaying my loan?

+

Yes, you can still apply for PPP loan forgiveness even if you have started repaying your loan. However, any payments made on the loan may affect the amount that can be forgiven.

How long does the PPP loan forgiveness process typically take?

+

The length of time for the PPP loan forgiveness process can vary, but lenders have 60 days to review applications and make a decision. After the lender’s decision, the SBA also reviews the application, which can add additional time.